DBG Markets: Market Report for Nov 18, 2024

Abstract:Market OverviewSignificant developments are expected this week, starting with Japans announcement on its monetary policy direction. Bank of Japan Governor Kazuo Ueda reiterated that the central bank w

Market Overview

Significant developments are expected this week, starting with Japan's announcement on its monetary policy direction. Bank of Japan Governor Kazuo Ueda reiterated that the central bank would continue raising interest rates if economic and price developments align with its forecasts. However, he did not specify whether a rate hike could occur in December. Governor Ueda's speech has been closely watched by investors seeking hints about the Bank of Japan's next steps. A rate hike is increasingly seen as a potential countermeasure against the yen's ongoing weakness.

Some analysts are focusing on the USD/JPY exchange rate, speculating that if it climbs to around 160, it would heighten the likelihood of a rate hike. The discussion is less about if rate hikes will occur and more about when they will be implemented—and whether the Japanese economy is prepared for such an adjustment.

Other key market events this week include: Tuesday: Canadian inflation reports.Wednesday: UK inflation data.Thursday: Another speech from Governor Ueda, remarks by the RBA Governor, and an update on U.S. unemployment claims.Friday: U.S. and European Manufacturing and Services PMI reports. The SNB Chairman will outline future policy directions, alongside UK and Canadian retail sales data.

GOLD - As anticipated, gold made a pullback, supported by MACD data showing growing volume for the correction. The RSI also indicates bullish momentum accompanying this movement, with price action further affirming the correction. Despite these developments, long-term expectations point to a decline in gold prices. However, the ongoing Ukraine-Russia war has heightened global security risks, which could bolster gold's safe-haven appeal and push its price higher.

SILVER - Silver prices are reflecting golds trends, pulling back from the $29.900 level and showing potential for continued upward movement. However, the MACD suggests the possibility of a downturn from current price levels, even as the RSI indicates continued bullish momentum in the pullback.

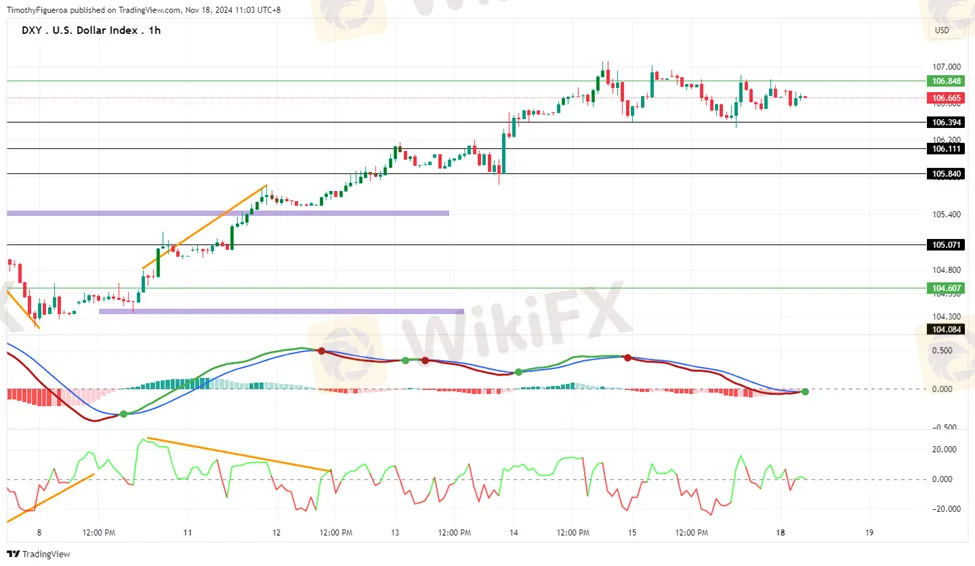

DXY - The dollar index remains confined to a narrower price range under 106.848 but shows strong potential for bullish continuation. The MACD indicates increasing buying volume, while the RSI confirms bullish momentum, holding above the zero line.

GBPUSD - The pound continues its downward trajectory against the dollar. MACD data highlights growing bearish momentum, while the RSI corroborates this trend with signals of further declines. The dollars anticipated strength, coupled with upcoming U.S. policy developments, adds additional downward pressure on the pound.

AUDUSD - The Australian dollar is showing reduced chances of a significant pullback, as MACD data points to weakening volume and a continuation of the bearish trend. While the RSI hints at bullish momentum, heightened global security risks are diminishing the Aussie dollars appeal as an investment option.

NZDUSD - Similar to the Australian dollar, the Kiwi faces increased selling pressure, with price action favoring a bearish market sentiment.

EURUSD - The euro is grappling with downward momentum amid expectations of higher tariffs that could strain its economy. MACD data supports further declines following a bearish cross, while the RSI indicates a continued downward curve.

USDJPY - The yen appears positioned for a bullish reversal. Current prices have declined past previous swing lows, and MACD data shows reduced bearish volume. The RSI highlights multiple divergences, suggesting a bullish continuation. Despite expectations of another rate hike, uncertainty surrounds its timing, which is crucial for ensuring economic stability.

USDCHF - The Swiss franc is exhibiting increased potential for bullish movement. The MACD histogram shows reduced volume, with the MACD line nearing an upward cross. RSI data also supports this trend, showing divergence and signaling further upward momentum.

USDCAD - The Canadian dollar remains weak, with price action showing no signs of momentum slowing. The MACD has recently turned upward, indicating delayed volume increases, and the RSI is beginning to turn higher. However, the RSI also suggests the potential for a correction or consolidation at current levels. Despite this, the broader outlook remains bullish for the USD and bearish for the CAD.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Rate Calc