【MACRO Alert】 London gold market under pressure , supply constraints and emerging market hoarding cr

Abstract:Recently, the global gold market has shown a series of significant dynamic changes, which has attracted widespread attention from the market. Simon White, a macro strategist at Bloomberg, pointed out

Recently, the global gold market has shown a series of significant dynamic changes, which has attracted widespread attention from the market. Simon White, a macro strategist at Bloomberg, pointed out that retail traders in the United States, Europe and other parts of the world have failed to take full advantage of the gold squeeze caused by the hoarding of gold by central banks in emerging markets, which is in sharp contrast to the performance of the Asian market.

Gold prices are currently hovering near all-time highs, with a one-year return of 44%, far outperforming the S&P 500. White believes the most plausible explanation is a shortage of physical gold in European vaults, a phenomenon that is mainly caused by hoarding by central banks in emerging markets. Since the global financial crisis, and especially after the outbreak of the Russian-Ukrainian conflict, central banks in Asia and the Middle East have been actively accumulating gold and shipping it back home from London.

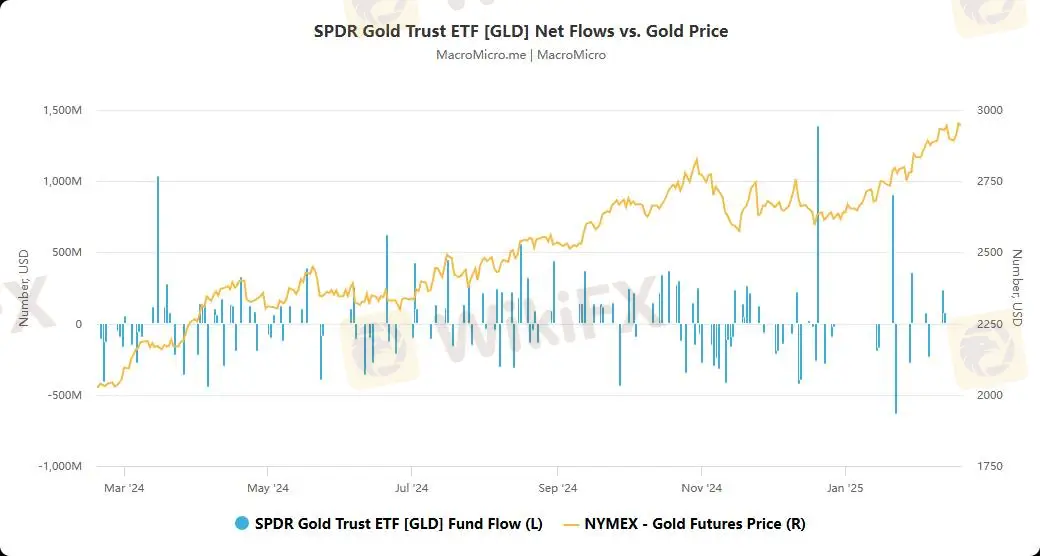

In the midst of the gold boom, Western retail investors have been relatively cool, which is a stark departure from past situations. Holdings of gold ETFs, such as GLD, which are often seen as a measure of retail enthusiasm, have been sluggish over the past year. Meanwhile, gold ETF holdings in Asian markets, especially India and China, have grown significantly faster than those in Europe, the United States and other regions. However, Asian ETF purchases may be just the tip of the iceberg, as the total amount of gold held by ETFs in Europe and the United States is still higher.

Asian buyers generally prefer to hold physical metals rather than paper certificates. China and India are the two largest sources of demand for bars, coins and jewelry, according to the World Gold Council. While Western retail investors have been lukewarm about gold's recent gains, perhaps because of greater attention paid to “Mag 7” stocks and Bitcoin, Asian buyers are holding on to gold, and so far the strategy has been successful.

In the past two months, 12.2 million ounces of gold have been shipped from London to COMEX vaults in the United States, mainly due to concerns about US import tariffs, a rush for physical gold and an impending supply crunch. Data shows that as of December 2024, there are 279 million ounces of gold stored in London vaults, but only 36 million ounces of this are available for immediate market use, while there are still 380 million ounces of unfulfilled spot contracts.

Spot gold prices are surging as supply tightens and delivery delays increase, with buyers scrambling for fewer available bars, pushing spot prices higher. Analysts warn that the tension is just beginning and that gold prices could climb further in the coming months as central banks, institutions and retail investors compete for dwindling supplies. Meanwhile, Singapore's gold exports to the United States climbed to their highest level in nearly three years in January. Gold shipments from Singapore to the United States rose 27% month-on-month to about 11 tons last month, the highest since March 2022, according to Enterprise Singapore.

Nikos Kavalis, managing director of precious metals consulting firm Metals Focus Ltd., pointed out that Singapore's gold bar exports mainly go to various parts of Asia, depending on where the demand is better. When the region is under-consumed, these gold bars will flow to London. But now, gold is being shipped to the United States from all places where there are refineries. Since the U.S. election day, the U.S. gold inventory has more than doubled, and the value of gold in the U.S. vaults is currently about $106 billion, compared with about $50 billion on November 5 last year.

The huge premium between the gold futures price on the Comex in New York and the spot gold price in London has attracted some of the world's largest financial institutions to arbitrage in the gold market. JPMorgan Chase and HSBC were identified as the two largest players in the transatlantic gold migration. These banks often lend their gold, much of which is stored in London, to borrowers who need to use gold bars as collateral, hedging the risk of a fall in the price of the underlying asset by selling gold futures in New York.

In summary, the global gold market is experiencing significant dynamic changes, from the hoarding behavior of emerging market central banks to the liquidity crisis in the London gold market to the surge in gold exports from Singapore to the United States, all of which indicate that the supply and demand relationship in the gold market is undergoing a profound adjustment. Whether this crisis will escalate or gradually stabilize, one thing is clear: the demand for real, tangible gold has never been so strong.

WikiFX Broker

Latest News

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

London Holds Firm as Global FX Hub, Handling 38% of Worldwide Trading

Rate Calc