Enrich Money

Abstract: Enrich Money is an investment platform that started in 2022 and is situated in India. It offers trading on Stocks, Equity Derivatives, Commodities, Currencies, IPOs, Mutual Funds, Bonds, and ETFs.

| Enrich Money Review Summary | |

| Founded | 2022 |

| Registered Country/Region | India |

| Regulation | No regulation |

| Trading Products | Stocks, Equity Derivatives, Commodities, Currencies, IPOs, Mutual Funds, Bonds, ETFs |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | Orca App, Hunt (Web Hunt) |

| Minimum Deposit | / |

| Customer Support | Phone: 044 40063663 / 35000470 |

| Email: helpdesk@enrichmoney.in | |

Enrich Money Information

Enrich Money is an investment platform that started in 2022 and is situated in India. It offers trading on Stocks, Equity Derivatives, Commodities, Currencies, IPOs, Mutual Funds, Bonds, and ETFs.

Pros and Cons

| Pros | Cons |

| Supports various trading products | No regulation |

| No deposit/withdrawal fees |

Is Enrich Money Legit?

No. Money Enrich is not a regulated broker. It says it works in India, although the Securities and Exchange Board of India (SEBI), the country's official financial market regulator, has not given it permission to do so. Please be aware of the risk!

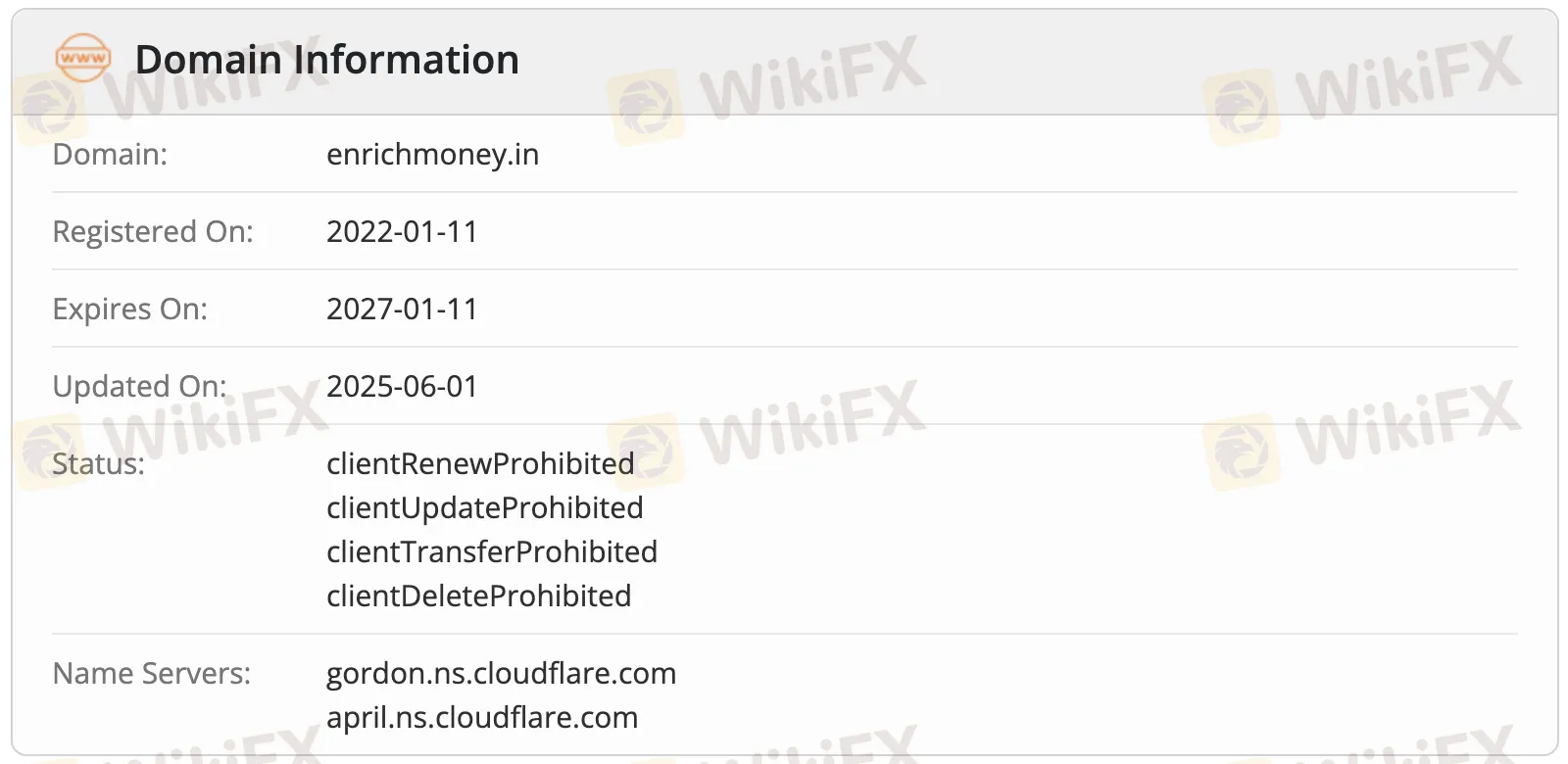

WHOIS records show that the domain enrichmoney.in was registered on January 11, 2022, and is still active. It was last changed on June 1, 2025, and it will end on January 11, 2027. The domain has several restriction statuses, including clientRenewProhibited, clientUpdateProhibited, clientTransferProhibited, and clientDeleteProhibited.

What Can I Trade on Enrich Money?

Enrich Money provides a range of trading products, such as stocks, derivatives, commodities, currencies, mutual funds, IPOs, and more.

| Trading Products | Supported |

| Stocks | ✔ |

| Equity Derivatives | ✔ |

| Commodities | ✔ |

| Currencies | ✔ |

| IPOs | ✔ |

| Mutual Funds | ✔ |

| Bonds | ✔ |

| ETFs | ✔ |

| Indices | ❌ |

| Cryptos | ❌ |

| Options | ❌ |

Enrich Money Fees

Compared to other companies in the same field, Enrich Money has very reasonable and low-cost price structures. Account opening, platform use, auto square-off, and call and trade are all free, which makes it one of the most economical brokers for retail traders in India.

| Segment | Brokerage | Key Fees & Taxes |

| Equity Delivery | 0.20% | STT: 0.1% Buy & Sell, Stamp Duty: 0.015% Buy side, SEBI: 0.0001%, GST: 18% |

| Equity Intraday | 0.02% | STT: 0.025% Sell side, Stamp Duty: 0.003% Buy side, SEBI: 0.0001%, GST: 18% |

| Transaction Charges | NSE: 0.00297% | Applies to both buy & sell |

| BSE: 0.00345% | ||

| Clearing Charges | 0.00% | / |

| DP Charges | ₹15 + ₹5.50 (CDSL) | Only applicable for delivery trades |

| Non-Trading Fees | Amount |

| Account Opening | ₹0 |

| Annual Maintenance (AMC) | ₹0 for first year |

| ₹300 + GST/year thereafter | |

| Platform Charges | ₹0 (Lifetime) |

| Auto Square-Off | ₹0/order (Lifetime) |

| Call & Trade | |

| UPI Payment Gateway | ₹0 |

| Net Banking Payment | ₹10/transaction + GST |

| Pledge Charges | 0.02% of transaction value |

| Overdue Charges | 0.05% per day on unpaid bill |

| Delivery Instruction Slip | First: 0; |

| Additional: ₹50/booklet + courier |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Orca | ✔ | iOS, Android | / |

| Hunt (Web Hunt) | ✔ | Web (PC/Mobile) | / |

| MT4 | ✘ | / | Beginners |

| MT5 | ✘ | / | Experienced traders |

Deposit and Withdrawal

Enrich Money doesn't charge fees for putting money in or taking it out. It's not clear what the minimum deposit is for a trading account, but transfers must come from a bank account that is registered in the client's name.

| Payment Method | Deposit | Withdrawal | Processing Time | Notes |

| UPI (e.g., GPay, PhonePe) | ✔ | ✔ | Instant (within 15 min) | From registered bank account only |

| Razorpay Gateway (44 banks) | ✔ | ✘ | Instant | Must reflect in ledger; otherwise, send proof to support |

| IMPS | ✔ | ✘ | Instant (≤15 min) | Contact RMS team if credit not reflected |

| NEFT | ✔ | ✘ | Few hours to 1 working day | Add Enrich as payee in bank |

| Cheque / DD | ✔ | ✘ | 3–5 working days | Cleared only after verification |

WikiFX Broker

Latest News

2 Malaysians Arrested in $1 Million Gold Scam Impersonating Singapore Officials

Moomoo Singapore Opens Investor Boutiques to Strengthen Community

OmegaPro Review: Traders Flood Comment Sections with Withdrawal Denials & Scam Complaints

An Unbiased Review of INZO Broker for Indian Traders: What You Must Know

BotBro’s “30% Return” Scheme Raises New Red Flags Amid Ongoing Fraud Allegations

The 5%ers Review: Is it a Scam or Legit? Find Out from These Trader Comments

WikiEXPO Dubai 2025 Concludes Successfully — Shaping a Transparent, Innovative Future

Admirals Cancels UAE License as Part of Global Restructuring

Forex Expert Recruitment Event – Sharing Insights, Building Rewards

Exness Broker Expands in South Africa with Cape Town Hub

Rate Calc