eToro Expands into Singapore with MAS CMS Licence

Abstract:eToro has officially expanded its services to Singapore after receiving and activating its Capital Markets Services (CMS) licence from the Monetary Authority of Singapore (MAS), the company announced today, July 16, 2025.

eToro has officially expanded its services to Singapore after receiving and activating its Capital Markets Services (CMS) licence from the Monetary Authority of Singapore (MAS), the company announced today, July 16, 2025.

What the MAS Licence Means for Singapore Investors

With its CMS licence now in force, eToro can offer eligible retail investors in Singapore access to:

Stocks from more than 20 of the worlds leading stock exchanges

Exchange-traded funds (ETFs) spanning global markets

Derivatives, including CFDs on indices, commodities, and more

All of these products will be available through eToros award‑winning social investing platform, empowering users to trade, share, and learn in a single, intuitive interface.

Following our report in May that eToro had tapped ABN Amro and Essence Group alum Yaki Razmovich to head its new Asia hub in Singapore, Razmovich officially took the reins of the Singapore operation earlier this year. He will oversee the build‑out of eToros regional franchise and drive further expansion across Asia Pacific

About eToro

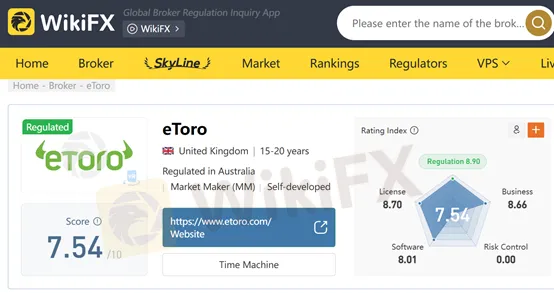

Founded in 2007, over the years, eToro has grown to support millions of registered users worldwide, offering a diverse range of financial instruments, including forex, stocks, ETFs, cryptocurrencies, and commodities. According to WikiFX, eToro holds a solid compliance and reliability rating, reflecting its commitment to regulatory standards and customer protection. For more information about this broker, you can go to WikiFX and search for yourself.

Read more

Forex Trends Explained for Your Successful Trading Experience

The dynamism of the forex market is full of trends - positive, negative and neutral. As trade intensifies, the currency pairs get into the action mode with ups and downs, causing frequent changes to investor mindsets. The market is like a rollercoaster ride, thanks to forex trends. Understanding what these trends indicate will help you take necessary investment calls for sustained success.

Best 5 Low-Spread FX Brokers in India 2025

Forex trading has grown rapidly in India, and choosing the right broker is critical—especially when it comes to spreads. A low spread broker means lower trading costs and higher potential profits, especially for active traders and scalpers. In this article, we list the top 5 low-spread forex brokers in India for 2025, trusted for their tight spreads, fast execution, and strong global reputation.

Mastering Margin Level in Forex: Key to Success

Discover the critical role of Margin Level in Forex Trading and learn how to use it for effective risk management and leverage control. Stay informed to optimize your trading strategy.

Master Forex Trading Psychology for Success

Unlock your potential with forex trading psychology. Master emotions, trading discipline, and market strategies to achieve consistent success.

WikiFX Broker

Latest News

Charles Schwab Forex Review 2025: What Traders Should Know

How 3 Simple Steps Cost a Businessman INR 4 Crore in a Forex Scam

PrimeXBT Expands FSCA Licence and Enhances Crypto Services in 2025

Quotex Broker Review 2025: Is It a High-Risk Broker?

Is CBCX a Safe and Trustworthy Broker for Traders?

TopFX Launches Synthetic Indices Trading on cTrader Platform

Is TradeEU Reliable in 2025?

How Commodity Prices Affect Forex Correlation Charts

What WikiFX Found When It Looked Into XS

The Global Inflation Outlook

Rate Calc