Market Greed Prevails: Gold Struggles in a Diverging Landscape

Abstract:Market Greed Prevails: Gold Struggles in a Diverging LandscapeIn the midst of a euphoric global financial environment, traditional safe-haven assets are facing an uphill battle. Gold prices have come

Market Greed Prevails: Gold Struggles in a Diverging Landscape

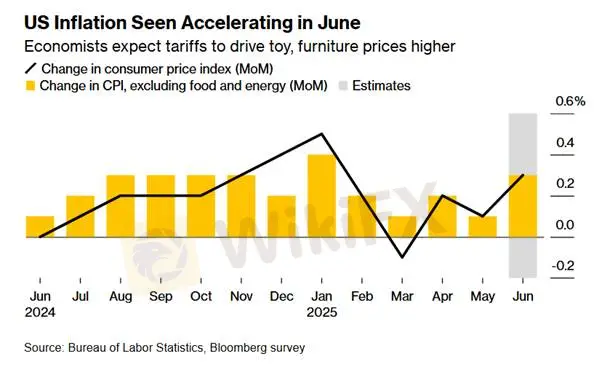

In the midst of a euphoric global financial environment, traditional safe-haven assets are facing an uphill battle. Gold prices have come under pressure following the latest inflation data, reflecting a clear shift in capital flows. Despite ongoing geopolitical risks, investors are increasingly favoring risk assets over safety. The strong performance of equities is drawing funds away from gold and bonds, leaving gold to struggle in a market dominated by greed.

[U.S. Inflation Comes in Hot | Image Source: Bloomberg]

U.S. Equity Markets Diverge as Capital Concentrates in Tech

U.S. stocks painted a mixed picture on Tuesday. The Dow Jones Industrial Average and the S&P 500 declined 0.98% and 0.4%, respectively, weighed down by bank earnings and inflation data. However, the Nasdaq bucked the trend, rising 0.18% to a record high close, driven by Nvidias announcement to resume sales of its H20 AI chips to China.

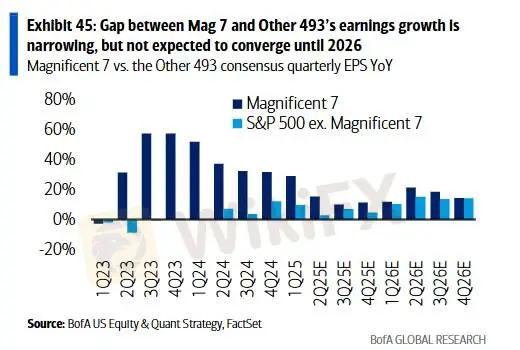

This underscores the current "narrow market" phenomenon. Capital isn't flowing indiscriminately into all risk assets but is instead focused on AI-driven tech giants. Despite analysts expecting Q2 earnings growth for S&P 500 companies to slow to 5%—the weakest pace since Q4 2023—tech stocks remain resilient. This relentless appetite for growth-oriented tech stocks is indirectly crowding out capital from traditional safe havens like gold.

[Earnings Growth Expected to Narrow This Season | Image Source: Bank of America]

Global Bond Market Pressure Adds to Gold's Woes

Gold isnt the only safe-haven asset under stress—global bond markets are also showing signs of strain, reinforcing the trend of capital exiting risk-off positions. In Japan, concerns over political uncertainty and future fiscal policy have pushed 10-year government bond yields to 1.595%, the highest since 2008. Unlike ultra-long-dated bonds, the 10-year yield directly affects key borrowing costs such as fixed-rate mortgages, and a continued rise could hamper economic activity, sparking fears of a "Truss moment"-style bond meltdown in Japan.

This selloff is not isolated. Investors globally are growing wary that governments are spending beyond sustainable limits, triggering a widespread selloff in long-term government bonds across major economies.

Conclusion: A Tough Road Ahead for Gold

In this highly polarized market environment, gold faces significant headwinds. On one side is the red-hot tech sector rally; on the other, traditional sectors remain cautious. This dynamic naturally suppresses gold‘s appeal. With market sentiment at a crossroads, all eyes now turn to the upcoming Producer Price Index (PPI) report—a key clue in gauging the next move in U.S. inflation. The PPI will serve as a vital barometer of inflation’s breadth and persistence, and may determine whether the market continues chasing risk assets or reconsiders the hedging value of gold.

[GOLD – Technical Outlook]

Should prices find stability and rebound from current levels, the first resistance to watch lies at $3,340. A decisive break above this level would ease bearish pressure and open the path toward retesting $3,375.

However, a clear breakdown below the $3,320–$3,325 support zone would signal renewed downside momentum, with the next key support area at $3,282–$3,285.

Based on the current technical setup, the probability leans toward a successful support hold and potential rebound.

Key Levels:

Resistance: $3,375, $3,400

Support: $3,282–$3,285, $3,320–$3,325, $3,340

Risk Disclaimer:

The views, analysis, research, price levels, or other information presented in this article are provided solely for general market commentary and do not constitute investment advice. Readers are solely responsible for their own trading decisions. Please exercise caution.

WikiFX Broker

Latest News

Kraken Review 2025: Is This Forex Broker Safe?

IQ Option Review: The High-Stakes Game of Withholding Trader Capital

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Rate Calc