Fortrade: A Closer Look at Its Licenses

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Fortrade and its licenses.

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Fortrade and its licenses.

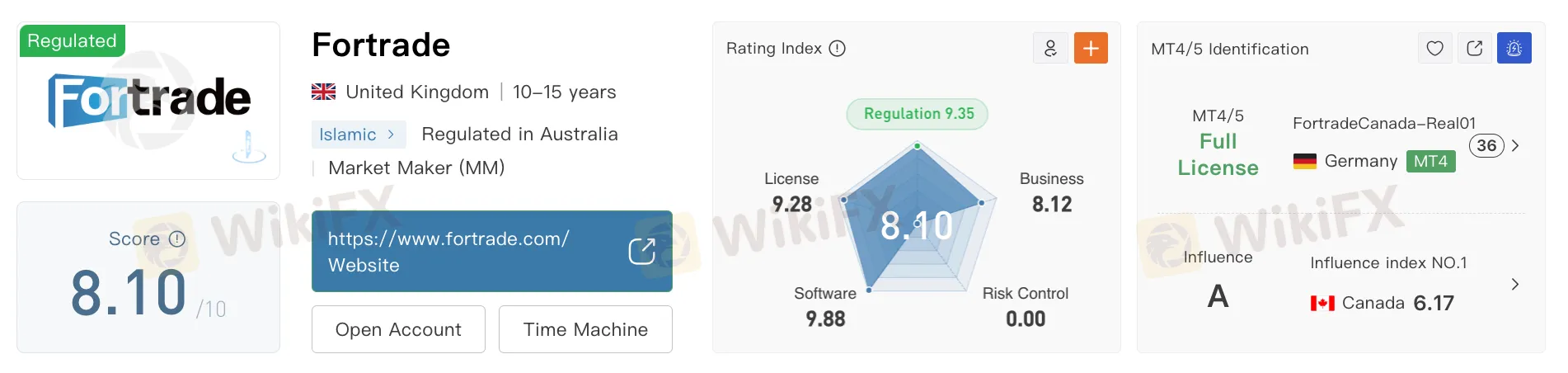

At first glance, Fortrade looks like one of the more reliable brokers in the trading world. It holds licenses from some of the world‘s toughest financial regulators, giving it an image of strength, trust, and legal compliance. Traders are often reassured by its approvals from the UK’s FCA, Australia‘s ASIC, Cyprus’s CySEC, and Canadas CIRO, which are widely known for their strong rules and protection for investors.

In the UK, Fortrade is licensed by the Financial Conduct Authority (FCA) as a Market Maker (License No. 609970). The FCA is known for strict standards in consumer protection and business practices, especially for brokers dealing with everyday traders. It requires high levels of transparency, strong financial health, and fair treatment of clients. These are the rules that help weed out weak or dishonest brokers.

In Australia, Fortrade is regulated by ASIC (License No. 493520), another respected authority. ASIC ensures brokers handle client funds properly, follow fair trading rules, and meet financial standards. Its also active in stopping misleading advertising and unsafe trading practices. Being licensed by both the FCA and ASIC gives Fortrade a strong reputation.

Fortrade also holds a license from CySEC in Cyprus (License No. 385/20). Although CySEC is sometimes seen as slightly less strict than the FCA or ASIC, it still follows EU laws under MiFID II. That means Fortrade must meet rules for capital reserves, risk management, and transparency. This adds to its credibility in Europe.

In North America, Fortrade operates under Canada‘s CIRO, a new regulatory body formed by merging IIROC and MFDA. Although the license number isn’t public, CIRO is known for its careful and investor-focused approach. It watches over brokers and trading platforms across the country, helping to keep the Canadian market safe.

However, despite this strong global regulatory presence, one issue stands out: a revoked license in Belarus.

Fortrade was once licensed by the National Bank of the Republic of Belarus (NBRB), under license No. 193075810. That license has now been revoked. This isn‘t a routine event like ending operations or letting a license expire, as it usually means the broker broke the rules or failed to meet the regulator’s requirements.

Revoking a license isn‘t done lightly. It often follows a pattern of non-compliance, missed deadlines, or problems uncovered during audits. While we don’t know exactly why Fortrade lost this license, the lack of public information makes it more concerning. Without answers, traders are left guessing.

Read more

Mazi Finance Exposure: Do Traders Find it Hard to Place Trades and Access Withdrawals?

Did Mazi Finance deny withdrawals once you made profits? Did the Saint Lucia-based forex broker deny based on terms and conditions that did not exist while opening a trading account? Do you frequently encounter issues concerning the Mazi Finance App download? Do you fail to place trades due to the server issues on the trading app? These are some problems traders have highlighted while sharing the Mazi Finance review. Read on as we share some complaints against the forex broker.

Jetafx Review: Allegations of Fund Scams and Withdrawal Blocks Using Unfair VPS Trading Rule

Did Jetafx allow you to withdraw initially to gain your trust and later disallow you from using this privilege? Were you prevented from withdrawing funds due to a seemingly inexplicable new VPS trading rule? Have you witnessed a complete fund scam experience with the forex broker? Does the Jetafx support team fail to address your trading queries? You are not alone! Many traders have complained about these issues on broker review platforms. In this Jetafx review article, we have shared some of their complaints. Read on!

uexo Analysis Report

uexo emerges as a recommended forex broker with a solid overall rating of 6.9 out of 10, demonstrating reliable performance that appeals to both novice and experienced traders. Based on a comprehensive analysis of 21 reviews, the broker maintains an impressively low negative rate of just 9.5%, with the sentiment distribution heavily favoring positive experiences—15 traders expressed satisfaction, 4 remained neutral, and only 2 reported negative encounters. Read on for more insights.

SEAPRIMECAPITAL Analysis Report

SEAPRIMECAPITAL stands out as a recommended forex broker with an impressive 7.8 out of 10 overall rating, backed by an exceptional track record of zero negative reviews among its 16 total user assessments. This remarkable achievement reflects the broker's commitment to delivering quality service that resonates with traders across various experience levels. The sentiment distribution speaks volumes, with 15 positive reviews and just one neutral response, demonstrating consistent client satisfaction and reliability in the competitive forex marketplace. Click on for an extended market report.

WikiFX Broker

Latest News

Telegram Investment Scam Wiped Out RM91,000 in Days

German Capital Flows Heavy into China, Defying Trade War Risks

PayPal Re-enters Inbound Nigerian Market via Paga Partnership

Global Macro: China Retrenches as Trump Signals Transactional Era

Dollar Index Hits Four-Year Low as 'Fed Whisperer' Signals Rate Pause

Gold Smashes $5,100 Barrier: Dalio Warns of 'Capital Wars'

Fiscal Policy Monitor: Authorities Tighten Tax Compliance Framework

SPEC TRADING Review 2026: Is this Forex Broker Legit or a Scam?

Who are the “Police” Watching Your Forex Broker? (FCA, ASIC, NFA Explained)

AMBER MARKETS Review 2026 — Is AMBER MARKETS Broker Safe for Forex Trading?

Rate Calc