Doctor Trapped by 520% Profit Promise, Loses RM8.7 Million

Abstract:A 53-year-old doctor in Malaysia has lost her entire life savings of RM8.7 million after falling prey to a sophisticated online investment scam that promised massive returns from stock trading.

A 53-year-old doctor in Malaysia has lost her entire life savings of RM8.7 million after falling prey to a sophisticated online investment scam that promised massive returns from stock trading.

According to Johor Bahru Selatan deputy police chief Azrul Hisham Shaffei, the woman came across a trading advertisement on social media in April. Intrigued by claims of high profits, she began communicating with an individual featured in the ad to learn more about the investment opportunity.

The scammers presented her with a tempting offer of up to 520% on her capital. Enticed by the promise of fast and substantial profits, she proceeded to transfer large sums of money to multiple bank accounts over three months, from May to July. In total, she deposited RM8.7 million, trusting that her investment would yield high returns.

However, the promised profits never materialised. Instead, the victim was told that her investment had only generated RM6,033. To access her funds, she was instructed to pay an additional RM500,000 as a “deposit”. The scammers threatened to freeze her account if she refused to comply, which ultimately led her to suspect she had been defrauded.

She reported the case to local authorities on Tuesday. The investigation is now underway under Section 420 of the Malaysian Penal Code, which covers offences related to cheating.

This case underscores the tactics commonly used by cybercriminals: exploiting victims trust with offers that appear both legitimate and lucrative. Social media has become a key platform for scammers to reach potential targets, often with well-crafted advertisements and convincing profiles.

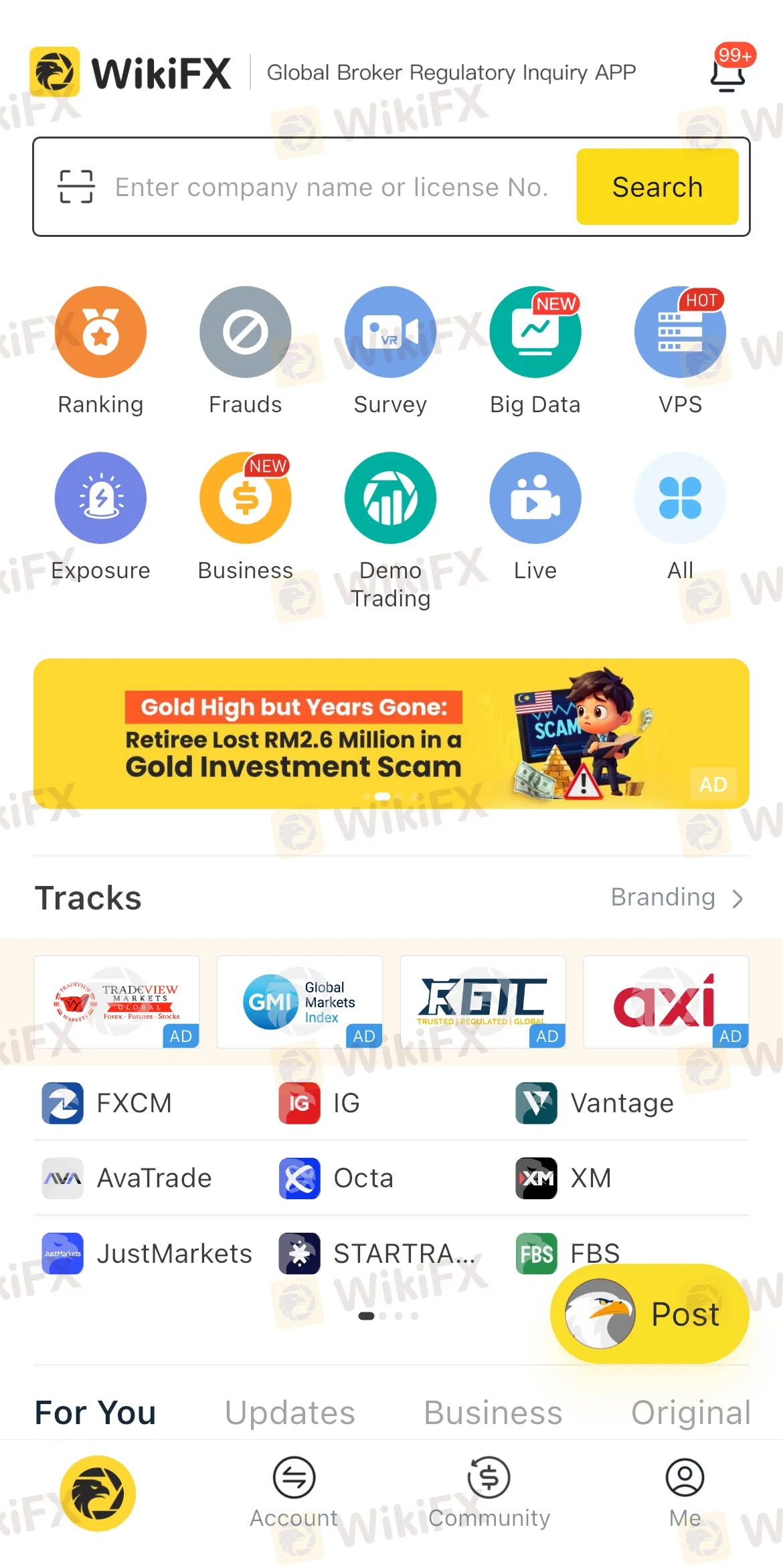

In the wake of such incidents, experts stress the importance of verifying the legitimacy of any investment platform before transferring funds. Tools like WikiFX are proving valuable in this regard. WikiFX offers detailed background checks on brokers, including their regulatory status, customer feedback, and overall safety scores. By providing insights and risk alerts, WikiFX enables users to make informed choices and avoid engaging with unlicensed or fraudulent platforms. With scams growing increasingly sophisticated, conducting proper due diligence can mean the difference between financial security and devastating loss.

Read more

Top Scam Allegations Against FinaDexa: Vanishing Deposits, Capital Losses & Withdrawal Issues

Has your deposit amount vanished instantly at FinaDexa? Finding it hard to access fund withdrawals as the broker continues to delay them? Are you facing capital losses due to a series of trade manipulations by the broker? You are not alone! Many traders have been facing these issues without resolution, and as a result, they have come out openly criticizing the broker. In this article, we will share their reviews for FinaDexa, a Comoros-based forex broker. Take a look!

Qorva Markets Review: Why You Should Avoid This Broker!

If you don’t find any review about broker. Does it make you suspicious about that particular broker? Qorva Markets is one such broker you can’t find any reviews about it. And it’s not just that — there are other red flags too that put this broker under the radar. Discover 7 legit reasons to stay away from it.

An Insightful Guide to the Importance of Forex Trading

The forex market, with an average trading volume of approximately $7.51 trillion per day, presents a wide range of avenues for traders, banks and other institutions engaged in this space. This market facilitates global trade and investment, offers hedging options for risk management, provides them with liquidity and profit accessibility, and ensures economic integration globally. Read on to know the utility of forex trading.

10 Best Forex Pairs to Trade in 2025

With economic shifts, central bank policies, and geopolitical events shaping currency movements, 2025 presents a mix of opportunities and risks. Whether you're a beginner or an experienced trader, selecting the most reliable and profitable pairs can boost your trading performance.

WikiFX Broker

Latest News

Robo Trading Explained: What It Is and How It Works?

Exness Redefines Forex Trading Standards

Forex Pips Explained: Definition, Importance & Key Insights for Traders

Robinhood Sues Massachusetts Over Sports Bet Rules

Neex Secures UAE License, Expands Middle East Ops

Simulated Trading Competition Experience Sharing

CySEC Updates CFD Restrictions to Enhance Retail Investor Protection

Chase-Plaid Deal Sets Banking Fee Precedent

Top 5 Forex MAM Brokers for 2025: A Complete Comparison Guide

Fed Meeting Begins: What a Potential Rate Cut Could Mean for Traders?

Rate Calc