EC Markets: A Closer Look at Its Licenses

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about EC Markets and its licenses.

In an increasingly regulated global trading environment, EC Markets is positioning itself as a broker with credibility, transparency, and compliance deeply embedded in its operational DNA. The broker now holds five regulatory licences in major financial regions, helping it serve both retail and professional traders with greater confidence.

One of EC Markets key licences is from the Australian Securities and Investments Commission (ASIC), with licence number 414198. ASIC is known for its strong rules and high standards, which help protect traders and keep financial companies in check. In Australia, EC Markets operates as a Market Maker (MM), which means it follows strict guidelines that aim to create a safe and fair trading environment.

The company has also expanded its presence in the Asia-Pacific region by getting a Market Maker licence from the Financial Markets Authority (FMA) in New Zealand. This licence, under number 197465, brings more trust to its services. The FMA watches over financial companies, focusing on fair trading, clear communication, and customer protection.

In the UK, EC Markets is authorised by the Financial Conduct Authority (FCA), with licence number 571881. This licence allows the company to use a Straight Through Processing (STP) model, where client orders go directly to the market. The FCA is one of the most respected regulators in the world, known for making sure companies treat clients fairly, keep client money safe, and stay financially stable.

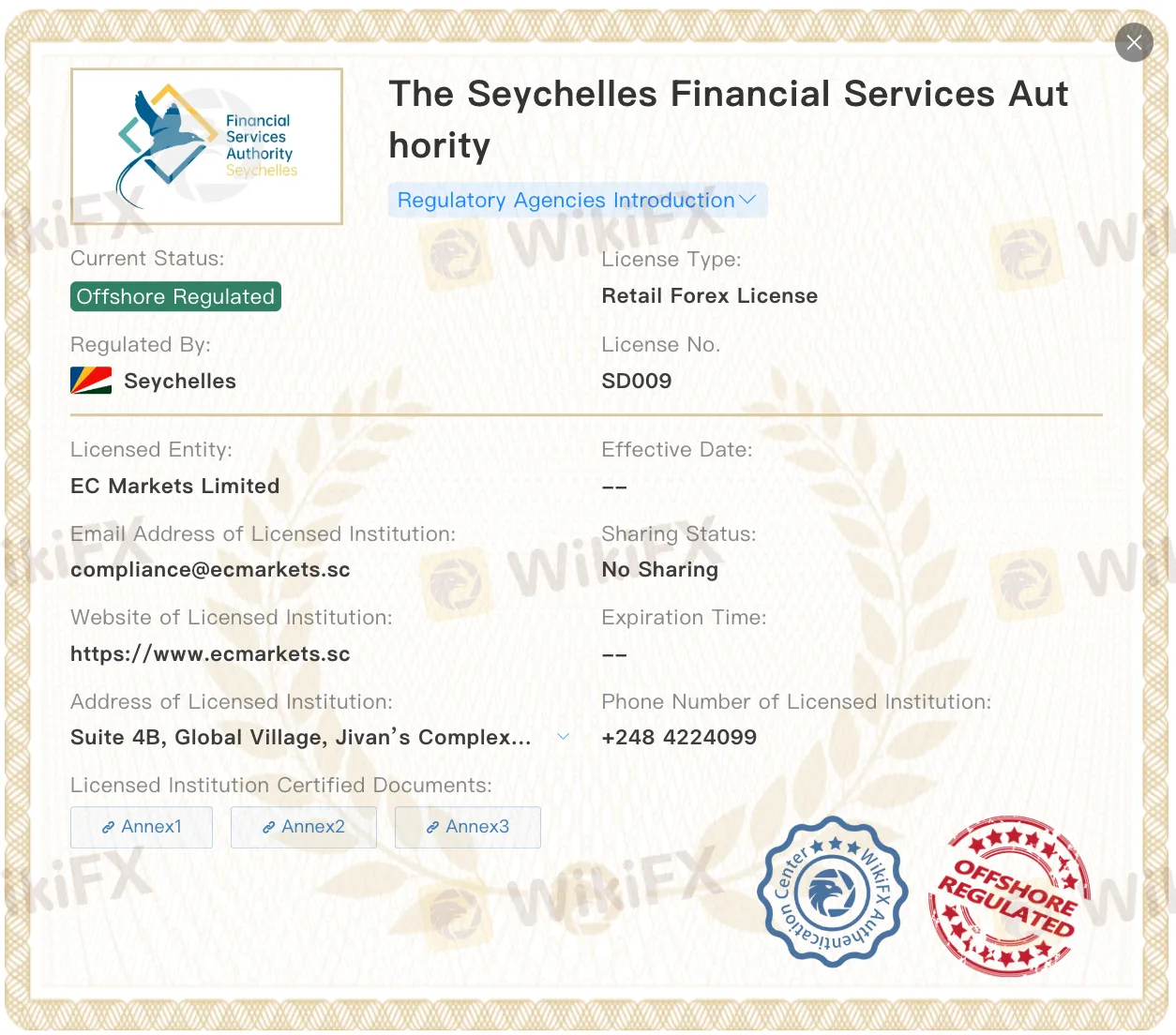

Outside of the usual financial centres, EC Markets also holds a Retail Forex Licence from the Financial Services Authority (FSA) in Seychelles, under licence SD009. Seychelles has become a popular location for forex and CFD brokers who serve clients internationally. This licence gives EC Markets the ability to offer services globally while staying under formal supervision.

In Africa, the company is authorised by South Africa‘s Financial Sector Conduct Authority (FSCA), with licence number 51886. The FSCA’s job is to make sure financial firms are honest, transparent, and treat clients fairly.

By holding licences in multiple regions, EC Markets is one of the few brokers with strong global coverage while still following local rules. This allows the company to offer services across many countries without lowering its standards.

Adding to its credibility, EC Markets has earned a high WikiScore of 9.07 out of 10 on WikiFX, a global platform that rates brokers. This score reflects the brokers strong performance in areas like regulation, risk management, software quality, and business strength.

Read more

Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Pemaxx Review: Fund Scams & No Withdrawals, Say Traders

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Fortune Prime Global Exposure: Withdrawal Denials & Profit Cancellations Frustrate Traders

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

Safe Trade with WikiFX - Exclusive Interview with Indonesian Professional Kenwilboy

WikiFX is launching the "Safe Trade with WikiFX" exclusive interview series, featuring members of the WikiFX Elite Club. This series delivers in-depth industry insights on trading safety, the establishment of industry standards, and regional market dynamics, aiming to foster deeper understanding of local markets and jointly advance transparency across the industry.

WikiFX Broker

Latest News

Telegram Investment Scam Wiped Out RM91,000 in Days

German Capital Flows Heavy into China, Defying Trade War Risks

PayPal Re-enters Inbound Nigerian Market via Paga Partnership

Global Macro: China Retrenches as Trump Signals Transactional Era

Dollar Index Hits Four-Year Low as 'Fed Whisperer' Signals Rate Pause

Gold Smashes $5,100 Barrier: Dalio Warns of 'Capital Wars'

Fiscal Policy Monitor: Authorities Tighten Tax Compliance Framework

SPEC TRADING Review 2026: Is this Forex Broker Legit or a Scam?

Who are the “Police” Watching Your Forex Broker? (FCA, ASIC, NFA Explained)

AMBER MARKETS Review 2026 — Is AMBER MARKETS Broker Safe for Forex Trading?

Rate Calc