FXPRIMUS Exposed: Withdrawal Denials, Account Blocks & Other Alarming Issues

Abstract:Have your fund withdrawal applications been constantly denied by FXPRIMUS? Does the forex broker inappropriately block your trading account? Are your deposits disappearing without reaching your trading account? There’s something seriously wrong with this forex broker, whose track record keeps getting worse by the day. Many traders have expressed their anguish on several broker review platforms. While reading those reviews, we could not resist exposing this broker. Check out how traders have criticized FXPRIMUS for its illicit acts.

Have your fund withdrawal applications been constantly denied by FXPRIMUS? Does the forex broker inappropriately block your trading account? Are your deposits disappearing without reaching your trading account? Theres something seriously wrong with this forex broker, whose track record keeps getting worse by the day. Many traders have expressed their anguish on several broker review platforms. While reading those reviews, we could not resist exposing this broker. Check out how traders have criticized FXPRIMUS for its illicit acts.

Top Complaints That Call for Strict Action Against FXPRIMUS

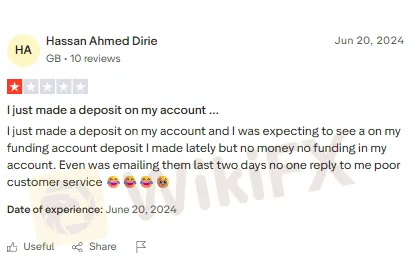

Deposits Not Credited to the Trading Account

This complaint makes it clear that there is something suspicious. How can the deposits made by traders not go to their trading accounts? At the same time, the lack of response from FXPRIMUS to traders queries makes for an even worse experience. Check the snapshot containing a complaint on this issue.

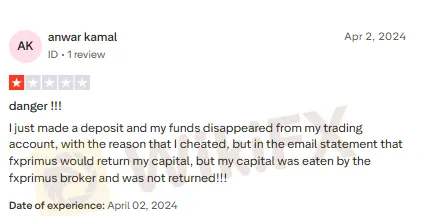

Funds Disappearing Under the Pretext of False Accusation on Traders

Funds disappearing the moment traders deposit is a major issue that grabbed our attention. The company falsely accuses traders of foul play, whereas the fault lies with it. In this blame game, the only sufferer is the trader. Where that hard-earned capital is does not bother FXPRIMUS. Frustrated by the turn of this event, a trader shared his anger on a broker review platform. Check out the snapshot below to see it.

Withdrawal Denials are Usual

The less said about withdrawals, the better! You can make a withdrawal request at FXPRIMUS and try to contact its officials using any of the communication platforms. Neither will these officials connect with you, nor will they resolve your withdrawal issues. Here are two snapshots regarding this issue.

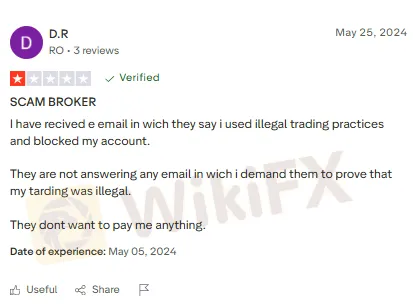

Account Block Issue for Traders

Account block issue in the name of illegal trading practices is just another guise employed by FXPRIMUS to dupe investors. One such trader witnessed this issue and wanted clarification on the email by the company. However, the company officials did not respond to the issue, which points to a potential forex scam. Check out the complaint.

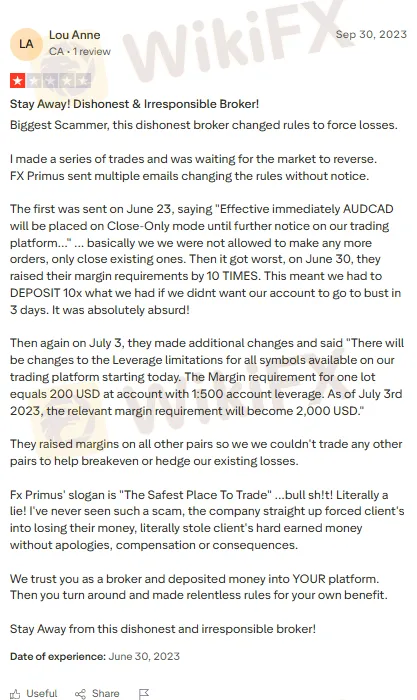

A Series of Bogus Trading Rules

After making quite a few trades, the trader wanted the market to reverse. Seeing this, FXPRIMUS suddenly changed the rules that took the trader by surprise. Firstly, the trader was restricted to closing the currency pair and then had to deposit 10X to meet the sudden rise in margin requirements set by the company. A few days later, FXPRIMUS changed the rules to leverage limitations. Here is how things went downhill for the trader owing to these bogus rules.

WikiFX Shares Views on FXPRIMUS

It is appalling to have read such extreme pain traders have witnessed at FXPRIMUS. This calls for a serious investigation by the competent financial authority. The safety of traders is compromised in the name of fake rules. Considering its operational methodology, the WikiFX team has given FXPRIMUS a score of just 2.46 out of 10.

Join WikiFX Masterminds, Where You Know the Latest Forex Scams Along with Other Updates

So, what is the joining process?

Just follow these steps -

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations, you are part of the community.

Read more

Behind the Licences: Is Pepperstone Really Safe for Malaysians?

Pepperstone has built a global reputation as a forex and CFD broker, and it frequently highlights its network of international licences. Yet, when examined through WikiFX, the picture becomes more complex.

IBKR Jumps on September DARTs, Equity Growth

Interactive Brokers' stock climbs after strong September metrics, with DARTs and client equity surging while Citigroup lifts its price target.

Hirose Halts UK Retail Trading Amid Market Shift

Hirose Financial UK suspends retail forex services, citing a shift toward institutional trading despite strong revenue growth.

FINRA Fines United Capital Markets $25,000

FINRA fined and censured United Capital Markets $25,000 for supervisory gaps and unapproved, exaggerated retail communications in 2018–2019.

WikiFX Broker

Latest News

Behind the Licences: Is Pepperstone Really Safe for Malaysians?

Promised Recession... So Where Is It?

Hirose Halts UK Retail Trading Amid Market Shift

FINRA Fines United Capital Markets $25,000

CONSOB Blocks EurotradeCFD’s Solve Smart, 4X News

Oanda: A Closer Look at Its Licenses

FCA Urges Firms To Report Online Financial Crime

IBKR Jumps on September DARTs, Equity Growth

Service Sector Surveys Show Slowdown In September Despite Rebound In Employment

Rate Calc