4XC Review 2025: 5 Major Warning Signs You Shouldn’t Ignore

Abstract:Investment scams are prevalent in the forex market. You need to be Scam alert to protect yourself from these kinds of scams. Otherwise, you could end up penniless, as fraudulent brokers may swindle your money. To stay informed, Read the major warning signs associated with 4XC.

Investment scams are prevalent in the forex market. You need to be Scam alert to protect yourself from these kinds of scams. Otherwise, you could end up penniless, as fraudulent brokers may swindle your money. To stay informed, Read the major warning signs associated with 4XC.

1.Limited variety of financial instruments - One of the key drawbacks of this trading platform is the limited variety of financial instruments it offers. This lack of diversity can limit potential returns and increase risk, especially for those who prefer to spread their investments across different markets such as stocks, commodities, forex, or cryptocurrencies. For serious traders and investors, access to a broader selection of instruments is essential for building a well-balanced and flexible investment strategy.

2. Not Tier-1 Regulated – 4XC operates under the trademark of 4xCube Ltd, which is registered in the Cook Islands and holds a license from the Financial Supervisory Commission (FSC) under Money-Changing License number MC03/2018. While this may appear legitimate at first glance, it's important to note that the Cook Islands is a relatively remote jurisdiction often chosen by companies seeking to benefit from lighter regulatory oversight. This raises concerns, as the region is not recognized as a Tier-1 regulatory environment, which typically offers stronger investor protection and stricter compliance standards.

3. 4XC app Not Available - The unavailability of the 4XC app is a significant inconvenience for users who rely on mobile access for trading and account management. Without the app, users may face challenges in monitoring the markets, executing trades quickly, or managing their portfolios on the go. This lack of accessibility can lead to missed opportunities and reduced user satisfaction. In todays fast-paced trading environment, having a reliable and functional mobile app is essential, and its absence puts 4XC at a disadvantage compared to competitors that offer seamless mobile solutions.

4. No Deposit Compensation Scheme Available – 4XC is the absence of a deposit compensation scheme, which is a government-backed fund designed to protect investors. In more reputable financial jurisdictions, such schemes act as a safety net, ensuring that clients can recover some or all of their funds if a licensed financial firm collapses or becomes insolvent. This lack of financial security makes trading with such platforms significantly riskier, especially for retail investors.

5. 24/5 Customer support – Having only 24/5 customer support can be a major concern for many users. This means help is only available during weekdays, and not on weekends. If a problem happens on a Saturday or Sunday, customers have to wait until Monday to get support. This can cause frustration, delays, and even lost business, especially for people who work on weekends or in different time zones. In todays world, many expect help at any time, so not having 24/7 support can be a big issue.

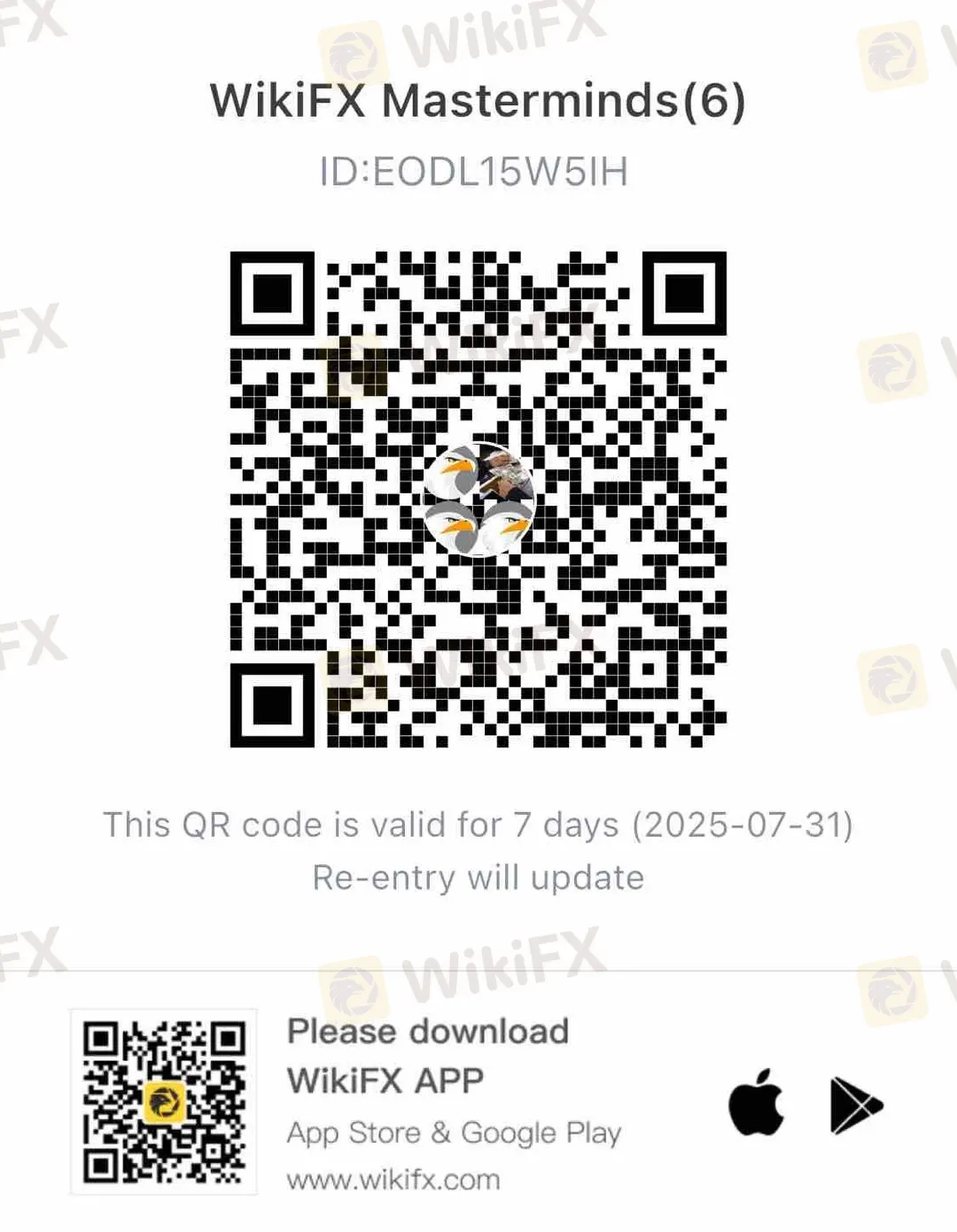

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

IG Group Expands French Stock Trading with Upvest

IG Group partners with Upvest to launch stock and ETF trading in France, boosting its European expansion amid rising broker competition.

Switch Markets Review: Do Traders Face Deposit Discrepancies and Account-related Issues?

Do you fail to deposit your funds into the Switch Markets forex trading account? Earned profits, withdrew them too, but did Switch Markets block your deposits? Wanted to close your trading account due to payment-related issues, but in turn got your emails blocked by the Australia-based forex broker? Faced a negative trading account balance because of illegitimate trade order execution? Many traders have shared these stories about Switch Markets on broker review platforms. In this Switch Markets review article, we have mentioned the same. Read on!

Is IEXS Safe or a Scam? A 2025 Review Based on 13 User Complaints and Regulatory Red Flags

You're asking a direct and important question: Is IEXS safe or a scam? As someone who might trade with them or already does, this is the most important research you can do. While IEXS says it is a global broker with over ten years of experience, a detailed look at its regulatory status and many user reviews shows serious warning signs that cannot be ignored. The evidence suggests a high-risk situation for traders' capital. This review will examine the available information, from official regulatory warnings to concerning first-hand user complaints, to give you a clear and fact-based view of the risks involved in trading with IEXS. Our goal is to give you the facts you need to make a smart decision.

Having Trouble Getting Your Funds Out of IEXS? A Simple Guide to Delays and Solutions

Are you having trouble withdrawing funds from your IEXS account or facing delays getting your funds? Not being able to access your own capital is one of the most stressful situations any trader can face. It breaks down your basic trust with a broker. This isn't just annoying - it's a serious problem that can mess up your financial plans and cause a lot of worry. This guide goes beyond basic advice. We'll look at real user experiences and official regulatory information to give you clear answers. Our goal is to help you understand why IEXS withdrawal problems happen and show you practical steps you can take. We understand your concerns and want to give you the information you need to handle this tough situation.

WikiFX Broker

Latest News

Trillium Financial Broker Exposed: Top Reasons Why Traders are Losing Trust Here

FIBO Group Ltd Review 2025: Find out whether FIBO Group Is Legit or Scam?

Amillex Withdrawal Problems

Is INGOT Brokers Safe or Scam? Critical 2025 Safety Review & Red Flags

150 Years Of Data Destroy Democrat Dogma On Tariffs: Fed Study Finds They Lower, Not Raise, Inflation

CQG Partners with Webull Singapore to Power the Broker’s New Futures Trading Offering

【WikiEXPO Global Expert Interviews】Ashish Kumar Singh: Building a Responsible and Interoperable Web3

Trump: India\s US exports jump despite 50% tariffs as trade tensions ease

IEXS Review 2025: A Complete Expert Analysis

CySEC Flags 21 Unauthorized Broker Websites in 2025 Crackdown

Rate Calc