Scam Alert: GTS Caught in Major Trading Fraud

Abstract:Have you been deceived by GTS officials? Has this forex broker prevented you from withdrawing funds? Unfortunately, you have been scammed! File a complaint with the authorities soon to recover your funds. Many have accused this forex broker of serious fraud allegations on several broker review platforms. Our WikiFX team found a massive number of trader complaints against this broker. In this article, we will share them with you.

Have you been deceived by GTS officials? Has this forex broker prevented you from withdrawing funds? Unfortunately, you have been scammed! File a complaint with the authorities soon to recover your funds. Many have accused this forex broker of serious fraud allegations on several broker review platforms. Our WikiFX team found a massive number of trader complaints against this broker. In this article, we will share them with you.

Complaints Keep Getting Filed Against GTS

Traders Label GTS as ‘Cheater’

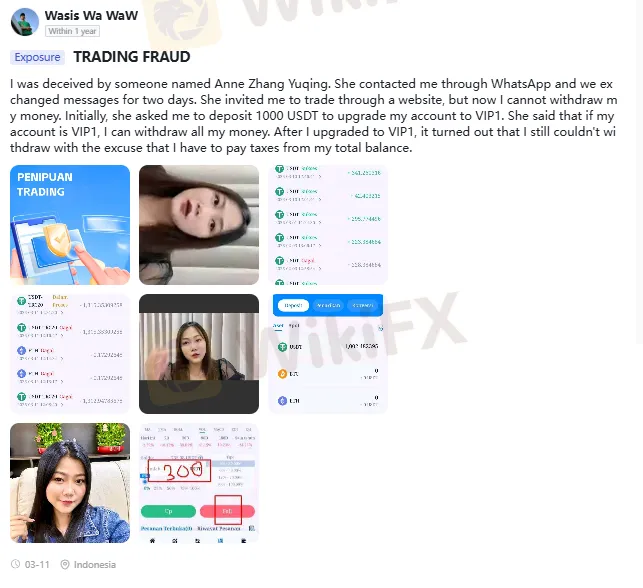

This forex broker has executives who contact traders through WhatsApp chats and invite them to the trading website. The minimum deposit required to initiate trading is $1,000 USD. Then, traders need to upgrade to VIP1 so that they can withdraw. However, even if you upgrade to VIP1, you cannot withdraw. Here is one screenshot that exposes this scam.

Company Executives Force Traders to Deposit Despite Being Aware of the Problem

The company officials operate with a sole mindset of deceiving traders. So, even if they are aware that the GTS platform is erroneous, they will continue to force traders to deposit funds. One trader admitted to have deposited over $300,000 solely on the insistence of the company executive. The trader faced a loss and expressed disappointment. Here is the complaint screenshot.

Forget Withdrawals When Trading with GTS

This is a dark reality about GTS as many traders have openly said that their withdrawal claims have been pending for months. Denying access to withdrawals is a clear scam that affects traders. Here are multiple screenshots regarding this complaint.

The WikiFX Advisory

Given the serious fraud allegations against GTS, the WikiFX team feels bad for the problems traders underwent with the broker. The fact that GTS does not have a valid license from the competent financial authority, the problems witnessed by traders don‘t surprise us. Unregulated brokers commit financial frauds, and one should avoid trading with them. That’s why, the score for GTS is only 1.60 out of 10.

Looking forward to joining WikiFX Masterminds Where You Stay Updated with Latest Forex News and Trends?

Here is how you can do it.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Thats it, you have become a community member.

Read more

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

FIBO Group has grabbed attention from traders for mostly the wrong reasons, as traders have accused the broker of causing financial losses using malicious tactics. Whether it is about withdrawal access, deposit disappearance, trade manipulation, or awful customer support service, the broker is receiving flak from traders on all aspects online. Our team accumulated a list of complaints against the FIBO Group broker. Let’s screen these with us in this FIBO Group review article.

GMO-Z.com Review: Do Traders Face Unfair Tax Payment on Withdrawals?

Do you have to pay taxes or margin when seeking fund withdrawals from GMO-Z.com, a Thailand-based forex broker? Do you witness heavy slippage when trading on the broker’s platform? These are some complaints traders have made against the broker. In this GMO-Z.com review article, we have explained these complaints. Take a look!

EO Broker Review: Why You Should Avoid It

EOBroker Review shows a low WikiFX score of 1.33/10. No regulation, fake license, and unsafe trading make this broker dangerous.

Pocket Broker Review: Why Traders Should Avoid It

Pocket Broker review highlights user complaints of blocked accounts, rejected withdrawals, and fraudulent practices.

WikiFX Broker

Latest News

BlackBull Markets Regulation: A Complete 2026 Guide to Their Licenses

ATFX Partners with AFA in Strategic Sponsorship

Forex Brokers with Strong Profit Potential in 2026

Gold's Structural Shift: Central Bank Buying Meets 'Peak Production'

CAD Slides as Venezuelan Supply Threat Weighs on Oil Markets\n\nThe Canadian Dollar (

Unitex Review (2025): Is it Safe or a Scam?

Otet Markets Exposed: Withdrawal Denials, Hidden Trading Rules & Scam Allegations

JP Markets Regulation Review: Legit or Fraud?

eFX Markets Review: Check Out Reported Trade Manipulation & Withdrawal Denial Cases

Treasury Secretary Bessent says more Fed rate cuts are 'only ingredient missing' for stronger economy

Rate Calc