Trading Strategies During Summer - Week 32 | Technical Analysis by Jasper Lawler

Abstract:Weekly thoughtsWe are now well in August and FYI Summer trading can get choppy.A popular strategy to navigate the choppy markets of the summer is dont trade - take a holiday (vacation)!In fact, the ch

Weekly thoughts

We are now well in August and FYI Summer trading can get choppy.

A popular strategy to navigate the choppy markets of the summer is dont trade - take a holiday (vacation)!

In fact, the choppy trading is a result of employees at big banks, corporate customers and institutional investors taking holidays. Less people trading tends to mean price moves dont follow through as much.

So taking a holiday yourself is simply a “if you can‘t beat them, join them” kind of approach. Plus it’s good to get some rest and clear your head!

I should say - I know it‘s winter in the Southern hemisphere! But as usual, it’s what goes on in ‘the west’ especially the USA that drives markets, including seasonality trends.

However, for those keen to keep trading, there‘s an upside to staying active.. you won’t miss those occasional big summer moves that often catch the wider market off guard. While many traders are away, thinner liquidity can sometimes magnify the impact of unexpected news or data, creating sharp, directional price moves. If youre in the market when they happen, you can be one of the few to catch them, while everyone else is still on the beach checking their phone!

Heres how we tend to approach the summer - can I use a fishing analogy?!

We want to have our hook in the water, but not be burning through bait all day. In other words, we stay engaged enough to catch those rare, bigger summer moves, but we dont waste energy and capital chasing every little ripple.

Heres how to do that..

First, remember that low liquidity can exaggerate price moves in both directions. What might normally be a small, manageable swing could become a bigger spike or drop simply because there arent as many orders in the market to absorb buying or selling pressure. That means stop-loss placement becomes extra important.

Second, keep your expectations realistic. If youre used to markets trending nicely for days or weeks at a time, summer might test your patience. Moves can reverse quickly, so be prepared to take profits a little earlier and avoid getting too attached to one bias.

Third, think about scaling back your position size. When conditions are less predictable, trading smaller can help you weather the inevitable false starts without doing major damage to your account.

Lastly, consider focusing on fewer, higher-quality setups. Its tempting to keep trading just for the sake of it, but in quieter markets, less can truly be more. Sometimes the best trade you make is the one you decide not to take.

Setups & signals

We look at hundreds of charts each week and present you with three of our favourite setups and signals.

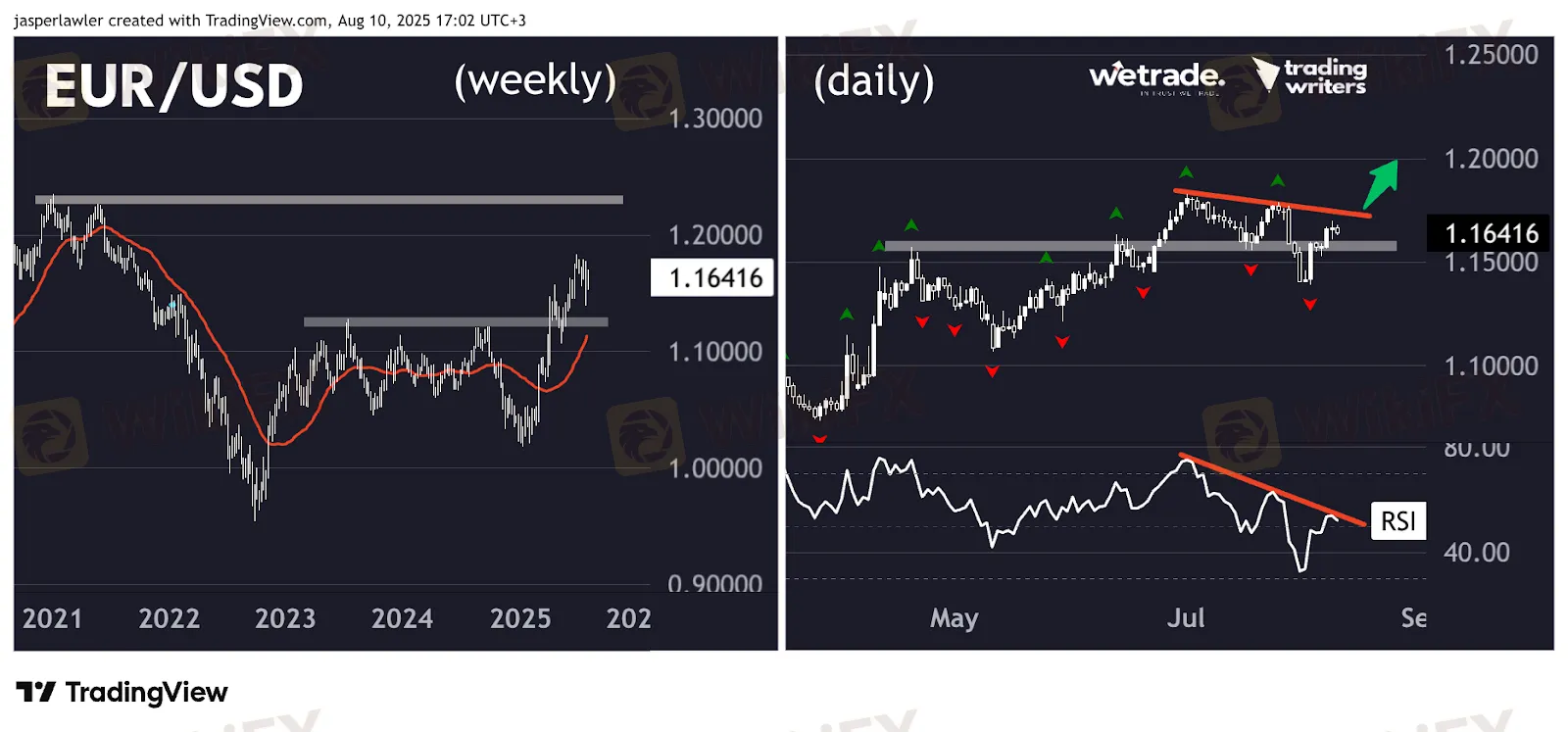

EUR/USDSetup

Price remains above the breakout level at 1.1250 and is comfortably above the 30 week SMA. Our ongoing assumption is that the probability of a retest of the prior high at 1.23 is more likely than a break back below 1.1250.

Signal

On the daily chart, the price entered a correction but after a break below 1.16 it has broken back above it in a sign the correction could be ending. A break above the price and RSI trendlines would confirm the trend is resuming.

EUR/JPYSetup

On the weekly chart, price has rallied strongly since breaking out of a triangle pattern and come just short of the former highs at 175. A double top is possible - especially following the bearish engulfing candlestick - but we would expect another rally towards the highs first.

Signal

A break below daily RSI support at 45 would be one way to interpret that the double top is in place and that the short-term trend has turned downwards. This should coincide with a close below 170.

NZD/JPYSetup

Price has rebounded back into the weekly bearish engulfing candlestick, offering a higher entry point for short trades. However, with the weekly downtrend broken and the price above 86.50 support, we assume the upward move continues.

Signal

While RSI hit its lowest level in months, the price uptrend is still supported by a rising trendline. The break of this trendline alongside weekly support would be enough to turn us bearish.

But - as always - thats just how the team and I are seeing things, what do you think?

Share your ideas OR send us a request!

WikiFX Broker

Latest News

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

FX SmartBull Regulation: Understanding Their Licenses and Company Information

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

Neptune Securities Exposure: Real Forex Scam Warnings

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

GODO Regulation: A Complete Guide

GODO Deposit and Withdrawal: A Simple Guide for Traders

Rate Calc