Malaysian Finfluencers Could Face RM10 Million Fine or 10 Years in Prison!

Abstract:A new regulatory measure by the Securities Commission Malaysia (SC) is set to change the country’s online trading and financial influencer landscape. Starting 1 November 2025, any trader or influencer caught promoting an unlicensed broker could face a fine of up to RM10 million, a prison sentence of up to 10 years, or both.

A new regulatory measure by the Securities Commission Malaysia (SC) is set to change the countrys online trading and financial influencer landscape. Starting 1 November 2025, any trader or influencer caught promoting an unlicensed broker could face a fine of up to RM10 million, a prison sentence of up to 10 years, or both.

For those accustomed to posting broker reviews, sharing referral links, or urging followers to open accounts with overseas platforms, this is no longer a harmless hustle, as it could soon become a criminal offence.

The SCs move aims to protect retail investors from scams and significant losses often linked to unregulated platforms. The principle mirrors licensing in medicine, just as only certified doctors may provide medical advice, only licensed financial intermediaries should promote investment products in Malaysia. By enforcing this law, the SC ensures promoters are both accountable and subject to regulatory oversight.

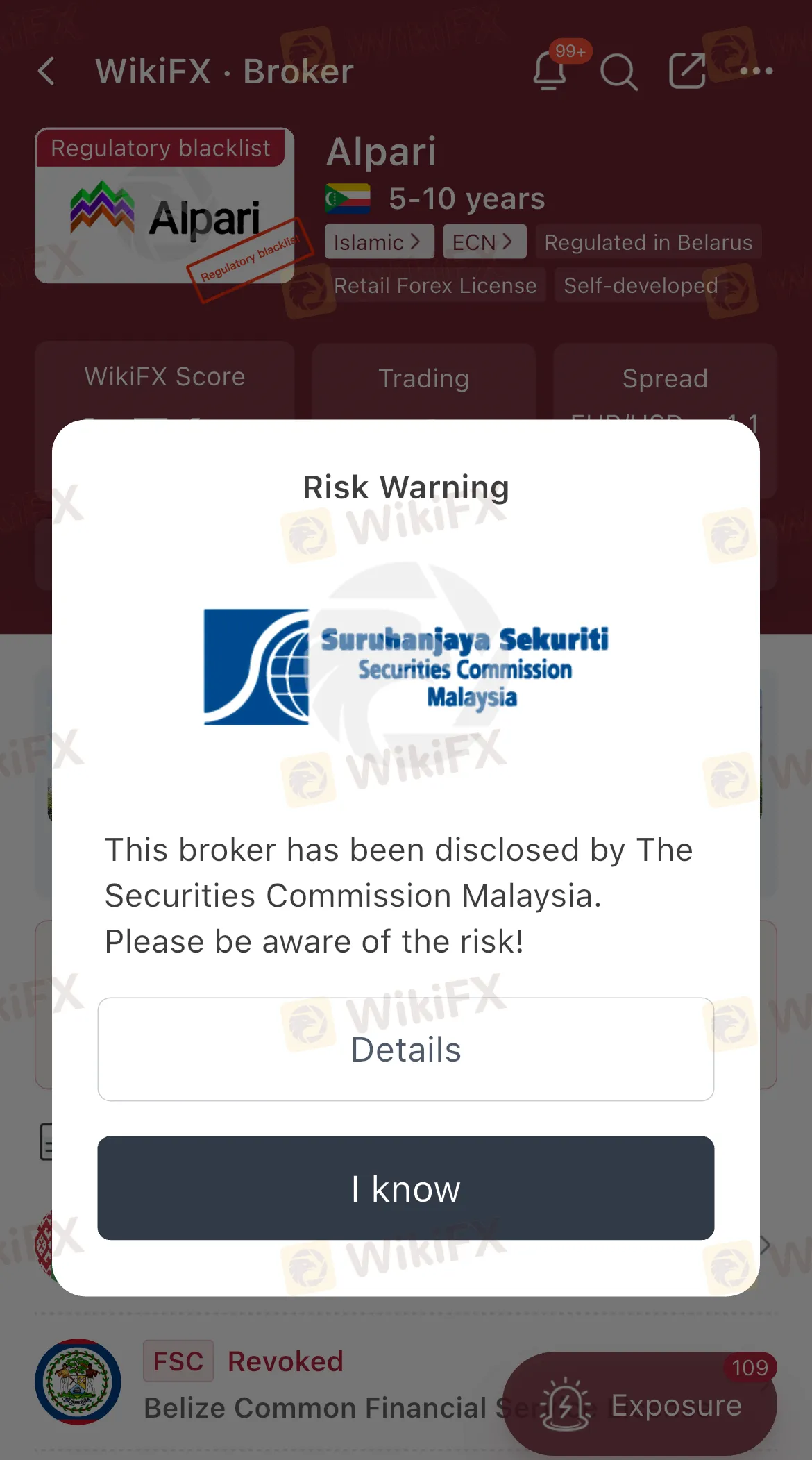

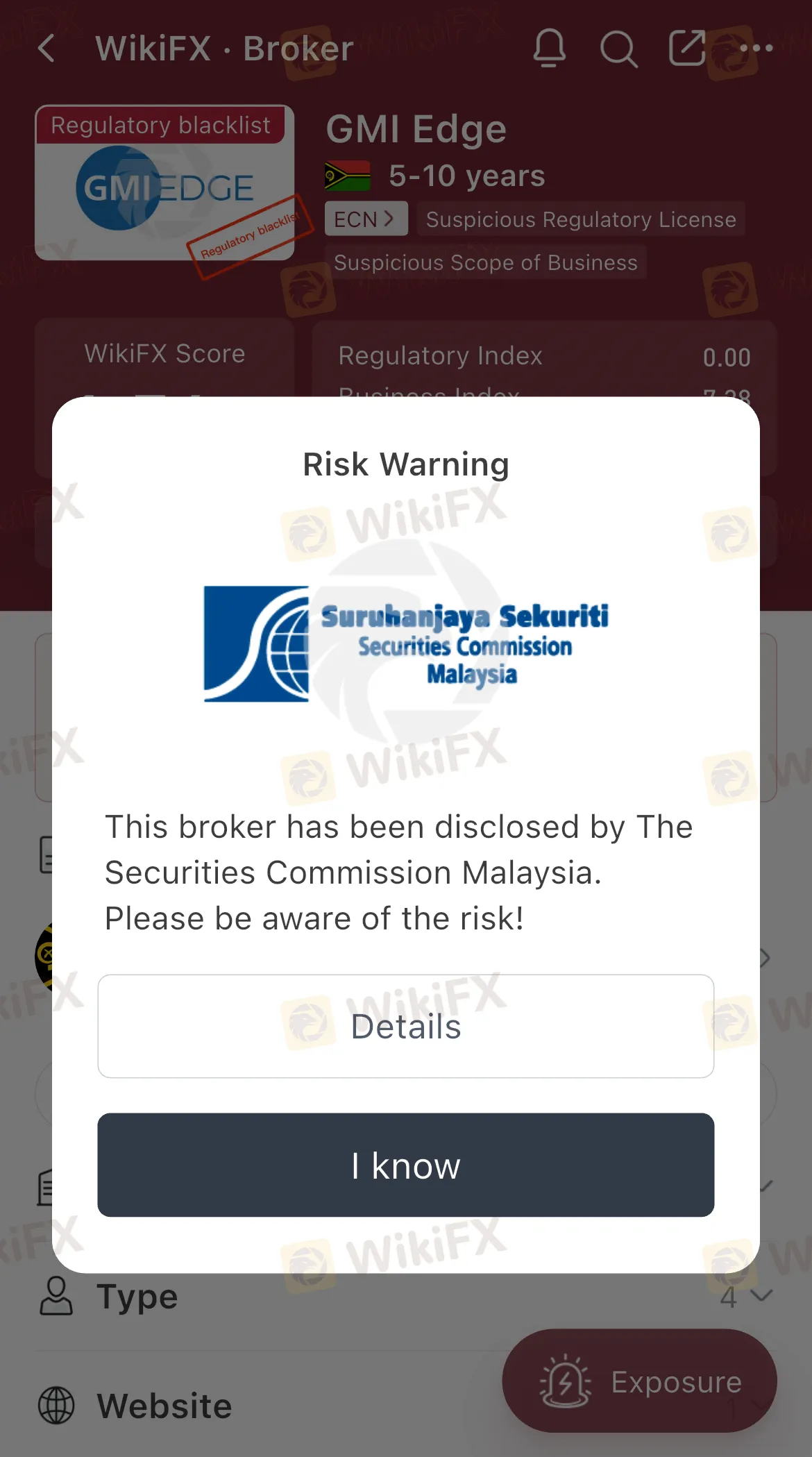

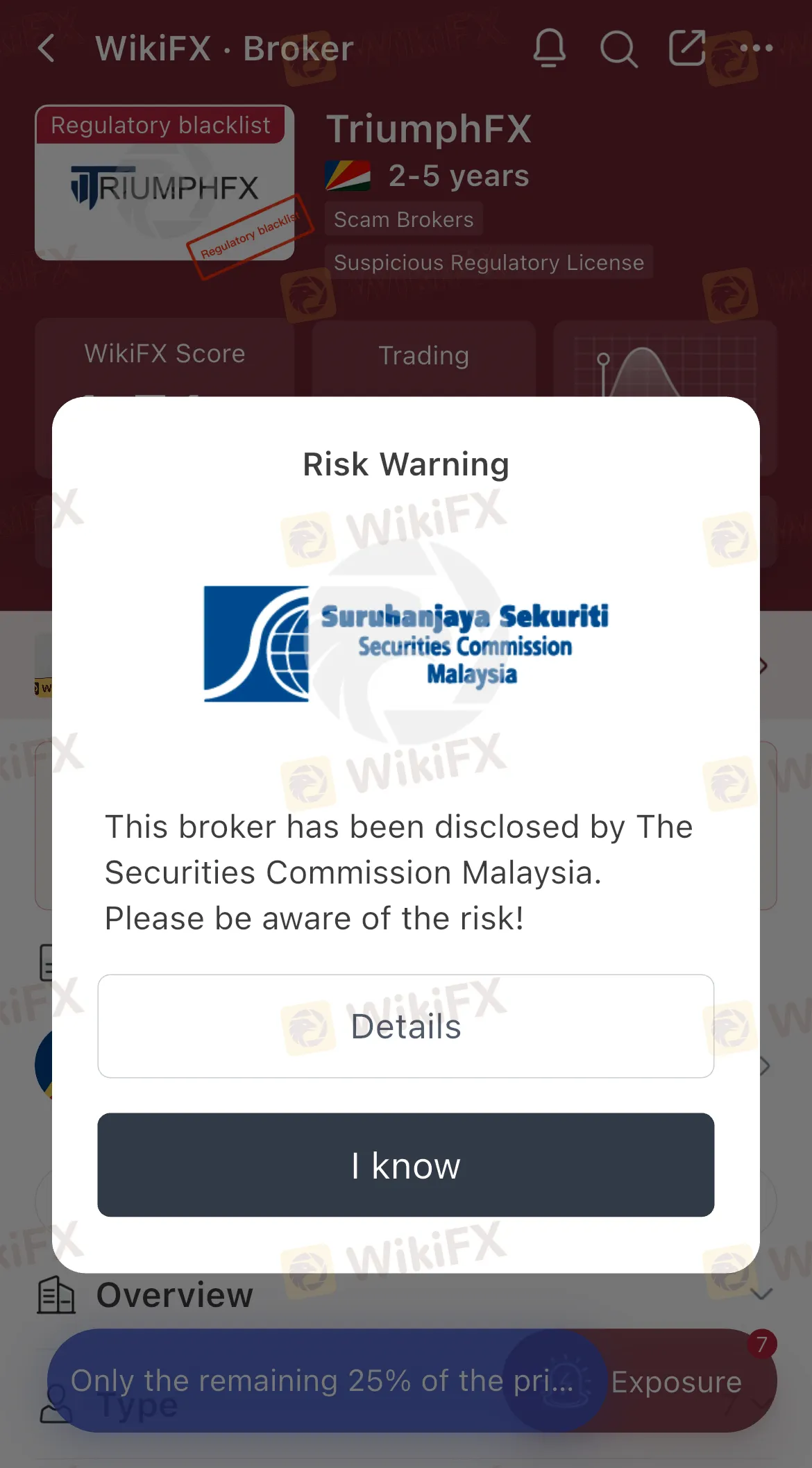

Currently, many Malaysian traders and “finfluencers” openly promote foreign brokers, often using affiliate codes to earn commissions. The problem is that many of these brokers are not licensed to operate in Malaysia, with several already named on the SCs Investor Alert List.

In practice, this list functions as a scam alert for investors, warning them about brokers that may be operating without authorisation. Up until now, such promotions were common, but under the new framework, promoting unlicensed financial products will be treated as a serious violation of securities law.

The SCs definition of promotion is broad, and the scope includes:

- Posting videos on social media with sign-up or referral links.

- Publishing blogs or Facebook posts endorsing an unlicensed broker.

- Hosting webinars explaining how to deposit into an overseas trading account.

Even if the promoter never handles investor funds directly, the act of promotion alone is enough to be considered an offence.

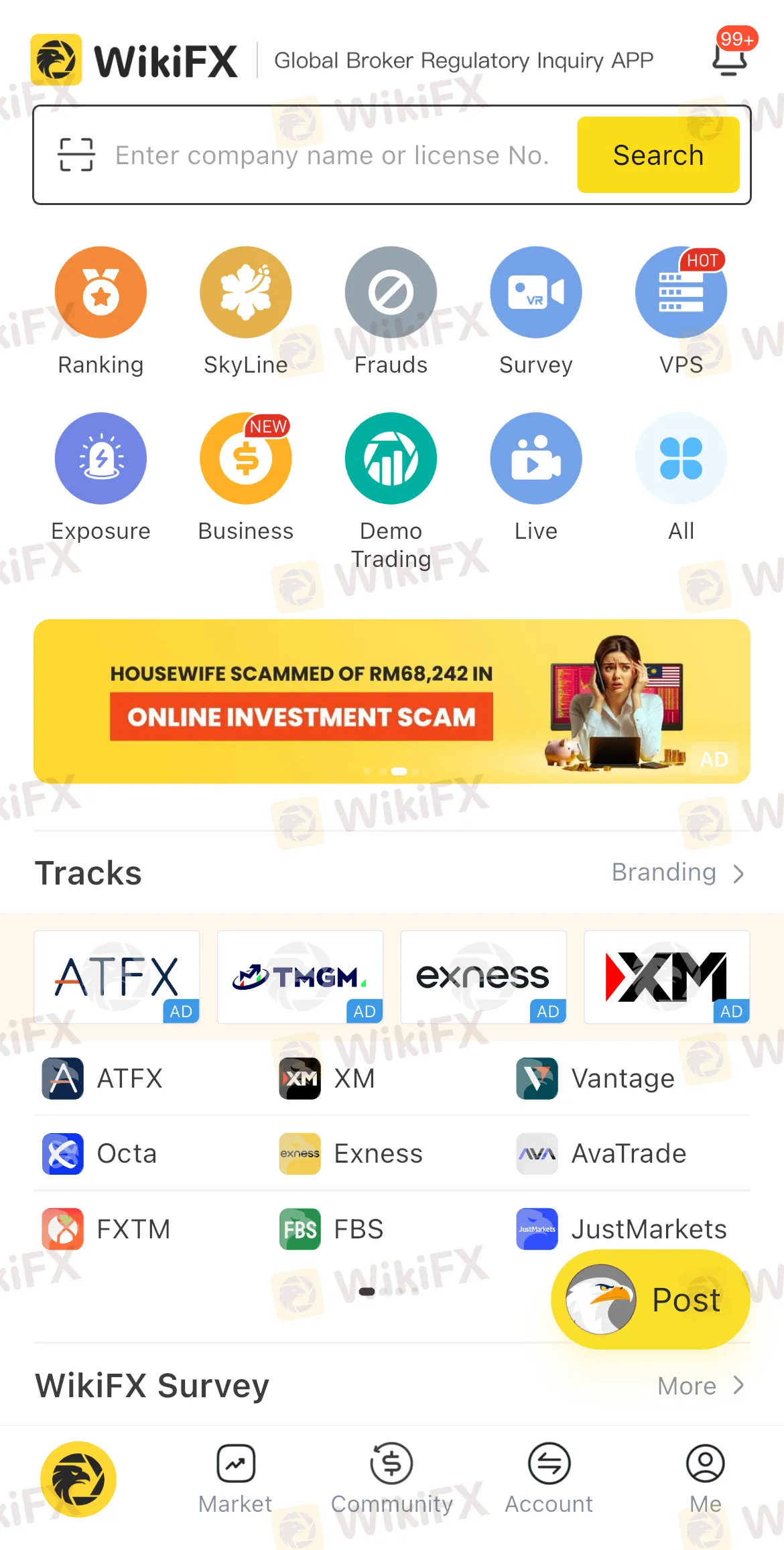

On this note, traders and investors can also use a free mobile application called WikiFX, which serves as a valuable tool for verifying the legitimacy of brokers and financial platforms. WikiFX offers an extensive database of global broker profiles, regulatory status updates, and user reviews, helping users make informed decisions before committing to any investment. Its risk ratings and alerts on unlicensed or suspicious entities can highlight potential red flags, including brokers flagged by the SC. With just a few clicks, investors can see a brokers background in full transparency, which is an important step that could save both money and peace of mind.

The bottom line: after 1 November 2025, one social media post could be all it takes to land you in legal trouble. The days of casually promoting unlicensed brokers for quick commissions are about to end.

Read more

Hirose Halts UK Retail Trading Amid Market Shift

Hirose Financial UK suspends retail forex services, citing a shift toward institutional trading despite strong revenue growth.

FCA Urges Firms To Report Online Financial Crime

FCA calls all regulated firms to report unlawful online promotions, tackling financial crime and deepfake scams under new compliance standards.

China’s Myanmar Scam Crackdown Intensifies with Death Sentences

China escalates its crackdown on Myanmar-based scam syndicates with death sentences and mass repatriations amid rising cross-border cyber fraud.

What Is a Good Spread in Forex? A Complete Guide

A good forex spread is typically under 1 pip on major pairs in liquid hours; learn definitions, benchmarks, costs, and how to pick low‑spread brokers.

WikiFX Broker

Latest News

Behind the Licences: Is Pepperstone Really Safe for Malaysians?

Promised Recession... So Where Is It?

Happy Mid-Autumn Festival from WikiFX to YOU!

Rate Calc