How Scammers Trap Victims Again and Again | Break this Cycle at Once

Abstract:Victims of financial scams are facing an even harsher reality as fraudsters increasingly exploit their desperation to recover lost funds. A growing number of cases reveal that criminals are posing as lawyers and law enforcement officers, luring victims into so-called “recovery scams” that compound their losses.

Victims of financial scams are facing an even harsher reality as fraudsters increasingly exploit their desperation to recover lost funds. A growing number of cases reveal that criminals are posing as lawyers and law enforcement officers, luring victims into so-called “recovery scams” that compound their losses.

This growing trend is a scam alert for anyone who has ever been defrauded online. It shows how easily victims can be deceived again if they do not take steps to protect themselves.

Experts point out that many victims fall prey to scams more than once because of the psychological burden of loss. After losing a significant sum, victims often experience desperation, shame, and a sense of urgency to repair the damage quickly. Fraudsters exploit these emotions by presenting themselves as rescuers who offer solutions to restore what was taken.

Desperation lowers a victims ability to question improbable claims, while shame often prevents them from confiding in friends or family who could provide objective advice. Fear of never recovering their savings also drives them to take risks they would not normally consider. These combined pressures create a cycle of vulnerability that scammers deliberately target.

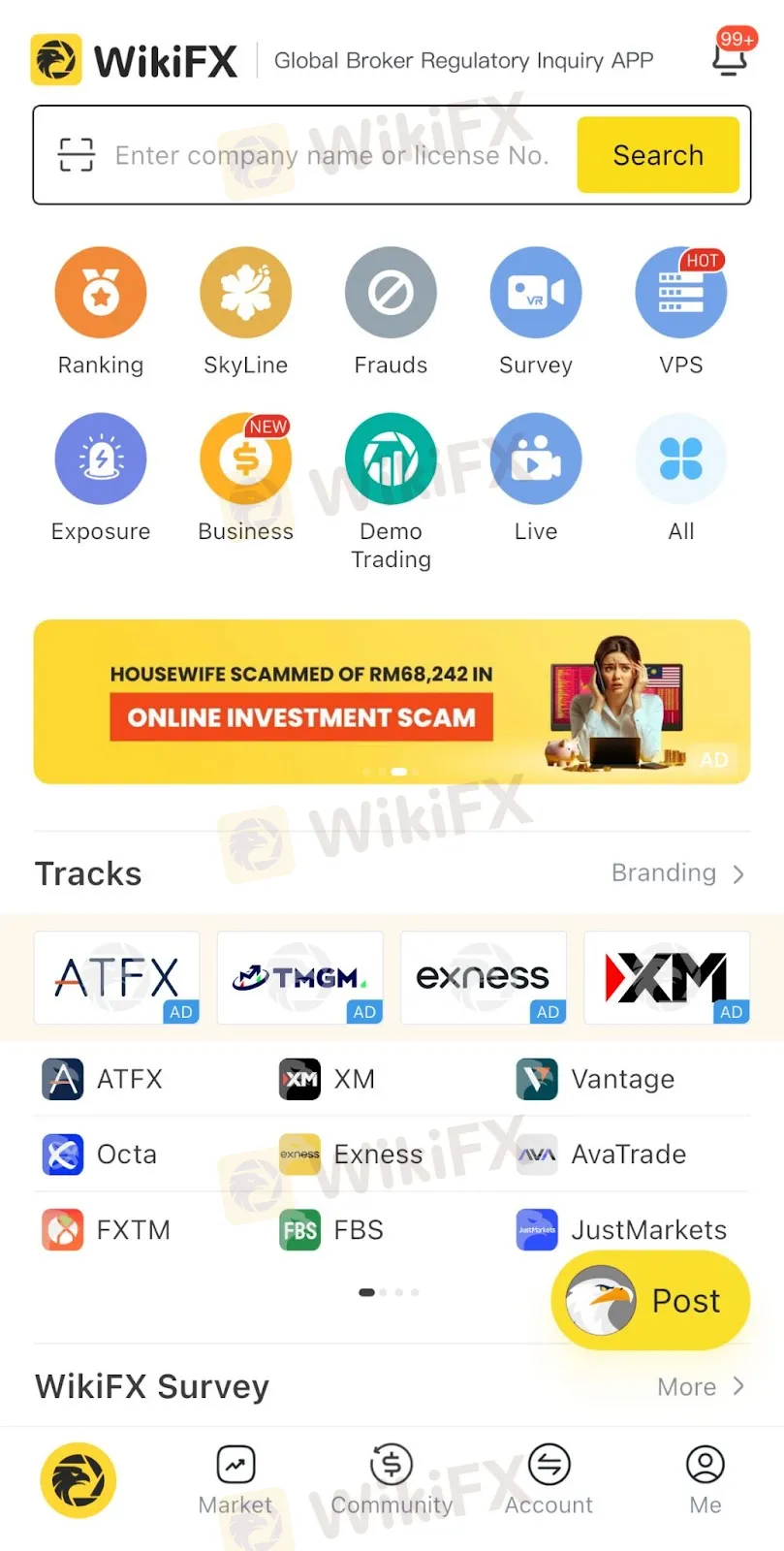

WikiFX: A Shield Against Investment Scams

To help investors navigate this environment, platforms such as WikiFX have become crucial. Designed to bring transparency to the forex and online trading space, WikiFX provides the very tools that victims of scams often lack:

- Regulatory Verification: Users can check whether brokers or financial platforms are officially licensed and regulated. This prevents scammers from using fake credentials to appear credible.

- Broker Ratings and Reviews: WikiFX offers trader feedback and broker ratings that help users understand the experiences of others before making investments.

- Scam Exposure Section: The platform hosts a space where traders can report suspicious activity or ongoing scams, turning individual experiences into community warnings.

- Global Coverage: With information of over 60,000 brokers across different regions, WikiFX helps investors identify red flags even when scammers hide behind foreign jurisdictions.

- Real-Time Alerts: Through updates on broker licences, suspensions, and regulatory warnings, WikiFX acts as an early scam alert, helping users avoid falling into the next trap.

Breaking the Cycle

For victims, the temptation to chase recovery offers is strong. But as countless cases show, rushing into these promises often leads to losing even more. Tools like WikiFX provide a more practical alternative: instead of reacting to scammers pressure, users can verify information and spot warning signs before they make another mistake.

As scammers shift their tactics to exploit victims' hopes of recovery, the risks of repeated deception are increasing. For those already defrauded, the danger of falling into a second trap is not only real but often more devastating than the first.

Read more

Behind the Licences: Is Pepperstone Really Safe for Malaysians?

Pepperstone has built a global reputation as a forex and CFD broker, and it frequently highlights its network of international licences. Yet, when examined through WikiFX, the picture becomes more complex.

IBKR Jumps on September DARTs, Equity Growth

Interactive Brokers' stock climbs after strong September metrics, with DARTs and client equity surging while Citigroup lifts its price target.

Hirose Halts UK Retail Trading Amid Market Shift

Hirose Financial UK suspends retail forex services, citing a shift toward institutional trading despite strong revenue growth.

FINRA Fines United Capital Markets $25,000

FINRA fined and censured United Capital Markets $25,000 for supervisory gaps and unapproved, exaggerated retail communications in 2018–2019.

WikiFX Broker

Latest News

Behind the Licences: Is Pepperstone Really Safe for Malaysians?

Promised Recession... So Where Is It?

Happy Mid-Autumn Festival from WikiFX to YOU!

Rate Calc