Weak Nonfarm Payrolls Signal Consumer Spending Cutbacks

Abstract:The U.S. August nonfarm payrolls report released last Friday showed an increase of just 22,000 jobs, while the unemployment rate rose to 4.3%. The total number of unemployed reached 7.4 million, of wh

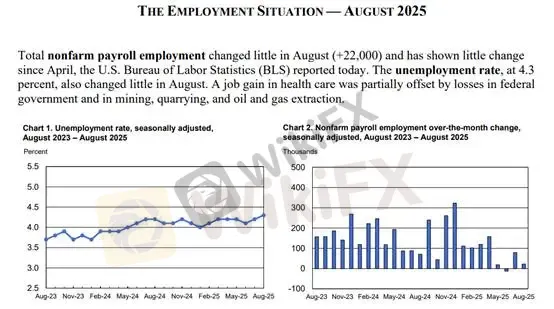

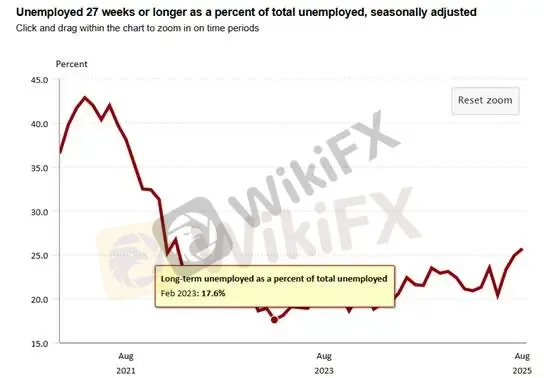

The U.S. August nonfarm payrolls report released last Friday showed an increase of just 22,000 jobs, while the unemployment rate rose to 4.3%. The total number of unemployed reached 7.4 million, of which 1.9 million were classified as long-term unemployed (jobless for 27 weeks or more), accounting for 25.7%. Historically, persistently high long-term unemployment has altered consumer behavior. In our view, the Feds rate cuts are not primarily aimed at saving the labor market, but rather at easing the financial burden on households.

(Chart 1. August Nonfarm Payrolls and Unemployment Rate; Source: BLS)

When analyzing employment data, one should not simply interpret the headline numbers. A deeper look provides a clearer picture of the real economy. Chart 2 shows that the share of long-term unemployed in the overall unemployment pool has risen steadily from 17.6% in February 2023 to 25.7%. This increase occurred during a period when U.S. equities and the economy appeared vibrant, yet the labor market environment failed to improve in tandem.

In short, those unable to find jobs remain unemployed, reflecting a mismatch between worker skills and corporate hiring needs.

(Chart 2. Long-term Unemployed as a Share of Total Unemployment; Source: BLS)

We are not overly concerned about the structural nature of long-term unemployment. Many disappearing jobs represent a transitional phase, and new forms of employment will likely emerge, creating opportunities for the jobless to reenter the labor market.

However, the immediate deterioration in the U.S. labor market has a direct impact on consumer spending. Chart 3 illustrates how inventories at U.S. retail wholesalers have been climbing since bottoming in December 2023. Rising inventories alongside tighter consumer spending suggest a cooling of overall business activity. This highlights the growing disconnect between record-breaking equity markets and the real economy.

(Chart 3. Retail Inventory YoY; Source: MacroMicro)

Meanwhile, U.S. 10-year Treasury yields have declined sharply, falling from 4.60% in May toward the 4.0% level. We believe this drop reflects more than rate cut expectations—it also signals slowing economic momentum.

Nominal Yield = Real Yield + Inflation

While markets cheer falling yields as a dovish signal, we view this as partially reflecting weaker future growth. Safe-haven demand remains concentrated in the U.S. dollar and Treasuries—two assets that, in our view, remain undervalued.

(Chart 4. U.S. 10-Year Treasury Yield; Source: CNBC)Gold Technical Analysis

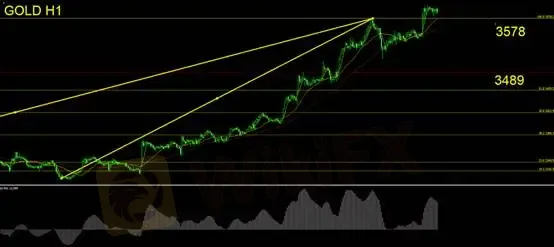

Weak nonfarm payrolls pushed gold to new highs last week. From a technical standpoint, MACD divergence has emerged. Such divergences often imply two possibilities: (1) a reversal signal, or (2) indicator saturation. We believe the current setup favors a reversal. Both gold and equities have rallied on Fed rate cut expectations, but market sentiment now reflects strong FOMO.

Our strategy: stay on the sidelines. Avoid chasing long positions or initiating shorts. Wait for confirmation of a daily-level reversal before re-entering.

Support: 3578 / 3489

Resistance: None significant identified

Risk Disclaimer: The above views, analyses, research, prices, or other information are provided as general market commentary and do not represent the platforms stance. All viewers should manage their own risks carefully.

WikiFX Broker

Latest News

Spring Rally in Chinese Equities Signals Potential Lift for AUS and NZD

China’s Export Resilience: A Structural Pivot Towards the 'Global South'

Silver Smashes $70: Is the "Forced Central Bank Buying" Thesis Playing Out?

Biggest 2025 FX surprise: USD/JPY

NFA Charges Japan’s Forex Wizard and Mitsuaki Kataoka With Delaying Withdrawal Requests

Why Your Entries Are Always Late (And How to Fix It)

【WikiEXPO Global Expert Interviews】Robert Hahm: From Asset Management to AI Innovation

Treasury vs. Fed: Bessent leads Trump's Campaign to Reshape US Monetary Policy

Ceasefire on the Brink: 14 Nations Condemn Israel as Geopolitical Risk Premiums Rise

Ringgit hits five-year high against US dollar in holiday trade

Rate Calc