Ai Trading Exposed: The Broker that Disappeared Online

Abstract:In online trading, one rule stands above all: if a broker’s website cannot be reached, it is a major red flag. Ai Trading is a clear example of this danger.

In online trading, one rule stands above all: if a brokers website cannot be reached, it is a major red flag. Ai Trading, recently listed on WikiFX, is a clear example of this danger. The broker shows a very low WikiScore, holds no trusted regulatory licence, and most worrying of all, its website is offline. For Malaysian traders, these are warning signs that cannot be ignored.

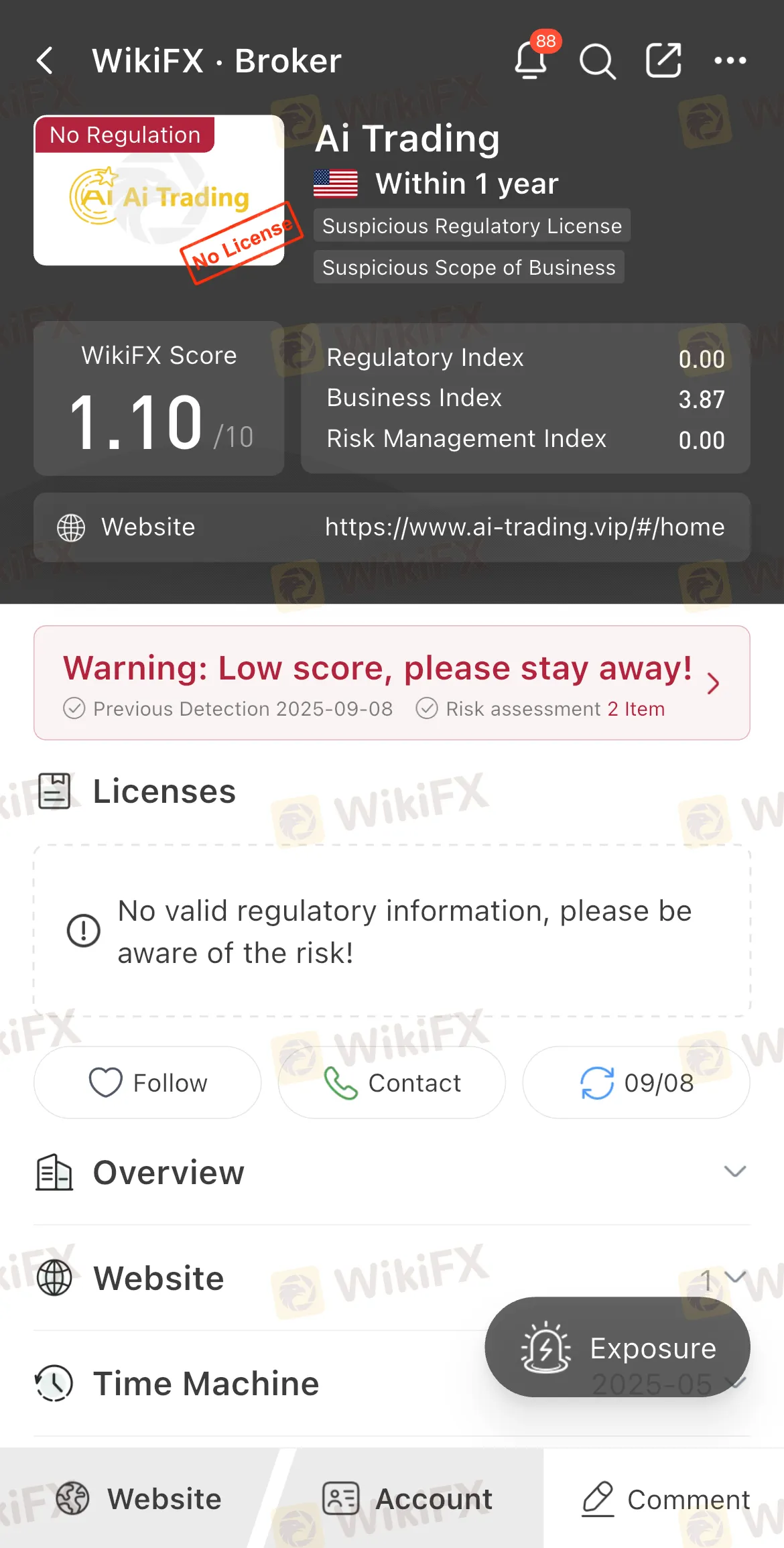

WikiScore and Licence Problems

WikiFX gives Ai Trading a low score of 1.10/10, noting a suspicious licence and unclear business information.

View WikiFXs full review on AI Trading here: https://www.wikifx.com/en/dealer/1664282378.html

The broker claims to be based in the United States, but there is no proof of regulation from any well-known authority. This means traders are left without protection if anything goes wrong. For Malaysians, this lack of oversight is especially risky, as the Securities Commission Malaysia (SC) has no control over offshore brokers.

Website Unreachable is The Biggest Red Flag

The fact that Ai Tradings website is not accessible is perhaps the most serious concern. Without a working website, how can traders deposit funds, log in to their accounts, or contact support? This raises a simple but important question: how can you trust a broker you cannot even reach?

Sadly, this pattern is common among unregulated brokers. They often disappear without notice, leaving traders unable to recover their money.

Complaints and Feedback

So far, there are no trader complaints recorded on WikiFX about Ai Trading. But this is not necessarily good news. If a broker has no website and no clients can log in, there is little chance for reviews or complaints to even appear. Silence in this case may point to a broker that has already shut down operations or is avoiding exposure.

A Warning for Malaysian Traders

For traders in Malaysia, the lessons are clear:

- Check the regulation first: only use brokers authorised by trusted regulators or listed under the SC.

- Transparency matters: if a broker has no website, there is no way to verify who they are or how they operate.

- Prevention is better than cure: once an offshore and unregulated broker disappears, there is almost no chance of getting your money back.

Conclusion: Dont Take the Risk

Ai Trading is missing the basics: a valid licence, a solid WikiScore, and even an accessible website. These issues make it far too risky for not just Malaysian investors, but also traders from all around the world.

At WikiFX, our mission is to empower investors with the knowledge and tools required to make safe, informed decisions. When selecting an overseas broker, we strongly advise exercising due diligence and, wherever possible, choosing one regulated by a reputable authority such as Australia‘s ASIC, the United Kingdom’s FCA, or other recognised regulators.

Should you fall victim to fraudulent activity, you must act without delay. We recommend reporting the matter to the police or consulting a qualified solicitor, as well as contacting your local consumer affairs office.

To further support investors, the WikiFX app delivers daily push notifications highlighting brokers identified as posing withdrawal risks. For timely updates and reliable protection, we encourage you to download the app.

WikiFX Broker

Latest News

Jim Cramer flips the playbook on the S&P 500

TakeProfitTrader Faces Trader Wrath Over Trade Manipulation & Unresponsive Customer Support

FCA Issues Red Alert: 7 Unlicensed Brokers You Must Avoid!

FCA Issued Warning Against DeltaFX? 5 Warning Signs it Hides from You

HTFX Broker Reviews: Withdrawal Complaints Rise Explained

Singapore AI-Trading Scam Nets Over US$4.6M—Director Pleads Guilty

Decoding Forex Range Trading: Definition, Strategies & Key Insights

Which Forex Account Fits Your Trading Goal? Review

RED ALERT: Weekly Scam Brokers List REVEALED!! Check Before You Invest!

Massive Forex Scam Allegations Rock Nadex Online

Rate Calc