Angel One Review: Regulation, Fees, Platforms, and Risks Explained

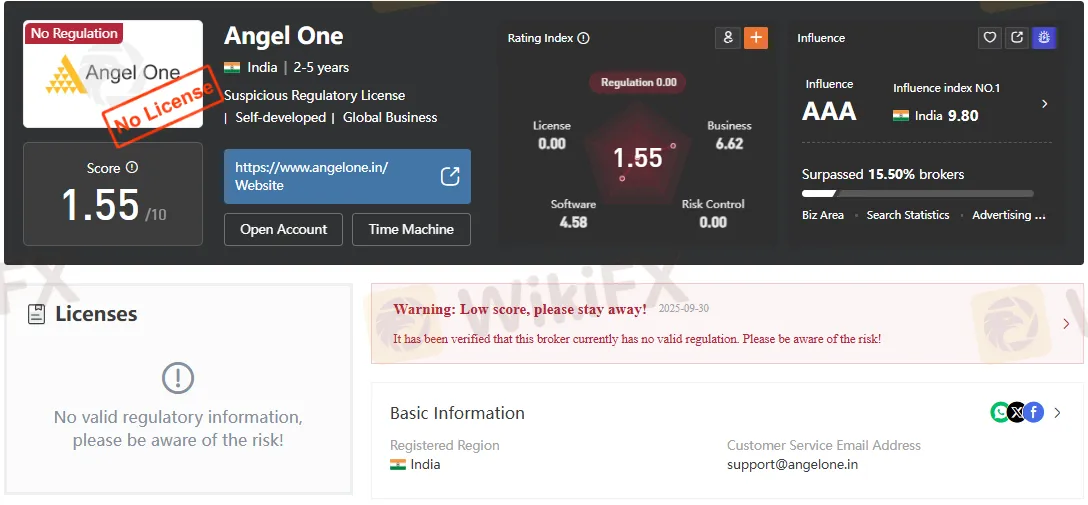

Abstract:Angel One review: An India-based unregulated broker with low fees and slick apps with no SEBI or global regulation, raising material investor risk concerns.

Introduction

Angel One is a long-standing India-based brokerage offering equities, F&O, mutual funds, commodities, and access to U.S. stocks, but it operates without SEBI or major global regulatory oversight, creating a pronounced trust and compliance gap despite competitive pricing and capable platforms. Founded in 1996 and positioned around the Angel One Super App, the web-based Angel One Trade, and a developer-focused Smart API, the firm emphasizes usability and product breadth while advertising zero brokerage for the first 30 days up to ₹500. The core issue for risk-minded traders and investors is not functionality or cost, but the absence of a recognized supervisory license, which places counterparty, operational, and recourse risks front and center.

Actionable Takeaways

- Confirm licensing: Verify any SEBI registration and the precise legal entity before account opening or funding.

- Model total cost: Combine brokerage caps with STT, GST, SEBI fees, stamp duty, and applicable daily interest to derive realistic all-in trading costs.

- Match platform to strategy: Mobile for simplicity, web for active trading, and Smart API for programmatic strategies.

- Stress-test risk controls: Without regulator-backed recourse, ensure personal risk management covers counterparty, operational, and margin risks.

What Angel One Offers

Angel One provides multi-asset access across Indian equities, IPOs, F&O, mutual funds, and commodities, plus channels to invest in U.S. equities, covering the typical retail investor journey from onboarding to trading and SIP investing. The lineup is delivered through three main platforms: the Angel One Super App for mobile, Angel One Trade for desktop/web, and Smart API for algorithmic and fintech integrations, addressing beginners through active traders and developers. This breadth positions the broker squarely within Indias mass retail segment, promoting “one-stop” investing and trading with an emphasis on convenience and low entry barriers.

Trading Instruments — Supported

- Stocks — ✓

- IPOs — ✓

- Derivatives (F&O) — ✓

- Mutual Funds — ✓

- Commodities — ✓

- Forex — ✗

- Indices — ✗

- Cryptocurrencies — ✗

- Bonds — ✗

- Options — ✗

- ETFs — ✗

Regulation and Legitimacy

Angel One is not regulated by SEBI or by notable foreign supervisors such as the FCA, ASIC, or NFA, and is described as operating without a controlling financial authority. The material also notes a separate UK company record for a similarly named ANGEL ONE LIMITED that appears deregistered with Companies House details, reinforcing confusion risks around similarly named entities and underscoring the importance of verified licensing. For investors, the practical implication is that dispute resolution, segregation assurances, and prudential safeguards associated with licensed intermediaries may not be available, raising the stakes of counterparty and operational risk.

Fees, Charges, and Pricing

Angel Ones pricing is framed as low to moderate, highlighted by a zero-brokerage introductory offer for the first 30 days, capped at ₹500, before standard capped brokerage applies. Post-offer, equity delivery is charged the lower of ₹20 or 0.1% per order (minimum ₹2), intraday the lower of ₹20 or 0.03% per order, and options at ₹20 per executed order, supplemented by exchange and statutory levies like STT, GST, SEBI fees, and stamp duty per segment. Account costs reflect ₹0 opening, ₹0 AMC for the first year, and thereafter alternatives such as ₹60/quarter for non-BSDA, ₹450/year, or a ₹2950 lifetime plan, with daily interest rates specified for margin funding and debit balances.

Platforms and User Experience

The Angel One Super App targets everyday investors with an accessible mobile interface for equities, mutual funds, and more, while Angel One Trade serves desktop-oriented traders who need fuller depth and tools. Smart API extends the ecosystem to developers and algo traders, enabling programmatic trading and integrations suited to custom strategies and fintech use cases. Marketing materials emphasize high downloads and broad appeal, aligning with India‘s mobile-first investing trend and the platform’s effort to simplify SIPs and multi-asset participation.

Pros, Cons, and Suitability

Key positives include the promotional zero brokerage up to ₹500 in the first 30 days, a broad product shelf covering equities, F&O, mutual funds, commodities, and U.S. exposure, plus a multi-surface platform suite from mobile to web to API. On the downside, the absence of SEBI or global regulatory oversight is a significant red flag, as are the various statutory and service charges that still apply beyond headline brokerage caps. Given these factors, cost-conscious users prioritizing convenience and breadth may see the appeal, but risk-aware investors should weigh the lack of regulation as a decisive factor before committing assets.

Experience and Expert Context

The portfolio of services resembles typical Indian retail brokerage stacks, with SIP-forward messaging and mobile-first utility aligning with market adoption patterns, but the licensing gap remains at odds with best practices for safeguarding client assets. Industry comparisons show that brokers operating under SEBI or top-tier global licenses usually publicize license numbers prominently; the attached profiles explicit “no regulation” status invites enhanced due diligence steps such as segregated funds verification, audited financials, and recovery mechanisms. For traders depending on leverage, margin terms like 0.041% per day for MTF and 0.049% per day for debit balances can materially affect costs in turbulent markets, reinforcing the need for transparent statements and margin risk controls.

Read more

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Is your trading experience with MYFX markets full of fund withdrawal denials despite repeated communications with its customer support team? Has the broker deleted all your profits? Did the broker accuse you of false trading strategy implementation while deleting your profits? There have been many such instances reported by traders against these activities online. In this MYFX Markets review article, we have shared some complaints. Take a look!

Exfor Exposure: Investigating Alleged Withdrawal Denials, Illegitimate Account Closure & More

Exfor, a Malaysia-based forex broker, has allegedly been the centre of attention for all the wrong reasons. These include long-pending withdrawal denials, no communication or assistance from the broker’s customer support team, manipulated pricing upon a withdrawal request by the trader, and account blowups due to bonus-related issues. It’s the traders who allegedly bear the brunt of all these suspicious trading activities. A lot of them have criticized it on broker review platforms. We have highlighted some of their complaints in this Exfor review article. Take a look!

Axiory Exposed: Low WikiFX Score & Trader Complaints!

Axiory WikiFX score 1.5: Active Belize FSC license (no FX authorization), multiple complaints. Reports show withdrawal/support issues. Traders beware.

RCG Markets Exposed: License Verification & Trader Complaints

RCG Markets holds a valid FSCA license. Reports show withdrawal rejections & stop‑loss issues. Traders urged to verify details and exercise caution.

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Rate Calc