Equiti Under Fire: Traders Report Sudden Fund Seizures and Blocked Withdrawals

Abstract:They trade for weeks, sometimes months. They follow the market, execute their strategy, and watch their account balance grow. Then, without warning, it's all gone. Not from a bad trade, but from a decision made by the broker. Their profits are confiscated, their principal is wiped, and their account is locked. This is the alarming reality dozens of traders have reported to WikiFX about their experiences with Equiti, painting a picture of a platform where success can be punished without explanation. In the last three months alone, WikiFX has been flooded with 11 new complaints against Equiti, each one echoing a similar, disturbing story. The central theme? Traders who manage to generate profits find themselves abruptly accused of “improper trading” or “abuse,” a vague justification used to seize their funds and sever communication. The evidence submitted by these users points to a deeply concerning pattern that every potential trader in Africa must be aware of.

All cases are based on real records; identities hidden for protection.

The ‘Improper Trading’ Accusation: A Pattern of Withholding Funds

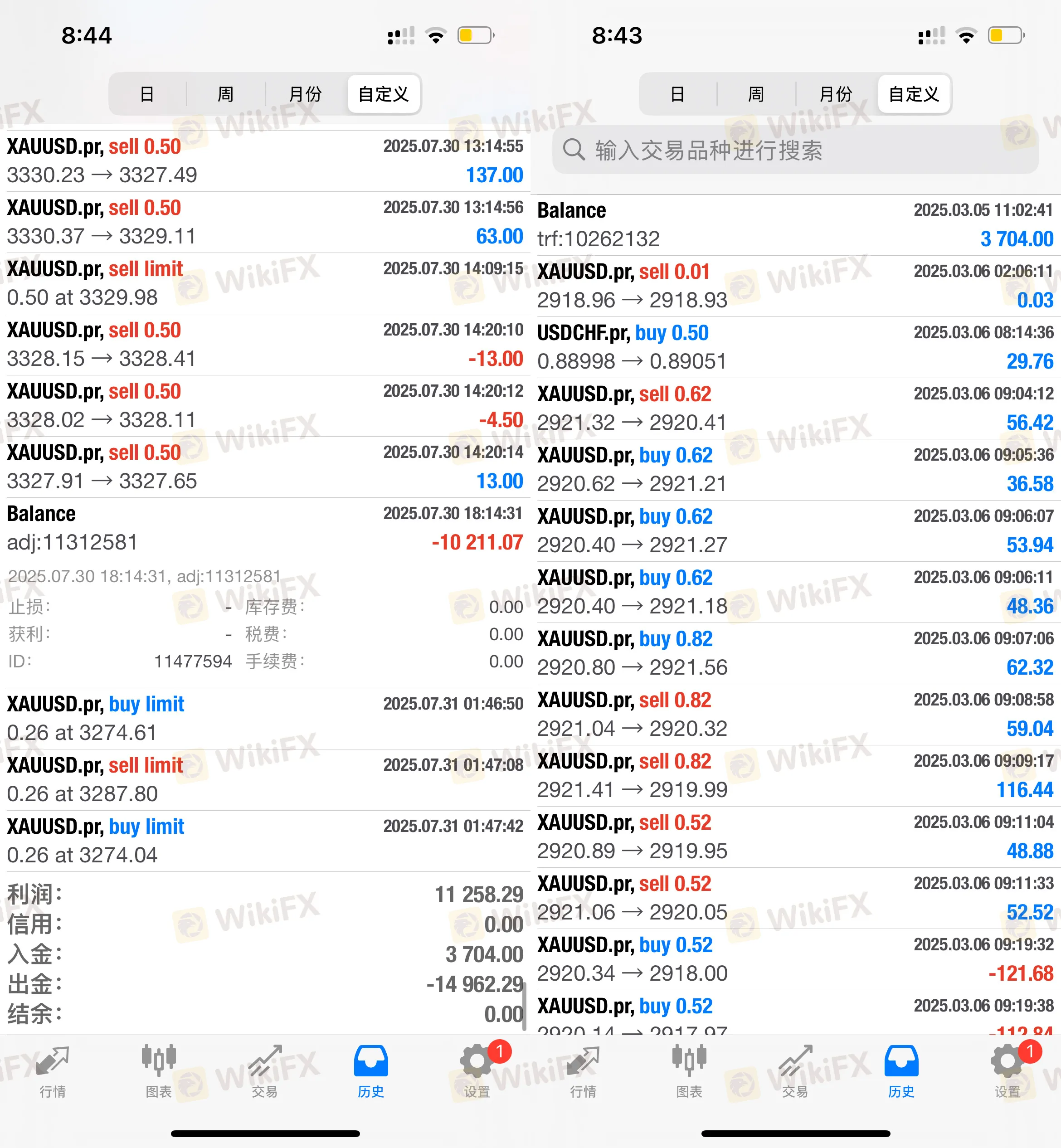

The most common and damaging complaint against Equiti revolves around the sudden confiscation of funds. Traders report that after a period of successful trading, the broker moves to claw back their money, often providing little to no concrete evidence for its actions.

One trader who had been with the platform for a long time was shocked to find that both their principal and profits had been suddenly deducted. The broker's reason? “Abuse.” The trader was left bewildered, stating, “I've been trading for a long time... suddenly they deduct all my principal and profit without any communication... this is ridiculous.”

This is not an isolated incident. Another trader reported that on September 1st, the platform maliciously deducted a sum of $2,365.41 from their account and then banned them from trading. Despite sending emails for two days, they received no resolution.

The scale of these withholdings can be devastating. One user reported having over $9,000 confiscated under the same pretext. Emails to the platform were met with a wall of silence or repetitive, unhelpful replies. Another user was equally blunt: “The broker simply withheld my profits without any valid reasons or evidence.” Historical complaints lodged with WikiFX show this has been a recurring issue for years, not a recent anomaly. One trader noted that after building his account up over three months and executing over 2,300 trades, he was accused of “improper trading” with no prior warning. His trust was completely eroded.

When Withdrawals Vanish: The Silent Block

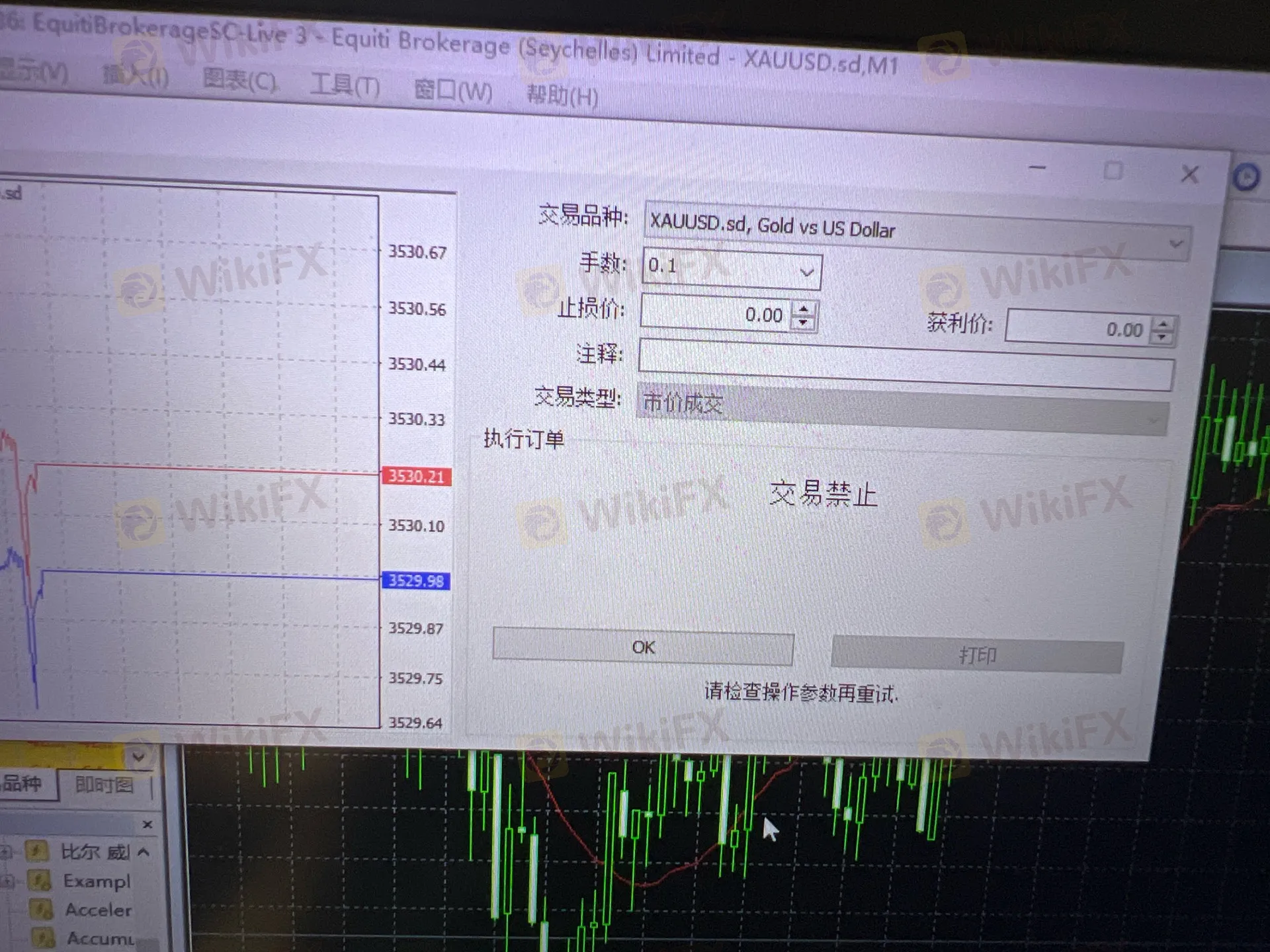

For those who arent immediately accused of violations, a different but equally frustrating barrier appears: the inability to make a withdrawal. Several traders have reported that when they attempt to access their funds, they find the withdrawal function in their account has been completely disabled.

One recent report from a trader is particularly chilling. “Cannot withdraw,” the report begins. “The platform closed my withdrawal option. It has been more than half a month, and they have not reactivated the withdrawal option for me.” The traders attempts to contact their account manager or get a response via email were met with total silence.

Another user trying to withdraw from their account, which was in overall loss, found the channel closed. Their desperate plea highlights the deep frustration: “Don't run a platform if you don't have the money... emails are never answered properly.” The experience becomes a maze of dead ends, with users locked out of their own money and given no information on when, or if, they will ever get it back. In some extreme cases, traders reported that after months of trading, their entire account became inaccessible, with login attempts on the website showing a blank page and the MT4 platform declaring the account “invalid.”

The Regulatory Maze: A Façade of Safety?

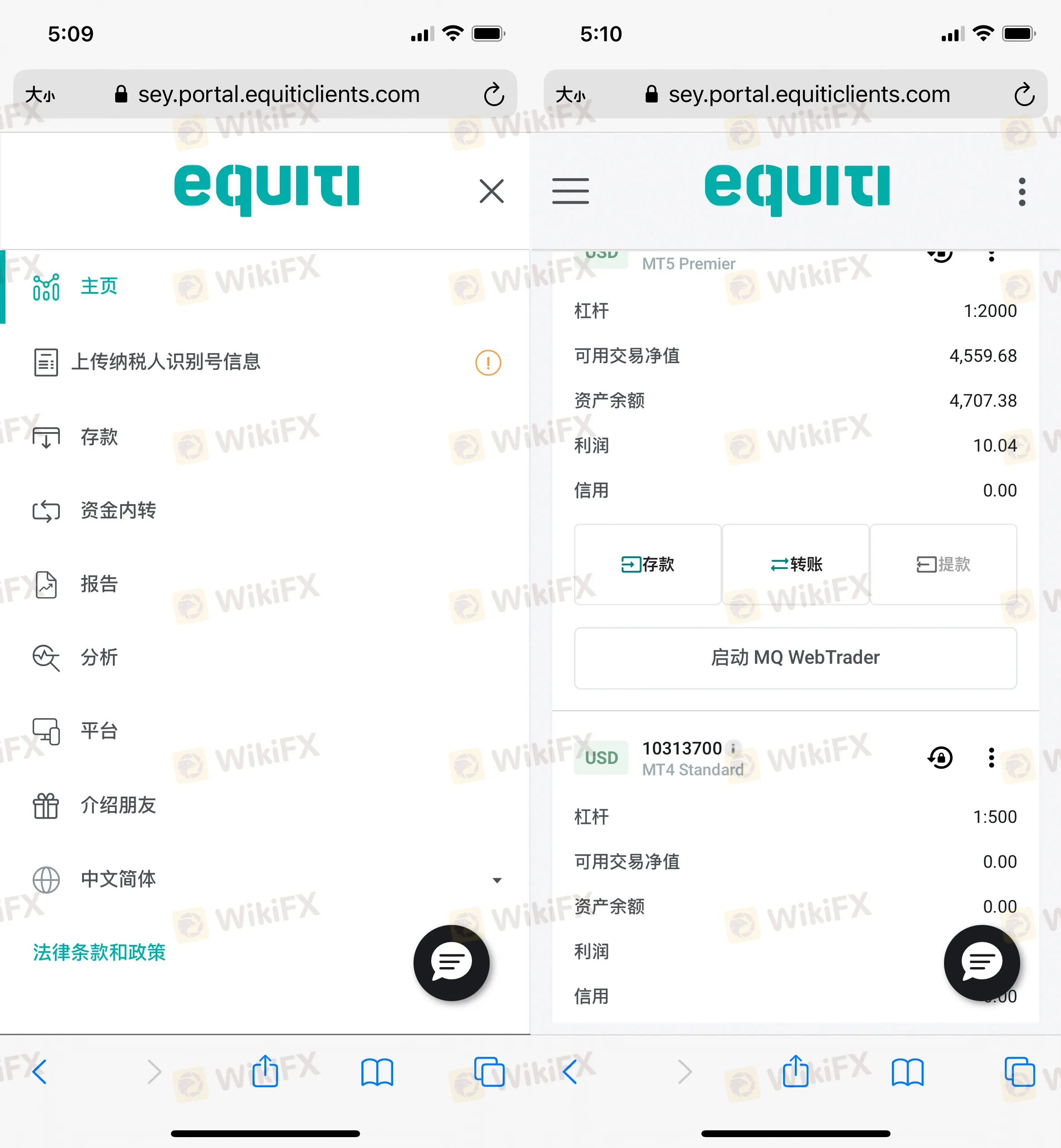

On the surface, Equiti presents itself as a regulated broker. However, a deeper analysis by WikiFX experts reveals a complex and potentially misleading regulatory picture that traders must understand. The protections you think you have might not apply to you.

Our investigation into Equitis regulatory status shows the following:

- Cyprus Securities and Exchange Commission (CYSEC): Equiti holds a license (No. 415/22) that is listed as “In Regulation.” This is a legitimate regulator. However, global brokers often onboard clients from Africa and other regions under different, less-regulated entities. It is crucial to know which entity your account is registered with.

- Seychelles Financial Services Authority (FSA): The license (No. SD064) held here is classified as “Offshore Regulation.” For African traders, this is a significant warning sign. Offshore regulators typically offer very weak oversight and minimal protection. In the event of a dispute, such as the fund withholding issues reported, traders have very little legal recourse.

- United Kingdom Financial Conduct Authority (FCA): Equiti claims a license (No. 528328) with the UKs top-tier regulator. However, WikiFX has marked this license as “Unverified.” This means our team could not confirm its validity for the services offered. Relying on an unverified license for protection is an extremely high-risk gamble.

Most alarmingly, WikiFX records show that Equiti has been officially warned by a major European regulator. On April 26, 2021, Spain's Comisión Nacional del Mercado de Valores (CNMV) issued a public warning stating that Equiti was not authorized to provide investment services in the country. This formal warning from a respected authority severely damages the broker's credibility and suggests a history of operating in regions without proper approval.

This mixed and questionable regulatory standing is a major red flag. It may explain why the broker appears to act with impunity when withholding client funds—many of its clients may be registered under the offshore entity with minimal protection.

WikiFX Investigation and Findings

The WikiFX review of Equiti currently assigns it a score of 6.27 out of 10. While not the lowest score, it reflects significant underlying risks, heavily influenced by the high volume of customer complaints and the concerning regulatory details. Is Equiti safe? The evidence collected by WikiFX, including an official regulatory warning and a growing chorus of traders reporting seized funds, strongly suggests that traders should exercise extreme caution. The risk of having your profits—and even your initial deposit—confiscated with little to no explanation appears to be substantial.

We advise all traders to stay vigilant. Test withdrawals early, keep detailed records of all interactions, and avoid allocating large deposits to any entity whose regulatory footing is unclear or offshore.

Risk Warning from WikiFX

As an independent financial media, WikiFX provides this information for reference only. Do not consider it as financial advice. The forex market is extremely high-risk. Before making any trading decisions, ensure you fully understand the risks involved, verify the brokers qualifications, and conduct thorough due diligence. If you encounter any issues with a broker, expose it on WikiFX to protect other traders.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

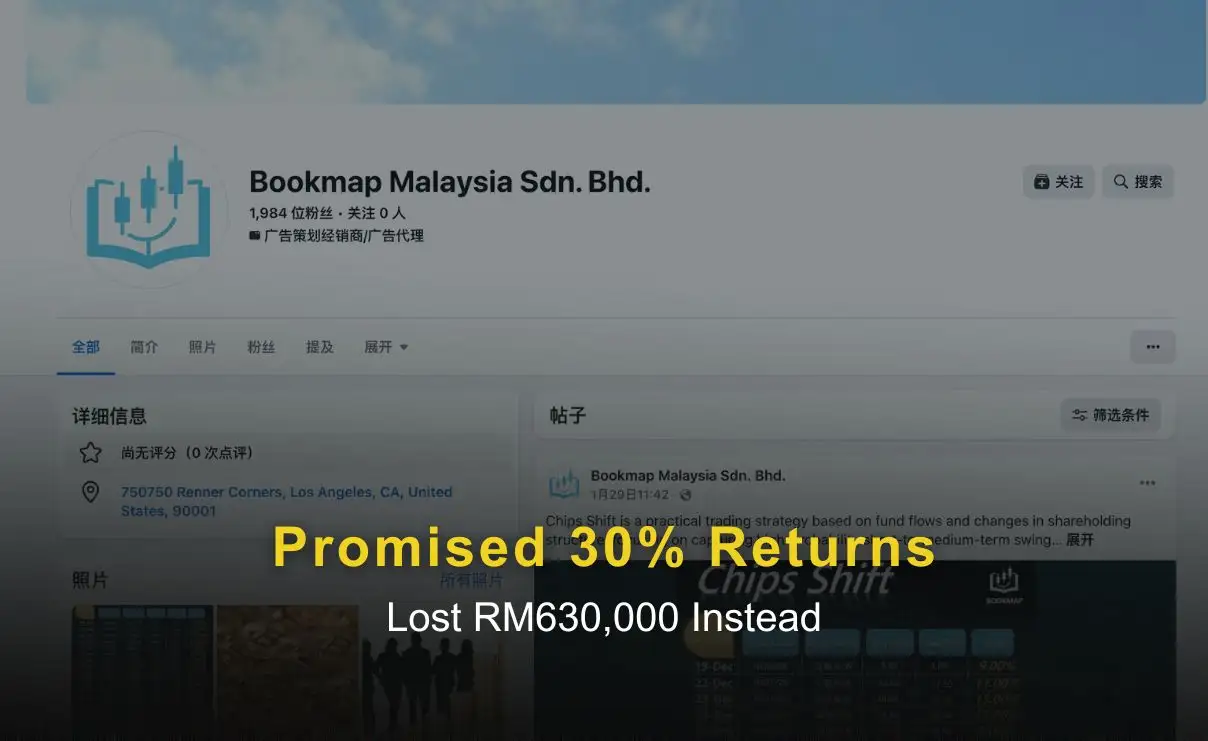

Promised 30% Returns, Lost RM630,000 Instead

A 57-year-old man in Kuantan lost over RM630,000 after being lured by a Facebook investment advertisement and directed to a fake trading app that displayed fabricated profits. The scam unraveled when withdrawal attempts triggered excuses and demands for additional fees, highlighting the risks of high-return promises and unverified platforms.

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

An in-depth look at a scalable fraud method in the forex sector, built on reusing the same website structure under different brand names.

Fidelity Exposure: Examining the Latest User Reviews on Withdrawal Denials & Trade Manipulation

Fidelity Investments has been grabbing attention of late for negative reasons. These include complaints concerning withdrawals, account closure without notice, technical glitches in trade order processing, and inept customer support service. As the complaints continue to grow, we prepared a Fidelity review article showcasing some of them. Read on as we share details.

WikiFX Broker

Latest News

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

MultiBank Group Analysis Report

NEWTON GLOBAL Legitimacy Check (Addressing fears: Is This a Fake or a Legitimate Trading Partner?)

SPREADEX Review: Reliable Broker Check

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump's tariffs

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Rate Calc