Gold Pushes Toward $4,200 as Bulls Regain Control

Abstract:Market expectations for a Federal Reserve rate cut in December have now become fully priced in. Economist Dong Tao noted that the Fed is likely to deliver one 25-bp cut per quarter next year—four cuts

Market expectations for a Federal Reserve rate cut in December have now become fully priced in. Economist Dong Tao noted that the Fed is likely to deliver one 25-bp cut per quarter next year—four cuts in total (1%).

Similarly, the CME FedWatch Tool shows the highest probability for 3–4 rate cuts in 2025, at 27.1% and 27.4% respectively.

(Figure 1. Rate-Cut Expectations; Source: CME FedWatch Tool)

CNBC reported that Goldman Sachs Chief Economist Jan Hatzius sees no available data that could prevent the Fed from announcing a rate cut on December 10, especially with the delayed release of the nonfarm payrolls report. While the BLS reported a rebound in September NFP to 119,000 jobs, alternative indicators continue to show rising layoff momentum, suggesting the labor market may be cooling earlier—and more sharply—than official data implies.

ADP has shifted its updates to a weekly schedule, making it a more timely alternative gauge of labor-market conditions. According to ADPs November 25 release, private-sector employment has declined by an average of 13,500 jobs per week over the past four weeks, signaling further labor-market weakness. Meanwhile, consumer spending momentum has softened, implying that job creation may remain delayed or subdued.

Whether in risk assets or gold, recent price action continues to be driven primarily by rate-cut expectations. Over the past two weeks, gold ETFs have recorded three consecutive weeks of net inflows. Although the inflows remain modest, the stabilization in positioning suggests selling pressure has eased. From a flows perspective, this should be interpreted as bottoming, not a shift into aggressive accumulation by bulls.

(Figure 2. Gold ETF Net Inflows Over the Past Two Weeks; Source: World Gold Council)

Current bullish narratives for gold remain centered on central-bank buying, Fed easing expectations, and geopolitical risks. However, investors should consider how long these well-known catalysts can continue supporting upside momentum.

HSBC Chief Precious Metals Analyst James Steel noted that global geopolitical restructuring, rising economic nationalism, tariff uncertainty, market volatility, and questions around Fed policy credibility all support higher gold prices. However, he also warned that physical demand may weaken, and that central-bank gold purchases could taper once prices break above $4,000/oz, reducing a key driver of the rally.

Indeed, central-bank buying interest today appears less aggressive than during 2022–2023, suggesting this driver may no longer provide the same upward force for gold.

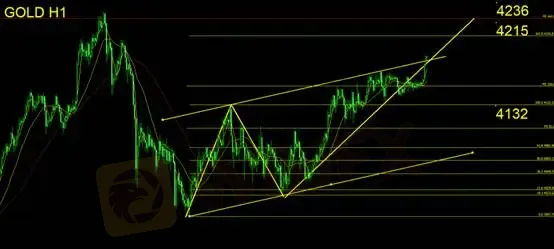

Technical Outlook: Gold Targets $4,215 as Bullish Momentum Builds

Gold has broken above the upper boundary of the price channel identified yesterday, signaling a continuation of bullish momentum. Fibonacci extension projections suggest an initial upside target at $4,215, where long positions may consider partial profit-taking. A confirmed breakout above $4,215 would open the door for a retest of the $4,236 area—aligned with the 2.00% Fibonacci expansion level.

Given current momentum, traders should avoid adopting a bearish bias in intraday setups.

Support: $4,132

Resistance: $4,215 / $4,236

Risk Disclaimer

The views, analysis, price levels, and research presented above are intended solely for general market commentary and do not represent the official position of this platform. All readers should conduct their own due diligence and trade responsibly.

WikiFX Broker

Latest News

Yen Fragility Persists: Inflation Miss Cements BoJ 'Hold' Expectation

Trade War Averted: Euro Rallies as US Withdraws Tariff Threats

Sticky US Inflation Data Dashes Near-Term Fed Rate Cut Hopes

Yen Volatility Spikes: PM Takaichi Calls Snap Election Amid BoJ 'Hawkish Pause'

ECB Minutes: Service Inflation and Wage Spikes Kill Rate Cut Speculation

BoJ "Politically Paralyzed" at 0.75% as Takaichi Calls Snap Election

'Bond Vigilantes' Return: JGB Rout Sparks Contagion Fears for US Treasuries

ZarVista User Reputation: Looking at Real User Reviews to Check Is ZarVista Safe or Scam?

Gold Fun Corporation Ltd Review 2025: Is This Forex Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

Rate Calc