Adam Capitals Review 2025: A Detailed Look at an Unregulated Broker

Abstract:Adam Capitals presents itself as a modern brokerage that started operating in 2021. The company is registered in Saint Vincent and the Grenadines, an offshore location, and tries to attract traders with a wide range of services. These include access to more than 275 trading instruments, the well-known MetaTrader 5 (MT5) platform, and high leverage up to 1:500. At first glance, these features might interest both new and experienced traders looking for a flexible trading environment.

Adam Capitals presents itself as a modern brokerage that started operating in 2021. The company is registered in Saint Vincent and the Grenadines, an offshore location, and tries to attract traders with a wide range of services. These include access to more than 275 trading instruments, the well-known MetaTrader 5 (MT5) platform, and high leverage up to 1:500. At first glance, these features might interest both new and experienced traders looking for a flexible trading environment.

However, a closer examination shows a serious problem between its attractive features and the major risks involved. The main issue, which will be the focus of this analysis, is how the broker operates. Adam Capitals operates completely without a valid license from any respected financial authority. This fact creates a high risk to traders' money that cannot be ignored. The purpose of this comprehensive Adam Capitals broker overview is to examine the available information objectively, looking at every aspect of its operation—from account types to trading costs—to help you make a fully informed and careful decision about working with this company.

Regulation and Trader Safety

The most important factor when evaluating any broker is its regulatory status, as this directly affects the safety of your money. In the case of Adam Capitals, the findings are clear: the broker does not have any valid regulatory licenses. It has been confirmed that the company currently operates without oversight from any recognized financial regulatory body. While the company is registered in Saint Vincent and the Grenadines, with a listed address at ` Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia, this is just a business registration. It should not be confused with financial regulation, which involves strict following of rules designed to protect investors.

Operating in an offshore location known for its less strict financial oversight has major consequences for traders. The term “unregulated” means a complete absence of the safety measures that are standard with licensed brokers. This includes:

• No Investor Protection Funds: If the broker goes bankrupt, there is no compensation program in place to protect client deposits. Your money could be lost entirely with no way to get it back.

• No Segregated Funds Guarantee: Regulated brokers are required to keep client funds in accounts separate from their own business money. Without this oversight, there is no guarantee that Adam Capitals is not using client funds for its own business purposes, putting deposits at extreme risk.

• No Formal Dispute Resolution: If you have a disagreement about trade execution, withdrawals, or any other issue, there is no independent regulatory body to help solve the problem or enforce a fair outcome. You are left to deal directly with the broker, who holds all the power.

These factors combine to create an environment of high risk. The absence of valid regulatory information is a major warning sign for any trader who prioritizes the security of their investment. Traders can view the complete, verified regulatory details and associated warnings for Adam Capitals to fully understand the risks involved.

A Look at Account Types

Adam Capitals organizes its services around three different account types, designed for traders with different amounts of money. The accounts—Standard, VIP, and ECN—follow a system where a higher minimum deposit provides progressively lower spreads. However, the entry requirement is notably high across all levels, which may immediately exclude many potential traders.

Here is a direct comparison of the account features based on the available information:

| Account Type | Minimum Deposit | Spreads (starting from) | Maximum Leverage |

| Fresher | $10 | 2.0 pips | 1:500 |

| Standard | $100 | 1.5 pip | 1:500 |

| Trader | $500 | 0.8 pips | 1:500 |

The most striking detail is the minimum deposit for the entry-level Fresher account, set at $10. This amount is much higher than the industry average, where many reputable, regulated brokers offer accounts starting from $100 or less. This high entry requirement suggests the broker may not be targeting beginners or those wanting to start with a smaller amount of money.

As trader- Standard move up to the and Trader account, the minimum deposits increase substantially to $100 and $500, respectively. In return, the main benefit is a reduction in the starting spread, from 1.5 pips on the account down to a more competitive 0.8 pips on the Trader account. Interestingly, the maximum leverage of 1:500 remains the same across all three account types, showing that it is a core feature of the broker's offering rather than a benefit for higher-tier clients. The lack of information about commissions, especially for the ECN account where they are common, is another point of concern about transparency.

Analyzing Trading Costs

A broker's cost structure is a crucial part of a trader's potential profitability. This Adam Capitals review found several points of concern regarding spreads, leverage, and hidden fees that require a critical analysis.

A Contradiction in Spreads?

Adam Capitals' marketing materials make a bold claim of offering “ultra-low spreads below 0.2 pips.” This is an attractive offer, as lower spreads directly translate to lower trading costs. However, this claim directly contradicts the spreads officially listed for its account types. The most competitive spread offered, available only on the ECN account with a $25,005 minimum deposit, starts at 0.6 pips. The Standard account, the most accessible option, begins at a far less competitive 1.5 pips. This difference is a common marketing tactic among some brokers. Such “ultra-low” spreads, if they exist at all, are typically only available for very brief periods during ideal market conditions with maximum liquidity. They may also apply to only a select few instruments and are not representative of the average trading experience. A more realistic measure of cost for a prospective client would be the standard spreads listed for each account type. The gap between the marketing claim and the documented reality raises questions about transparency.

The Double-Edged Sword of 1:500 Leverage

The broker offers a maximum leverage of 1:500 across all its accounts. High leverage is a powerful tool that can significantly increase potential profits from small price movements. However, it is a double-edged sword that increases losses with equal intensity. For example, with 1:500 leverage, a trader only needs to put down $200 of their own money to control a position worth $100,000. While this can lead to substantial gains if the market moves favorably, a mere 0.2% adverse movement is enough to wipe out the trader's entire margin for that position.

Such high levels of leverage are often restricted by regulators in major financial centers precisely because of the immense risk they pose, especially to inexperienced traders. While it can be a valuable tool for seasoned professionals with sophisticated risk management strategies, it can also lead to rapid and catastrophic losses for those who do not fully understand its implications.

Hidden Fees

Transparency in fees is a hallmark of a trustworthy broker. Adam Capitals' profile is notably silent on several key cost areas. There is no information provided regarding accepted deposit and withdrawal methods, nor any mention of associated fees. Furthermore, details on other potential charges, such as inactivity fees or currency conversion fees, are completely absent.

As information on deposit, withdrawal, and other non-trading fees is not publicly available, traders should proceed with caution. It is advisable to clarify these costs directly with the broker before funding an account, though this lack of upfront transparency is itself a significant trust factor to consider. For a full breakdown of the fee structure and to see how it compares to other brokers, traders are encouraged to examine the detailed broker profile.

Platform and Market Access

A broker is only as good as the technology and market access it provides. Adam Capitals centers its trading infrastructure on a well-known platform and offers a reasonably diverse range of instruments.

Platform: MetaTrader 5 (MT5)

Adam Capitals provides its clients with the MetaTrader 5 (MT5) platform. MT5 is a globally recognized, multi-asset platform respected for its powerful features and strong performance. A key positive point is that the broker appears to hold a “Full License” for MT5, which suggests a more stable and feature-complete version of the software compared to less integrated white-label solutions. The platform's key features include:

• Multi-Device Access: Available on PC, Web, and Mobile (iOS & Android), allowing traders to manage their accounts from anywhere.

• Advanced Trading Capabilities: Supports automated trading through Expert Advisors (EAs), complex order types, and in-depth technical analysis.

• Comprehensive Charting Tools: Includes a wide array of built-in indicators, graphical objects, and timeframes for thorough market analysis.

• Multi-Asset Functionality: MT5 is designed to handle trading across different asset classes, making it suitable for traders with diverse strategies.

The choice of MT5 is a definite advantage, providing a professional-grade trading environment.

Tradable Instruments: Over 275+ Assets

The broker provides access to a selection of over 275 tradable instruments, covering several major asset classes. This allows for a good degree of portfolio diversification. The available markets include:

• Crypto: ✔

• Indices: ✔

• Gold Commodities ✔

• Currency trading Energies: ✔

• Metal & Energy: ✔

while the offering is comprehensive for popular markets like forex, indices, and commodities, traders looking for exposure to Exchange-Traded Funds (ETFs) or government bonds will need to look elsewhere. Nonetheless, the available selection is sufficient for most common trading strategies focused on major global markets.

The User Experience

Beyond the technical specifications, the practical user experience is a vital consideration. This includes the account opening process, the quality of support, and any notable limitations that might affect a trader's journey.

No Demo Account: A Major Drawback

Perhaps one of the most significant limitations of Adam Capitals is the complete absence of a demo account. This is a major disadvantage for several reasons. A demo account is an essential tool for any trader, allowing them to test the platform's execution speed, observe live spreads and swaps in a real-time environment, and practice their trading strategies without risking real money.

Without this facility, prospective clients have no way to “try before they buy.” They cannot get a feel for the broker's trading conditions or the MT5 platform's specific configuration. This forces traders to commit the substantial minimum deposit of $1,005 just to experience the live environment, a risk that many careful traders would be unwilling to take, especially with an unregulated entity. This lack of a practice environment is a serious user experience flaw.

Customer Support Channels

Adam Capitals claims to offer “24/5 expert support” through a couple of standard channels. Clients can reach out for assistance via:

• Email: support@adamcapitals.com

• Phone: +911413532704

While the provision of a phone number and email address is standard, the quality, responsiveness, and actual expertise of this support could not be independently verified for this Adam Capitals review. With unregulated brokers, the level of customer service can be inconsistent, and resolving issues, particularly those related to funds, can be challenging without regulatory pressure.

Regional Restrictions

It is crucial for potential clients to know if they are eligible to open an account. Adam Capitals has specific regional restrictions and does not offer its services to residents of several key regions, including: the USA, Japan, British Columbia, Mauritius, Quebec, and all FATF blacklisted countries. Traders from these locations are not permitted to trade with the broker. For a more comprehensive understanding of user feedback and experiences from different regions, we recommend that you explore further on WikiFX, where you can find reviews and discussions from other traders.

Final Verdict and Summary

After a detailed examination of its services, a clear picture of Adam Capitals emerges. The broker attempts to attract traders with a powerful platform and a broad range of markets but is fundamentally undermined by its complete lack of regulation. To summarize, here are the key pros and cons:

| Pros | Cons |

| MetaTrader 5 (MT5) Platform with Full License | Completely Unregulated (Major Risk) |

| Access to 275+ Tradable Instruments | High Minimum Deposit ($500) |

| High Leverage Available (up to 1:500) | No Demo Account to Test Conditions |

| Lack of Transparency on Deposit/Withdrawal Methods and Fees | |

| Contradictory Information on Spreads | |

While features like the MT5 platform and a diverse instrument list are genuinely appealing, they are overshadowed by the critical risk posed by the broker's unregulated status. The core principles of trader protection—fund segregation, investor compensation, and fair dispute resolution—are absent. This transforms what could be a normal trading risk into a significant counterparty risk, where the safety of the trader's capital depends solely on the broker's goodwill.

Ultimately, in this Adam Capitals review, the absence of valid regulation is a critical warning sign that cannot be ignored. Careful traders prioritize the safety of their funds above all else, a security that is typically ensured only through strong regulatory oversight. Before considering any investment with this broker, we strongly advise a final, thorough check of their complete profile and any updated alerts on their status.

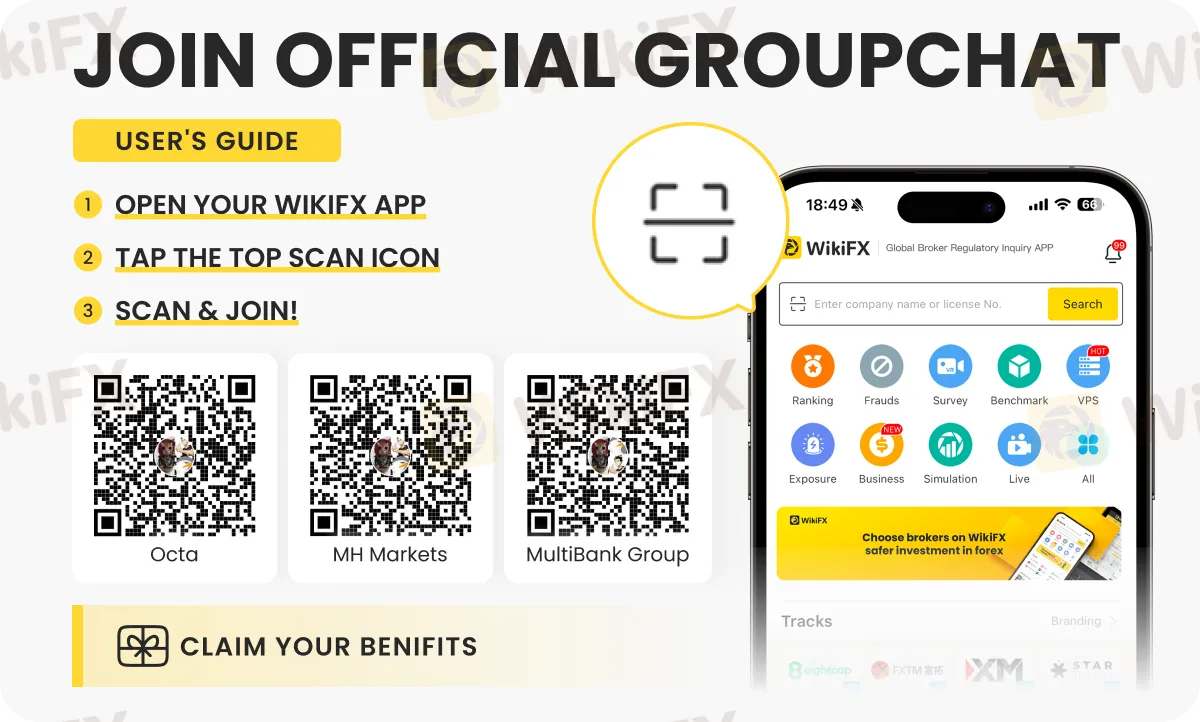

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

WikiFX Broker

Latest News

FTMO Completes Acquisition of Global CFDs Broker OANDA, Marking a Major Milestone

Scam Alert: 8,500 People Duped with Fake 8% Monthly Return Promises from Forex and Stock Investments

Plus500 Allegations Exposed in Real Trader Cases

November private payrolls unexpectedly fell by 32,000, led by steep small business job cuts, ADP reports

US Industrial Production Sees Biggest Annual Gain In 3 Years Despite Slowing Capacity Utilization

HEADWAY: The Fast Track to Financial Dead-Ends?

Polymarket Launches First U.S. Mobile App After Securing CFTC Approval

Thailand Seizes $318 Million in Assets, Issues 42 Arrest Warrants in Major Scams Crackdown

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

The "Balance Correction" Trap: Uncovering the Disappearing Funds at Vittaverse

Rate Calc