Is Adam Capitals Trustworthy? A 2025 Simple Analysis for Traders

Abstract:Traders often ask, "Is Adam Capitals trustworthy?" and "Is Adam Capitals reliable?". A valid concern, as all of us would prioritize capital safety. This analysis gets straight to the answer. The biggest problem with Adam Capitals is that the broker works without any proper government oversight. This one fact alone creates a big risk that you cannot ignore. While the broker advertises features like the MT5 platform and many different trading options, not having regulation is a major problem. This article looks at its regulatory status, trading conditions, account features, and what users have reported to give you the complete picture.

Getting to the Main Point

Traders often ask, “Is Adam Capitals trustworthy?” and “Is Adam Capitals reliable?”. A valid concern, as all of us would prioritize capital safety. This analysis gets straight to the answer. The biggest problem with Adam Capitals is that the broker works without any proper government oversight. This one fact alone creates a big risk that you cannot ignore. While the broker advertises features like the MT5 platform and many different trading options, not having regulation is a major problem. This article looks at its regulatory status, trading conditions, account features, and what users have reported to give you the complete picture.

Regulation and Safety Check

The foundation of any trustworthy broker is whether it is properly regulated. This isn't something you can trade off for lower costs or higher leverage - it is absolutely necessary for your safety. When it comes to Adam Capitals, the findings are clear and worrying.

The Regulation Decision

Our analysis shows that Adam Capitals currently has no valid regulatory license from any respected financial authority. It is marked with a “Suspicious Regulatory License” status and carries a “High potential risk” warning. This means that no recognized government body is watching over its operations, making sure it follows fair practices, or protecting client money. This is the biggest red flag a trader can see.

Understanding Offshore Registration

The broker is registered in Saint Lucia. As industry experts, we need to give you important context: this location is widely known for not having a dedicated financial authority that regulates forex and CFD brokerage activities. For a trader, this offshore registration has serious practical results:

· There are no required client capital protection programs, such as an investor compensation fund, which would pay you back if the broker goes out of business.

· There is no legal requirement for keeping client capital separate, meaning the broker could potentially mix your deposits with its own business money.

· There is no access to a financial ombudsman or a similar independent group to help solve disputes. If you have a problem with a withdrawal or a trade, you have almost no legal options.

What “High Risk” Actually Means

The “High potential risk” label isn't just a general warning. It means there's a real and higher chance that you could face serious problems. These issues can include unfair trade execution and unexplained platform problems to major difficulties with withdrawals. In the worst case, it means there's a real possibility of losing your entire investment without any legal way to get it back. Working with an unregulated, offshore company puts all the risk directly on the trader.

A Look Inside Adam Capitals

To give you a balanced view, we need to examine the trading conditions and features that Adam Capitals advertises. These are the things that may attract traders, but they must be compared against the fundamental risks already discussed. The following information is based on data provided by the broker and should be approached carefully.

Account Types Available

Adam Capitals organizes its offering across three main account levels, seemingly designed for traders with different amounts of money. The minimum deposit requirements, however, are notably high compared to the industry standard for regulated brokers.

| Account Type | Minimum Deposit | Leverage | Spread (from) |

| Standard | $100 | 1:500 | 1.5 pips |

| Trader | $500 | 1:500 | 0.8 pip |

| Fresher | $10 | 1:500 | 2.0 pips |

Spreads and Leverage

The broker offers leverage up to 1:500 across all its account types. While high leverage can increase potential profits, it equally increases potential losses and is a tool that should be used very carefully, especially with an unregulated broker.

There is also a big contradiction in the information about spreads. The broker's marketing materials claim “ultra-low spreads below 0.2 pips.” However, the details for their own account types list much higher starting spreads: 1.5 pips for the Standard account, 0.8 pip for Trader, and 2.0 pips for Fresher. This difference raises questions about honesty and the actual trading costs a client would face. Such “ultra-low” spreads, if they exist at all, may only be available under brief, perfect market conditions and don't represent a typical trading experience.

Market Access and Platform

One of the positive aspects advertised is the range of tradable instruments and the trading platform. The broker claims to offer over 275 instruments, providing access to many different markets.

· Forex

· CFDs

· Stocks

· Indices

· Metals

· Energies

The trading platform provided is MetaTrader 5 (MT5). Adam Capitals appears to hold a full license for the MT5 platform, which is a powerful and highly respected platform in the industry. MT5 is known for its advanced charting tools, technical indicators, and strong support for automated trading through Expert Advisors (EAs). Technical details show its server, named “AdamFxCapitals-Server,” is located in France. While access to a quality platform like MT5 is good, it does not and cannot make up for the lack of regulatory protection.

The Trader Experience

Beyond advertised features, the practical experience of a trader is what truly shows a broker's character. Looking at user feedback and operational limitations reveals several critical red flags that directly impact usability and trust.

A Barrier to Getting Started

A major and immediate problem is the complete lack of a demo account. This is a standard and essential feature offered by almost every reputable broker. A demo account allows potential clients to perform several crucial checks without risks:

· Test the platform's stability and interface.

· Check the real-time spreads and execution speed.

· Practice trading strategies in a live market environment.

· Get familiar with the broker's overall system.

The absence of this feature is highly unusual and user-unfriendly. It forces traders to commit a large amount of real capital ($100 minimum) just to test the environment. As one user noted:

> “The inability to try the platform with a demo account is a considerable downside. Most traders prefer to test a broker's conditions before committing real funds, and this option is not available here.”

Safety Concerns

When the question “Is Adam Capitals safe?” is asked in the trading community, the response is overwhelmingly cautious. Feedback suggests that while the advertised trading conditions might seem appealing on the surface, the lack of regulation is an impossible-to-overcome concern for experienced traders. The general agreement is that no broker can be classified as “very safe or fully legitimate” without official oversight from a credible authority. This reinforces the main theme of this analysis: features are less important than safety.

Lack of Clear Information

Another significant operational red flag is the complete absence of information about deposit and withdrawal methods. On the broker's profile, the sections for both “Depositing Method” and “Withdrawal Method” are empty. This is a critical failure in transparency. A trustworthy broker will always provide clear, detailed information on how clients can fund their accounts and, more importantly, how they can access their capital. The process should be straightforward and reliable. The lack of this basic information suggests potential difficulties or unfavorable terms related to transactions, and traders should be extremely careful.

Final Decision: Risk vs Reward

Looking at all the available information—from regulation and trading conditions to user experience—allows us to draw a clear and decisive conclusion. The question is not whether Adam Capitals offers some potentially attractive features, but whether those features are worth the fundamental risk to your money.

Comparing Pros and Cons

To make the assessment clear, here is a summary of the potential positives versus the critical red flags.

· Potential Positives:

· Access to the powerful and popular MetaTrader 5 (MT5) platform.

· A wide range of over 275 tradable instruments across multiple asset classes.

· Three different account levels for different (though high) deposit amounts.

· Critical Red Flags:

· No valid regulation from any recognized financial authority.

· Offshore registration in a location with no forex oversight.

·· No demo account available to test conditions without risk.

· A complete lack of transparency on deposit and withdrawal methods.

· Conflicting information on advertised spreads versus account-specific spreads.

· Widespread community and expert concern about its safety and legitimacy.

Our Conclusion on Reliability

Based on the overwhelming evidence, we cannot consider Adam Capitals to be a trustworthy or reliable broker for 2025. The critical red flags, particularly the complete absence of regulation, far outweigh any perceived benefits. The risks associated with depositing funds with an unregulated, offshore entity are simply too great. The lack of separate accounts, investor compensation, and a dispute resolution system means a trader's capital is exposed to significant and unacceptable danger. While the MT5 platform and instrument variety are appealing, they are readily available at countless other brokers who operate under the strict oversight of top-tier regulatory bodies. To stay updated on any changes to Adam Capitals' status or to read more user reviews, we strongly advise traders to check independent verification platforms like WikiFX before making any financial commitments.

A Final Piece of Advice

As final advice for all traders, new and experienced: always put regulation first above all else. A broker's regulatory license is your single most important safety net. Look for brokers regulated by top-tier authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). These bodies enforce strict rules that protect you and your funds. No amount of bonus offers, high leverage, or low advertised spreads can ever replace the security and peace of mind that comes with proper regulation.

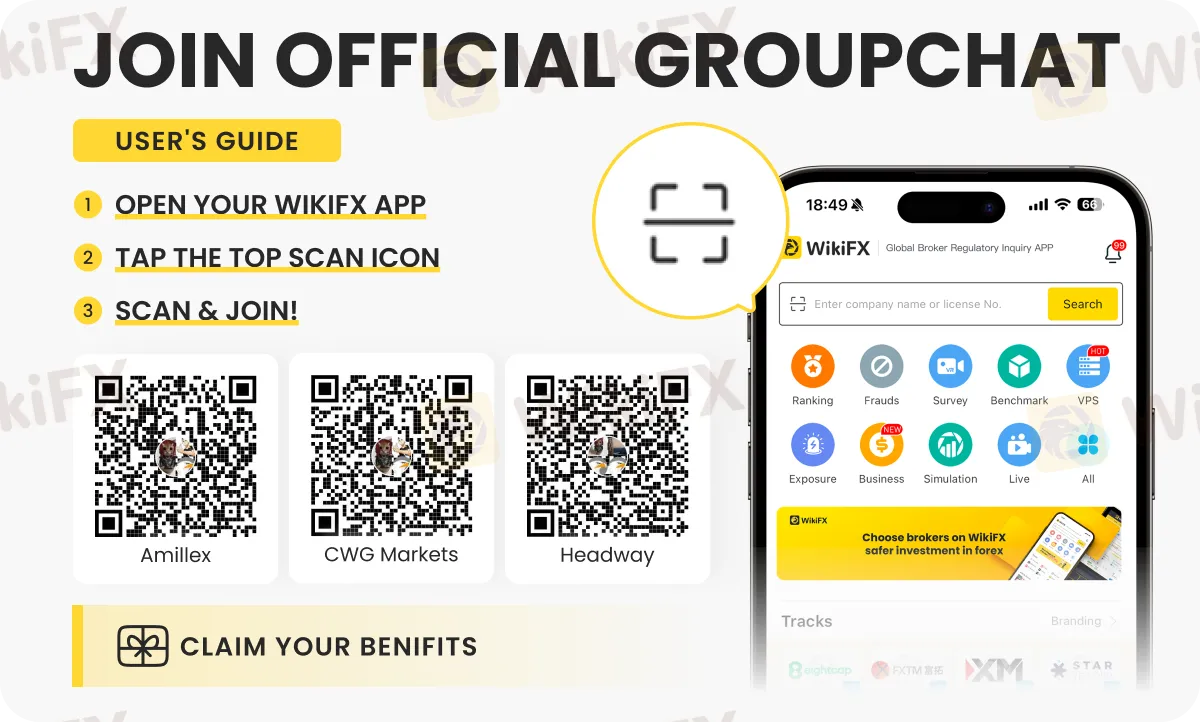

For more insightful forex trading insights, tips and strategies, join these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G).

Read more

Mazi Finance Comprehensive Review: A Deep Look into Trader Warnings and Risks

Mazi Finance is a trading company registered in Saint Lucia, an offshore location. Recently, it has received a lot of attention in the trading world. The company shows off many modern trading features, but when we look closer, we find many potential dangers. Before any trader thinks about opening an account, they need to understand the most important finding from our research: Mazi Finance does not have proper regulation. This single fact creates major warning signs about whether client capital is safe.

Pemaxx User Reputation: Looking at Real User Reviews to Check If It's Trustworthy

When you look for information about a forex broker, you often find a confusing mix of great reviews and serious warnings. This is especially true for Pemaxx, where traders have one main question: Is Pemaxx Safe or Scam? The internet has many different user experiences, making it hard to know what's true. This article won't give you a simple yes or no answer. Instead, we'll do an objective, fact-based study to help you make a smart choice. We'll look at the available information, focusing on real user reviews, common Pemaxx Complaints, and whether it follows proper regulations. By looking at patterns in both good and bad reports, we want to give you a clear picture of the risks and warning signs with this broker, helping you protect your capital.

Pemaxx Regulatory Status: A Complete Guide to Licenses and Trading Risks

The regulatory status of Pemaxx is a major concern for traders. When you search online, you can find the broker claiming to be regulated, but financial watchdog sites show serious warnings and user complaints. This creates a confusing and potentially risky situation for anyone considering an investment. The goal of this analysis is to clear up the confusion. We will examine the available information, explain the facts about the Pemaxx License status, and look at the risks for traders.

HFM Scam Warning: Withdrawal Complaints Surge

HFM users report withdrawal delays and missing funds. Read verified scam complaints, check regulatory info, and report your HFM case now.

WikiFX Broker

Latest News

Global Capital Rotation Batters Greenback; USD/JPY Pierces 156

Dollar Bears Circle as Fed Signals 'Crisis Readiness'

Japanese Yen Surges as Political Stability Lures Foreign Capital

Nigeria Net Foreign Reserves Hit $49B in Liquidity Turnaround

WikiFX Elite Club Focus | Mohamed Lewaa: Trust Is Built on Verification, Not Feelings

Is Alpari safe or scam? What You Need to Know

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

Here are the five key takeaways from the January jobs report

Tariff revenue soars more than 300% as U.S. awaits Supreme Court decision

KK Park 2.0? New Scam Hub Shockingly Emerges in Myanmar

Rate Calc