FXCM Broker ASIC Stop Order Halts CFD Sales

Abstract:FXCM Broker ASIC Stop Order blocks new CFD trading for retail clients in Australia due to TMD flaws. Explore FXCM Broker CFD Trading Ban Australia impacts, retail client restrictions, and next steps for traders.

FXCM Broker ASIC Stop Order Explained

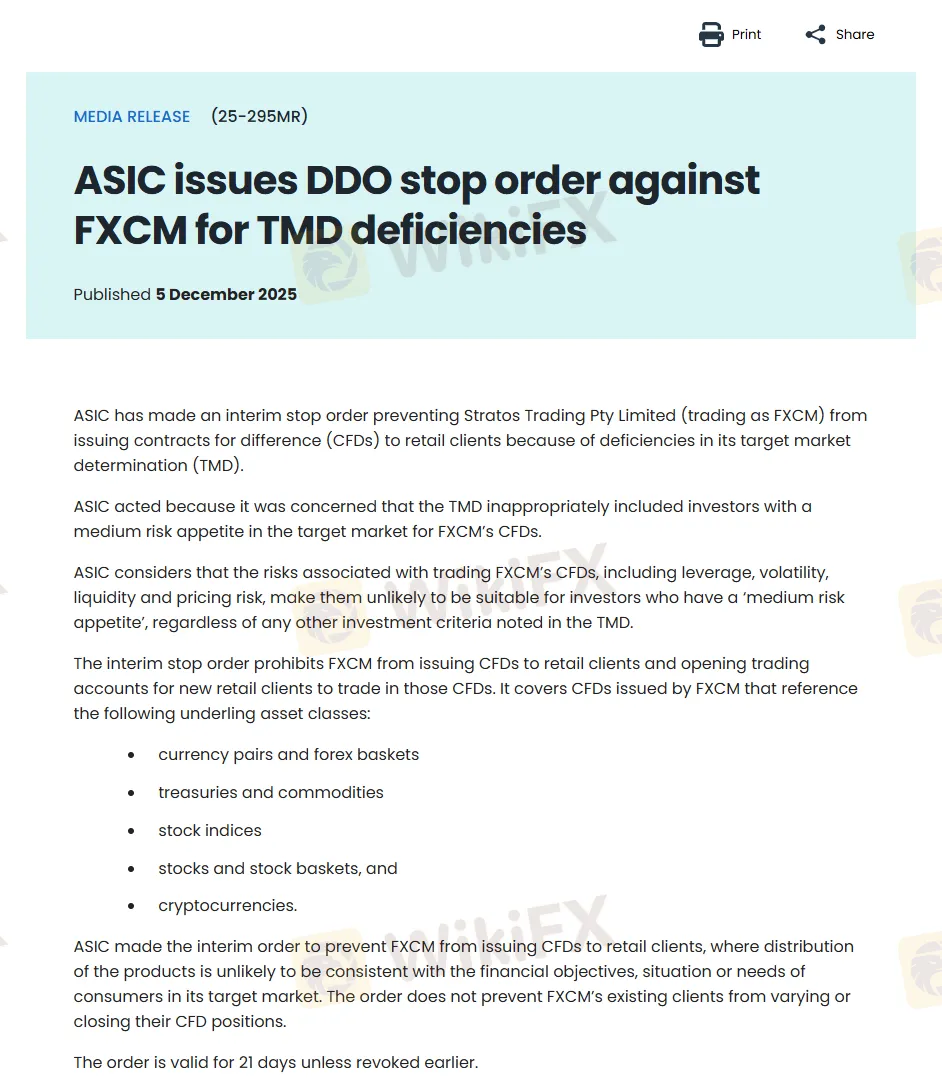

The Australian Securities and Investments Commission (ASIC) issued an interim stop order against Stratos Trading Pty Limited, operating as FXCM Broker, targeting deficiencies in its target market determination (TMD) for contracts for difference (CFDs). This FXCM Broker ASIC Stop Order prevents the issuance of CFDs to retail clients and bars opening new accounts for such trading, effective immediately across key asset classes like forex, commodities, indices, stocks, and cryptocurrencies. Existing clients retain the ability to adjust or close positions, with the measure lasting 21 days unless lifted sooner.

ASIC's action stems from concerns that FXCM's TMD wrongly categorizes investors with medium risk tolerance as suitable for high-risk CFDs, despite inherent dangers from leverage, market volatility, liquidity gaps, and pricing discrepancies. High-leverage CFD trading amplifies losses, often exceeding initial deposits, making it mismatched for those not accepting extreme risk profiles. This intervention aligns with ASIC's ongoing push to shield Australian retail traders from unsuitable products, building on prior reforms that capped leverage at 30:1 for major forex pairs and lower for others since 2021.

FXCM Broker CFD Trading Ban Australia Implications

The FXCM Broker CFD Trading Ban Australia, enacted via this stop order, disrupts new retail onboarding for leveraged products, a cornerstone of FXCM's offerings in the local market. CFDs referencing currency pairs, treasuries, commodities, stock indices, stocks, and cryptocurrencies fall under the prohibition, reflecting ASIC's view that such instruments fail to meet the financial goals or risk capacity of broad retail segments. For context, ASIC data shows retail CFD losses frequently surpass 70% of accounts in monitored periods, justifying stringent oversight.

This ban echoes Australia's tightened regime post-2021, where leverage restrictions curbed exposure from 500:1 to asset-specific limits, aiming to curb aggressive sales and inducements. FXCM, rebranded under Stratos Trading since 2023, now faces scrutiny that could reshape its competitive stance against peers like IC Markets or Pepperstone, who navigated similar TMD requirements. Traders eyeing alternatives must verify AFSL compliance and TMD alignment, as non-compliance risks face further enforcement.

Market analysts note that this FXCM Broker CFD Trading Ban Australia could prompt FXCM to refine its TMD swiftly, potentially narrowing the target to high-risk-tolerant clients only. With Australia's CFD market valued at billions in annual volume, such halts underscore regulators' zero tolerance for misaligned distributions. Existing FXCM users should monitor positions closely, leveraging stop orders—FXCM's automated tools to exit trades at predefined levels amid volatility.

FXCM Broker Retail Client Restrictions Deep Dive

FXCM Broker retail client restrictions under the ASIC stop order exclude new entrants from CFD exposure, prioritizing consumer protection over business growth in a high-stakes arena. The TMD flaw centered on including medium-risk profiles, overlooking how CFDs' leverage can magnify swings in forex baskets or crypto references, often leading to rapid capital erosion. ASIC mandates TMDs ensure products suit clients' objectives, financial situation, and needs; FXCM's oversight triggered this preemptive block.

These FXCM Broker retail client restrictions do not impact wholesale or professional clients, nor halt ongoing trades, offering a carve-out for continuity. In parallel, FXCM's platform supports advanced order types like stop losses, which execute at market price once thresholds are hit to limit downside—crucial for navigating restricted environments. Historical precedents, such as ASIC's bans on XTrade directors for compliance lapses, signal escalating accountability for brokers.

Broader FXCM Broker retail client restrictions in Australia reflect global trends, with EU and UK caps mirroring local leverage curbs to foster sustainable trading. Stakeholders anticipate FXCM's response, possibly via TMD revisions or appeals, within the 21-day window. For retail traders, this reinforces due diligence: assess broker TMDs via ASIC's registers and prioritize platforms with proven risk disclosures.

Future Outlook for FXCM in Australia

Resolution of the FXCM Broker ASIC Stop Order hinges on FXCM addressing TMD gaps, potentially through targeted exclusions for medium-risk investors. Success could lift the FXCM Broker CFD Trading Ban in Australia swiftly, restoring access while enhancing compliance credibility. Meanwhile, FXCM Broker retail client restrictions spotlight the need for robust risk profiling, as ASIC ramps up design and distribution obligation (DDO) enforcement across derivatives.

Australia's retail forex and CFD sector, serving over 100,000 active accounts, faces heightened scrutiny amid persistent loss rates above 60-80%. FXCM, with its global footprint, must balance innovation—like its Trading Station stop order features—against local mandates. Investors are advised to diversify via ASIC-licensed alternatives and employ risk tools amid uncertainties.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Promised 30% Returns, Lost RM630,000 Instead

MultiBank Group Analysis Report

Pepperstone Analysis Report

TradingPro: Regulation, Licences and WikiScore Analysis

NEWTON GLOBAL Legitimacy Check (Addressing fears: Is This a Fake or a Legitimate Trading Partner?)

Weltrade Review: Safety, Regulation & Forex Trading Details

SPREADEX Review: Reliable Broker Check

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump's tariffs

Rate Calc