OneRoyal Review 2025: Multiple Licenses Yet Flooded with Scam Complaints

Abstract:OneRoyal holds licenses from ASIC and CySEC, yet faces a flood of user complaints. From "AI trading" frauds to withdrawal blocks, our 2025 review investigates why this multi-regulated broker carries such high risks.

The OneRoyal Paradox: Valid Licenses, Zero Trust?

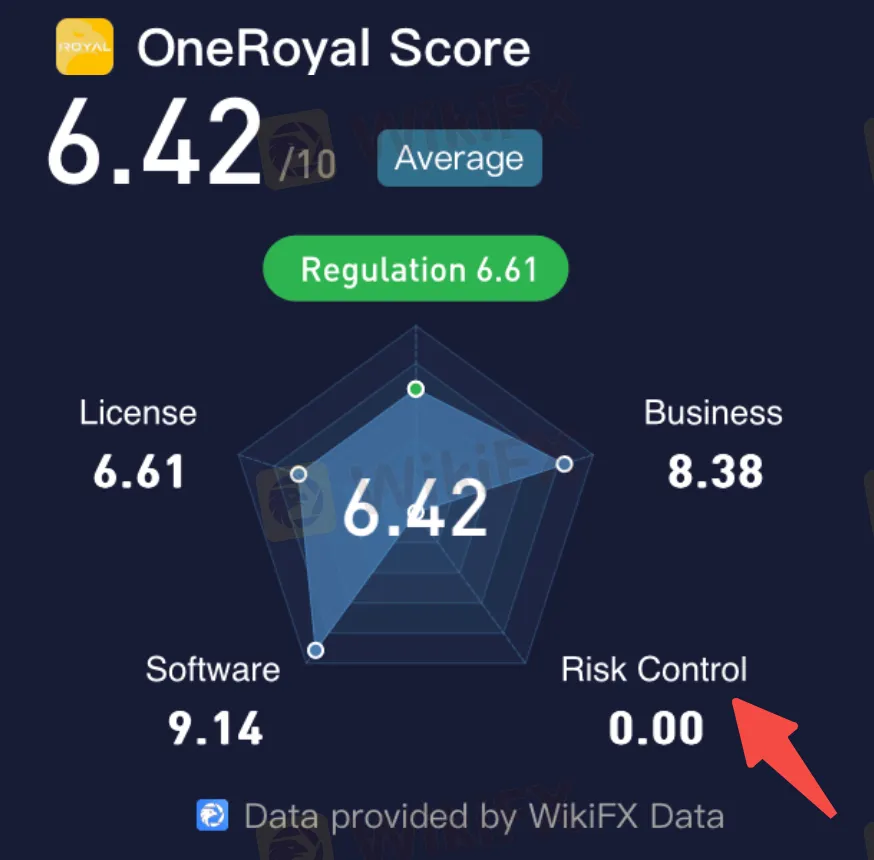

In the crowded forex market, OneRoyal presents a confusing picture for investors. On paper, it appears to be a legitimate powerhouse, boasting regulation from top-tier authorities like ASIC (Australia) and CySEC (Cyprus). These credentials earn it a respectable WikiFX Score of 6.42/10.

However, a closer evaluation exposes a dangerous disconnect. Despite the high “License Index,” the brokers “Risk Control Index” is a flat 0.00. Even more alarming is the red warning banner highlighting 23 verified user complaints. This review investigates how a broker with such prestigious licenses can generate such a high volume of “scam” allegations.

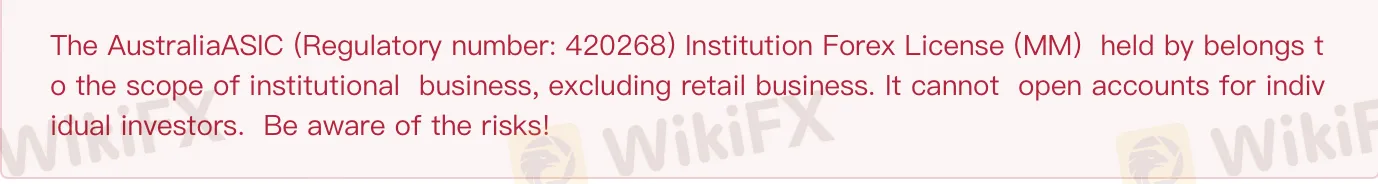

The “Offshore” Trap: Why Regulation Matters

The key to understanding these complaints lies in the fine print. While OneRoyal proudly displays its ASIC license, WikiFX data reveals a critical limitation: this Australian license is strictly for “Institutional Business” and cannot be used to open accounts for individual retail investors.

Consequently, most retail traders—particularly those in Asia and the Middle East—are likely being onboarded under the VFSC (Vanuatu) entity. This is an offshore license with minimal client protection, creating a regulatory gap where questionable practices can thrive unchecked.

Deep Dive: Categorizing the User Complaints

The grievances against OneRoyal are not random. They follow specific, recurring patterns of alleged misconduct. We have analyzed the “Exposure” section to categorize the most severe risks.

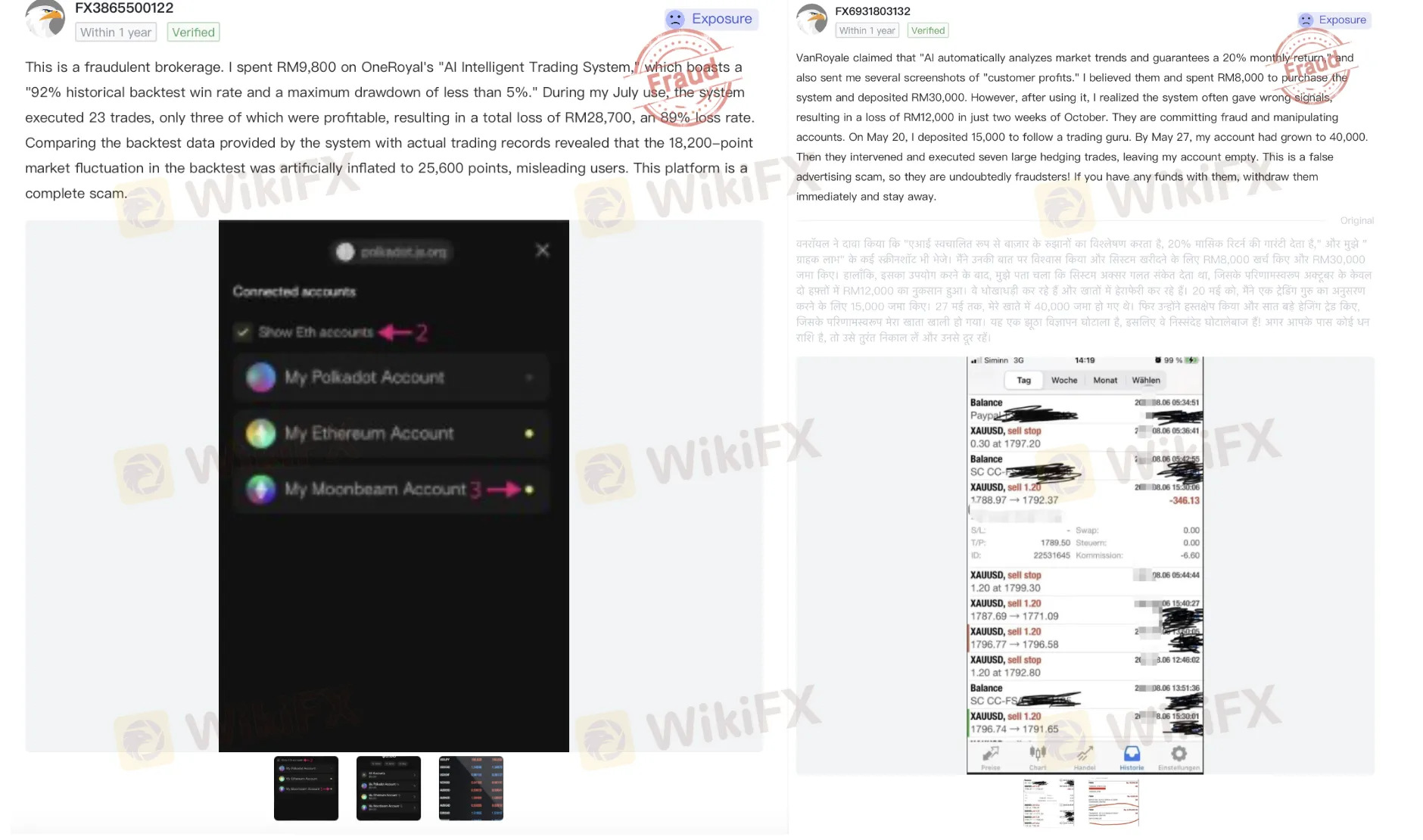

1. The “AI Trading” and Managed Account Schemes

A distinct cluster of complaints revolves around the promotion of “AI Intelligent Trading Systems.” Users report being enticed by promises of guaranteed returns or high win rates, only to see their capital decimated by the software.

The Allegation: One trader detailed investing in an “AI System” that boasted a “92% historical backtest win rate.” In reality, the system reportedly executed trades with an 80% loss rate, wiping out RM28,000. Another user claimed they were promised a “20% monthly return,” but the signals resulted in immediate losses, leading them to accuse the broker of fraud.

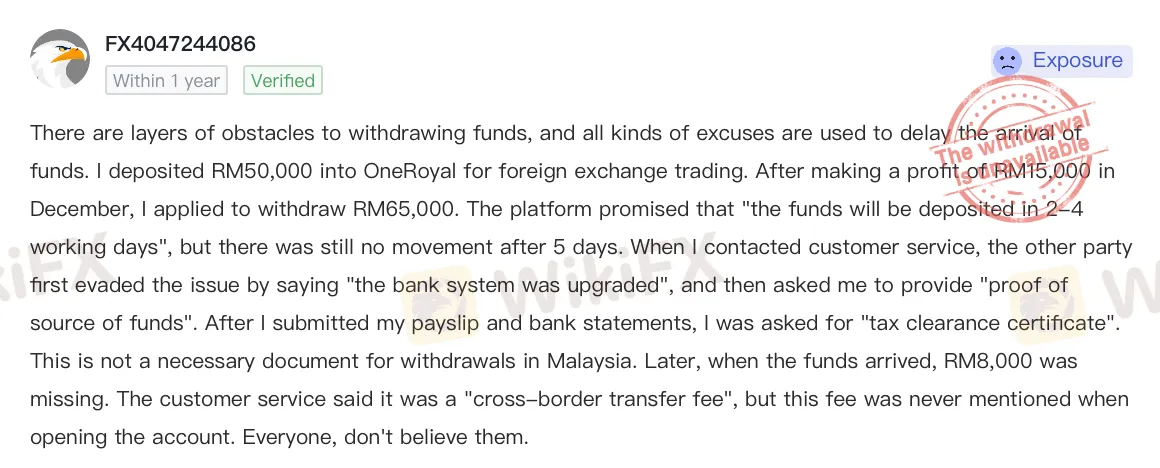

2. The “Withdrawal Block” & Fee Extortion

The most frequent and alarming grievance is the refusal to process withdrawals. These are not standard processing delays; they involve allegations of extortion where the broker demands additional payments to release funds.

The Allegation: Multiple traders reported that when they attempted to withdraw profits, customer support demanded a “20% margin fee” or a fee to “raise credit score” before the withdrawal could proceed. This tactic—asking for more money to release existing funds—is a hallmark of investment scams. In one case, a Malaysian trader reported being stuck in a withdrawal loop for RM65,000, facing endless “under review” statuses.

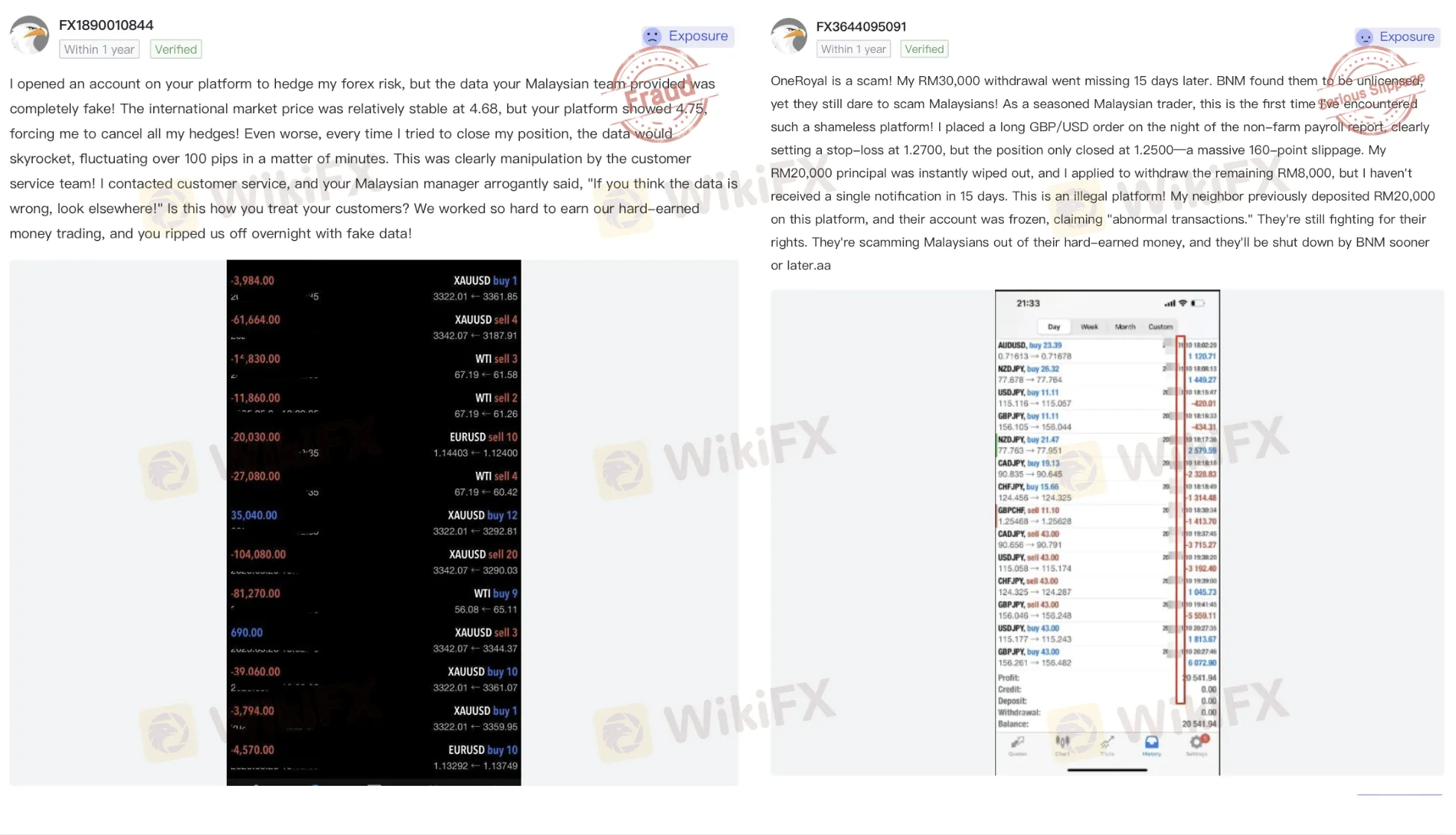

3. Data Manipulation and Stop-Loss Hunting

The third category of complaints attacks the integrity of OneRoyal's trading environment. Traders have accused the broker of manipulating price feeds to force liquidations.

The Allegation: One detailed report describes a suspicious event where a trader placed a stop-loss on a GBP/USD position. The user alleges the platform ignored the stop-loss, allowing the price to slip 160 points beyond the limit, resulting in a massive loss of RM30,000. Another user noticed discrepancies between OneRoyal's price data and international market prices, forcing them to close hedges at a disadvantage.

WikiFX Final Verdict

OneRoyal illustrates a critical lesson for traders: a top-tier license in one jurisdiction does not protect you in another. While the broker holds ASIC and CySEC authorizations, the sheer volume of complaints regarding withdrawal fees and AI schemes suggests that its offshore entity operates with high risk.

- The Reality: A 6.42 score masks the danger of the “Offshore” loophole.

- The Advice: Retail investors should be extremely cautious. If you are not trading under the UK or Australian entity, you likely lack the regulatory safety net needed to prevent these withdrawal issues.

Use the WikiFX App to verify which specific entity holds your account. Don't assume that a UK or Australian license covers you globally. A quick check on WikiFX can reveal if you are being funneled into a high-risk offshore branch where these complaints are most common.

WikiFX Broker

Latest News

Is Tauro Markets Safe? A 2025 Deep Look into Its Risks and Openness

QuickTrade Review: Multiple Reports of Account Freezes and Login Failures by Users

The TikTok Scam That Cost a Retiree Nearly RM470,000

The "Arbitrage" Accusation: How Winning Trades Turn Into Account Reviews at ACY Securities

IC Markets Formula 1 Partnership Debuts at Abu Dhabi GP 2025

FCA Waning list of Unauthorised firms

Trading Knowledge is Wealth! Take the Daily Quiz Challenge and Win 1,000 Points!

CommSec Regulation, Login Information & User Review : A Comprehensive Review

Can You Trust Tauro Markets? A Complete Guide for New Traders

FCA’s 2027 Compliance Overhaul: A New Reality for FX and CFD Brokers

Rate Calc