UIIC Broker Review: Is It Legit or a Fraud?

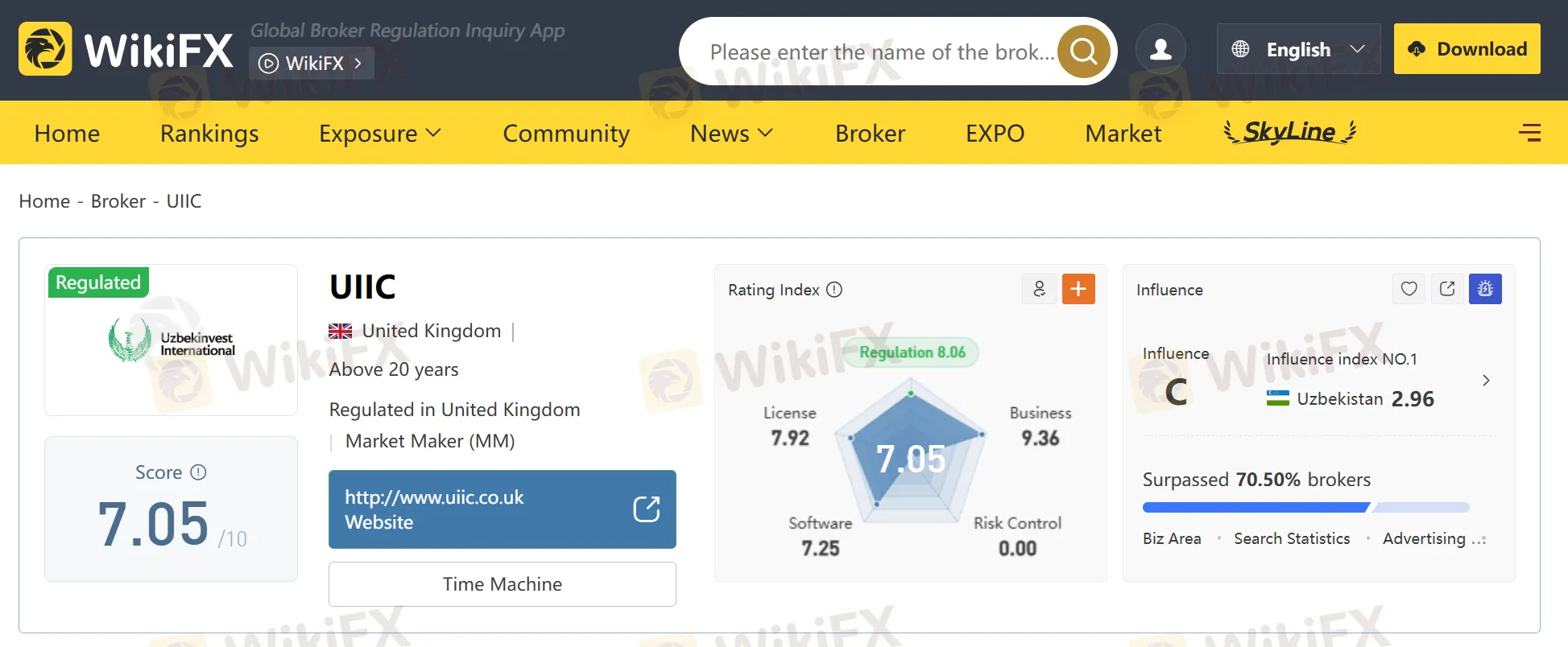

Abstract:In this article, we want to discuss the broker named UIIC, as it recently caught our eye. UIIC is a UK-based broker. This broker, registered in the United Kingdom, claims more than 20 years of operation, a long history in the financial industry, and regulatory oversight from UK authorities. But is UIIC truly safe and trustworthy? How is the regulation? Or are there red flags you should know? This article may offer you clues.

In this article, we want to discuss the broker named UIIC, as it recently caught our eye. UIIC is a UK-based broker. This broker, registered in the United Kingdom, claims more than 20 years of operation, a long history in the financial industry, and regulatory oversight from UK authorities. But is UIIC truly safe and trustworthy? How is the regulation? Or are there red flags you should know? This article may offer you clues.

What Is UIIC? Company Background

UIIC (United International Investment Corporation) is a financial services provider reportedly founded in 1994, giving the firm more than 30 years of operational history. The broker operates as a Market Maker (MM) and offers various trading services such as forex, CFDs, indices, and possibly other asset classes depending on the region.

Key Facts About UIIC

- Founded: 1994

- Headquarters: AIG Building, 58 Fenchurch Street, London, United Kingdom

- Broker Type: Market Maker (MM)

- Operating History: Over 20 years (based on company claims)

- Regulation: Claims to be regulated in the UK

At first glance, UIIC presents itself as a long-established British brokerage with strong regulatory protection. However, investors should look deeper into whether these claims are accurate and still valid.

Is UIIC Regulated by the FCA?

UIIC states that it is regulated in the United Kingdom and has an FCA license.

According to the publicly available historical data, UIIC was indeed regulated by the Financial Conduct Authority (FCA) at one point.

However, traders must verify:

- Is the FCA license still active?

- Is the license number legitimate?

- Does the registered address match FCA records?

Address Listed

- AIG Building, 58 Fenchurch Street, London EC3M 4AB

WikiFX‘s on-site verification confirms that UIIC has a physical presence at this address, strengthening the firm’s credibility.

However, regulatory status can change over time, especially with long-running brokers. Traders should always check the current FCA register to ensure that UIICs license has not been revoked, expired, or suspended.

UIIC vs. Typical FCA-Regulated Brokers: How Does It Compare?

To understand whether UIIC offers the same level of safety and transparency as a standard UK-regulated broker, its important to compare key criteria such as regulation, trading conditions, transparency, investor protection, and operational history.

Regulatory Status & Transparency

| Criteria | UIIC | Typical FCA-Regulated Broker |

| Regulation | Claims FCA regulation (must verify if still active) | Fully regulated with an active FCA license |

| Regulatory Information on Website | Limited, sometimes outdated | Clear FCA license number, registration, permissions, and legal entity |

| Compliance Reporting | Not fully transparent | Must submit regular reports to the FCA and meet strict capital requirements |

Client Fund Protection

| Criteria | UIIC | Typical FCA-Regulated Broker |

| Segregated Accounts | Not clearly stated | Mandatory – client funds must be held in segregated Tier-1 bank accounts |

| FSCS Insurance | Not clearly confirmed | Retail clients protected up to £85,000 under the Financial Services Compensation Scheme |

| Negative Balance Protection | Not explicitly mentioned | Required under UK law for all retail clients |

Trading Conditions

| Criteria | UIIC | Typical FCA-Regulated Broker |

| Leverage | Possibly higher depending on region | Capped at 1:30 for retail traders under FCA rules |

| Spreads | Can vary; MM model may offer wider spreads | Transparent, published spreads with standardized pricing |

| Order Execution Model | Market Maker (MM) | Can be MM, STP, or ECN but must disclose execution practices clearly |

Operational History & Reputation

| Criteria | UIIC | Typical FCA-Regulated Broker |

| Years of Operation | Founded in 1994 (over 30 years) | Usually 5–20+ years |

| Physical Office | Verified by WikiFX at 58 Fenchurch Street, London | All FCA brokers must have a verifiable UK physical office |

| Public Reviews | Mixed or limited | Widely reviewed and monitored on multiple platforms |

Website & Information Disclosure

| Criteria | UIIC | Typical FCA-Regulated Broker |

| Website Clarity | Limited information on accounts, spreads, and fees | Detailed, standardized, fully transparent disclosures |

| Legal Documents | May not be comprehensive | Must publicly provide Terms of Business, Risk Disclosure, Client Agreement, Execution Policy |

| Updates | Some outdated pages | Regular updates required for compliance |

Overall Comparison: Does UIIC Match FCA Standards?

Where UIIC Performs Well

- Long operational history (since 1994)

- Verified London office

- Claims past FCA regulation

- Offers a standard Market Maker model similar to many UK brokers

Where UIIC Falls Behind

- Regulatory status needs verification

- Does not clearly outline client fund safety mechanisms

- Limited website transparency

- Fewer public reviews than major FCA brokers

- Unclear negative balance protection and FSCS coverage

WikiFX On-Site Survey Results

WikiFX has conducted an on-site inspection of UIIC in the UK.

Key findings include:

- The companys office address is consistent with its claimed location at 58 Fenchurch Street.

- The building is a well-known commercial tower that hosts multiple financial service providers.

- There are visible signs of UIICs office operations.

On-site verifications do not guarantee a brokers regulatory compliance or trading fairness, but they do confirm physical presence, which many fraudulent brokers lack.

UIIC Trading Conditions

Although some information varies by region, UIIC typically provides:

1. Trading Instruments

- Forex currency pairs

- CFDs

- Stocks

- Indices

- Commodities

2. Account Types

Specific account types are not publicly detailed on all regions of UIICs website, but most Market Maker brokers offer:

- Standard accounts

- Mini/Micro accounts

- VIP or professional accounts

3. Trading Platform

UIIC reportedly supports MetaTrader or proprietary trading software. More verification is recommended depending on the official website.

4. Leverage & Spreads

- Leverage depends on regulatory rules (FCA typically limits retail leverage to 1:30)

- Spreads may start from 1.0 pip or higher based on its MM model

Pros and Cons of UIIC

✔ Pros

- Long operational history (founded in 1994)

- UK registration and past regulation by the FCA

- Verified physical office location

- Market Maker model suitable for beginners

- Offers a variety of trading instruments

✘ Cons

- Current FCA regulatory status needs verification

- Limited transparency in account details and fees

- Website information may be outdated

- Some traders prefer ECN brokers instead of MM brokers

- Lack of clear client fund protection information

Is UIIC Legit or a Scam?

Based on available evidence:

UIIC appears to be a legitimate broker with a long operational history and physical presence in London.

The firm has been FCA-regulated in the past, which strengthens its credibility. However, the most important step for traders is to verify the brokers current regulatory status, as licenses can change over time.

If its FCA license is still active, UIIC can be considered a trustworthy and compliant UK broker.

But if the license is inactive, traders should proceed with caution.

Should You Trade with UIIC?

UIIC is a broker with a long history and a real office in London, giving it an advantage over many offshore or unregulated brokers. However, regulation and transparency remain the determining factors.

Recommended steps before opening an account:

- Verify UIICs FCA license number directly on the FCA register

- Confirm account fees, spreads, and withdrawal policies

- Check up-to-date WikiFX ratings and user reviews

- Start with a small deposit and test withdrawal speed

If UIIC is still fully regulated and compliant, it may be a safe option for traders seeking a UK-based Market Maker broker.

Read more

Effective Stop Loss Trading Strategies

In a forex market where fundamental and technical factors impact the currency pair prices, volatility is expected. If the price volatility acts against the speculation made by traders, it can result in significant losses for them. This is where a stop-loss order comes to their rescue. It is one of the vital investment risk management tools that traders can use to limit potential downside as markets get volatile. Read on as we share its definition and several strategies you should consider to remain calm even as markets go crazy.

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

WikiFX Broker

Latest News

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Promised 30% Returns, Lost RM630,000 Instead

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Effective Stop Loss Trading Strategies

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Hits Q4 Growth

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Slams Growth

BitPania Review 2026: Is this Broker Safe?

Rate Calc