OneRoyal Review 2025: Is This Broker Legit or a Scam?

Abstract:OneRoyal is an Australian-based brokerage established in 2012 that offers trading services across global markets. With over a decade of operation, the broker has established a significant presence, holding licenses from top-tier regulators like ASIC and CySEC. However, despite its strong regulatory framework, recent user feedback paints a conflicting picture involving withdrawal struggles and severe slippage.

OneRoyal is an Australian-based brokerage established in 2012 that offers trading services across global markets. With over a decade of operation, the broker has established a significant presence, holding licenses from top-tier regulators like ASIC and CySEC. However, despite its strong regulatory framework, recent user feedback paints a conflicting picture involving withdrawal struggles and severe slippage.

With a WikiFX score of 6.42 and an “AA” trading environment ranking, OneRoyal appears solid on paper. However, a recent surge in complaints requires a closer look at whether this broker is truly safe for retail investors.

Is OneRoyal Safe? Regulatory Status and Licenses

The primary indicator of a broker's safety is its regulatory oversight. OneRoyal operates under a complex structure involving multiple legal entities, ranging from top-tier protection to offshore regulation.

Regulatory Licenses:

| Regulator | Country | License Type | Status |

|---|---|---|---|

| ASIC | Australia | Tier 1 (High Safety) | Regulating |

| CySEC | Cyprus | Tier 2 (Europe) | Regulating |

| AMF | France | Tier 1 (Europe) | Regulating |

| VFSC | Vanuatu | Offshore | Offshore Regulation |

Regulatory Analysis:

OneRoyal holds highly respected licenses from the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). These regulators enforce strict capital requirements and segregation of client funds.

However, many international clients are onboarded through the Vanuatu (VFSC) entity. This offshore license allows for higher leverage (up to 1:1000) but offers significantly less protection than Australian or European standards. Additionally, investors should be aware that the Securities Commission of Malaysia (SC) has issued a warning regarding OneRoyal for carrying out unauthorized capital market activities.

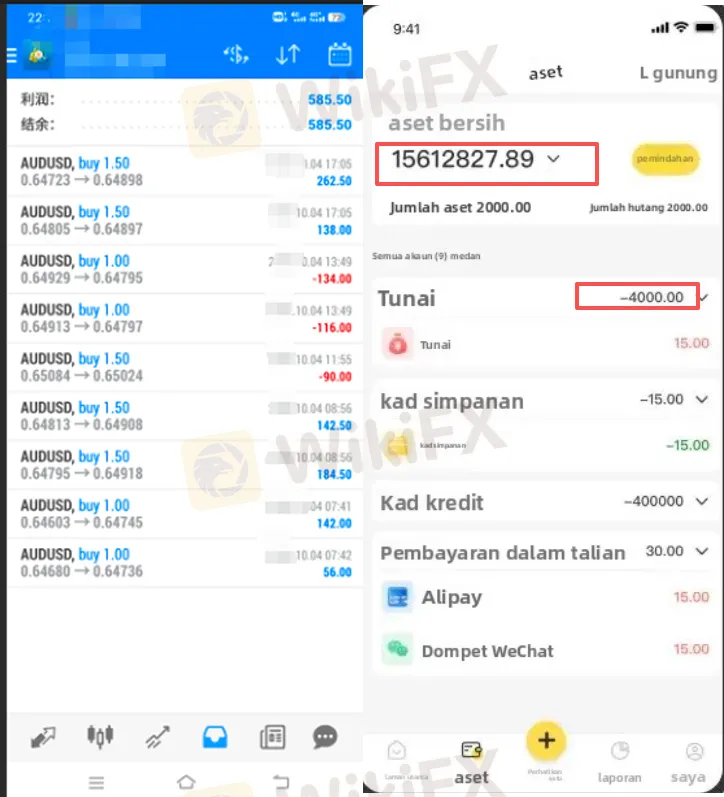

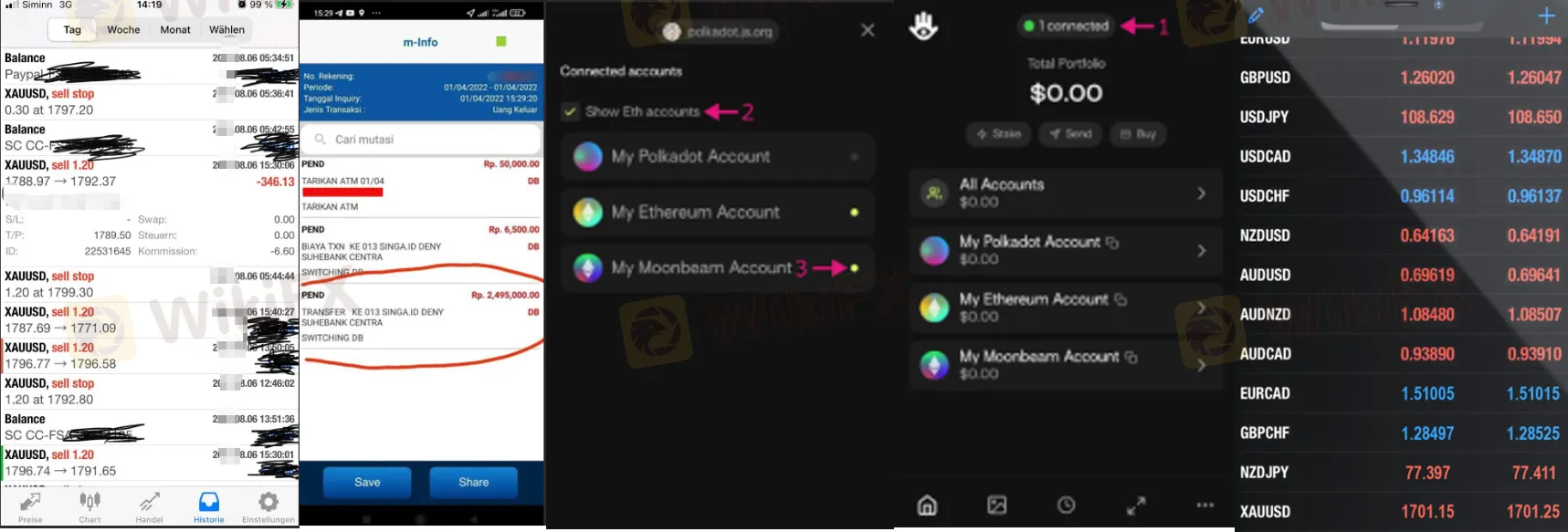

OneRoyal Scam Exposure: Withdrawal Complaints and Slippage

While the regulatory background is strong, the practical user experience has raised red flags. In the last three months alone, there have been 23 formal complaints lodged against the broker. The allegations fall into three alarming categories: withdrawal failures, platform dominance, and bonus traps.

Withdrawal Issues

A significant number of traders have reported being unable to access their funds. Reports from users in Malaysia and other regions detail instances where withdrawal requests are rejected without clear justification or remain “under review” for over 15 days.

- Documentation Delays: Users report being asked for excessive documentation, such as “tax clearance certificates”—documents not standard for standard withdrawals—essentially stalling the process.

Deducted Profits: Some traders claimed their profits were deducted under accusations of “illegal trading” or “abnormal market fluctuations,” even when they believed they traded legitimately.

Severe Slippage and Data Manipulation

Multiple case studies highlight massive slippage, where the price a trade is executed at differs vastly from the requested price.

- Stop-Loss Failures: One user reported a 160-point slippage on a GBP/USD trade, which wiped out their principal. Another user noted a gold trade was closed $30 below their stop-loss price.

Price Discrepancies: Traders have accused the platform of showing price feeds that differ from the international market rate, specifically fluctuating wildly during attempts to close positions to force losses.

“AI” Trading and Bonus Schemes

Several complaints mention an “AI Intelligent Trading System” promoted by the broker (or affiliates) guaranteeing high returns (e.g., 20% monthly). Users reported that backtest data was manipulated to look profitable, but real trading resulted in rapid losses.

Additionally, one user reported a 50% deposit bonus trap where funds were locked until a trading volume turnover of 30 times the bonus amount was achieved—a requirement often impossible to meet without losing the principal.

Trading Conditions: Fees, Spreads, and Accounts

For users who do not encounter these operational issues, OneRoyal offers a robust technical environment with flexible account options.

Trading Platforms

OneRoyal supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These are the industry standards, offering advanced charting and automated trading capabilities (EAs). The platform availability is rated “Perfect,” though it lacks proprietary mobile apps for smoother account management.

Account Types

The broker offers five distinct account types to suit different traders:

- ECN / VIP Accounts: These accounts feature raw spreads starting as low as 0.0 pips. The VIP account requires a deposit of $10,000, while the standard ECN account requires only $50.

- Classic Account: Designed for beginners with a $50 entry, but spreads are higher, starting from 1.4 pips.

- Swap-Free: Available for Islamic traders or those holding long-term positions.

Leverage

OneRoyal offers extremely high leverage up to 1:1000. While this allows for maximizing small deposits, it also increases the risk of rapid liquidation, especially given the slippage reports mentioned in user reviews.

Pros and Cons of OneRoyal

Pros:

- Regulated by top-tier authorities (ASIC, CySEC).

- Access to MT4 and MT5 trading platforms.

- Tight spreads (0.0 pips) on ECN accounts.

- Multiple account types with low entry barriers ($50 minimum deposit).

Cons:

- High volume of recent complaints regarding withdrawals.

- Regulatory Warning from the Securities Commission of Malaysia.

- Reports of severe slippage and stop-loss failures.

- Offshore entity (Vanuatu) offers lower client protection.

- Allegations of misleading bonus terms and AI trading “scams.”

Final Verdict: Is OneRoyal Safe?

The verdict on OneRoyal is complicated. Legally, it is a legitimate broker with valid licenses from top-tier regulators like ASIC and CySEC. However, the operational reality reported by recent users contradicts this safety. The accumulation of complaints regarding denied withdrawals, price manipulation, and misleading bonus schemes suggests significant risk, particularly for clients registered under the offshore (Vanuatu) entity.

While the trading conditions (spreads and platforms) are competitive, the risk of capital being locked or lost to “technical errors” currently outweighs the benefits for many retail traders. Caution is strongly advised.

To ensure you stay protected and avoid brokers with withdrawal issues, verify the specific entity you are registering with. Use the WikiFX app to check the latest regulatory warnings and real-time user reviews before making any deposit.

Read more

eFX Markets Review: Check Out Reported Trade Manipulation & Withdrawal Denial Cases

Has eFX Markets taken away your deposited capital? Faced losses due to manipulative ‘stop loss and take profit’ orders? Were you denied fund withdrawals because you did not finish your trading lot? Did the broker lure you into trading through a fake welcome bonus and scam you later? Traders have accused the Virgin Islands-based forex broker of driving these fraudulent practices. In this eFX Markets review article, we have shared some complaints against the broker. Take a look!

Otet Markets Exposed: Withdrawal Denials, Hidden Trading Rules & Scam Allegations

Has OTET Markets scammed you by freezing your forex trading account? Were you caught off guard by hidden trading rules diminishing your trading gains? Is the Otet Markets withdrawal process too slow or negligent? Don’t you receive adequate support from the broker’s customer care department? You are not alone! Many traders have opposed the Saint Lucia-based forex broker for their alleged malicious tactics. In this Otet Markets review article, we have covered a series of complaints against the broker. Read on!

E-Global Review: Order Closure Issues, Alleged Trade Manipulation & Fund Scams

Have you witnessed a failure of order closure by the E-Global Forex executive? Did you see an unprecedented rise in a forex pair not available on platforms other than that of this broker? Did the slow trading server prevent you from closing your trade at a favorable price? Has the broker scammed you after earning you from your investment? Many traders have expressed disappointment over the unfair forex trading practices at the US-based forex broker. In this E-Global Forex review article, we have shared some complaints against the broker. Take a look!

JP Markets Regulation Review: Legit or Fraud?

JP Markets SA (Pty) Ltd holds FSCA License No.46855. Learn about its regulation, derivatives trading license, and MT4/MT5 platform compliance.

WikiFX Broker

Latest News

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

Commodity Super-Spike: Gold Nears $4,500 and Silver Tops $80 on Venezuela Shock and Tariff Fears

Merin Review (2025): Is it Safe or a Scam?

Oil Slide Deepens: Trump Secures 50M Barrels from Venezuela Following Regime Change

IG Boosts Cash Interest, Drops Account Fees for UK Investors

Revolutfx Review 2025: Institutional Audit & Risk Assessment

Gold Eyes $4,500 Milestone While Yen Crumbles Under Rate Disparity

Rate Calc