MONAXA Exposed: Why Highly Profitable Traders Are Losing Everything to the 'Abuse' Clause

Abstract:WikiFX has detected a disturbing pattern of profit confiscation involving the broker MONAXA, particularly affecting traders in Malaysia and Vietnam. While the broker promotes "instant entries" and digital ease, our investigation reveals a high-risk environment where significant profits are systematically deducted under vague clauses, and regulatory bodies act as mere spectators to an offshore vacuum.

Abstract

WikiFX has detected a disturbing pattern of profit confiscation involving the broker MONAXA, particularly affecting traders in Malaysia and Vietnam. While the broker promotes “instant entries” and digital ease, our investigation reveals a high-risk environment where significant profits are systematically deducted under vague clauses, and regulatory bodies act as mere spectators to an offshore vacuum.

Disclaimer

To protect the privacy of the individuals involved who assisted in this investigation, all names have been anonymized. The following narrative is constructed strictly from verified user logs, complaint tickets, and regulatory data recorded by WikiFX.

The “Winning Too Much” Syndrome

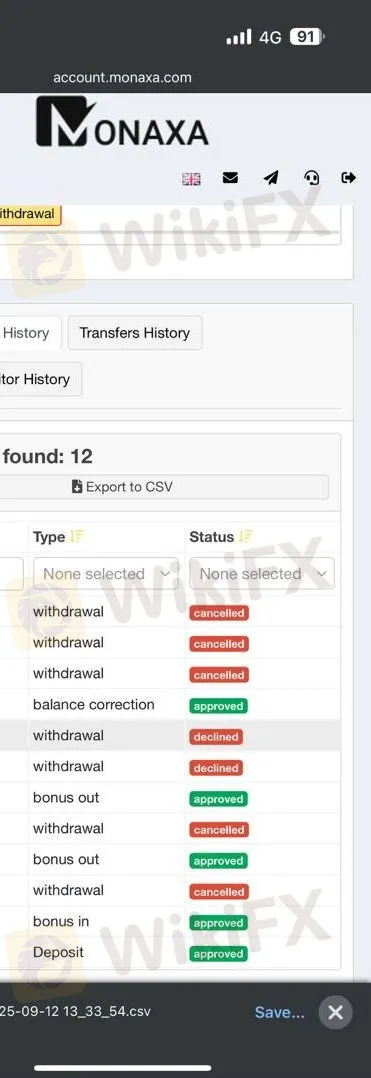

In the world of online trading, the ultimate goal is to generate a profit. However, for clients of MONAXA, achieving success appears to be the trigger for a nightmare scenario. Our investigation into recent complaints reveals a specific modus operandi: allow the trader to deposit and trade, but intervene drastically once the account equity grows significantly.

We reviewed the distressing case of a trader from Malaysia ($Case 9$) who deposited $5,500 in March 2024. By April 1st, instead of celebrating a successful month, the trader discovered that $15,150.04 had been forcibly removed from their MT4 account without prior notice.

What makes this case particularly chilling is the alleged justification. The trader reports receiving a call from a Business Development Manager who candidly claimed the user had simply “won too much.” This arbitrary cap on success contradicts the fundamental promise of any legitimate financial market participation.

This was not an isolated incident. Another Malaysian trader ($Case 7$) reported a staggering deduction of approximately $22,000 USD. In this instance, the broker's justification shifted to technicalities. The user was accused of “breaking rules” by having multiple logins with the same VPS (Virtual Private Server). Despite the trader's attempts to resolve the issue via live chat and email, the funds were deducted, and communication channels were effectively closed. When a broker uses technical infrastructure choices—common among automated traders—as a pretext to confiscate five-figure sums, it signals a severe conflict of interest.

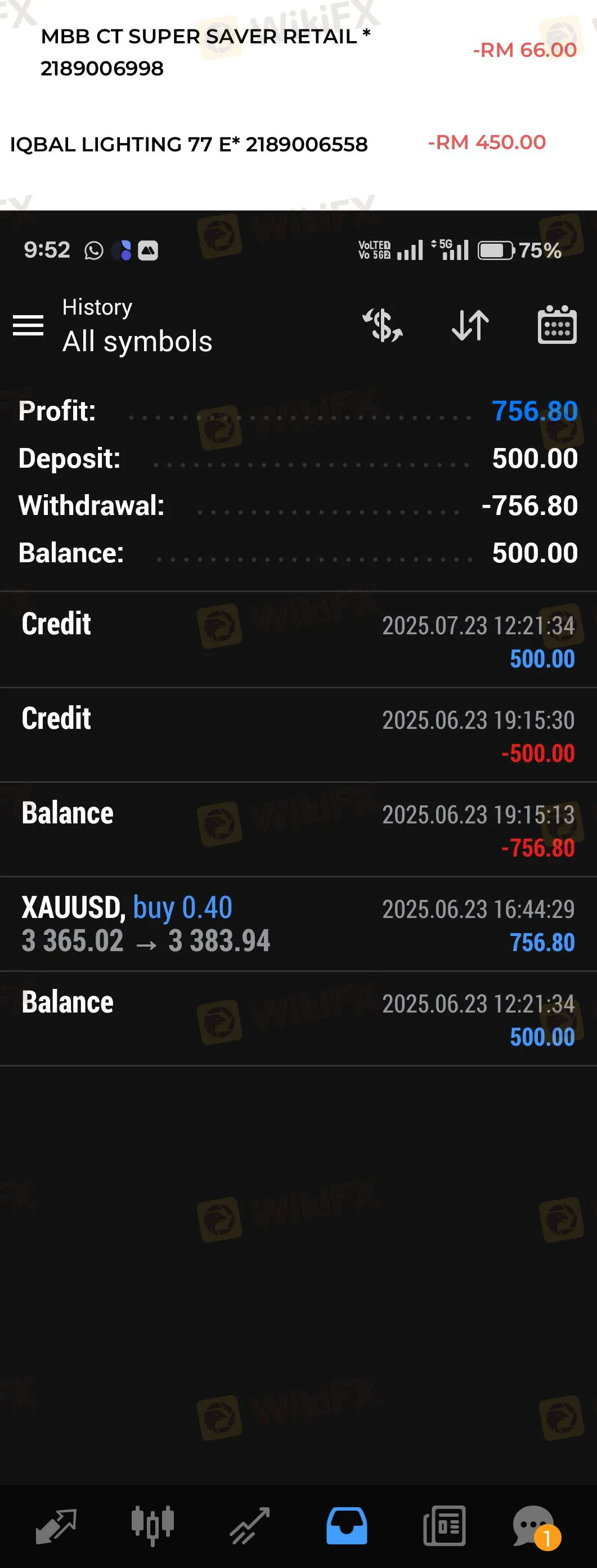

The “Bonus” Trap and Market Manipulation

MONAXA aggressively markets bonuses to attract new clients, particularly in Southeast Asia. However, WikiFX data suggests these bonuses often function as a “poison pill” for account withdrawals.

A report from Vietnam ($Case 3$) highlights this trap. A trader attracted by a bonus scheme traded profitably for a week. When attempting to withdraw the profits, the broker demanded a video of the user holding their ID—a standard verification request. However, immediately after compliance, the broker deducted all accumulated profits, returning only the initial principal. The user was left with nothing but wasted time and the frustration of a retrograde step.

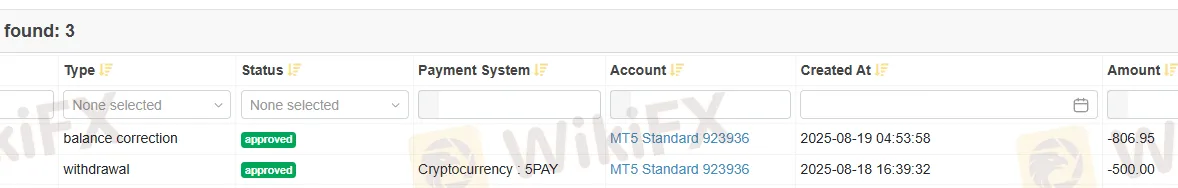

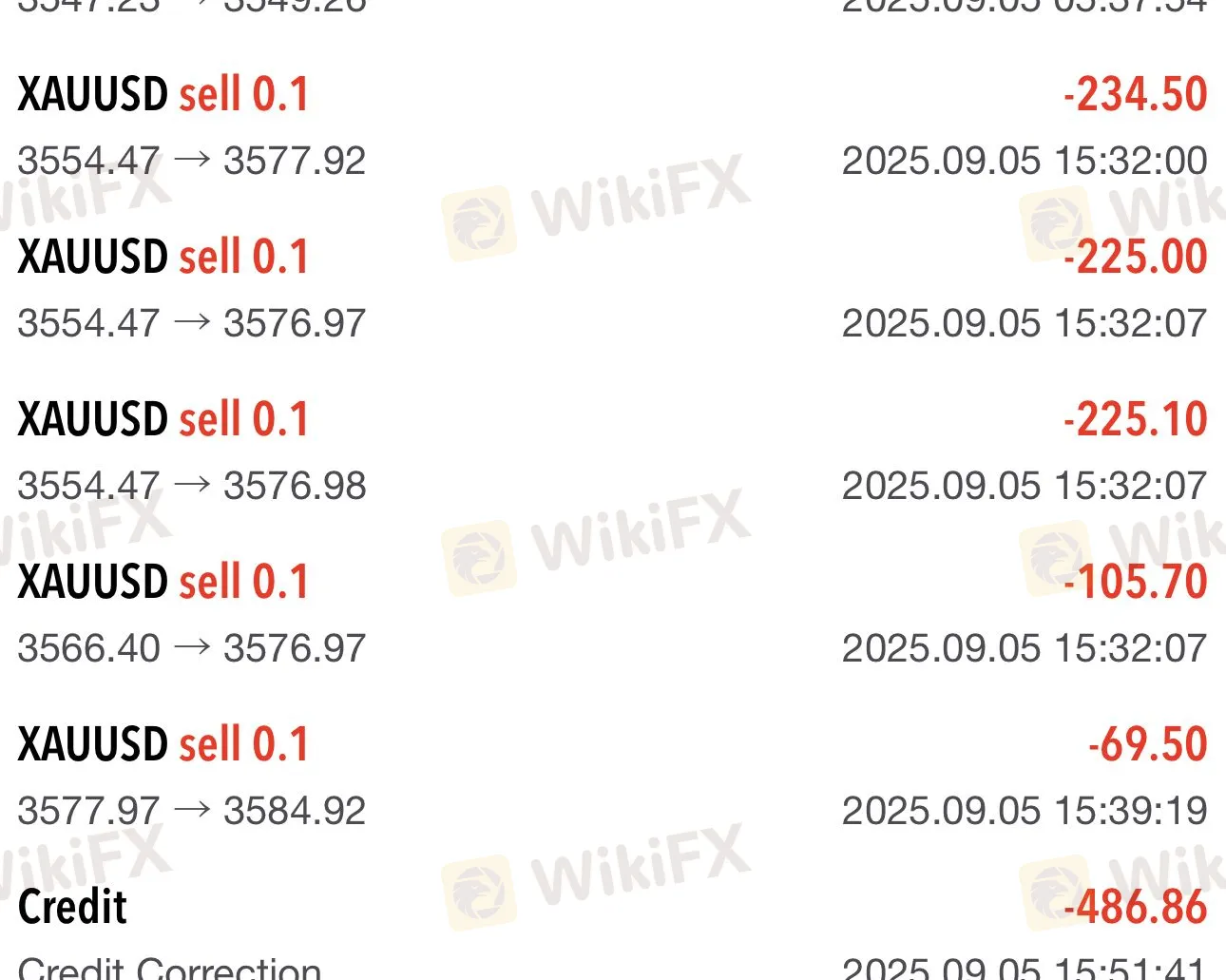

Furthermore, the integrity of the trading feed itself has been called into question. During the high-volatility Non-Farm Payroll (NFP) news event in September 2025, a trader ($Case 2$) reported severe anomalies. They claimed the broker “took early” their position, costing them around 100 pips, and manipulated the price on instant entries, resulting in immediate floating losses that did not reflect the broader market reality. Such “slippage” usually occurs in one direction—favoring the house.

Digital Silence: The Customer Service Black Hole

While MONAXA boasts about its digital usability and “fast” processes, users report that this speed applies strictly to deposits.

An investor from Singapore ($Case 8$) described the experience as a “rollercoaster,” noting that while deposits clear in under 24 hours, withdrawals face indefinite delays and support becomes unresponsive. This asymmetry is a classic warning sign of a liquidity-challenged or unethical operation.

More alarming are the cases where deposits vanish entirely. A trader from Malaysia ($Case 4$) waited four days for a deposit to reflect, during which their support tickets were completely ignored. Similarly, an Indian trader ($Case 5) reported that while their withdrawal was technically marked as “approved” in the system, the funds never arrived in their bank account—a tactic often used to stall traders while maintaining a veneer of functionality.

Eventually, for many traders, the outcome is total exclusion. As described in a vehement report from September 2025 ($Case 1$), once withdrawal requests pile up, the broker allegedly stops making excuses and simply blocks the account.

Why Regulatory Status Matters

Why can MONAXA verify an ID, deduct $15,000, and face no immediate shutdown? The answer lies in its regulatory structure.

According to WikiFX's database, MONAXA is headquartered in Saint Vincent and the Grenadines. This jurisdiction does not regulate forex trading activities, meaning there is no local government oversight protecting trader funds.

More critically, recognized European regulators have actively flagged this entity. The Cyprus Securities and Exchange Commission (CySEC) issued specific warnings regarding monaxa.com.

Regulatory Disclosure Table

The following data is extracted directly from official regulatory filings recorded by WikiFX:

| Regulator Name | License Type | Current Status |

|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | No License (Warning Issued) | Unauthorized / Blacklisted |

| Specific Action | Reason | Date |

| CySEC Warning | Domain monaxa.com is not authorized to provide investment services. | 2025-01-31 |

| CySEC Warning | Domain included in list of unregulated entities. | 2025-08-14 |

The repeated warnings from CySEC in both January and August 2025 serve as a smoking gun. They confirm that MONAXA is operating in jurisdictions where it is not authorized, and is soliciting clients without the necessary legal framework to guarantee the safety of funds.

Editorial Conclusion

The evidence presented by multiple traders points to a systemic risk. Whether it is the $22,000 deduction on VPS grounds, the $15,000 removal for “winning too much,” or the manipulation of NFP pricing, MONAXA displays the characteristics of a platform that profits from client losses and penalizes client success.

For traders asking “is MONAXA safe?”, the combination of offshore registration, verified regulatory warnings, and a documented history of profit confiscation suggests the answer is a definitive no. We strongly advise traders to exercise extreme caution and consider properly regulated alternatives where profit is a right, not a revocable privilege.

Read more

Biggest Scams In Malaysia In 2025

Malaysia is facing a sharp escalation in online scam activities, with reported losses reaching RM2.7 billion between January and November, driven by increasingly sophisticated and well-organised fraud schemes. Official data shows a significant rise in cases compared to the previous year, while experts warn that the true economic impact may be far greater due to widespread underreporting.

Is PRCBroker Legit or a Scam? 5 Key Questions Answered (2025)

You are likely looking at PRCBroker because you’ve seen their ads or heard about their platform, but you have doubts about whether your funds will be safe. You are right to be cautious.

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

You are likely looking for a broker that can handle serious liquidity without compromising safety. You might be asking: is Finalto just another generic platform, or is it a secure place for your capital?

Is SOUQ CAPITAL Legit or a Scam? 5 Key Questions Answered (2025)

If you are considering depositing money with SOUQ CAPITAL, you are right to be doing your research first. Safety is the most important factor in trading, not just profit potential.

WikiFX Broker

Latest News

Gold Cements Historic 66% Gain as Silver Supply Crunch Looms for 2026

Scammed Twice: How a RM1,500 Loss Escalated to RM1.2 Million

Celebrate the New Year and Usher in a Safer 2026 for All Traders!

Is 4SYTE TRADING LTD Legit or a Scam? 5 Key Questions Answered (2025)

Poland Fines Trading Firms $5.7M Over Pyramid Schemes

AURO MARKETS Review 2025: Institutional Audit & Risk Assessment

Euro Under Siege: French Fiscal Crisis Weighs heavily on the Common Currency

SogoTrade Fined $75K Amid Compliance Failures

Indonesian Nickel Supply Cut Sends LME Prices Soaring

Fed Focus: Markets Pause for Minutes as 2026 'Dovish Shift' Looms

Rate Calc