FAKE TRADES ALERT: How Long Candles Are Used to Mislead Retail Traders

Abstract:This article will make you think twice the next time you spot a bullish or bearish engulfing. Big candles do not mean what you think they mean.

In the world of forex trading, few price movements provoke as much excitement and confusion as the sudden appearance of a long candle. Whether bullish or bearish, these extended price bars often trigger emotional responses among retail traders, convincing many that a powerful new trend is underway. Yet beneath the surface, long candles frequently tell a far more complex and uncomfortable story.

Long candles represent strong price movement within a short period. To the untrained eye, they suggest momentum, urgency and opportunity. Trading forums fill with screenshots, social media buzz intensifies, and novice traders rush to participate out of fear of missing out. However, experienced market participants understand that such dramatic moves can be deliberately manufactured and often serve as traps rather than genuine invitations.

Institutional traders, supported by vast capital, advanced technology, and detailed order flow insights, know precisely where retail traders cluster their stop-losses and pending orders. These levels are typically positioned around obvious technical zones such as previous highs, lows and widely recognised support or resistance areas. Long candles are frequently deployed to sweep through these zones, triggering stops and activating breakout trades, thereby providing institutions with the liquidity required to enter or exit large positions efficiently.

This practice, commonly referred to as a liquidity grab, creates the illusion of a legitimate breakout. Retail traders enter late, buying at the peak of a bullish candle or selling at the bottom of a bearish one, only to witness price reverse sharply moments later. What appeared to be strength was in fact distribution. What looked like weakness was accumulation.

The psychology behind this tactic is both simple and highly effective. Long candles exploit human emotion, particularly fear, greed and urgency. A rapidly moving market leaves little time for careful analysis, encouraging impulsive decisions. Institutions thrive in these conditions, while retail traders often find themselves positioned on the wrong side of the move.

Crucially, long candles should never be analysed in isolation. Context is key in trading. A long candle appearing after an extended trend may indicate exhaustion rather than continuation. Similarly, sudden price surges during periods of thin liquidity, such as session opens or major economic announcements, should always be approached with caution. Volume behaviour, higher time frame structure and overall market conditions offer essential insight into whether a move reflects genuine demand or deliberate manipulation.

Seasoned traders often wait for confirmation once a long candle has formed instead of reacting immediately. They observe how price behaves when volatility subsides. Does the market stabilise and build structure, or does it retrace aggressively. More often than not, a rapid reversal exposes the true intention behind the move.

As retail participation continues to grow and information spreads instantly, institutions have refined their tactics accordingly. Long candles remain one of the most effective tools for transferring risk from informed participants to emotionally driven traders.

For those seeking consistency rather than momentary excitement, the message is clear. Avoid chasing dramatic price movements. In financial markets, the most striking signals are not always the most truthful. Sometimes, the longest candles cast the deepest shadows.

Read more

Inside the Elite Committee: Talk with Vichet Sun

WikiFX has launched the “Inside the Elite” Interview Series, featuring outstanding members of the newly formed Elite Committee. During the committee’s first offline gathering in Dubai, we conducted exclusive interviews and gained deeper insights into regional market dynamics and industry developments. Through this series, WikiFX aims to highlight the voices of professionals who are shaping the future of forex trading — from education and compliance to risk control, technology, and trader empowerment.

The Points Mall tasks have been refreshed!

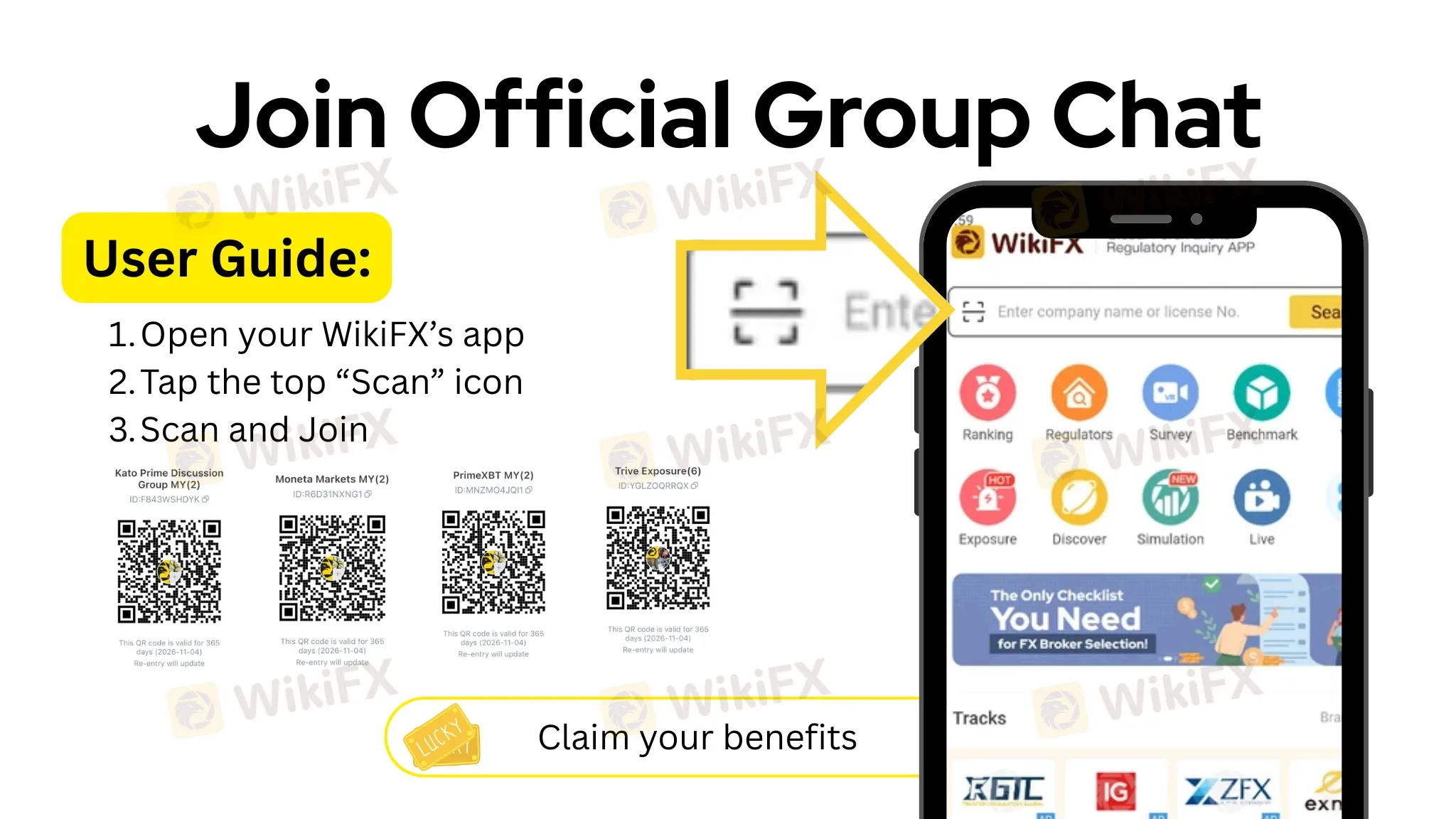

Each app update brings an enhanced user experience. In this version, we have optimized the points task system by removing tasks with complex steps and introducing new ones such as joining community groups and participating in simulated trading. Users who enjoy simulated trading should definitely not miss out—remember to claim your points after completing the tasks!

TrueFX Review: Traders Report Inaccurate Forex Signals & Regulatory Issues

Losing trades due to misleading forex signals on the TrueFX platform? Followed all the instructions, yet you received losses? Have you been lured into trading with TrueFX because of the NFA-registered claim on its website? Many have reported these trading concerns online. In this TrueFX review article, we have discussed these complaints. Take a look!

GMI to Stop Global Operations from Dec 31, 2025; Don’t Miss the Final Withdrawal Deadline

Taking the financial market by surprise, GMI, one of the leading global forex and CFD brokers, announced its intention to close its global operations from December 31, 2025. Since the official shutdown announcement, traders have been concerned about the status of fund deposits and withdrawals. They have understandably been searching for answers to these questions amid this announcement made by the group. Read on as we share with you key details emerging from the development.

WikiFX Broker

Latest News

The "Demo Trap": Why You Win Millions for Fun but Lose Your Rent in Real Life

Want to Trade with $100,000? The Truth About Prop Firms

Stop Bleeding Cash: Why Most Forex Rookies Get Crushed

Introducing Broker in Forex Trading: Meaning, Roles, Responsibilities & Fees

EO Broker Regulation & Feedback from Real Users

The "Golden Rule" of Trading: Why Your Indicators Are Lying to You

Police Smash Forex Scam Network Operating from Pahang

News Trading: The Fastest Way to Double Your Money (or Lose It All)

Stop Chasing Green Candles: 3 Fatal Mistakes You’re Making in Trend Trading

Tradgrip Review 2025: Regulation Details, User Experiences & Complaints

Rate Calc