GivTrade Secures UAE SCA Category 5 Licence

Abstract:GivTrade gains UAE SCA Category 5 licence, enabling advisory, arrangement, and consulting services under strict regulatory oversight.

GivTrade Secures UAE SCA Category 5 Licence

GivTrade has reached a significant regulatory milestone with the approval of a Category 5 (“Arrangement and Advice”) licence from the UAE Securities and Commodities Authority (SCA). The licence, issued on 22 December 2025, formally authorises the broker to provide regulated services including financial consultations, introductions, listing advisory, and promotional activities in line with SCA requirements.

The Category 5 licence, granted under the SCA Rulebook, is recognised as one of the most robust frameworks for firms offering non-discretionary advisory and arrangement services. Applicants must demonstrate strong governance, capital adequacy, internal controls, and compliance procedures. GivTrade‘s approval underscores its readiness to operate under rigorous local oversight in one of the Middle East’s leading financial centres.

Expanding UAE Operations

For GivTrade, the licence represents more than regulatory compliance. It provides a legal foundation for expanding onshore operations in the UAE, strengthening ties with regional institutions and aligning closely with local regulatory expectations. Operating from Icon Tower in Barsha Heights (Tecom), the firm plans to deepen collaboration with domestic and regional financial institutions.

“Holding an SCA Category 5 license is a strategic turning point for GivTrade and for our clients in the UAE,” said Hassan Fawaz, Chairman & Founder of GivTrade. “This approval confirms that our governance, risk and compliance standards meet the expectations of a leading global financial centre, and it allows us to provide independent financial consulting, introductions and promotion activities within a clear local regulatory framework.”

Global Market Access

With the licence secured, GivTrade is positioned to enhance its UAE presence while continuing to serve international clients. The broker offers access to global markets via CFDs, covering forex, precious metals, energy, indices, commodities, and stocks. Trading is supported through MetaTrader 5 and proprietary applications.

Beyond execution, GivTrade emphasises informed trading decisions, providing clients with market news, research, and educational resources to help manage risk in volatile conditions. This approach reflects the firms commitment to responsible product engagement and transparent communication.

Strategic Roadmap

The licence approval supports GivTrades broader regional expansion strategy heading into 2026. By operating within a clearly defined regulatory perimeter, the firm aims to reinforce transparency, build trust, and establish long-term relationships with clients and partners across the Middle East.

Backed by nearly a decade of industry experience, GivTrade continues to place regulation and governance at the core of its business model. Its strategy focuses on delivering cost-effective trading solutions, platform innovation, and consistent client support, ensuring compliance remains integral to growth ambitions.

Read more

VPS Review: Do Clients Face Trading Issues Due to Constant Login Errors?

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

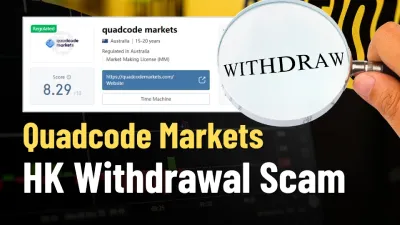

Quadcode Markets HK Withdrawal Scam

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

ThinkMarkets has 83/93 negative cases, with withdrawal delays and scam alerts. Check regulation and details on the WikiFX App before trading.

FBS Forex Scam Alert: High Complaint Ratio

FBS shows 188 negative cases out of 205 on WikiFX, despite regulation—a major red flag for withdrawals & profits. Uncover risks & protect funds before trading now!

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc