FPG USDJPY Market Report January 9, 2026

Abstract:On the USDJPY H1 chart, a sharp bearish move was recorded in early January, where price dropped aggressively from the 157.29 high down to the 156.10 area within a single trading day, signaling strong

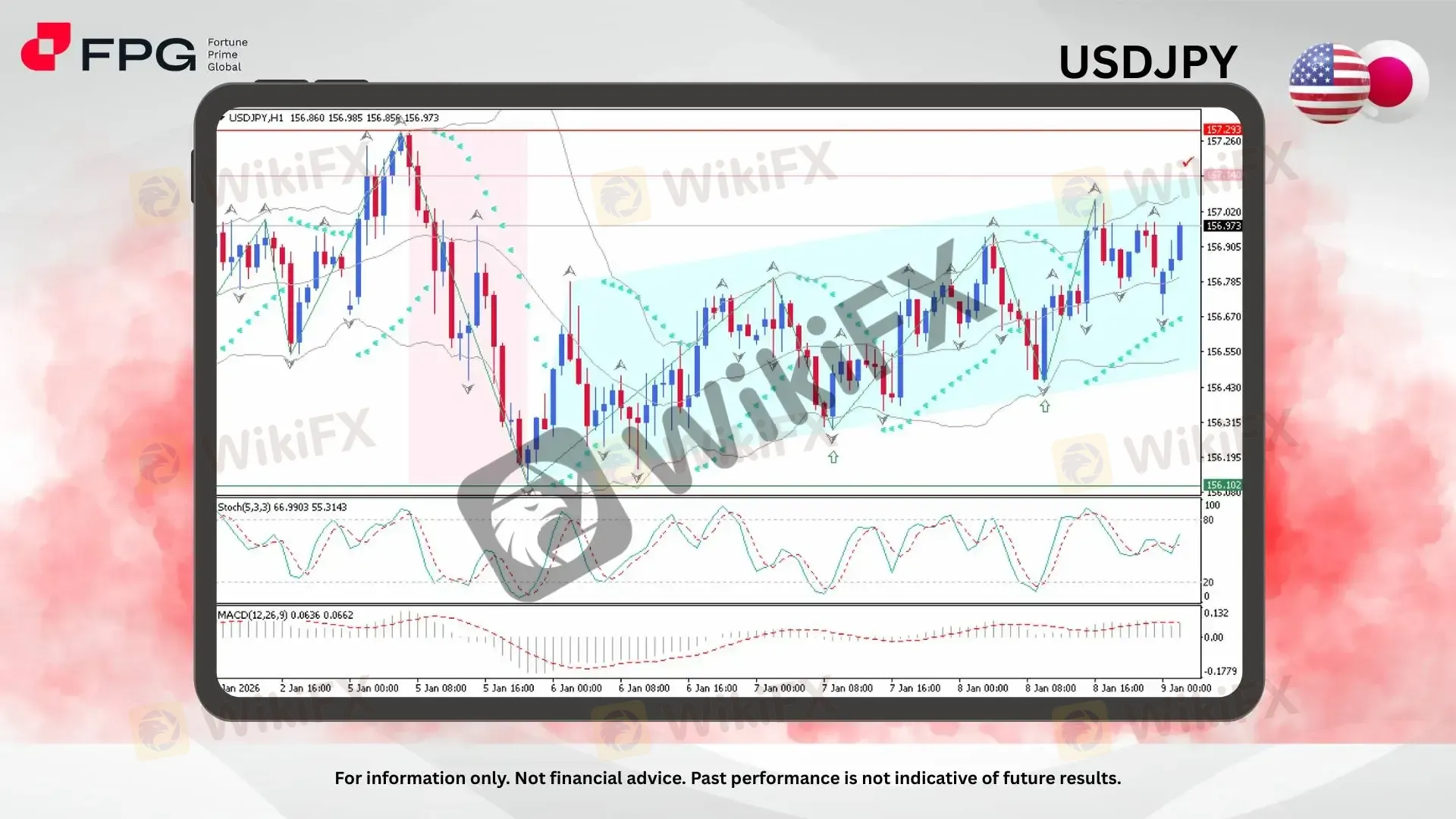

On the USDJPY H1 chart, a sharp bearish move was recorded in early January, where price dropped aggressively from the 157.29 high down to the 156.10 area within a single trading day, signaling strong short-term selling pressure. From that low, price staged a steady corrective rebound and began moving within a clearly defined bullish channel, forming higher lows and gradual higher highs. Currently, USDJPY is trading around 156.97 and remains volatile as it approaches the channels diagonal resistance, with the 157.14 zone standing out as the next key area that could determine whether the recovery extends or stalls.

Technically, the recovery structure remains constructive but still corrective in nature when viewed against the broader price rejection from the 157.29 peak. Price action continues to respect the ascending channel, with multiple successful reactions from the lower channel boundary, indicating that buyers are still active on dips. However, repeated hesitation near the upper channel area suggests diminishing upside momentum as price approaches resistance. From the indicator side, Stochastic Oscillator (5,3,3) is currently fluctuating in the upper-mid range, reflecting bullish momentum that is present but no longer aggressive, and showing early signs of consolidation rather than expansion. MACD (12,26,9) remains above the zero line with a positive histogram, confirming bullish momentum, although the flattening histogram bars suggest that upside momentum may be stabilizing rather than accelerating. This combination points to a market that is still biased higher, but increasingly sensitive to resistance reactions.

From a broader perspective, this corrective rebound appears to be part of the market‘s ongoing adjustment to geopolitical tensions involving the U.S. and the global environment, which have recently driven volatility. USDJPY remains highly sensitive to shifts in risk sentiment and U.S. macro expectations, particularly interest rate outlooks. Traders should remain alert to today’s key economic data releases and official statements, as fresh catalysts could either reinforce the current recovery or trigger renewed downside pressure if risk-off sentiment resurfaces.

Market Observation & Strategy Advice

1. Current Position: USDJPY is trading around 156.97, holding above the midline of the bullish channel.

2. Resistance Zone: Immediate resistance is located at 157.14, followed by the major rejection high near 157.29.

3. Support Zone: Key support lies at 156.55–156.43, aligned with the lower channel boundary and prior rebound points.

4. Indicators: Stochastic Oscillator (5,3,3) is elevated but no longer expanding, while MACD remains positive with slowing momentum. As long as price remains inside the bullish channel, short-term bias stays positive, but upside potential weakens near resistance.

5. Trading Strategy Suggestions:

Buy-on-dip scenario: Consider long positions near the 156.55–156.43 support zone, targeting 157.14.

Resistance reaction trade: Watch for bearish rejection signals near 157.14–157.29 for potential short-term pullbacks.

Invalidation level: A sustained break below 156.10 would invalidate the bullish channel and shift bias back to bearish.

Market Performance:

Forex Last Price % Change

EUR/USD 1.1655 −0.04%

GBP/USD 1.3432 −0.02%

Today's Key Economic Calendar:

JP: Household Spending MoM & YoY

CN: Inflation Rate MoM & YoY

CN: PPI YoY

DE: Balance of Trade

EU: Retail Sales MoM

US: Average Hourly Earning MoM & YoY

US: Building Permits Prel

CA: Employment Change

US: Housing Starts

US: Nonfarm Payrolls

US: Participation Rate

US: Unemployment Rate

US: Fed Kashkari Speech

US: Michigan Consumer Sentiment Prel

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Rate Calc