Is TradingMoon Regulation Strict or Light-Touch?

Abstract:TradingMoon operates under offshore regulation by Seychelles FSA. License SD042 covers forex and derivatives trading.

Introduction: Investigating TradingMoon Regulation

TradingMoon presents itself as a global broker offering access to forex, stocks, indices, cryptocurrencies, and commodities. Founded in 2005 and registered in Seychelles, the firm operates under the oversight of the Seychelles Financial Services Authority (FSA). Its license number SD042 authorizes retail forex and derivatives trading. Yet, the central question for traders remains: Is TradingMoon regulation strict or light-touch?

This review examines TradingMoon‘s regulatory framework, trading conditions, platforms, and overall legitimacy. The analysis is grounded in the broker’s own disclosures and visible documentation, with a neutral editorial tone that weighs both strengths and weaknesses.

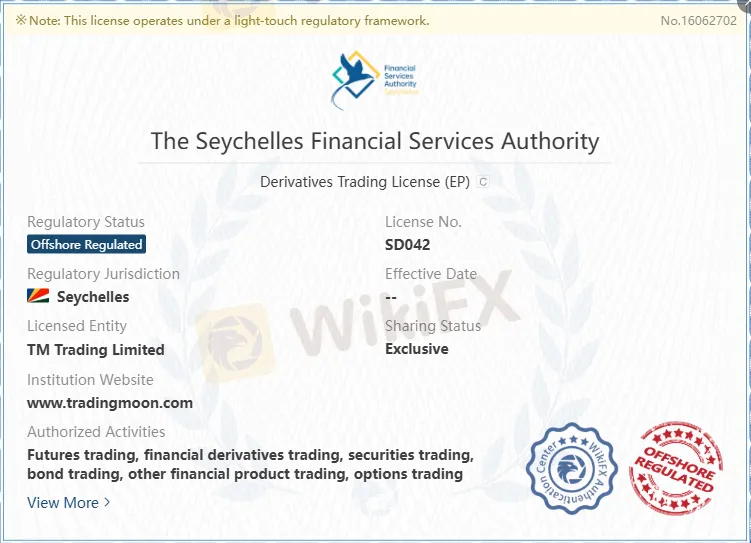

TradingMoon Regulation: Offshore Oversight in Seychelles

TradingMoon holds a Retail Forex License (SD042) issued by the Seychelles FSA. The license permits futures trading, derivatives trading, securities, bonds, and options. While this confirms that TradingMoon is not an unlicensed entity, the jurisdiction itself raises questions.

Seychelles is widely considered an offshore regulatory hub. Its framework is lighter compared to tier-one regulators such as the UKs Financial Conduct Authority (FCA) or the US Commodity Futures Trading Commission (CFTC). Offshore regulation often means reduced investor protection, limited enforcement mechanisms, and less stringent capital requirements.

The broker itself acknowledges operating under a “light-touch regulatory framework.” This phrasing signals that while TradingMoon Regulation exists, it may not provide the same safeguards as stricter jurisdictions.

Domain and Licensing Transparency

Transparency is a key factor in evaluating broker legitimacy. TradingMoons official domain is tradingmoon.com, hosted on servers located in the United States (IP: 172.66.40.167). The license is registered to TM Trading Limited, with contact details including a Seychelles phone number (+248 463 2031) and email support@tradingmoon.com.

The Seychelles FSA lists TradingMoon under license SD042, confirming its offshore regulated status. However, the broker does not maintain a physical office presence, which may concern traders seeking direct accountability.

Trading Instruments: Broad Market Access

TradingMoon offers more than 1,000 tradable assets across multiple categories:

- Forex: Major and minor currency pairs

- Stocks: Over 900 equities

- Indices: 18 global benchmarks

- Cryptocurrencies: 61 digital assets

- Commodities: 21 instruments, including gold and oil

- Bonds, Options, ETFs, and Funds: Additional diversification opportunities

This breadth of instruments positions TradingMoon competitively against offshore peers. Many brokers in similar jurisdictions limit offerings to forex and CFDs, whereas TradingMoon Regulation permits a wider scope of financial products.

Account Types and Fees

TradingMoon provides two live account structures alongside demo accounts:

| Account Type | Minimum Deposit | Leverage | Spread | Commission |

| Standard | $25 | 1:1000 | From 0.7 pips | Zero |

| Premium | $5,000 | 1:1000 | From 0.2 pips | $35 per million |

- Standard Account: Designed for beginners, with zero commission and a low entry threshold. Cryptocurrency CFDs carry a taker fee starting at 0.08%.

- Premium Account: Targets experienced traders with tighter spreads but introduces commissions. Crypto CFD taker fees start at 0.05%.

The leverage model is dynamic, with maximum ratios reaching 1:1000 for forex and indices. While attractive for high-risk strategies, such leverage amplifies losses as much as profits.

Trading Platforms: Proprietary and Third-Party Options

TradingMoon supports multiple platforms:

- Moon Trader: Proprietary platform designed for simplicity and accessibility.

- cTrader: Popular among experienced traders for advanced charting and execution.

- MT4: Industry-standard platform available on desktop, mobile, and web.

- MT5: Listed as supported, though details are limited.

This multi-platform approach allows traders to choose between beginner-friendly interfaces and professional-grade tools. Competitors often restrict access to MT4 alone, so TradingMoons broader platform support is a notable advantage.

Deposit and Withdrawal Policies

TradingMoon accepts diverse payment methods:

- Neteller, Skrill (2.9% fee applies)

- Mastercard, VISA

- Binance Pay, Apple Pay, Google Pay

- Bank transfers

- Cryptocurrencies

Deposits and withdrawals are generally fee-free, except for Neteller and Skrill. The broker explicitly disallows third-party payments, aligning with standard compliance practices.

Customer Support and Accessibility

Support channels include live chat, phone (+248 463 2031), email, and social media (LinkedIn, Instagram, Twitter). Regional restrictions apply, with services unavailable in the United States, United Kingdom, Iran, and North Korea.

The absence of a physical office may limit direct engagement, but digital support channels are consistent with offshore broker norms.

Pros and Cons of TradingMoon Regulation

Pros:

- Licensed by Seychelles FSA (SD042)

- Wide range of trading instruments (forex, stocks, crypto, commodities)

- Multiple platforms, including MT4 and cTrader

- Low minimum deposit ($25)

- Demo accounts available

- Copy trading supported

- Flexible payment options

Cons:

- Offshore regulation with weaker oversight

- No physical office presence

- Regional restrictions in major markets (US, UK)

- High leverage increases risk exposure

- Premium account requires $5,000 minimum deposit

Competitor Comparison: Offshore vs Tier-One Brokers

Compared to offshore peers, TradingMoon offers broader instruments and platform diversity. Many Seychelles-based brokers provide only forex and CFDs, whereas TradingMoon Regulation permits bonds, ETFs, and funds.

Against tier-one brokers, however, TradingMoon falls short in regulatory credibility. FCA or ASIC-regulated brokers enforce stricter capital requirements, compensation schemes, and client fund segregation. Traders prioritizing safety may prefer those jurisdictions despite higher entry costs.

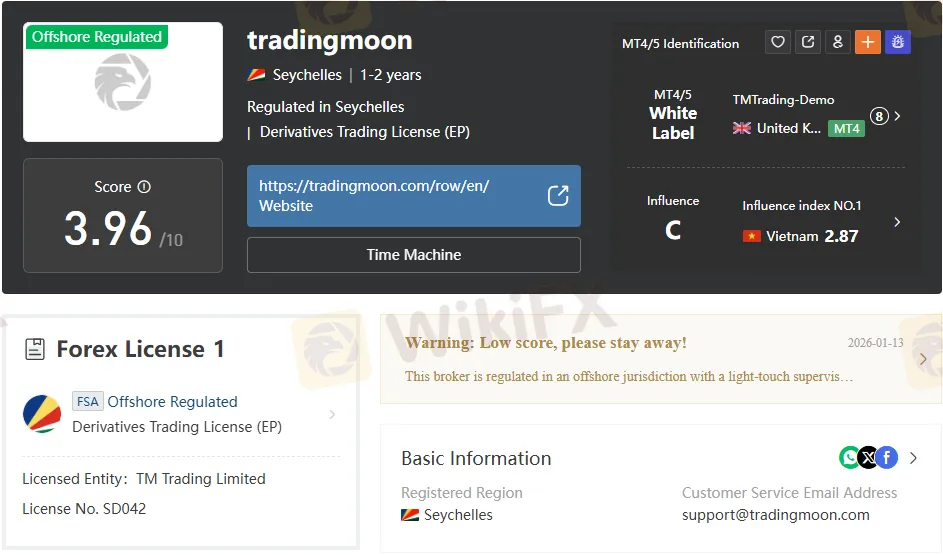

WikiFX Score and Influence

TradingMoons WikiFX score is 3.96/10, reflecting moderate credibility concerns. The broker is identified as offshore regulated, with MT4/5 white label usage. Influence ratings show activity in Vietnam, with a score of 2.87.

Such ratings highlight the brokers limited global recognition compared to established competitors.

Risk Considerations Under Offshore Regulation

TradingMoon Regulation provides a license number and jurisdiction, but offshore oversight inherently carries risks:

- Weaker enforcement: Limited recourse in disputes.

- High leverage exposure: Potential for rapid losses.

- No compensation scheme: Unlike FCA-regulated brokers, Seychelles does not guarantee client funds.

Traders must weigh these risks against the brokers attractive trading conditions.

Bottom Line: Evaluating TradingMoons Value Proposition

TradingMoon operates under Seychelles FSA license SD042, confirming its regulated status. However, the offshore nature of this regulation means oversight is lighter compared to tier-one jurisdictions.

The brokers strengths lie in its broad instrument range, multi-platform support, low minimum deposit, and flexible payment options. Yet, the absence of a physical office, regional restrictions, and reliance on offshore regulation may deter risk-averse traders.

Final Assessment: TradingMoon Regulation is legitimate but light-touch. The broker suits traders seeking high leverage and diverse instruments at low entry costs. Those prioritizing strict regulatory safeguards may prefer brokers licensed in the UK, EU, or Australia.

Read more

VPS Review: Do Clients Face Trading Issues Due to Constant Login Errors?

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

Quadcode Markets HK Withdrawal Scam

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

ThinkMarkets has 83/93 negative cases, with withdrawal delays and scam alerts. Check regulation and details on the WikiFX App before trading.

FBS Forex Scam Alert: High Complaint Ratio

FBS shows 188 negative cases out of 205 on WikiFX, despite regulation—a major red flag for withdrawals & profits. Uncover risks & protect funds before trading now!

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc