Common Questions About BOLD PRIME: Safety, Fees, and Risks (2025)

Abstract:If you are currently looking at BOLD PRIME, you might be tempted by their promises of ultra-high leverage and easy account openings. It is common for newer traders to look for brokers that lower the barrier to entry. However, beneath the surface of slick marketing layouts lies a complex reality that requires serious caution.

If you are currently looking at BOLD PRIME, you might be tempted by their promises of ultra-high leverage and easy account openings. It is common for newer traders to look for brokers that lower the barrier to entry. However, beneath the surface of slick marketing layouts lies a complex reality that requires serious caution.

Before you deposit any capital, it is crucial to look at the data rather than the advertisements. According to the WikiFX database, BOLD PRIME currently holds a Score of 2.32, which is significantly below the safety threshold for reliable financial service providers. A score this low usually acts as an immediate warning sign regarding the brokers legitimacy and operational security.

Is BOLD PRIME actually regulated?

No, BOLD PRIME is not effectively regulated.

While the broker was established in 2020 and claims an address in Comoros, our data indicates that it does not hold a valid regulatory license from a Tier-1 authority (such as the FCA in the UK or ASIC in Australia). In the world of forex trading, operating without a valid license is the single biggest risk factor for a trader.

The “Unauthorized” Warning

The situation goes beyond simply being unregulated. In 2023, the Securities Commission Malaysia (SC) officially placed BOLD PRIME on its “Investor Alert List.” The regulator specifically engaged in a disclosure stating that the entity is carrying out capital market activities without a license.

Why does this matter?

When a broker operates without valid regulation, you lose all standard financial protections.

- No Segregated Funds: Regulated brokers must keep client money in separate bank accounts from the company's operating funds. Unregulated brokers can legally mix your deposits with their payroll or marketing budgets.

- No Compensation Scheme: If BOLD PRIME were to go bankrupt, there is no insurance fund to reimburse you.

- Zero Legal Recourse: Because they are offshore and unauthorized, you cannot complain to a government ombudsman if they refuse to pay out your profits. You are essentially trusting a private website with your banking information and hard-earned cash.

What problems are users reporting?

A recurring theme in the feedback for BOLD PRIME is the inability to withdraw funds, often accompanied by sudden account suspensions. Over the last three months alone, WikiFX has logged 18 separate complaints, suggesting a systemic issue rather than isolated technical glitches.

The “Frozen Account” Pattern

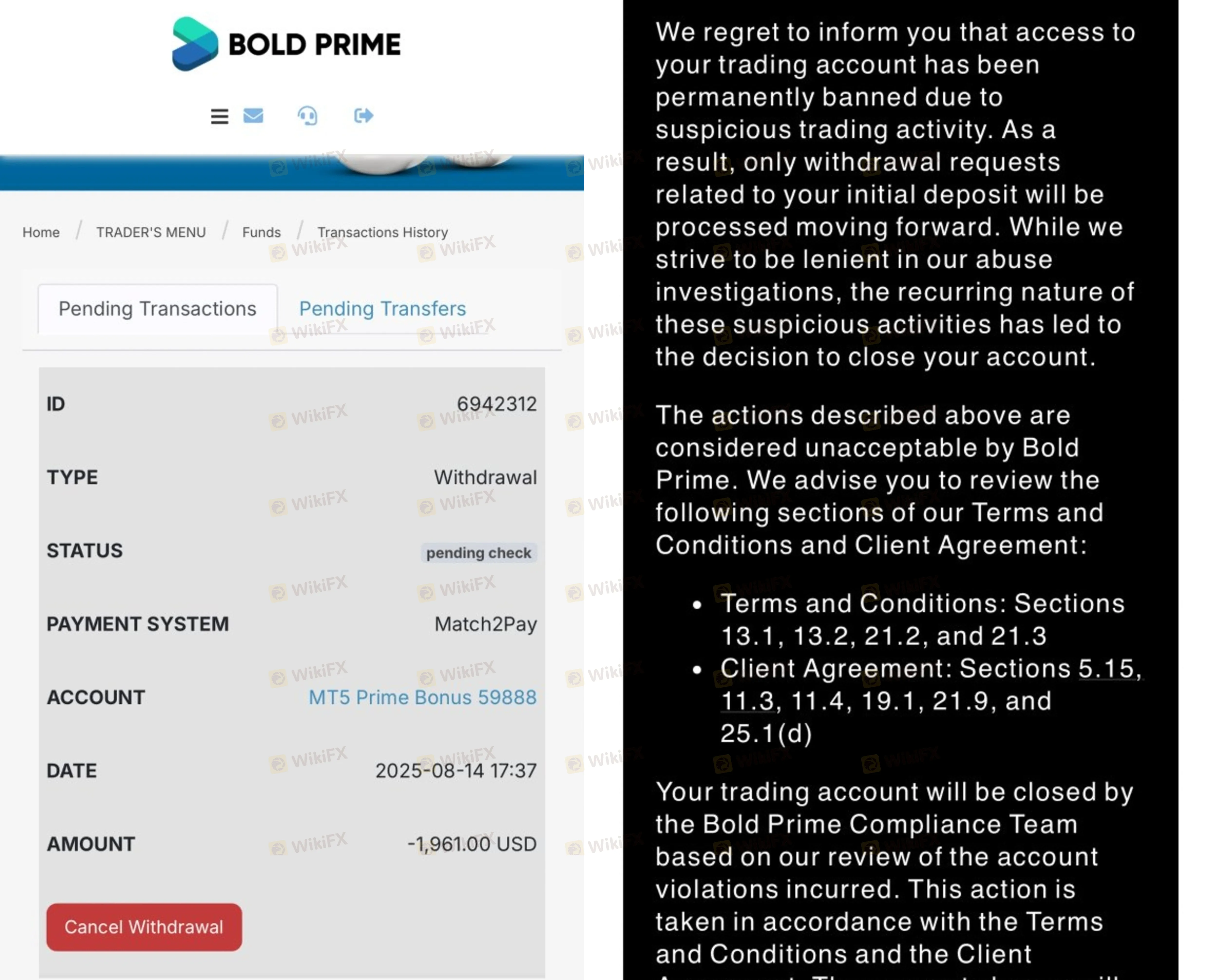

One of the most concerning narratives involves the broker accusing profitable traders of “violations” to justify freezing their accounts. For example, a user from Malaysia reported having a balance of over $42,000. When they attempted to withdraw, the broker allegedly only processed a small fraction ($5,344) and then completely froze the account, locking the user out of the system.

Other users have reported similar tactics where withdrawal requests remain “pending” for days, only for the user to eventually be banned from the platform entirely without a clear explanation or evidence of wrongdoing.

Withdrawal Denials

Another specific case involved a user from India who requested a withdrawal. Instead of receiving their funds, their account was banned, and the support team ceased all email communication. This “ghosting” behavior—where support goes silent the moment money is owed—is a classic red flag associated with high-risk platforms.

What trading conditions does BOLD PRIME offer?

If you ignore the safety warnings, the trading conditions offered by BOLD PRIME are aggressive, which explains why they attract risk-takers. They provide access to popular software, but the financial terms are extreme.

Leverage Rules

BOLD PRIME offers leverage up to 1:1000, and on certain account types, even 1:2000.

To put this into perspective, most global regulators cap leverage at 1:30 for retail traders to protect them from rapid losses. While 1:2000 leverage allows you to control massive positions with just a few dollars, it also means a market movement of a fraction of a percent against you will instantly wipe out your entire balance. This environment is often referred to as a “churn and burn” model, designed to liquidate inexperienced traders quickly.

Spreads & Costs

The broker operates with four main account types split between Standard and ECN models:

- Standard Accounts: These require a low deposit ($15 to $50) with spreads starting from 1.5 pips. This is relatively high compared to industry leaders who often average around 1.0 to 1.2 pips for standard accounts.

- ECN Accounts: These require a slightly higher deposit ($150) but offer spreads from 0.0 pips. While raw spreads look attractive, traders must verify the commission fees per lot, which are the trade-off for zero spreads.

Software

One of the few positives is their platform support. They offer MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These are industry-standard platforms known for their charting capabilities and stability. However, using excellent software on an untrusted broker is like driving a Ferrari on a bridge that is about to collapse; the vehicle is great, but the infrastructure below it is dangerous.

Bottom Line: Should you trust BOLD PRIME?

Based on the data, the answer is no.

BOLD PRIME exhibits multiple characteristics of a high-risk broker: a low trust score (2.32), an official warning from a financial regulator (Malaysia SC), and a high volume of unresolved complaints regarding frozen accounts and denied withdrawals. The allure of high leverage (1:2000) is often a trap to attract beginner traders who may not understand the risks of an unregulated environment.

Your capital is likely at significant risk here. It is highly advisable to choose a broker that holds a valid license from a reputable jurisdiction to ensure your funds are segregated and protected.

Markets change fast. To verify their current license status before depositing, search for BOLD PRIME on the WikiFX App.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

80% Plunge In Immigration Is Reshaping Labor Market Math, But AI Wildcard Looms: Goldman

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Rate Calc