MultiBank Group Review 2025: Is This Forex Broker Safe?

Abstract:MultiBank Group Review 2025: An in-depth analysis of the 2.54 WikiFX Score, conflicting regulatory status (ASIC/MAS vs. CNMV warnings), and over 600 user complaints regarding severe withdrawal delays and platform access issues.

MultiBank Group is a MultiBank Group broker established in 2012, headquartered in Cyprus. While it presents a robust portfolio of regulatory licenses from major jurisdictions, its current standing in the forex community is heavily impacted by a surge in negative client feedback. The broker currently holds a potentially risky WikiFX Score of 2.54, reflecting a significant disparity between its regulatory paper trail and actual user experiences.

Despite offering digital account opening and high leverage, the broker has been flagged with over 615 complaints in just the last three months. This review analyzes the safety, regulation, and trading conditions to determine if this broker is a viable option for 2025.

Pros and Cons of MultiBank Group

- ✅ Regulated by top-tier authorities including ASIC (Australia) and MAS (Singapore).

- ✅ Offers industry-standard MT4 and MT5 trading platforms.

- ✅ High leverage up to 1:500 available for traders.

- ✅ Zero pips spreads advertised on ECN accounts.

- ❌ Extremely low WikiFX Score (2.54) indicates high risk.

- ❌ Over 600 complaints received recently, mainly concerning fund safety.

- ❌ Official warnings issued by CNMV (Spain) and AMF (France).

- ❌ Numerous reports of withdrawal denials and inaccessible customer support.

MultiBank Group Regulation and License Safety

MultiBank Group operates under a complex web of regulatory licenses, holding authorizations from multiple jurisdictions. However, traders must distinguish between top-tier licenses and offshore registrations, as well as pay attention to recent regulatory warnings.

Regulatory Licenses

The broker holds active licenses from several reputable bodies:

- ASIC (Australia): Regulated entity MEX AUSTRALIA PTY LTD (License No. 416279).

- MAS (Singapore): Regulated entity MEX GLOBAL MARKETS PTE. LTD (License No. CMS101174).

- CySEC (Cyprus): Regulated entity MEX Europe Ltd (License No. 430/23).

- CIMA (Cayman Islands): Offshore regulation under MEX Atlantic Corporation.

- VFSC (Vanuatu) & FSC (Virgin Islands): Offshore licenses which generally offer lower investor protection compared to ASIC or MAS.

Risk Warning: Regulatory Disclosures

Despite these licenses, the broker has faced regulatory scrutiny. The CNMV (Spain) issued a warning in late 2024 stating that the group is not authorized to provide investment services in Spain. Additionally, the AMF (France) included the broker on its blacklist of unauthorized companies. These warnings suggest compliance issues in specific regions, which contributes to the low trust score.

Real User Feedback and Complaints

The most alarming aspect of MultiBank Group is the sheer volume of complaints. With 615 complaints logged recently, the feedback paints a concerning picture of the trading environment.

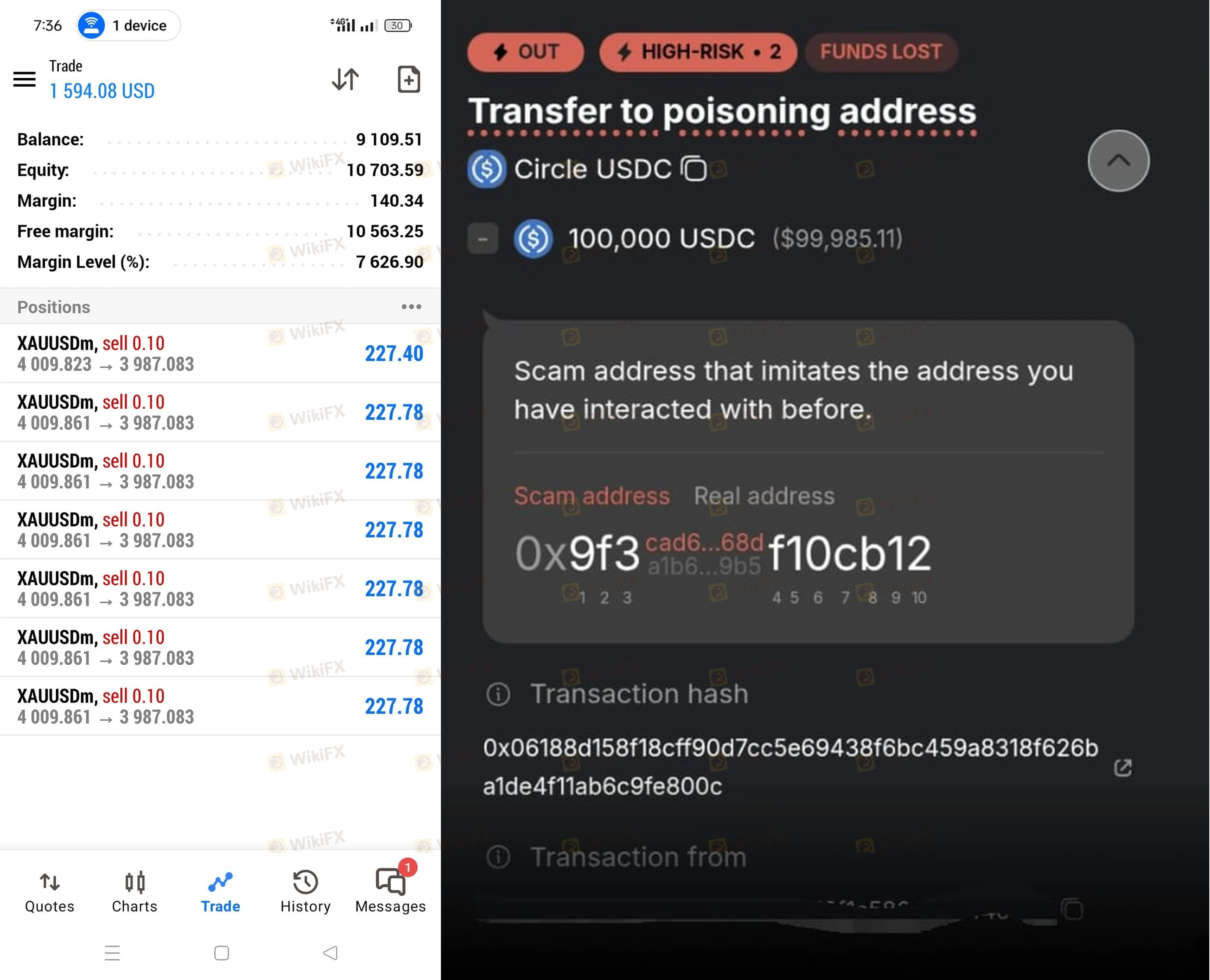

Withdrawal Failures and Fund Disputes

The majority of complaints (Cases 4, 5, 9, 15, 17, 24) come from users in Vietnam, China, and Indonesia who report being unable to withdraw their funds. Users allege that withdrawal requests are ignored, rejected without valid reasons, or that customer service creates endless bureaucratic loops to delay payment. One user in Vietnam noted waiting 15 days for a $750 withdrawal that was never processed.

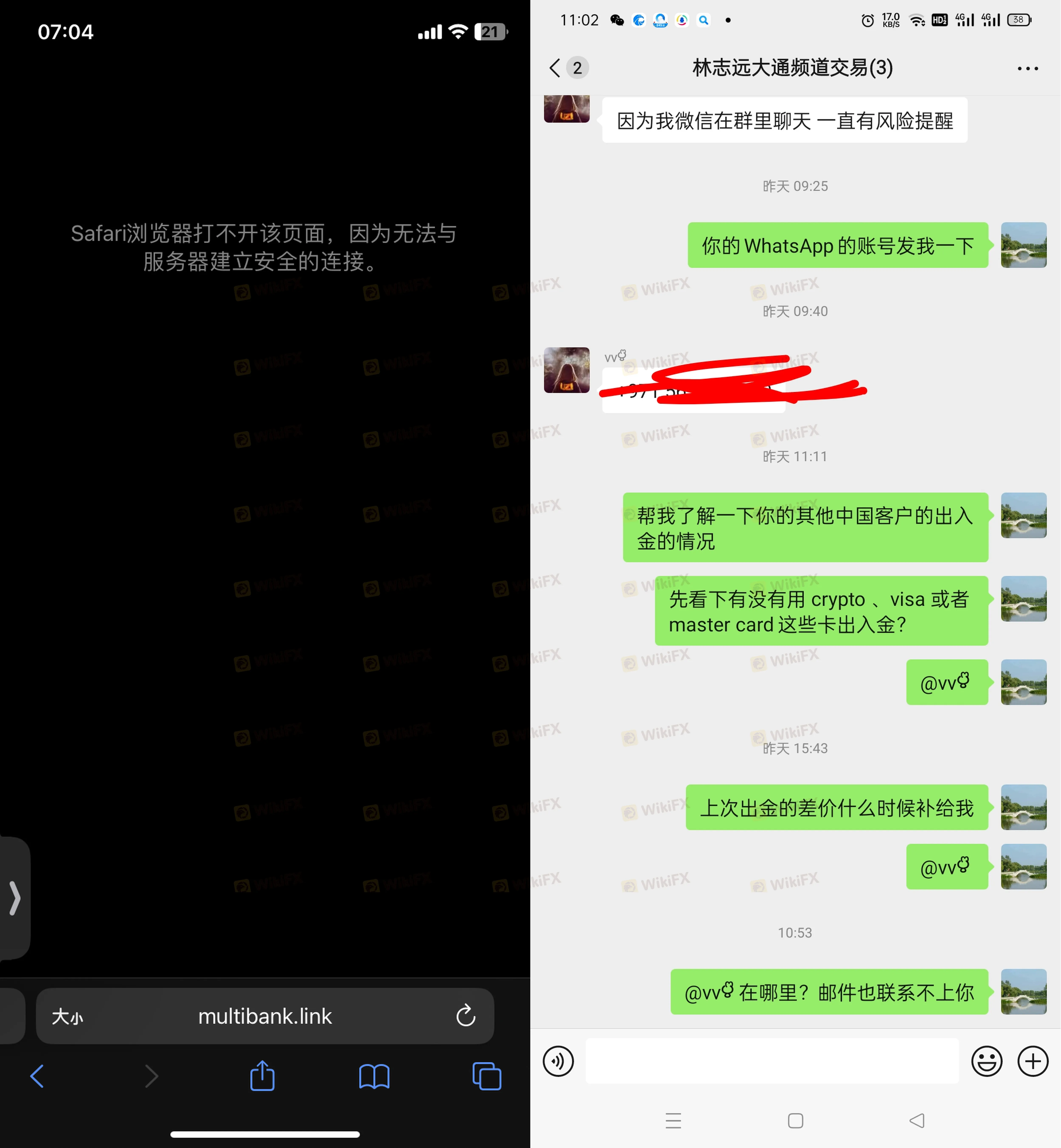

Connection and Access Issues

Technical reliability is another critical paint point. Users have reported difficulties with the MultiBank Group login process, with several clients (Cases 13 and 16) specifically noting that the official website became inaccessible or that they could not open the URL to manage their accounts. This loss of access often leaves traders unable to contact support or track their funds.

Accusations of Forced Liquidation

A serious allegation comes from a user in Malaysia (Case 27), claiming the broker used a “market exit” excuse to force the liquidation of positions within 14 days, resulting in massive financial losses for long-term traders.

Forex Trading Conditions and Fees

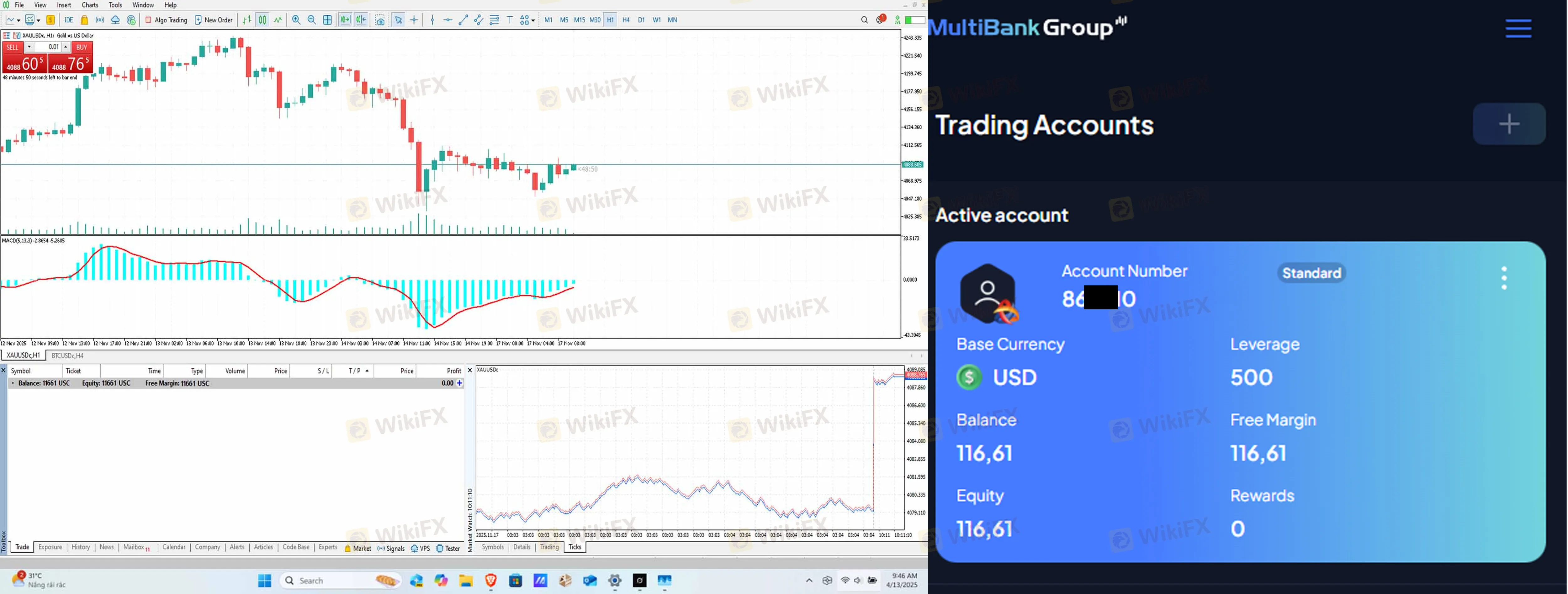

For traders who can access the platform, MultiBank Group offers competitive specifications, though the execution quality is disputed in user reviews.

Account Types and Spreads

The broker offers three main account tiers:

- Standard: Minimum deposit $50, spreads from 1.5 pips.

- Pro: Minimum deposit $1,000, spreads from 0.8 pips.

- ECN: Minimum deposit $10,000, spreads from 0.0 pips.

Leverage

Traders can access maximum leverage of 1:500. While high leverage can amplify profits, it also increases the risk of rapid capital loss, especially in volatile markets.

Platforms

MultiBank Group provides the MT4 and MT5 platforms. These are the industry standard for charting and automated trading.

Final Verdict

MultiBank Group presents a paradox: it holds valid licenses from major regulators like ASIC and MAS, yet it suffers from an overwhelmingly negative reputation among current users. The massive volume of withdrawal complaints, combined with official warnings from European regulators (CNMV, AMF), makes this broker a high-risk option in 2025. The low WikiFX Score of 2.54 serves as a critical warning sign.

To stay safe and view the latest regulatory certificates, check MultiBank Group on the WikiFX App.

WikiFX Broker

Latest News

Solitaire PRIME Regulatory Status: Understanding Their Licenses and Company Information

Asia FX & Rates: JGB Yields Spike vs. China Capital Inflows

USD Crisis: Capital Flight Accelerates as Europe Pivots Away from 'Political Risk'

FX Movers: Yen Soars on Intervention Watch; CAD Tumbles on Trade Threats

Gold Pierces $5,000 Milestone; Pan African Resources Signals Cash Flow Surge

PRCBroker Review: Where Profitable Accounts Go to Die

Gold Breaches $5,110: 'Fear Trade' Dominates as Dollar Wavers

USD Outlook: Markets Eye 'Politicized' Fed Risks as Tariff Impact Deepens

Italian Regulator Moves to Block Multiple Unauthorised Investment Platforms

Yen Awakening: Intervention Risks and Real Rates Signal Structural Turn

Rate Calc