WZG Review 2025: Is This Forex Broker Safe?

Abstract:WZG, a Hong Kong-based broker established in 2022, holds a license from the Chinese Gold and Silver Exchange Society (HKGX) and offers MT4/MT5 platforms. However, its reputation is currently challenged by a high volume of recent user complaints citing withdrawal delays and platform instability.

WZG (万洲金业) is a Hong Kong-based financial service provider established in 2022. Operating primarily as a “WZG broker,” it provides trading services focused on precious metals and financial markets. The broker holds a regulatory status with the Chinese Gold and Silver Exchange Society (HKGX) and has achieved a WikiFX Score of 6.95. Despite its regulated status and support for industry-standard software, potential clients should be aware of a recent surge in investor complaints.

Pros and Cons of WZG

- ✅ Regulated: Holds a valid license from the Hong Kong HKGX (Chinese Gold and Silver Exchange Society).

- ✅ Software: Supports top-tier trading platforms, including MT4 and MT5.

- ✅ Localization: Offers customer support with Main Label software qualification.

- ❌ High Complaint Volume: Over 30 complaints received in the past 3 months.

- ❌ Withdrawal Issues: Multiple users report delays or inability to withdraw funds.

- ❌ Security Gaps: Trading software reportedly lacks two-step login or biometric authentication.

WZG Regulation and License Safety

Regulatory oversight is the cornerstone of trust in the forex and bullion markets.

Hong Kong HKGX License

WZG is regulated by the Chinese Gold and Silver Exchange Society (HKGX) under membership number 141. This regulation verifies that the broker is a recognized member of Hong Kong's established gold exchange, which provides a layer of legitimacy regarding its corporate existence and basic operational standards for bullion trading.

However, while the license is valid, the “C” influence rank and the high volume of risks detected by the WikiFX system suggest that traders should exercise caution. Regulation does not always guarantee immunity from operational disputes.

Real User Feedback and Complaints

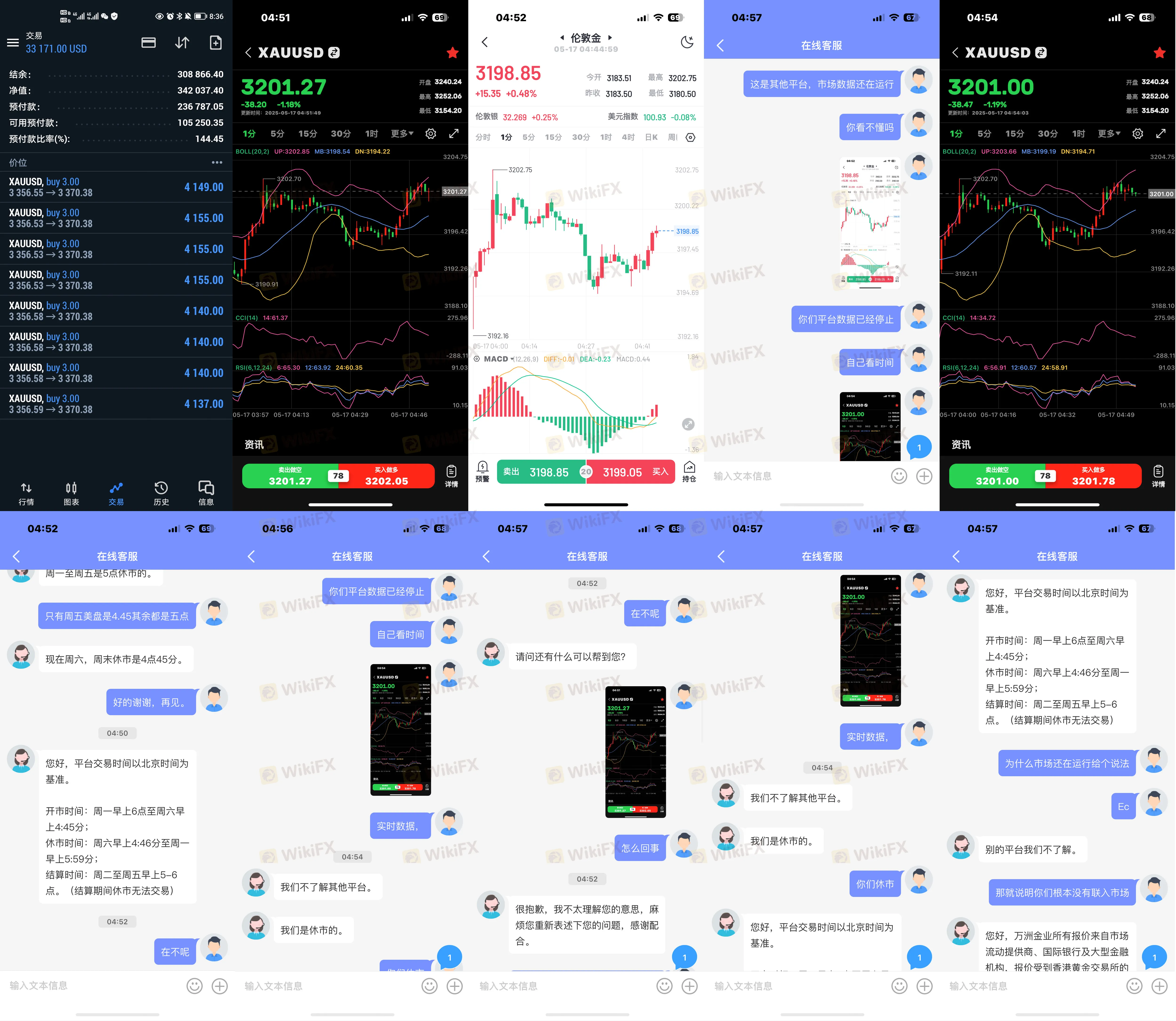

Recent data indicates a worrying trend in user satisfaction. In the last three months alone, WikiFX has logged 30 complaints.

Common issues reported include:

- Withdrawal Denials: Users claiming that profitable accounts are blocked from withdrawing funds.

- Market Manipulation: Allegations of price data freezing or moving contrary to broader market trends.

- Platform Instability: Traders have reported system freezes during volatile market conditions.

In one specific case (Case 5), a trader alleged profound system failures during a trading session. According to the report, the platform allegedly froze while the user was in profit, preventing them from closing the position. The user explicitly reported issues with the WZG login process, stating they could not access their account until the position had incurred a loss, at which point access was restored.

WZG Forex Trading Conditions and Fees

Platforms

WZG provides access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. This is a significant advantage, as these platforms are known for their advanced charting tools, automated trading capabilities (EAs), and stability.

However, the broker's software review notes a lack of modern security features, such as biometrics or two-factor authentication, which are becoming standard for securing trading accounts.

Trading Costs

Detailed information regarding spreads, leverage, and commission structures is not explicitly provided in the current dataset. While the platform infrastructure is robust (Main Label MT4/5), the lack of transparent cost data requires traders to verify terms directly before depositing.

Final Verdict

WZG presents a mixed picture. On one hand, it is a regulated entity in Hong Kong with valid credentials from the CGSE (HKGX) and offers robust MT4/MT5 trading software. On the other hand, the significant number of recent complaints regarding withdrawals and platform performance raises serious red flags.

Traders should carefully weigh the regulatory safety against the reported operational risks.

To stay safe and view the latest regulatory certificates, check WZG on the WikiFX App.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Rate Calc