LONG ASIA Review 2026: Is this Forex Broker Legit or a Scam?

Abstract:LONG ASIA is considered a high-risk broker with a low WikiFX score of 2.0, primarily operating under an unverified regulatory status in St. Vincent and the Grenadines. Numerous recent complaints cite severe withdrawal failures and blocked accounts, making this platform unsafe for capital.

Executive Summary: LONG ASIA poses a significant risk to your funds, holding a dangerously low WikiFX score of 2.0 out of 10. Despite offering popular trading platforms like MT4 and MT5, the broker operates with unverified regulation and faces a surge of user complaints regarding unpaid withdrawals. We strongly advise extreme caution.

Introduction

Are you currently looking for a safe place to invest, or have you already encountered LONG ASIA? Before you find a Forex broker that deserves your trust, it is crucial to look past the flashy website and investigate the hard data. In this LONG ASIA review, we strip away the marketing to analyze the broker's safety mechanisms, fee structure, and real user feedback.

With a WikiFX score hovering at a failing 2.0, this broker shows clear warning signs. Whether you are a beginner or a pro, understanding why this score is so low could save you thousands of dollars.

Question 1: Regulation & Safety: Is my money safe?

When entrusting your savings to a financial institution, the first question must always be about regulation. A license is not just a piece of paper; it is your only insurance policy against fraud.

According to the WikiFX database, LONG ASIA claims an association with the Financial Sector Conduct Authority (FSCA) in South Africa. However, our data indicates that this regulation status is currently “Unverified.” Furthermore, the broker is registered in St. Vincent and the Grenadines, a jurisdiction widely known for having little to no oversight over Forex trading activities.

Why does this matter?

Regulation determines the safety of your funds. top-tier regulators (like the FCA in the UK or ASIC in Australia) enforce “Segregated Accounts.” This means the broker must keep your money in a separate bank account from their own company funds, so they cannot use your deposits to pay their electricity bills or debts. With an offshore or unverified broker like LONG ASIA, you face “Counterparty Risk.” Effectively, your money is stored in the broker's own pocket, and if they disappear or go bankrupt, there is no government compensation scheme to help you recover your capital.

Question 2: Are the trading fees and leverage fair?

LONG ASIA offers competitive conditions on paper, including three account types: “Low Spread,” “Normal,” and “Cent.” They advertise a maximum leverage of 1:500.

The Double-Edged Sword of Leverage

While 1:500 leverage might resolve your desire for quick profits, it is statistically the number one reason beginners lose their entire deposit. Leverage borrows money from the broker to increase your position size. At 1:500, a market move of just 0.2% against you can wipe out your entire equity. While this is standard for many offshore Forex trading costs, it requires strict risk management that most new traders lack.

Spreads and Costs

The broker advertises spreads as low as 0.0 on specific accounts. While this sounds appealing, remember that unregulated brokers often use “teaser spreads” to lure clients in, only to widen them during news events or add hidden commissions later. Always verify if the trading costs remain stable during high volatility.

Question 3: What are real traders complaining about?

A low score is often a result of real-world friction. In the case of LONG ASIA, our database has flagged 9 recent complaints, primarily revolving around the inability to withdraw funds.

Common Issues Reported:

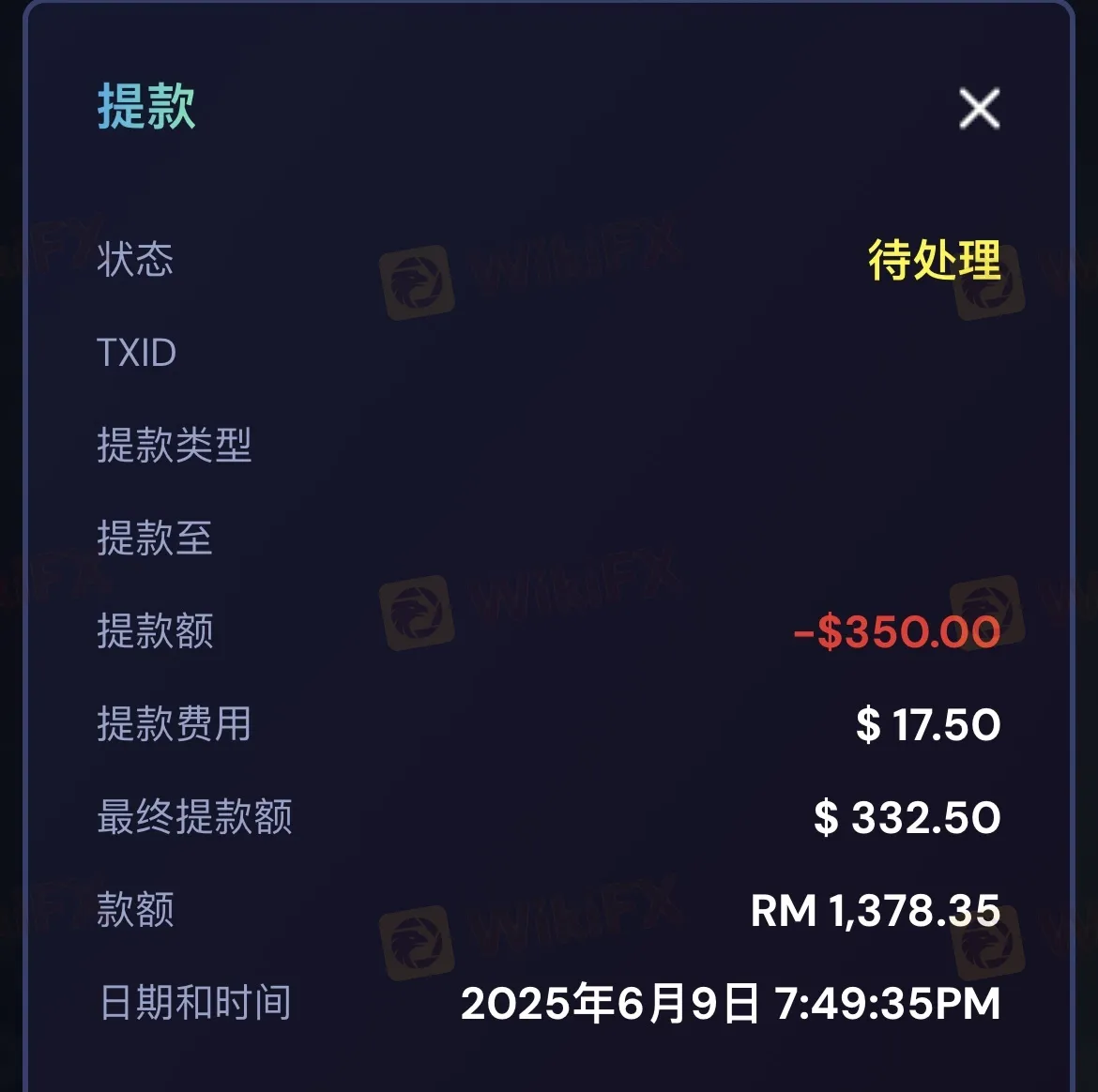

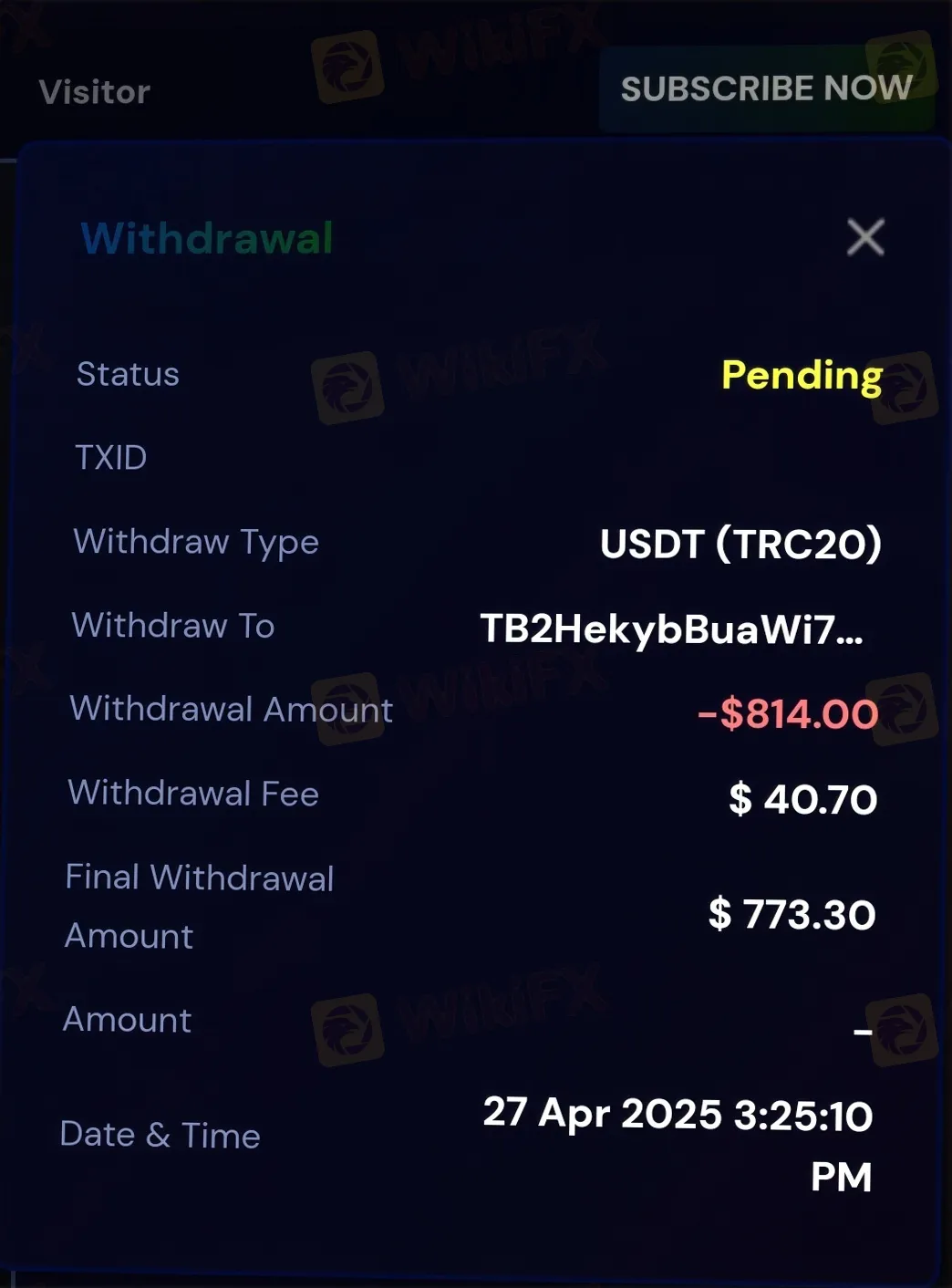

- Withdrawal Paralysis: Multiple users, particularly from Malaysia, have reported waiting weeks or even months for withdrawals. One user noted a request from November 2023 was still pending in July 2024.

- The “Gateway” Excuse: A distinct pattern has emerged where support blames “payment gateway issues” for delays. `Reviewer note: If a gateway is down for more than 48 hours, it is usually a liquidity crisis, not a technical glitch.`

- Bonus Traps: A trader from Peru reported that bonus terms were used as a loophole to seize profits, describing the experience as a “bait and switch.”

- Account Lockouts: A user from Pakistan alleged that after requesting a return of funds, they were locked out of the website entirely.

Pro Tip: If a broker delays your withdrawal for more than 3 business days without a clear valid reason (like identity verification), stop trading immediately. Do not generic more fees in hopes of “unlocking” a withdrawal.

Question 4: What software will I use?

LONG ASIA provides access to the industry-standard MT4 (MetaTrader 4) and MT5 (MetaTrader 5) platforms. These are robust platforms favored by millions for their charting tools and automated trading (EA) capabilities.

Security Warning

While the software itself is legitimate, how you access it matters. Always ensure you are on the official site before entering your login details to avoid phishing scams. However, be aware that even legitimate MT4/5 software can be manipulated on the server side by dishonest brokers. If you notice “slippage” (where your order fills at a worse price than you clicked) or if your login fails frequently during profitable trades, these are classic signs of backend interference.

Final Verdict: Should I open an account?

Based on the data, we strongly recommend avoiding LONG ASIA.

The combination of an unverified regulatory license, an offshore registration in St. Vincent, and a high volume of unresolved withdrawal complaints creates an unacceptable level of risk. The reports of “payment gateway” errors are a classic hallmark of a broker struggling with liquidity or intent on withholding funds.

Your Next Step: The Forex market is volatile, but your broker choice shouldn't be a gamble. Status changes daily. Before depositing, check the WikiFX App for the latest real-time certificate and choose a broker with a score above 7.0.

WikiFX Broker

Latest News

Telegram Investment Scam Wiped Out RM91,000 in Days

SPEC TRADING Review 2026: Is this Forex Broker Legit or a Scam?

Gold Smashes $5,100 Barrier: Dalio Warns of 'Capital Wars'

Fiscal Policy Monitor: Authorities Tighten Tax Compliance Framework

AMBER MARKETS Review 2026 — Is AMBER MARKETS Broker Safe for Forex Trading?

Who are the “Police” Watching Your Forex Broker? (FCA, ASIC, NFA Explained)

Dollar Index Hits Four-Year Low as 'Fed Whisperer' Signals Rate Pause

PayPal Re-enters Inbound Nigerian Market via Paga Partnership

German Capital Flows Heavy into China, Defying Trade War Risks

FIBOGROUP Review: Safety, Regulation & Forex Trading Details

Rate Calc