XTB Scam Alert: Forex Withdrawal Issues Exposed

Abstract:XTB traders worldwide report missing withdrawals and delayed payouts. Check out the verified complaints and stay protected.

XTB Exposed: Forex Scam Alert

XTB hides behind a regulated facade while traders worldwide scream about vanished withdrawals and endless delays. This brutal exposure rips open 83 negative WikiFX reviews, painting XTB as a textbook forex scam operation. Funds disappear, support ghost users, and excuses stack up—pure predatory tactics targeting hopeful investors.

Countless victims from Ecuador to Iraq detail how XTB withholds profits under fake bank rejections and hidden fees. Don‘t fall for their slick xStation platform; this forex trading scam alert demands you look closer before risking a cent. Real stories prove XTB’s withdrawal nightmare isn‘t rare—it’s their game.

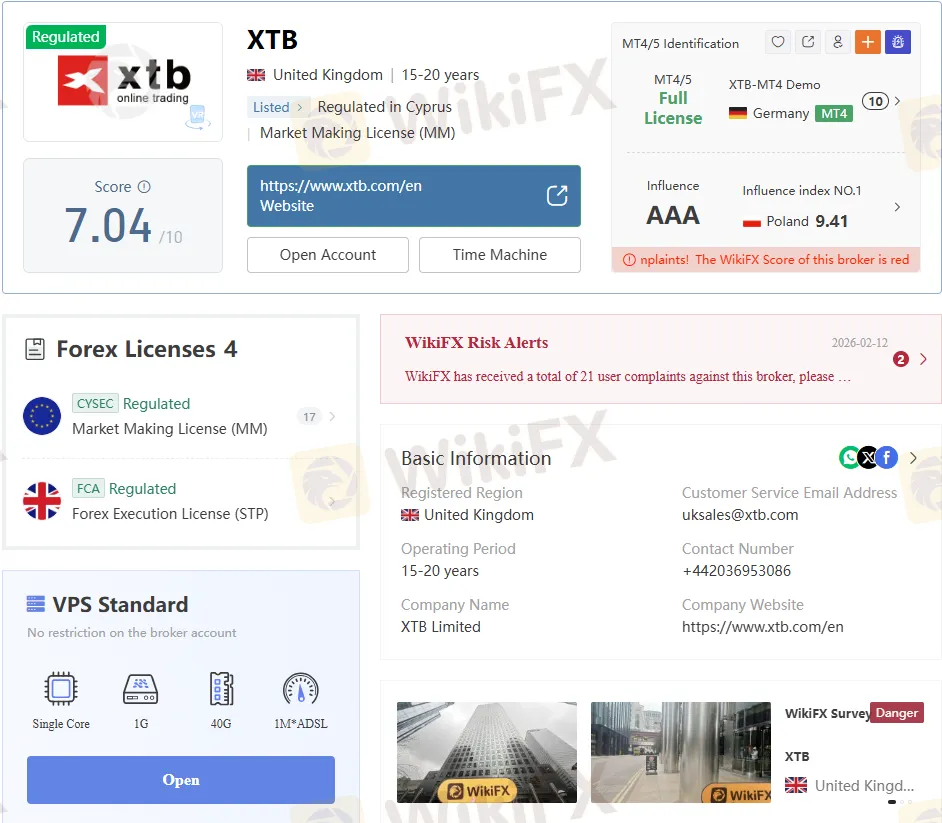

Broker Overview

XTB, founded in 1995 and registered in the UK, operates as a forex and CFD broker offering over 6,800 instruments like stocks, ETFs, forex, indices, and commodities. It provides leverage up to 1:500, floating spreads of 0.5 pips on pairs like EUR/USD and around 1.0 pips, and its proprietary xStation platform across mobile, desktop, and tablet. Despite no minimum deposit and commission-free CFD trading, the broker charges fees for withdrawals under 50 USD/EUR/GBP and for inactivity after 365 days.

Regulatory Status

XTB complies with regulations from top-tier authorities, including CySEC (license 169/12 for XTB Ltd as Market Making) and the FCA (license 522157 for XTB Limited as STP). This setup suggests legitimacy on paper, with client funds protected under these rules. However, even regulated brokers face complaints, and WikiFX rates it as “Regulated” while noting scam exposure risks from user feedback.

Withdrawal Policy Details

XTB claims free withdrawals above 50 USD/EUR/GBP via bank transfer, Visa, MasterCard, or Maestro in USD, EUR, GBP, processed same-day before 1 PM GMT for UK clients or next business day otherwise. Bank verification is required once for security, but users must use accounts in their name only. Small withdrawals incur a 5 USD/EUR/GBP fee, which some reviews link to disputes.

Surge in Negative Reviews

Out of 43 total reviews on WikiFX, a striking 83 are negative, highlighting persistent concerns about forex scams that far outweigh the positives. Traders label XTB a “complete scammer” for withholding funds, unresponsive support, and delays that turn into permanent losses. Download the WikiFX App to scan broker scores and dodge such forex trading scams before depositing.

Case from Ecuador

One trader requested a $200 withdrawal but received only $140, accusing XTB of deliberately retaining funds and calling the company a scam. This partial payout tactic leaves users chasing balances while support ghosts them. Such forex investment scam patterns erode trust in even regulated platforms.

India Withdrawal Nightmare

On September 26, 2025, an Indian user cried that they were unable to withdraw money, a common forex scam alert in XTB exposure stories. Delays stretched beyond the promised timeline, with no refunds despite bank checks showing no transfers. The WikiFX App highlights these red flags early to enable safer trading.

Saudi Arabia Month-Long Delay

A Saudi trader on August 28, 2025, detailed a withdrawal request that had been ignored for over a month, despite 24/7 support claims. Agents blamed bank rejections but failed to refund or respond after promising 10-day fixes; now silent for 30 days. This mirrors broader XTB scam complaints of vanished funds.

Colombia Funds Vanished

From July 31 to August 19, 2025, a Colombian user waited for funds that never arrived, with no bank records of the transfer. Customer service stopped replying, fueling fears of total loss in this forex withdrawal scam. Verify via the WikiFX App to avoid similar exposures.

Iraq High Interest Trap

An Iraqi trader on January 20, 2025, profited but couldn‘t withdraw due to sky-high interest deducted only on payout, under XTB control. They dictate terms, blocking access in a classic investment scam ploy. Regulated status doesn’t shield from these manipulative fees.

Common Scam Tactics

Traders face verification loops, ghosted chats, and excuses like bank recoveries without refunds, hallmarks of forex scams. Some report platform glitches or forced high-risk trades before payout blocks, amplifying losses. WikiFX App users spot these via real-time reviews and scam alerts.

Official policy ties issues to cutoffs and verifications, but complaints exceed explanations, with high volumes (21 in 3 months) signalling systemic problems. Clone warnings from regulators add risk of fake XTB sites mimicking the real one. Cross-check legitimacy on the WikiFX App before any deposit.

Broker Pros and Cons

| Aspect | Pros | Cons |

| Regulation | CySEC, FCA top-tier | Clone scams reported |

| Trading | 6,898 instruments, no min deposit | Single account type only |

| Fees | Free CFD commissions, spreads 0.5 pips | Withdrawal fees under 50 units, inactivity 10 GBP |

| Support | 24/5 chat | Often unresponsive per reviews |

| Platforms | xStation multi-device | No MT4/MT5 |

This table reveals appeal for diverse trading but red flags in access and service.

Protect Yourself Now

Before trading, use the WikiFX App for instant broker exposure, review counts, and scam checks—essential against forex withdrawal issues. Avoid small test withdrawals that trigger fees, document everything, and test support responsiveness first. Stay ahead of scams by heeding these global alerts; your funds depend on it.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Rate Calc