IQ Option Review: The High-Stakes Game of Withholding Trader Capital

Abstract:IQ Option maintains a high-gloss facade through its CySEC status, but the underlying data reveals a systemic failure in capital repatriation and a mounting pile of verified trader complaints. While they tout a custom-built environment, the reality for many is a one-way street where deposits enter smoothly but withdrawals vanish into a 'permanent review' void.

IQ Option markets itself as a sleek, innovative gateway to the financial markets, but the sheer volume of “account under review” excuses suggests a much darker operational reality. For a broker established in 2014, the grace period for “growing pains” ended a decade ago. Today, the data paints a picture of a platform that excels at onboarding but falters—sometimes terminally—at the point of exit. With a WikiFX score of just 5.46 and nearly 100 complaints in the recent quarter, this is not a platform for the faint of heart or the cash-dependent.

The Mirage of Global IQ Option Regulation

The primary shield for IQ Option is its CySEC license, which provides a veneer of European respectability. However, a deep dive into the regulatory landscape reveals a broker operating on the fringes of global legality. Regulators in high-profile jurisdictions have already begun raising red flags, noting that IQ Option frequently oversteps its boundaries by targeting clients in regions where it has no legal mandate to operate.

| Regulator | License Type | Status |

|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | Market Making (MM) | Regulated (License 247/14) |

| Securities Commission Malaysia (SCM) | Unauthorized Entity | Danger / Alert List |

| Monetary Authority of Singapore (MAS) | Unlicensed / Investor Alert | Warning List |

The discrepancy between its Cyprus license and the warnings from Asian regulators like MAS and SCM suggests a broker that plays fast and loose with international boundaries. If you are trading from a region outside the EEA, your “regulated” protection might be nothing more than a marketing slogan.

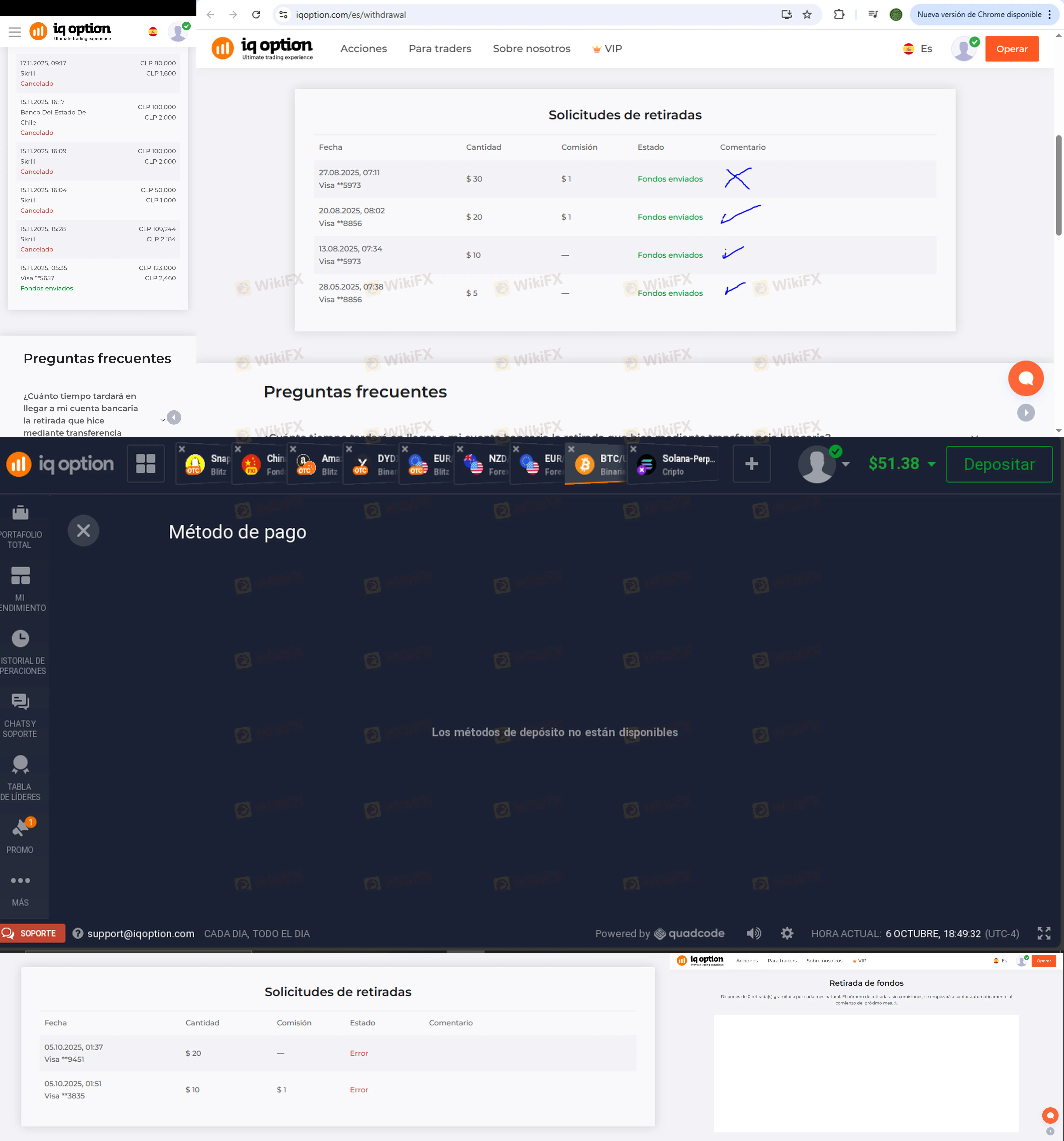

The Withdrawal Black Hole: Case Studies in Frustration

The most damning evidence against this broker comes not from the regulators, but from the victims. A recurring theme in recent months involves the “Review” trap. Traders report that as soon as they achieve significant gains or attempt a large withdrawal, their accounts are suddenly flagged for verification—even if they have been verified for years.

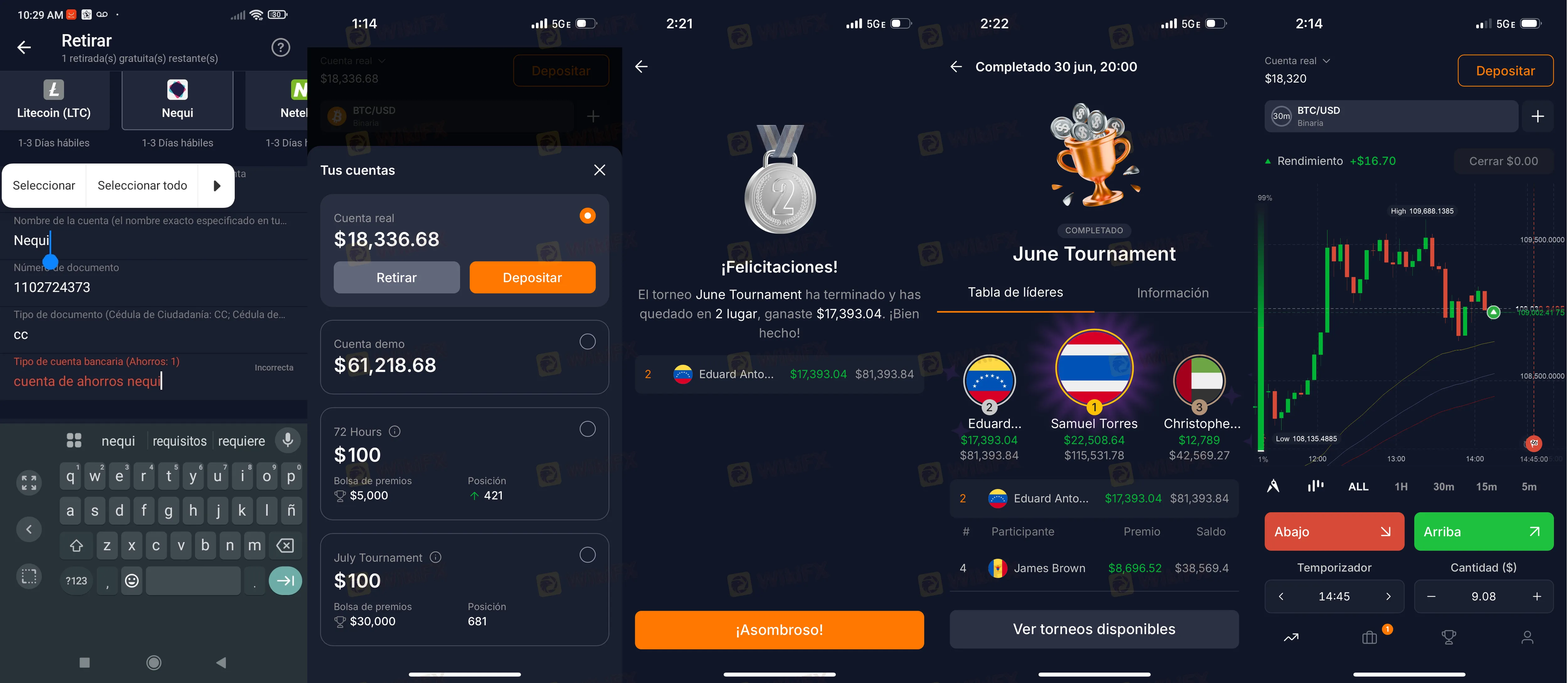

In one instance from Colombia (Case 5), a user reported that after attempting to withdraw winnings, the system suddenly claimed an “incorrect account type” despite the account being fully operational for months. In Case 6, a trader from Venezuela described the platform as a total “estafa” (fraud), alleging that the broker uses verification as a perpetual delay tactic before ultimately blocking the account and seizing the balance.

Technical Sophistry and the IQ Option Login Barrier

The broker's proprietary software is often praised for its “fluidity,” but the lack of MT4/MT5 support is a calculated move to keep users trapped within a closed ecosystem. This custom software lacks standard security features like two-step authentication or biometric login protocols. This is particularly ironic for a company that claims to prioritize financial security.

While the mobile experience is touted as “smooth,” traders in Chile and Mexico have found that the technical ease of placing a trade does not translate to the technical ease of receiving a payout. Several users have reported that after a successful login , they find their withdrawal options frozen or cancelled without explanation. In Case 3, a trader from Bolivia saw their account blocked immediately after growing a $20 deposit to $51, with technical support offering zero information on the status of the funds.

The VIP Trap and Institutional Ghosting

Perhaps the most cynical aspect of the IQ Option review is the treatment of “VIP” clients. Evidence suggests that “investor status” is a temporary privilege that expires the moment you become too profitable. Case 20 details a VIP user who had a dedicated account manager until they began withdrawing profits. Suddenly, the percentages dropped, the manager vanished, and the withdrawal of $2,778 was placed under an indefinite “review” with the support chat disabled.

This isn't a technical glitch; it's a business model. By stripping away support from successful traders, the broker effectively isolates them, making it impossible to contest the freezing of their assets.

Final Investigation Verdict: High Risk, Low Accountability

The Forex market is volatile enough without having to worry if your broker will let you have your own money. IQ Option's regulation in Cyprus does little to help a trader in Latin America or Southeast Asia when their account is locked. The sheer volume of matching testimonies—ranging from blocked accounts in Portugal to ghosted withdrawals in the Dominican Republic—indicates a systemic issue.

Before you ever reach the login screen of their “award-winning” platform, ask yourself if you are prepared to wait months for a withdrawal that might never arrive. The data suggests that at IQ Option, winning the trade is only half the battle; the real struggle is getting paid.

Risk Warning: Trading involves high risk. This broker has been flagged for multiple withdrawal issues and is on several international alert lists. Proceed only with capital you are prepared to lose—not just to the market, but to the platform itself.

WikiFX Broker

Latest News

CBN Bolsters Forex Liquidity: Resumes BDC Sales as Reserves Hit $47 Billion

PXBT Review: A Seychelles-Based Trap for Your Capital

KK Park 2.0? New Scam Hub Shockingly Emerges in Myanmar

FX Markets: Aussie Dollar Breaks 0.7100, Yen Rallies on Political Shifts

Anzo Capital Detailed Analysis

Pemaxx User Reputation: Looking at Real User Reviews to Check If It's Trustworthy

CFI Detailed Analysis

Beware ThinkMarkets: Forex Fraud Cases Exposed

China’s "Deposit Migration" Myth Debunked: A Gradual Shift, Not a Flood

Theos Markets Review 2026: Is this Forex Broker Legit or a Scam?

Rate Calc