User Reviews

More

User comment

30

CommentsWrite a review

2025-12-22 16:45

2025-12-22 16:45

2025-12-20 06:34

2025-12-20 06:34

Score

15-20 years

15-20 yearsRegulated in Australia

Market Making License (MM)

Self-developed

Global Business

High potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 53

Exposure

Score

Regulatory Index9.08

Business Index8.00

Risk Management Index0.00

Software Index8.17

License Index8.87

Single Core

1G

40G

More

Danger

Danger

Danger

More

Company Name

eToro (UK) Ltd

Company Abbreviation

eToro

Platform registered country and region

United Kingdom

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

Please return my money

Etoro not letting me withdraw AUD: "Withdraw Failed", with no clear reason Today when I attempted to withdraw some AUD, it gave me the following error message: Withdrawal Failed.

Trying to withdraw usdt to Coinbase as my country is no longer supported. By I can't! it. I have 58.76 usdt but when I click max in the withdrawal page it fills amount to only 33.76 and says can not be less than 40. And if I manually enter 58.76 it says max I have is 33.76 which is incorrect. please help

Whenever I deposit in the Tron Link wallet and register for mining with the Divi system, the deposit funds are withdrawn with profits, and I cannot take them out to the wallet again, although I spoke with a customer about this problem, they ask me to deposit the same money that is inside my mining pool, and I cannot deposit again because The total amount of money is 500 dollars, but I have the capacity for this amount. Really, I am very sad because I needed this money to sponsor my mother’s treatment, but what should I do?

Toro and ITGFX are partners with authrization, and ITGFX platform has absconded, please help me

Scammers, they ask for tax payment before allowing withdrawals, otherwise no withdrawals are permitted. Not even a single cent is given out, and they even threaten to freeze the account if you submit any more requests.

I used etoro for a while, tried to withdraw money but it didn't come through. Contacted support and they just gave vague answers, then later went completely silent. It's clearly a scam. The platform is also laggy. Did some more research and found out it's not approved by the SEC. I don't recommend it, I'll pass.

Today unfortunately I was scammed by a company called EFE-Mall that supposedly operates in Lima-Peru. Everything was going well, I started activating the account with 12 soles, and for each task I completed they deposited me, and later they assigned me more tasks where they wanted me to deposit more and I did it, until they asked me for the highest figure of almost 1400 soles but I didn't deposit it, because it's a lot, now they don't want to deposit the proceeds because they say that I must finish carrying out the entrusted task, which is 1400 soles. The last deposit I made was 390 soles as well as 100, 50, 26, 12, and 10 soles. In total deposited is 588 soles. I just want my money back.

etoro requires the regulation of other regions before allowing you to trade, but this regulatory guarantee is not as good as the original one!

On 2021 Nov 10, intc closed at 50.76 . On Nov 11, I placed a buy limit order at 50.76 . However, etoro strategically interpreted as that my order was 1 cent higher than market price, 50.75 . etoro filled my buy order at 51.05 , which was the open price on Nov 11.

Deceiving users by closing their accounts without notifying them. The reason given was just for security? When the price went up, I couldn't buy. Another issue is withdrawing money—sometimes it takes too long, sometimes it's impossible. Problems keep happening. Support is useless, as if they know nothing about trading.

I lost 170,000 dollars on eToro due to unfair slippage, platform failures, and forced closures. As a beginner, I had no real understanding of CFDs, leverage, or the extreme risks involved. Instead of protecting me, eToro moved my account from Australia’s AFCA regulation to Seychelles, stripping away my legal protections without warning and then took advantage of my ignorance. The way my account was closed was disrespectful, as if they were doing me a favor Now I’m buried under $200,000 in debt, my family is suffering, and my health has collapsed. eToro’s system is not built to protect traders, it profits from their mistakes. I have full evidence of every trade showing the technical issues. Please read this before trusting eToro, once you lose, you lose everything

Unable to withdraw the amount and after a period of time the amount is returned and $20 is deducted. The reason given is that my receiving bank refused to accept the amount.

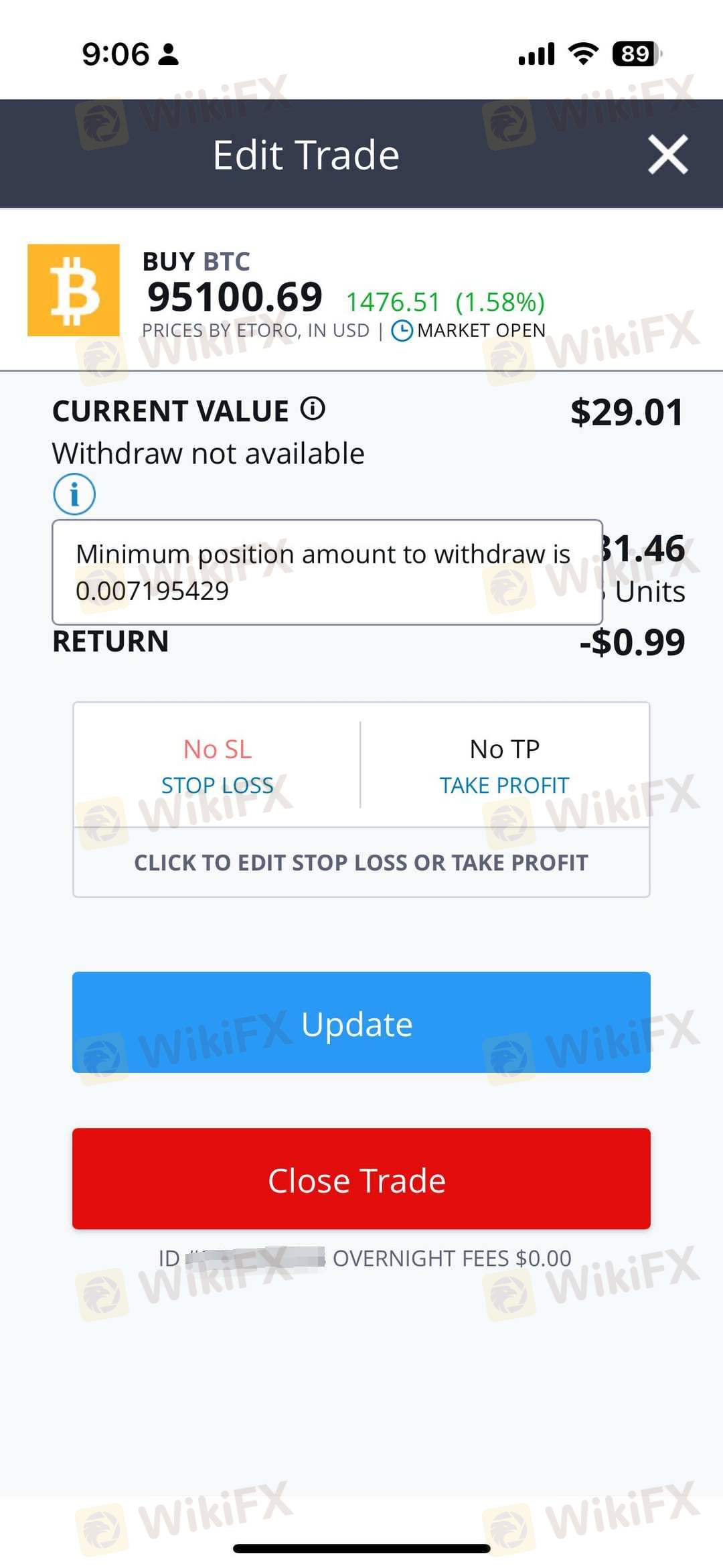

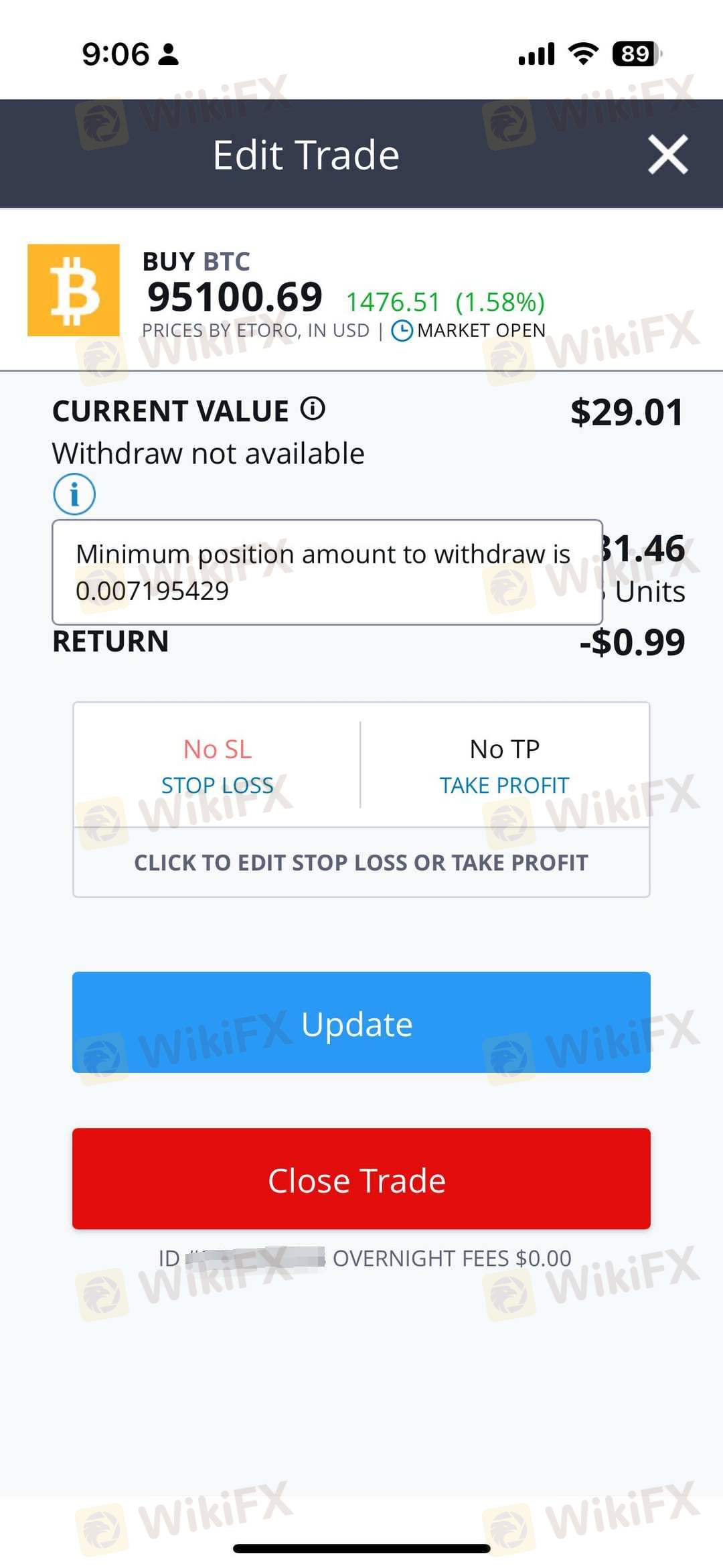

Hey everybody! I recently opened an account with EToro, bought some BTC and wanted to transfer it to my EToro Wallet, however I can’t seem to find the option for doing so, is it because I must withdraw a minimum of 0.007 BTC or is this option not available in my jurisdiction? I’m in France btw

I bought a product with no overnight fees. I held this product for 1.5 years. Then one day they decided to start charging me overnight holding fees. The fees amounted to $19900 and I only had $128000 in the account. Literally 15% of my account they sucked out in fees with no notification that fees were changing. I knew it was scam i had to involve Assetsclaimback/com against insolvency.

The "ETORO" platform also started with job hunting on Facebook, using the same method of adding a LINE assistant, then adding the manager's LINE, and joining a group. After waiting for a long time with no job openings, one day they said I won some special event and asked me to leave the group first, then add another manager's LINE who claimed they would help me make money. That manager then had me and another person participate in a challenge, which we failed, and they demanded I repay them 30,000. At the time, I really couldn't gather the money and kept delaying. Every day, they kept asking if I had the money. When I finally managed to gather it, they said the data was corrupted and they didn’t dare take the risk, so they asked me to gather another 70,000, totaling 100,000. I only managed to get 50,000, and the other party said they would cover the remaining 20,000. Then we continued the challenge, and after succeeding, they asked me to pay another 20,000 for data uninstallation fees. My account being flagged as suspicious was also because this manager introduced me to another person from their company. I had only worked for three days before my account was flagged. To withdraw money, I had to go through another person who helped with payouts, but again, they required a deposit of 400,000. I was truly speechless.

| Quick eToro Review Summary | |

| Founded in | 2007 |

| Headquarters | United Kingdom |

| Regulations | ASIC, CySEC, FCA |

| Tradable Assets | 7,000+, 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, 106 cryptocurrencies |

| Demo Account | ✅ ($100,000 in virtual funds) |

| Min Deposit | $10 |

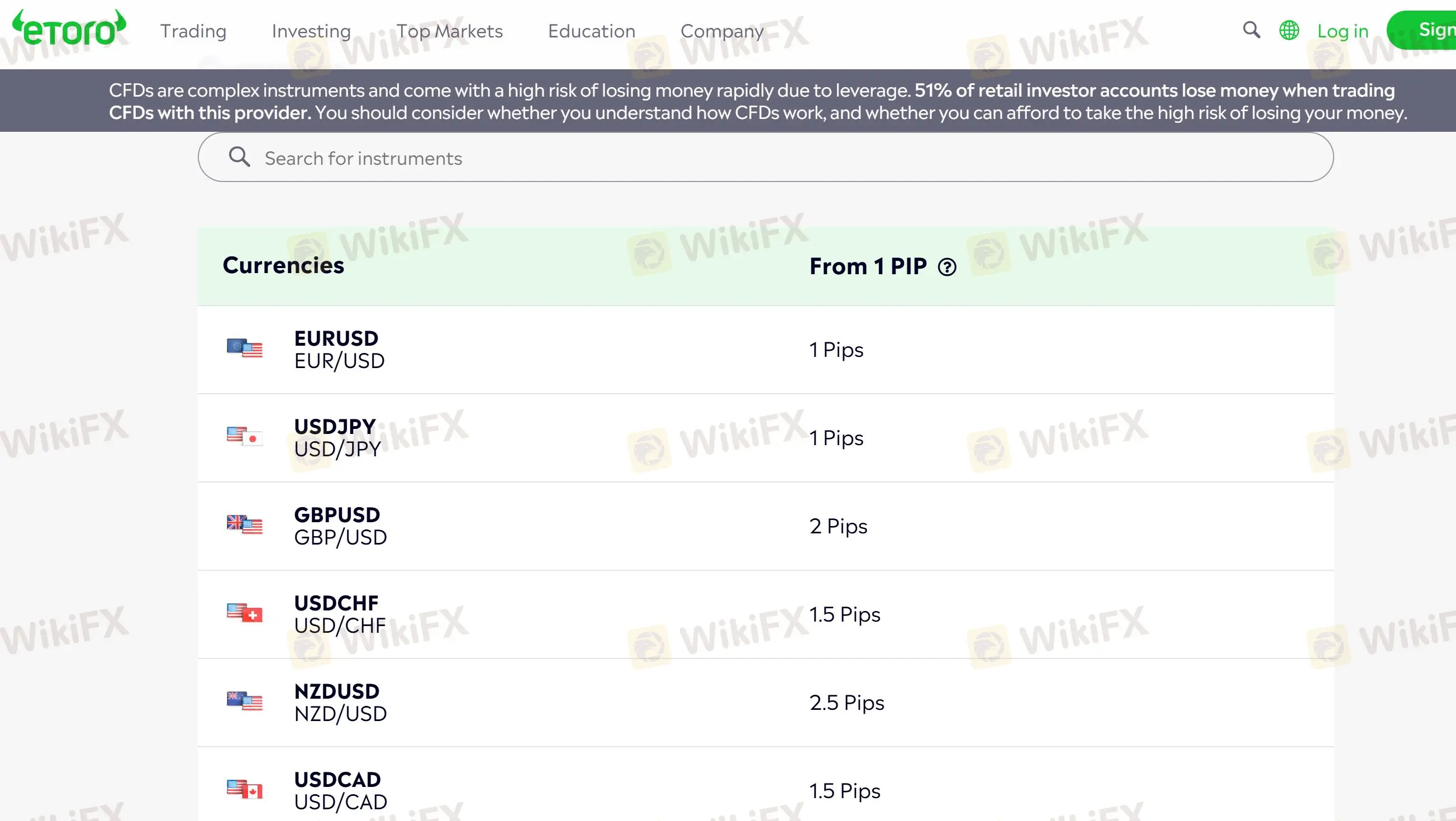

| Trading Fees | From 1 pip (EUR/USD) & commission-free (forex) |

| Non-Trading Fees | Withdrawal fee: Free (GBP and EUR accounts) or $5 (USD investment account) |

| Inactivity fee: $10/month applies to accounts with no logins in the previous 12 months | |

| Leverage | Up to 1:30 (retail)/1:400 (professional) |

| Trading Platforms | eToro proprietary platform, MetaTrader 4 |

| Copy/Social Trading | ✅ |

| Payment Methods | Credit/debit cards, bank transfers, PayPal, Neteller, Skrill |

| Customer Support | / |

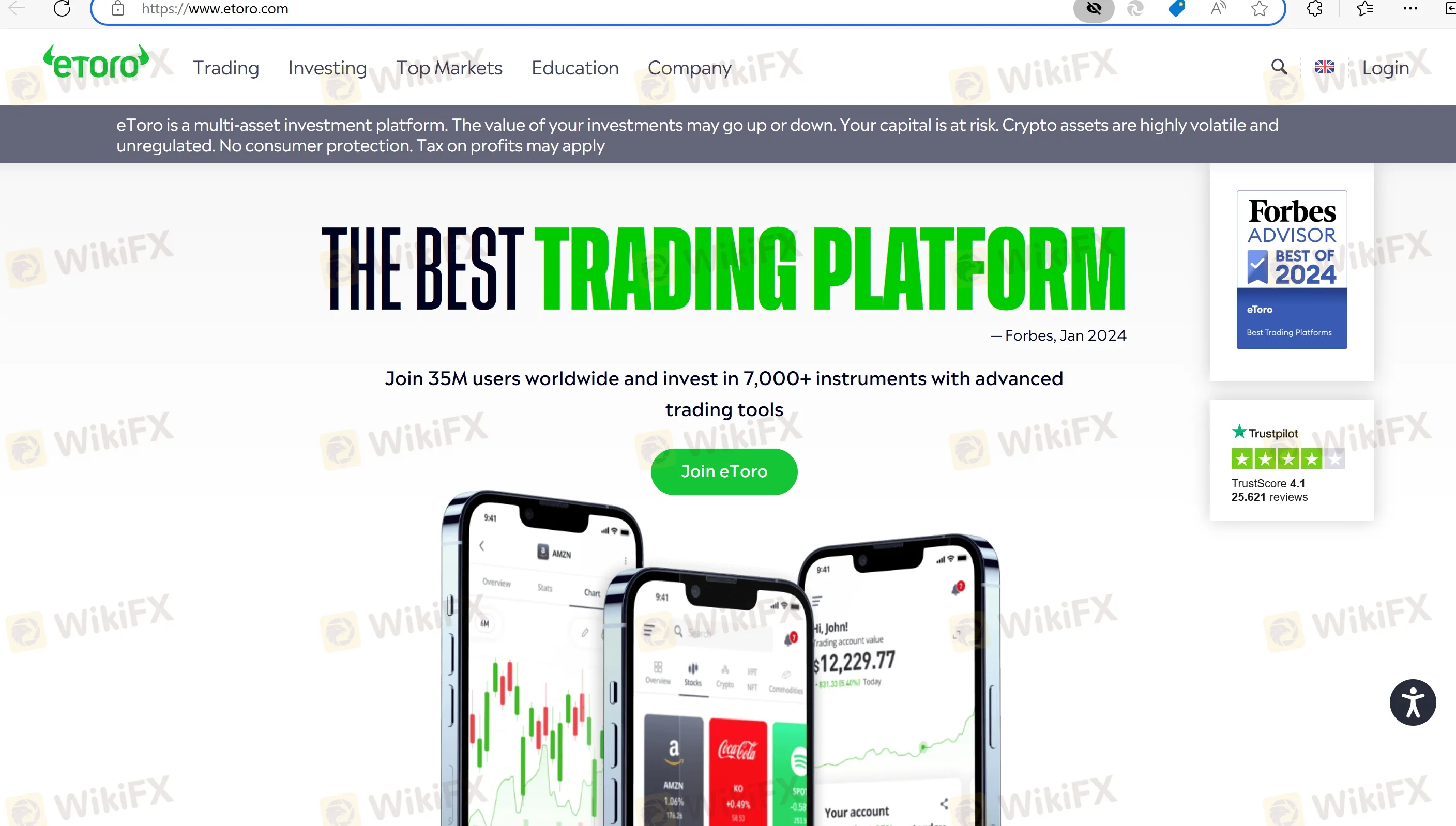

eToro is a multi-asset social trading platform that has gained widespread popularity among investors, traders, and social media enthusiasts since its inception in 2007. It offers users access to a wide range of financial instruments, including stocks, cryptocurrencies, forex, indices, and commodities, among others. The platform provides a user-friendly interface that caters to both novice and experienced traders alike, making it one of the most popular trading platforms on the market.

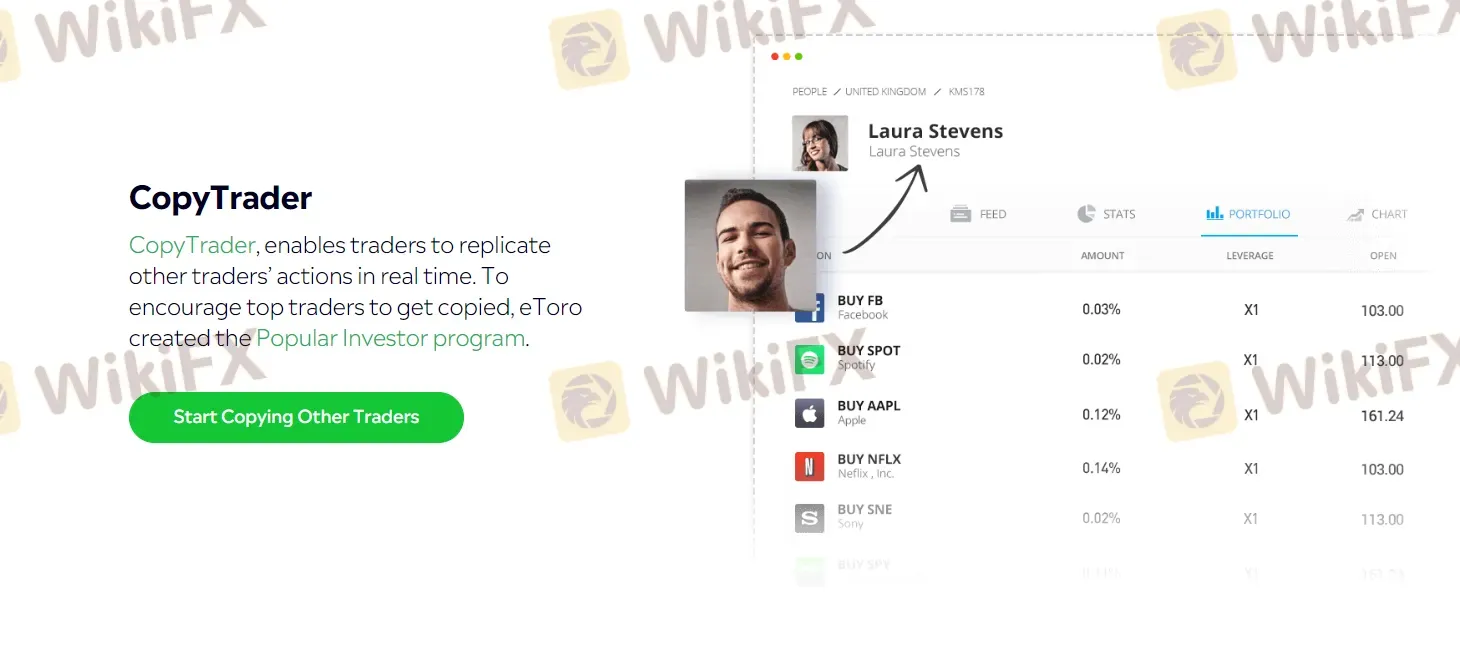

One of eToro's standout features is its social trading capabilities, which allow users to copy the trades of successful traders and build their investment portfolios. The platform has a large community of traders who share insights, strategies, and knowledge, making it an excellent learning resource for traders looking to improve their skills.

eToro's user-friendly interface, range of trading assets, and social trading features have made it popular among both beginner and experienced traders.

However, as with any trading platform, eToro has its pros and cons, which potential users should consider before signing up.

In this section, we will discuss the advantages and disadvantages of using eToro as a trading platform.

| Pros | Cons |

| User-friendly and easy-to-use platform | Inactivity fee charged after 12 months of inactivity |

| Regulated by reputable financial authorities | $5 withdrawal fee for the USD investment account |

| Copy trading and social trading features | Limited contact options |

| Demo accounts available for practice |

eToro is a legitimate and regulated online brokerage firm that has been operating since 2007.

It is licensed and regulated by several reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

| Regulated Country | Regulated by | Regulated Entity | License Type | License Number |

| ASIC | ETORO AUS CAPITAL LIMITED | Market Making (MM) | 000491139 |

| CySEC | Etoro (Europe) Limited | Market Making (MM) | 109/10 |

| FCA | eToro (UK) Ltd | Straight Through Processing (STP) | 583263 |

The company is also a member of the Investor Compensation Fund, which provides additional protection for traders' funds.

However, as with any investment platform, there are risks involved in trading, and traders should always be aware of the potential risks and take steps to protect their investments.

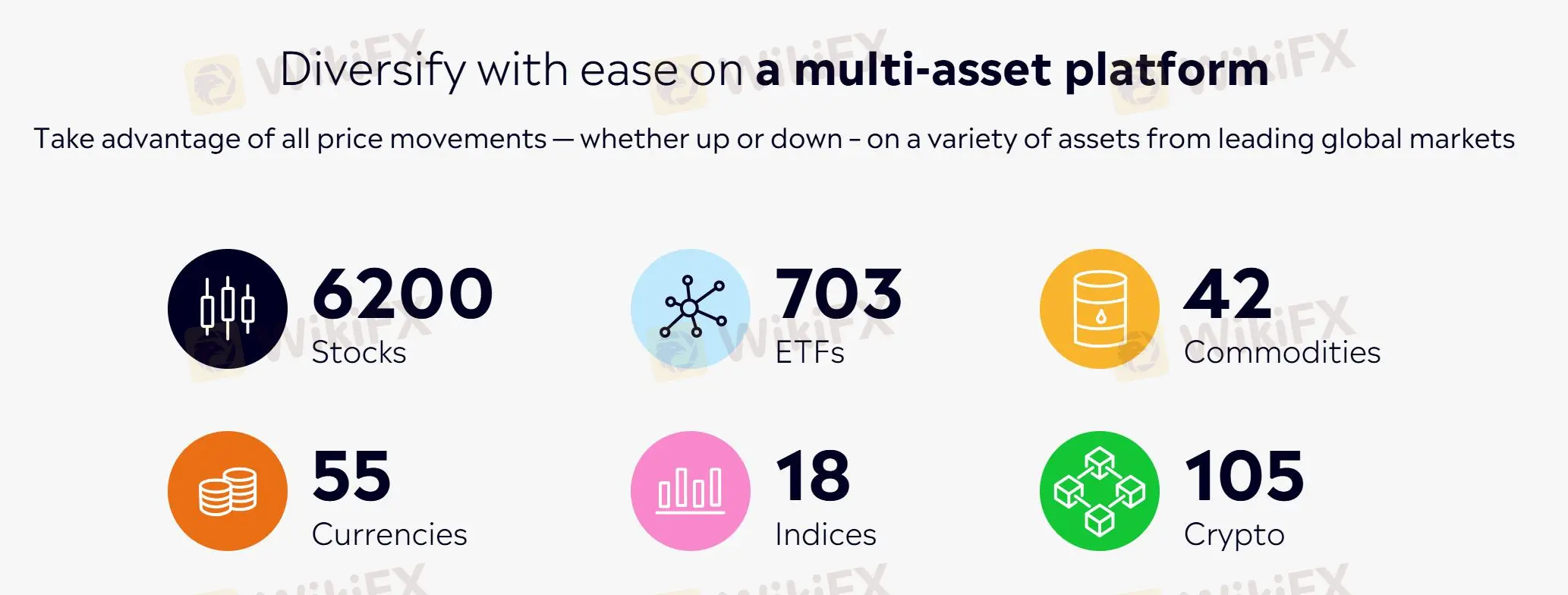

eToro offers a wide range of financial instruments for traders to choose from, covering various markets globally.

Traders can access more than 7,000 assets, including 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, and 106 cryptocurrencies.

With this wide range of instruments available, traders can diversify their portfolios and explore various markets to find the best investment opportunities.

| Asset Class | Supported |

| Stocks | ✔ |

| ETFs | ✔ |

| Commodities | ✔ |

| Currencies | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

eToro offers leverage for trading various financial instruments. The maximum leverage provided by eToro varies depending on the instrument and the jurisdiction of the client.

| Asset Class | Max Leverage (Reatil) | Max Leverage (Professional) |

| Major forex pairs | 1:30 | 1:400 |

| Commodities | 1:20 | 1:100 |

| Stocks | 1:5 | |

It is noted that high leverage can amplify your potential returns, but more importantly, it can increase your risks.

The spread for EUR/USD pair is from 1 pip, which is more competitive than most other brokers. If you are interested in spreads on other trading instruments, you can directly visit https://www.etoro.com/trading/fees/cfd-spreads/

As for commissions, if you trade on ETFs or CFDs, there is no commission. However, there is a commssion of $1 or $2 for stock trading and 1% commission for crypto trading.

| Asset Class | Commission |

| Stock | $1/2 |

| ETFs | ❌ |

| Crypto | 1% |

| CFDs | ❌ |

On eToro, account opening and management are both free of charge. However, withdrawal fee, inactivity fee, and conversion fee are charged, and you can find detailed info in the table below:

| Account Opening Fee | ❌ |

| Management Fee | ❌ |

| Withdrawal Fee | Free (GBP and EUR accounts) or $5 (USD investment account) |

| Inactivity Fee | $10/month applies to accounts with no logins in the previous 12 months |

| Conversion Fee | 0.75% |

eToro offers its proprietary trading platform, which is designed to be user-friendly and intuitive, particularly for novice traders. The platform provides a variety of tools and features, including real-time market data, advanced charting tools, and an easy-to-use order entry system.

One of the most notable features of the eToro platform is its social trading functionality, which allows users to follow and copy the trades of successful traders. This feature is particularly appealing to new traders who may lack the knowledge or experience to make their own trades.

In addition to its proprietary platform, eToro also supports the popular MetaTrader 4 (MT4) platform, which is widely used by traders around the world. MT4 is known for its advanced charting capabilities, extensive library of technical indicators, and the ability to automate trading strategies through the use of Expert Advisors (EAs).

Deposit

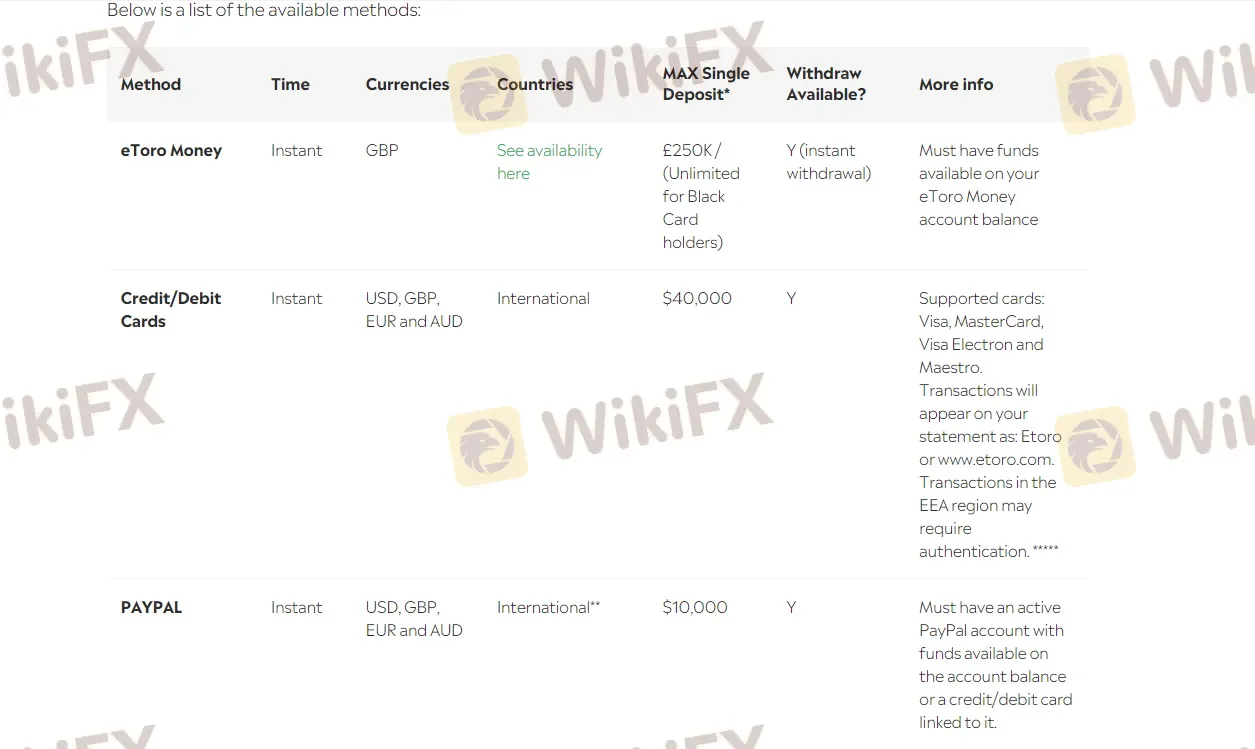

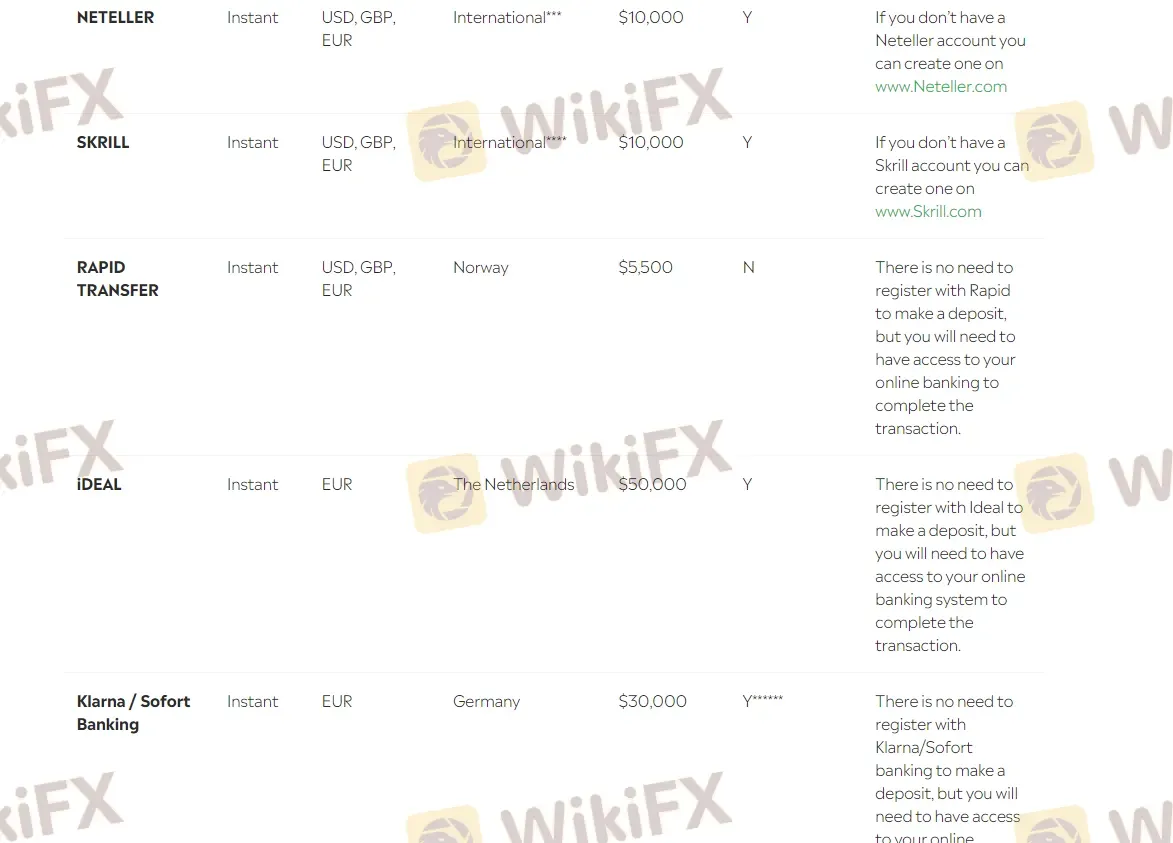

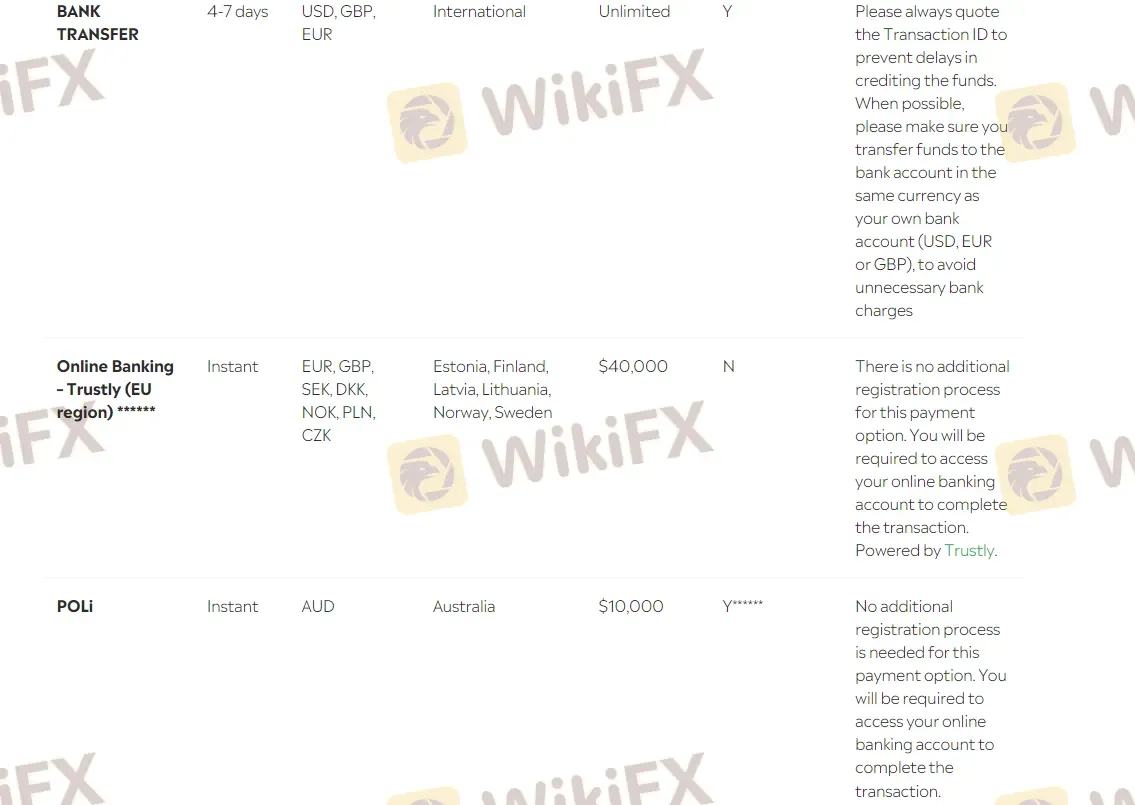

eToro accepts multiple payment methods, including credit/debit cards, bank transfers, and e-wallets such as PayPal, Neteller, and Skrill.

The minimum deposit amount is $10, which is relatively low compared to other brokers in the industry.

Deposits are usually processed instantly or within one business day, depending on the payment method.

eToro does not charge any deposit fees, but some payment providers may have their own fees.

eToro allows you to withdraw funds using the same payment methods as deposits.

Withdrawal

The minimum withdrawal amount is $30, and there is a withdrawal fee of $5 for USD investment account, while free for GBP and EUR accounts.

Withdrawals are usually processed within one business day, but it may take longer for bank transfers.

Before making a withdrawal, you need to verify your identity and complete the necessary KYC (Know Your Customer) procedures.

eToro also has a policy of returning funds to the original payment method used for deposits, whenever possible.

When it comes to educational resources, Toro offers a variety of educational content to help traders improve their skills and knowledge of the financial markets.

These resources include but are not limited to:

More other educational resources can be found on its official website.

Overall, eToro is a reputable and user-friendly online trading platform that offers a wide range of financial instruments and trading options to its clients. Its innovative social trading features, intuitive platform, and excellent customer service make it an attractive choice for both beginner and experienced traders. However, it does have some drawbacks, such as withdrawal and inactivity fees charged, as well as limited direct contact channels.

Is eToro a regulated broker?

Yes, eToro is a regulated broker. It is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) in Europe, the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC) in Australia.

What trading instruments are available on eToro?

eToro offers 7,000+ trading instruments, including 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, and 106 cryptocurrencies.

Does eToro offer a demo account?

Yes, eToro offers a demo account that allows you to practice trading with up to $100,000 virtual funds. The demo account is free and can be used for an unlimited period of time.

Urgent warning for mobile traders: Our investigation confirms complaints of eToro forcibly moving client accounts from top-tier jurisdictions to offshore zones, stripping vital legal protections. With 47 recent complaints and active regulatory lawsuits regarding high-risk client acquisition, immediate caution is advised.

WikiFX

WikiFX

Our investigation exposes a critical 'regulatory arbitrage' risk where eToro traders report being quietly shifted from protected jurisdictions to offshore entities, resulting in catastrophic losses up to $170,000. With the Philippines SEC blacklisting the platform for unauthorized operations and Australian regulators suing over consumer harm, the safety of your funds is in question.

WikiFX

WikiFX

eToro is regulated by ASIC, FCA, CySEC, MAS & ADGM, though some users report withdrawal delays and offshore risks.

WikiFX

WikiFX

Online trading and investing platform eToro has expanded its offering by adding 43 new tradable assets, giving users broader access to a wider range of U.S. equities and exchange-traded funds (ETFs).

WikiFX

WikiFX

More

User comment

30

CommentsWrite a review

2025-12-22 16:45

2025-12-22 16:45

2025-12-20 06:34

2025-12-20 06:34