User Reviews

More

User comment

4

CommentsWrite a review

2024-08-07 14:07

2024-08-07 14:07 2024-03-29 14:55

2024-03-29 14:55

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

United Kingdom Appointed Representative(AR) Revoked

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.75

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

DFX Global Limited

Company Abbreviation

DFX

Platform registered country and region

United States

Company website

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | 5-10 years |

| Company Name | DFX Global Limited |

| Regulation | Lacks proper regulation |

| Minimum Deposit | USD 10 for fiat deposits, 0.001 BTC for BTC deposits |

| Maximum Leverage | Up to 10x leverage |

| Spreads | Typically around 0.10% - 0.20% |

| Trading Platforms | Meta Trader 4 |

| Tradable Assets | Cryptocurrencies, Tokenized Assets, Decentralized Lending, Margin Trading, Decentralized Options |

| Account Types | Individual Accounts, Corporate Accounts, Institutional Accounts |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | QQ: 3300728517, Email: service@dfxglobal.com |

| Payment Methods | Fiat deposits via bank transfer, credit card, or debit card. Cryptocurrency deposits and withdrawals. |

| Educational Tools | Online Courses, On-demand Webinars, Live Events, Learning Resources |

Overview of DFX

DFX, a broker based in the United Kingdom and operating under the name DFX Global Limited, offers a range of market instruments and account types for traders and investors. However, it is important to note that DFX lacks proper regulation, which poses a significant risk to potential users. The absence of valid regulation and negative field survey reviews indicate potential dangers and the need for caution when considering this unregulated broker.

DFX provides various market instruments, including cryptocurrency trading, tokenized assets, decentralized lending, margin trading, and decentralized options. These instruments cater to different trading and investment strategies within the cryptocurrency ecosystem. However, it is essential to carefully evaluate the risks and potential losses associated with these activities, especially considering the lack of regulation.

DFX offers different account types, including individual, corporate, and institutional accounts. Individual accounts are designed for retail traders and investors, while corporate accounts cater to businesses and organizations. Institutional accounts are tailored for large financial institutions. Each account type offers specific features and permissions to meet the needs of different users. However, given the absence of proper regulation, potential users should exercise caution when considering these account types.

Overall, DFX lacks proper regulation and has received negative reviews, highlighting potential risks associated with engaging with this unregulated broker. While DFX offers various market instruments and account types, it is crucial to consider the potential dangers and exercise caution before proceeding with any transactions or investments.

Pros and Cons

DFX, while offering a wide range of cryptocurrencies for trading and allowing tokenization of real-world assets, faces several cons that potential investors should consider. One significant drawback is the lack of proper regulation, which poses a risk to investors. Additionally, there is an absence of information on trading volumes or market depth, which may limit transparency. Negative reviews and warnings from investors further contribute to concerns. Withdrawal fees for fiat and BTC withdrawals are another con, and there is no information available on deposit insurance or protection. While DFX supports various deposit and withdrawal methods and provides the Meta Trader 4 trading platform, there is no mention of advanced trading tools or features. It is worth noting that the main website of DFX is currently not available, which may raise questions about its accessibility and reliability.

| Pros | Cons |

| Offers a wide range of cryptocurrencies for trading | Lacks proper regulation, posing a risk to investors |

| Allows tokenization of real-world assets | Absence of information on trading volumes or market depth |

| Provides different account types for various needs | Negative reviews and warnings from investors |

| Offers leverage of up to 10x on trades | Withdrawal fees for fiat and BTC withdrawals |

| No commissions | Absence of information on trading volumes or market depth |

| Low minimum deposit requirements | No information on deposit insurance or protection |

| Supports various deposit and withdrawal methods | Lack of educational resources mentioned |

| Provides Meta Trader 4 trading platform | No mention of advanced trading tools or features |

| Offers customer support through QQ and email | Main website is currently not available |

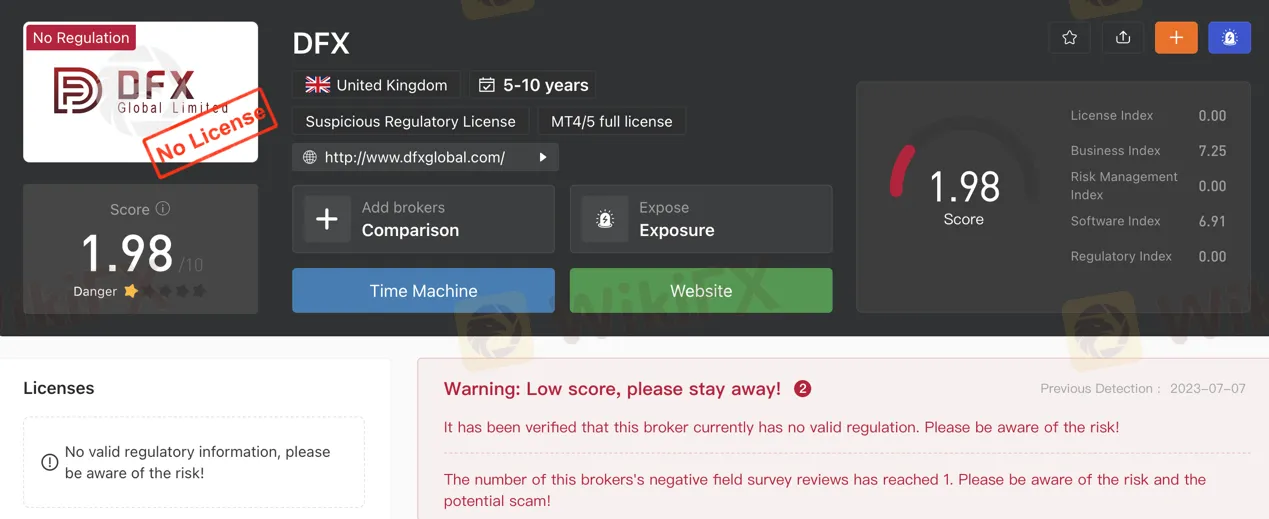

Is DFX Legit?

DFX, the broker in question, lacks proper regulation, which has been confirmed. This absence of valid regulation poses a significant risk to potential investors or traders. It is crucial to exercise caution and be mindful of the potential dangers associated with engaging with an unregulated broker. The fact that this broker has received negative field survey reviews further emphasizes the need to be vigilant and wary of possible scams.

Market Instruments

Cryptocurrency Trading: DFX offers a wide range of cryptocurrencies for trading, allowing users to buy, sell, and trade various digital assets. Some examples of cryptocurrencies available on DFX include Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP). Users can take advantage of price fluctuations and market movements to potentially generate profits through cryptocurrency trading.

Tokenized Assets: DFX allows users to tokenize real-world assets, such as stocks, commodities, and indices. Tokenization involves representing these assets as digital tokens on the blockchain, making them easily tradable and accessible to a wider audience. Examples of tokenized assets available on DFX include Apple (AAPL) stocks, gold (XAU) tokens, and S&P 500 (SPX) index tokens.

Decentralized Lending: DFX provides a decentralized lending platform that allows users to lend and borrow cryptocurrencies. Users can lend their idle assets to earn interest or borrow assets by using their existing holdings as collateral. This type of lending offers convenience for users who want to earn passive income or access additional funds without going through traditional financial institutions.

Margin Trading: DFX enables margin trading, which allows users to trade with borrowed funds, amplifying potential profits or losses. Traders can leverage their positions to increase their buying power and participate in larger trades. Margin trading on DFX offers traders the opportunity to magnify their investment returns but also involves higher risk due to potential losses exceeding the initial investment.

Decentralized Options: DFX provides a decentralized options trading platform, allowing users to trade options contracts without the need for intermediaries. Users can engage in options trading to hedge against price volatility or speculate on the future price movement of cryptocurrencies. Examples of options available on DFX include call options, put options, and various expiration dates.

These market instruments offered by DFX cater to a wide range of trading and investment strategies, providing users with opportunities to engage in different types of financial activities within the cryptocurrency ecosystem.

Pros and Cons

| Pros | Cons |

| Offers a wide range of cryptocurrencies for trading | Lack of specific information on trading volumes or market depth |

| Allows tokenization of real-world assets | Limited types of instruments other than cryptocurrencies |

| Provides a decentralized lending platform | |

| Enables margin trading, amplifying potential profits |

Account Types

Individual Accounts: Individual accounts on DFX are designed for individual traders and investors. These accounts provide a personal platform for individuals to access and trade the available market instruments. Individual accounts are commonly used by retail traders who want to engage in cryptocurrency trading or participate in the foreign exchange market. They offer the options to manage personal funds and make independent trading decisions.

Corporate Accounts: Corporate accounts are tailored for businesses and organizations that wish to engage in trading activities on DFX. These accounts allow companies to manage their funds and execute trades on behalf of their organization. Corporate accounts may be used by businesses that engage in cross-border transactions and require foreign exchange services or those that want to diversify their investment portfolios. They offer additional features and permissions that cater to the specific needs of corporate entities.

Institutional Accounts: Institutional accounts on DFX are designed to meet the requirements of large financial institutions, such as banks, hedge funds, and asset management firms. These accounts provide access to advanced trading tools, high liquidity, and specialized services tailored to institutional investors. Institutional accounts may require higher minimum deposit requirements and offer additional support and resources to facilitate large-scale trading activities.

Pros and Cons

| Pros | Cons |

| Individual Accounts provide a personal platform | Lack of information on specific features and benefits |

| Corporate Accounts allow businesses to manage funds and execute trades | No details on additional features and permissions offered |

| Institutional Accounts cater to the needs of large financial institutions | Higher minimum deposit requirements for institutional accounts |

Leverage

DFX offers up to 10x leverage on all trades. This means that you can control 100 USD worth of an asset with a deposit of only 10 USD. However, it is important to note that leverage can magnify your losses as well as your gains. Therefore, it is important to use leverage carefully and only if you understand the risks involved.

Spreads & Commissions

DFX charges spreads on all trades, typically around 0.10% - 0.20%. There are no commissions on trades, but there is a withdrawal fee of 0.10% for fiat withdrawals and 0.0005 BTC for BTC withdrawals. For example, if you trade 100 USD worth of EUR/USD, you would pay a spread of around 0.10 USD. This means that you would receive 99.90 USD in EUR after the trade is executed.

Minimum Deposit

The minimum deposit for DFX is USD 10 for fiat deposits and 0.001 BTC for BTC deposits. There is no minimum deposit for cryptocurrency deposits other than BTC.

Deposit & Withdraw

DFX supports a variety of deposit and withdrawal methods, including fiat deposits via bank transfer, credit card, or debit card, and cryptocurrency deposits and withdrawals via sending tokens to DFX's deposit address or the user's desired address. The fees for deposits and withdrawals vary depending on the method used. The processing times for deposits and withdrawals also vary depending on the method used, but they are generally fast.

Pros and Cons

| Pros | Cons |

| Supports multiple deposit and withdrawal methods | Fees vary depending on the method used |

| Deposits accepted via bank transfer, credit/debit card | No specific positive words used in the description |

| Allows cryptocurrency deposits and withdrawals | No information on deposit insurance or protection |

Trading Platforms

Meta Trader 4 is a widely used trading platform provided by DFX. It offers a range of features and functionalities for Windows users. Meta Trader 4 provides traders with a user-friendly interface and a comprehensive set of tools for executing trades, analyzing market data, and managing positions. It supports various order types, including market orders, limit orders, and stop orders, allowing traders to enter and exit positions according to their preferred strategies. With Meta Trader 4, traders can access real-time market prices, historical data, and customizable charts, which can aid in making informed trading decisions. The platform also supports the use of expert advisors (EAs) and automated trading systems, enabling traders to implement algorithmic strategies.

Pros and Cons

| Pros | Cons |

| Widely used Meta Trader 4 trading platform | No mention of advanced trading tools or features |

| User-friendly interface and comprehensive trading tools | Lack of information on trading volumes or market depth |

| Supports various order types for trading strategies | Main website is currently not available |

Educational Tools

Online Courses

DFX offers a variety of online courses on a variety of topics related to child development and pediatric therapy. These courses are designed to provide clinicians, educators, and parents with the knowledge and skills they need to improve the lives of children with special needs.

On-demand Webinars

DFX also offers a variety of on-demand webinars on a variety of topics related to child development and pediatric therapy. These webinars are designed to provide clinicians, educators, and parents with the latest information on the latest research and trends in the field.

Live Events

DFX hosts a variety of live events, such as conferences, workshops, and trainings. These events provide clinicians, educators, and parents with the opportunity to network with other professionals, learn from experts, and share their own experiences.

Learning Resources

DFX also offers a variety of learning resources, such as articles, blog posts, and infographics. These resources are designed to provide clinicians, educators, and parents with the information they need to stay up-to-date on the latest research and trends in the field.

Customer Support

DFX provides customer support through multiple channels. For immediate assistance, customers can reach out to DFX through QQ at 3300728517 or via email at service@dfxglobal.com. These contact options allow customers to directly connect with the support team for inquiries, issues, or any assistance they may require.

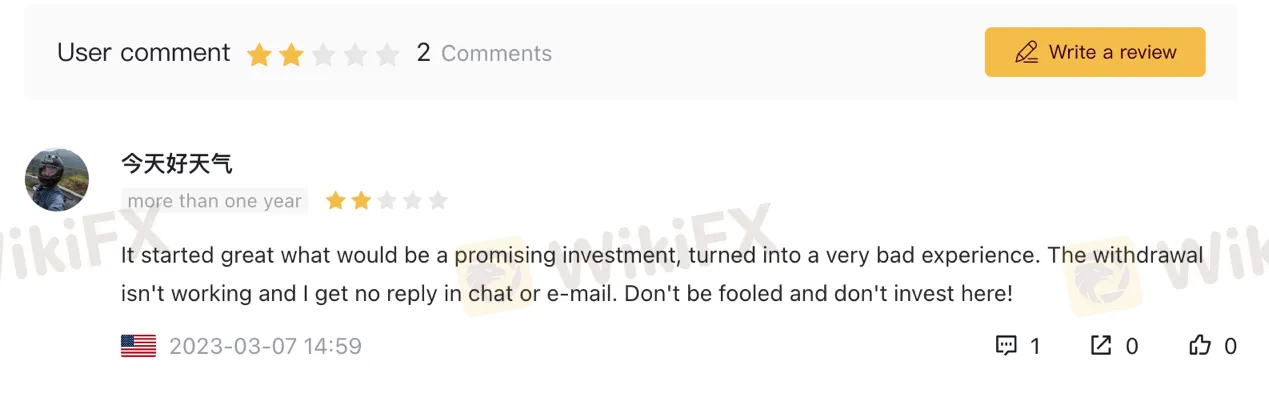

Reviews

The reviews of DFX on WikiFX reflect a negative sentiment from some investors. These reviews highlight issues with the withdrawal process and difficulties in receiving prompt responses through chat or email. The reviewers express disappointment and warn others not to invest with DFX based on their negative experiences.

Conclusion

In conclusion, DFX, the unregulated broker, presents potential risks due to its lack of proper regulation. It is important for investors and traders to exercise caution and be aware of the associated dangers. DFX offers a range of market instruments, including cryptocurrency trading, tokenized assets, decentralized lending, margin trading, and decentralized options, catering to various trading and investment strategies. The account types available on DFX include individual, corporate, and institutional accounts, each tailored to different needs. DFX provides leverage of up to 10x, which can amplify both gains and losses, necessitating careful use. Spreads are charged on trades, while commissions are absent, and there are minimum deposit requirements. DFX supports multiple deposit and withdrawal methods, with low fees and processing times. The Meta Trader 4 trading platform is offered, providing a user-friendly interface and comprehensive tools for trading and analysis. DFX offers educational resources such as online courses, on-demand webinars, live events, and learning materials. Customer support is available through QQ and email. However, negative reviews on WikiFX highlight issues with the withdrawal process and communication.

FAQs

Q: Is DFX a legitimate broker?

A: DFX lacks proper regulation, posing risks to potential investors. Exercise caution when dealing with an unregulated broker.

Q: What market instruments does DFX offer?

A: DFX offers cryptocurrency trading, tokenized assets, decentralized lending, margin trading, and decentralized options.

Q: What types of accounts are available on DFX?

A: DFX offers individual, corporate, and institutional accounts to cater to different traders and investors.

Q: What leverage does DFX provide?

A: DFX offers up to 10x leverage on trades, but remember that it can amplify both gains and losses.

Q: What are the spreads, commissions, and minimum deposit on DFX?

A: DFX charges spreads (0.10% - 0.20%) but has no commissions. The minimum deposit is $10 for fiat deposits and 0.001 BTC for BTC deposits.

Q: How can I deposit and withdraw funds on DFX?

A: DFX supports various methods for deposits and withdrawals, including fiat and cryptocurrency options.

Q: What trading platform does DFX offer?

A: DFX provides Meta Trader 4, a popular trading platform with a user-friendly interface and comprehensive tools.

Q: What educational tools does DFX offer?

A: DFX offers online courses, on-demand webinars, live events, and learning resources on child development and pediatric therapy.

Q: How can I contact DFX customer support?

A: You can contact DFX customer support through QQ or email for prompt assistance.

Q: What do the reviews say about DFX?

A: Some reviews express negative experiences with DFX, particularly regarding withdrawals and communication.

Please note that the provided information is for reference purposes only and should not be considered as financial advice.

More

User comment

4

CommentsWrite a review

2024-08-07 14:07

2024-08-07 14:07 2024-03-29 14:55

2024-03-29 14:55