User Reviews

More

User comment

7

CommentsWrite a review

2023-02-24 12:13

2023-02-24 12:13

Score

5-10 years

5-10 yearsRegulated in United Kingdom

Forex Execution License (STP)

Suspicious Scope of Business

Cyprus Forex Execution License (STP) Revoked

High potential risk

Influence

Add brokers

Comparison

Quantity 33

Exposure

Score

Regulatory Index6.32

Business Index7.83

Risk Management Index0.00

Software Index5.69

License Index5.50

Single Core

1G

40G

More

Danger

Danger

Danger

More

Company Name

London Capital Group Ltd

Company Abbreviation

LONDON CAPITAL GROUP

Platform registered country and region

United Kingdom

Company website

Company summary

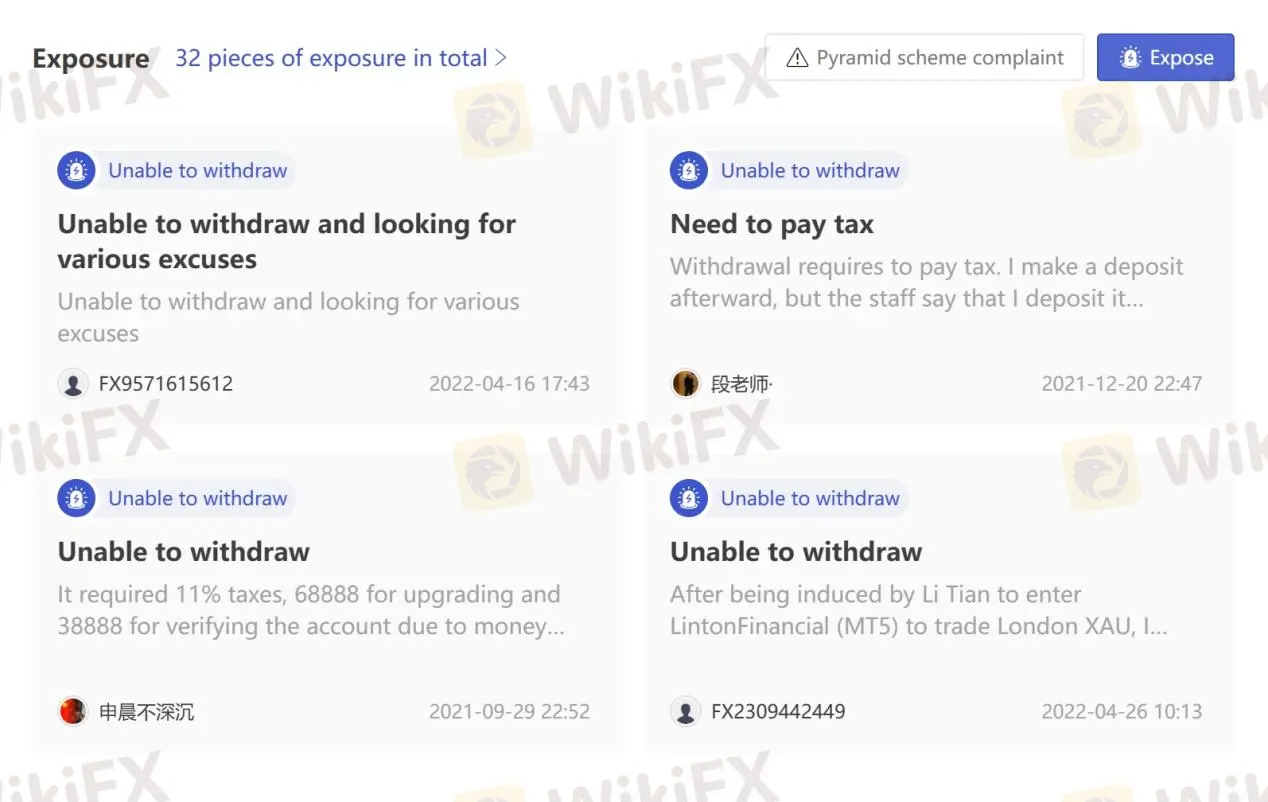

Pyramid scheme complaint

Expose

Fake LCG

It rejected my withdrawal for several times. It was a fraud platform which led me to deposit with scams.

The money cannot be withdrawn, the parent company filed for bankruptcy, and the subsidiary has to withdraw from the Chinese market

After being induced by Li Tian to enter LintonFinancial (MT5) to trade London XAU, I could not withdraw money, resulting in only playing with numbers. The platform disappears for no reason, and it is impossible to withdraw money and contact, and it is a proper romance scam.

I WAS ASKED TO PAY 30% TAX. Must be a scam.

Withdrawal requires to pay tax. I make a deposit afterward, but the staff say that I deposit it indiscriminately.

It required 11% taxes, 68888 for upgrading and 38888 for verifying the account due to money laundering. Finally the account would be blocked.

A few months ago, they contacted me so that they could invest in LCG, with the theme of using cryptocurrency for mining, so that your daily profitability can reach 1.5%; I entered $25 to prove it, and one month later, I wanted to re-enter my account and was surprised to find that it did not exist. be careful

Unable to withdraw and looking for various excuses

It required margins in order to unlock the account because of money laundering. I wanted to get my principal back.

The website of fraud LCG is www.lcg-chi.com. Its service kept fending off. At 23:48, June 3rd, I found that the fund has be returned into the backstage.

The first time I made a withdrawal, the customer service said that my account was locked because of wrong number. And I must be deposit 2,000 dollars to unlock it and proceed with the withdrawal. After unlocking, I need to withdraw money. But he said that I should deposit another 3,000 dollars. The staff said that it is impossible to withdraw without the remittance deposit. It is a scam. What should I do?

Fraud platform. Beware of it. I lost more than 2 million. Stay away from it.

I just withdraw funds successfully once. And I truly think this is a scam group. I’ve lost tens of thousands here.

The customer service asked me to offer my ID card and proof of address which I already offered when I opened my account. Please pay attention. They may wanna embezzle my money

During August 3 to 9, I deposited fund into over 10 a26ccounts, with amount totaling to 100 thousand dollars. I suffered losses most of the time. The commission was up to $24866.17. During trading time, I hadn’t received any email that mentioned about violation. Since 10th, LCG gave no access to withdrawal. Who would compensate me this 100 thousand? Actually, I don’t know what is scalping trading. My clients all traded regularly, while the profits were unavailable. Will you give the indemnity? Did you define it by how much we profit?

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| LCG Review Summary in 10 Points | |

| Founded | 1996 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA |

| Market Instruments | CFDs on forex, shares, indices, spot metals, futures, bonds, options and ETFs |

| Demo Account | Available |

| Leverage | 1:200 |

| EUR/USD Spread | 1 pip |

| Trading Platforms | LCG Trader & MT4 |

| Minimum deposit | $100 |

| Customer Support | Phone, email |

Founded in 1996 and headquartered in London, UK, London Capital Group (LCG) has been an online trading provider for over twenty years, committed to providing competitive pricing, advanced technology, and professional service to all types of investors. Concerning regulation, LCG is authorized and regulated by the Financial Conduct Authority (FCA) under regulatory license: 182110.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

LCG has several notable strengths, including its regulation by the Financial Conduct Authority (FCA), a wide range of tradable instruments, and access to multiple trading platforms. With its years of experience in the industry, LCG has established a reputation for providing a transparent and reliable trading environment. The broker also offers educational resources to support traders in their learning journey.

However, it is important to consider some potential drawbacks. There have been reports of difficulties with withdrawals, which can be a concerning factor for traders.

| Pros of LCG | Cons of LCG |

| • FCA-regulated | • Reports of difficulties with withdrawals. |

| • Has been in operation for many years, indicating experience in the industry | • Clients from some countries are not accepted |

| • Over 7,000 trading instruments available | • Limited trading tools |

| • Demo & Islamic accounts available | |

| • MT4 & proprietary platform available | |

| • Multiple payment methods | |

| • Rich educational resources | |

| • Transparent and reliable trading environment |

Please note that the information provided is based on the available data and may not reflect the complete picture of LCG. It's important to conduct thorough research and consider individual trading needs before choosing a broker.

There are many alternative brokers to LCG depending on the specific needs and preferences of the trader. Some popular options include:

Windsor Brokers: A reputable broker with a diverse range of trading instruments and reliable customer support.

FOREX TB: A user-friendly platform with competitive spreads and a wide selection of trading tools.

Markets.com: A well-regulated broker offering a comprehensive range of assets, advanced trading platforms, and excellent customer service.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

LCG (London Capital Group) being regulated by the Financial Conduct Authority (FCA, License No. 182110) is a positive aspect indicating a higher level of oversight and compliance. However, the reports of difficulties with withdrawals should be a cause for concern and warrant further investigation. It is important for potential investors to exercise caution and conduct thorough research before engaging with LCG or any other broker. Checking for additional reviews and feedback from reliable sources can help in assessing the safety and reliability of the broker.

LCG offers investors over 7,000 financial trading instruments across 9 major asset classes, including Forex, spot metals, indices, commodities, shares, bonds & interest rates, vanilla options, and exchange traded funds (ETFs). Forex products include CFDs in over 60 currencies, with a full range of popular markets such as USDEUR, GBPUSD, and GBPJPY. Commodities include precious metals such as gold and silver, energies such as US crude oil and Brent crude oil, and soft commodities such as coffee and sugar. Stocks cover 3,500 stocks in the UK, US, and European markets.

A total of three types of trading accounts are available: Islamic, ECN, and CFD trading accounts.

Islamic accounts are also known as swap-free accounts as they imply no swap or rollover interest on overnight positions. LCG offers Sharia-compliant trading options that adhere to Islamic principles. This account is designed to accommodate the requirements of traders who follow Islamic finance principles.

ECN (Electronic Communication Network) accounts allow traders to trade from 0 pips with no requotes and direct market access.

Spreads starting from 0 pips and no requotes

Maintain a $10,000 account balance to qualify

Trade on MT4 trading platform

This account is suited for traders who prefer tighter spreads and faster execution speeds.

CFD trading-Trade CFD contacts accross a wide range of asset classes, including forex, shares, spot metals, futures, bonds and interest rates. Choose between its proprietary web-based LCG Trader platform or MT4 with all benefit of LCG's price improvement technologies and superior execution.

A choice of two platforms available on any of your devices

Trade over 7,000 instruments across 9 different classes

Competitive pricing and reliable execution

Access to a wealth of analysis, research and educational material

Demo accounts

For traders looking to explore the markets without risking real money, LCG offers demo accounts. These accounts allow users to practice their trading strategies and familiarize themselves with the platform's features using virtual funds. Demo accounts serve as valuable learning tools for both beginner and experienced traders.

Leverage

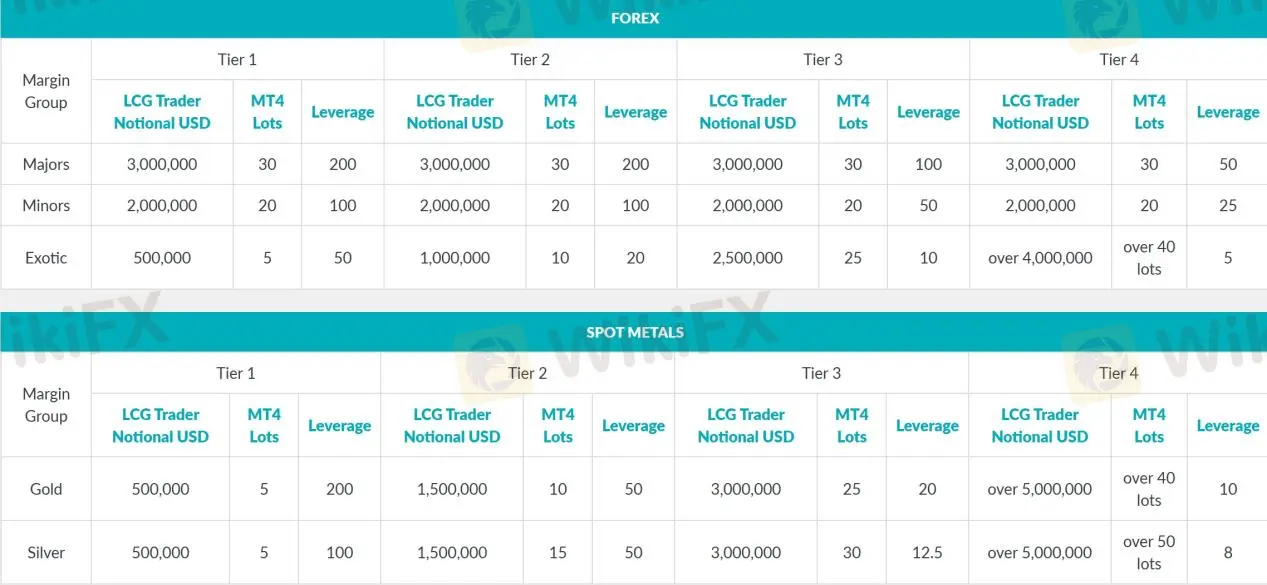

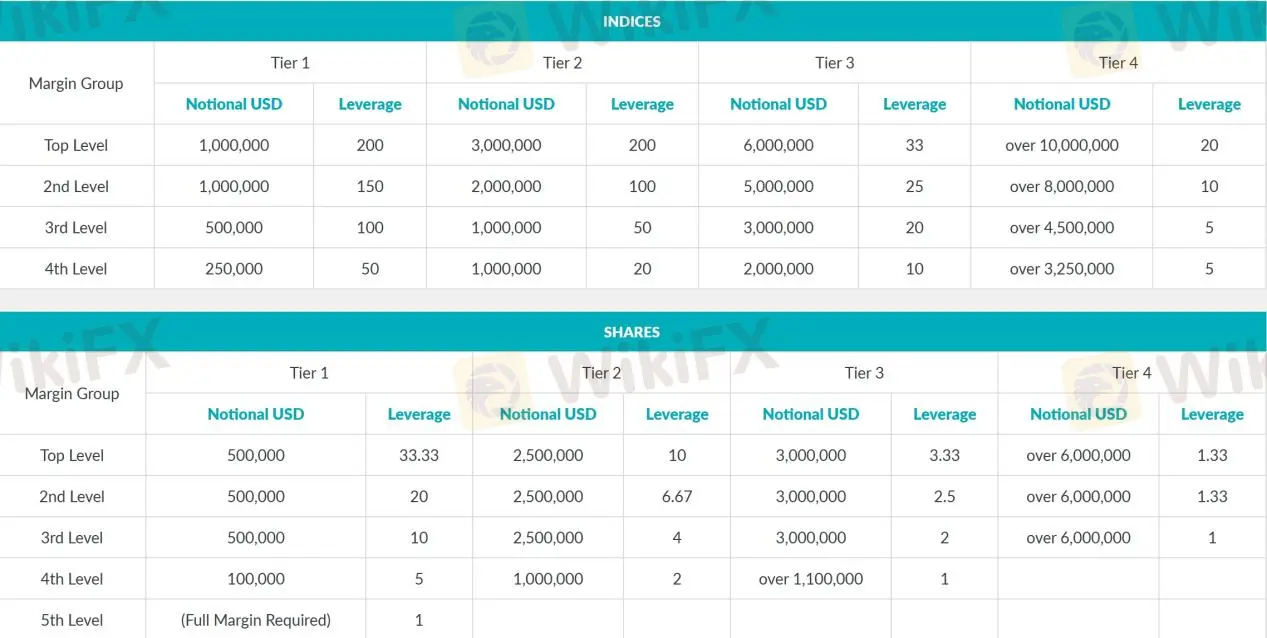

LCG' s leverage level is determined by a tier system, which ranges from Tier 1 to Tier 4. The more exotic the pair and the higher the Tier, the lower the maximum leverage level will be. This is due to compliance requirements and protection of traders.

Each trading instrument has a leverage level which is worked out according to the margin group and the Tier Level. Take Tier 1 leverage as an example, for major forex pairs, gold, indices, commodities, bonds, and rates, LCG offers leverage of up to 1:200. This allows traders to amplify their trading positions and potentially increase their potential profits or losses. For minor forex pairs and silver, the leverage offered is up to 1:100. Forex exotic pairs have a leverage of up to 1:50, while shares have a leverage of up to 1:33.33.

The varying leverage levels reflect the different risk profiles and volatility associated with each asset class. It is important for traders to carefully consider their risk tolerance and trading strategies when utilizing leverage to ensure responsible and informed trading decisions.

LCG offers competitive spreads on its trading instruments, with the minimum spread for the popular EUR/USD pair starting at 1 pip. However, it's important to note that spreads may vary depending on market conditions and the specific trading instrument being traded. For traders opting for the ECN account, spreads start from 0 pips, which can be beneficial for those looking for tighter spreads and potentially lower trading costs.

It's worth mentioning that LCG does not provide explicit information on commissions, so it's advisable for traders to contact LCG directly or refer to their official documentation to get a clear understanding of any potential commission charges that may apply to their trading activities.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions |

| LCG | 1 | Not specified |

| Windsor Brokers | 1.5 | No commissions |

| FOREX TB | 0.6 | No commissions |

| Markets.com | 0.7 | No commissions |

Please note that the information provided may be subject to change, and it's always recommended to verify the latest details directly from the brokers' official websites or contact their customer support for the most accurate and up-to-date information.

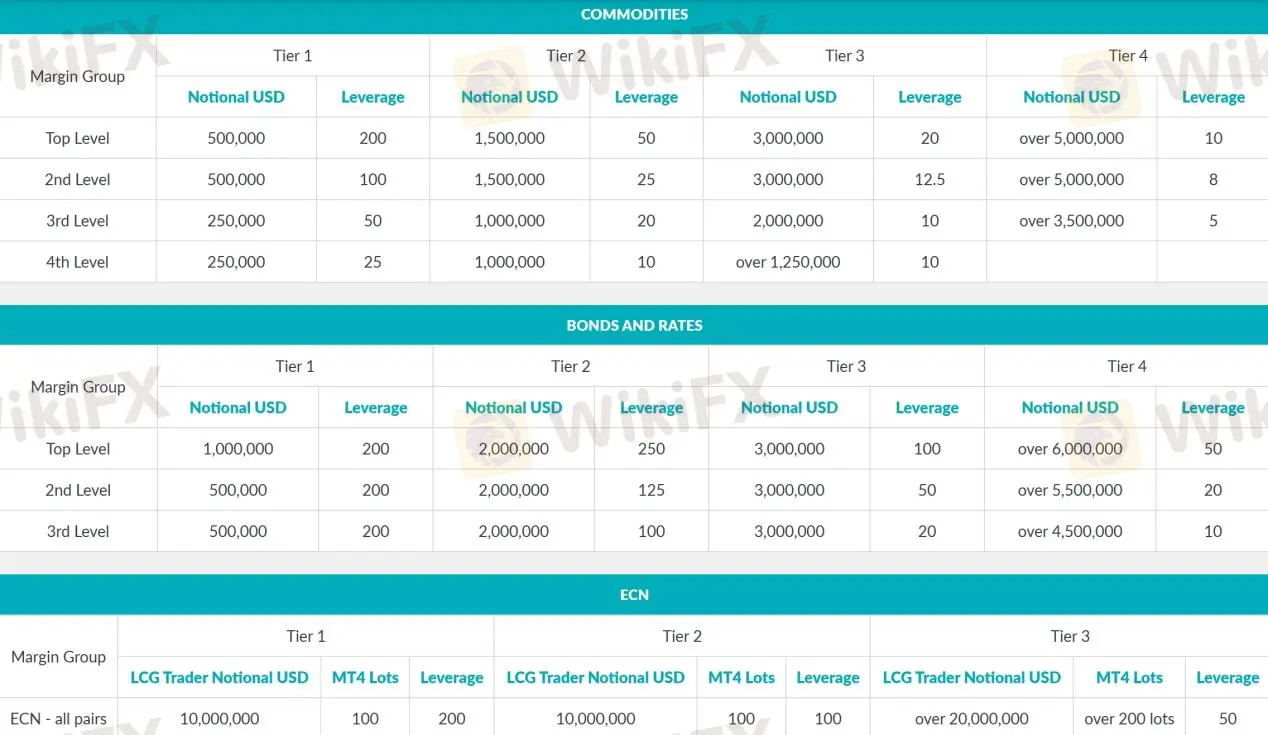

LCG provides a proprietary trading platform, LCG Trader, offers a wide range of market data, charts, news, and analysis to help investors build their trading strategies and can be used on laptops, tablets, and cell phones.

Besides, clients can also trade on the popular MetaTrader 4 (MT4) forex trading platform, available in 39 languages, the platform offers a combination of free indicators, automated trading, advanced charting, and a range of trading tools, technical indicators, and graphical objects.

With both LCG Trader and MT4, traders have the flexibility to choose the platform that best suits their trading style and preferences. These platforms provide access to LCG's diverse range of trading instruments and enable traders to execute trades, analyze markets, and manage their positions effectively.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| LCG | LCG Trader, MetaTrader 4 |

| Windsor Brokers | MT4, MT5, GWAZY Trading Platform |

| FOREX TB | MetaTrader 5 (MT5) |

| Markets.com | Marketsx, MetaTrader 4, WebTrader |

The company supports bank transfers, Visa, MasterCard, UnionPay, Southeast Asia Realtime banking, Skrill, and Neteller. Credit card deposits are subject to a 2% fee, while other deposit methods do not incur any fees. When it comes to withdrawals, LCG ensures a hassle-free experience by not charging any fees for withdrawals.

The processing time for deposits is relatively quick, with most deposits being processed within 30 minutes. For withdrawals, LCG aims to process requests within one working day, providing prompt access to funds.

| LCG | Most other | |

| Minimum Deposit | $100 | $100 |

By offering a range of trusted payment options and efficient processing times, LCG strives to provide a seamless and convenient deposit and withdrawal experience for its traders.

See the deposit/withdrawal fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee |

| LCG | Free | Free |

| Windsor Brokers | Free | Free |

| FOREX TB | Free | Free |

| Markets.com | Free | Free |

Clients with any inquiries or trading-related issues can get in touch with LCG Monday to Friday from 5:00 to 22:00 (GMT) through the following contact channels:

Phone: +1 (0) 242 601 6866

Email: customerservices.bhs@lcg.com

Additionally, LCG maintains an active presence on various social media platforms such as LinkedIn, Twitter, Facebook, YouTube, and Instagram, allowing clients to stay updated with the latest news and developments.

Furthermore, LCG provides a comprehensive FAQ section on its website, which addresses common queries and provides valuable information for clients seeking quick answers to their questions.

Overall, LCG's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • Responsive customer support | • Limited customer service hours (Monday to Friday) |

| • Multiple contact channels available | • Lack of 24/7 customer support |

| • Social media presence for updates and news | |

| • FAQ section for quick reference |

Note: These pros and cons are subjective and may vary depending on the individual's experience with LCG's customer service.

On our website, you can see that many reports of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

LCG provides a range of educational resources to support traders in their journey. Traders can access trading guides, which offer valuable insights and strategies to enhance their trading knowledge. Additionally, LCG offers trading videos that cover various topics, including technical analysis, fundamental analysis, and risk management. Market reports are also available, providing traders with up-to-date information on market trends and analysis.

To further enhance traders' understanding, LCG offers a comprehensive glossary of trading terms, ensuring clarity and comprehension. Furthermore, LCG conducts webinars, allowing traders to participate in interactive sessions led by experienced professionals, where they can learn from real-time market analysis and ask questions.

These educational resources provided by LCG aim to empower traders with the knowledge and skills necessary to make informed trading decisions.

In conclusion, LCG is a regulated broker with a wide range of tradable instruments and multiple trading platforms. With years of experience in the industry, they offer educational resources to assist traders. However, there have been reports of difficulties with withdrawals. Traders are advised to carefully consider these factors before engaging with LCG.

| Q 1: | Is LCG regulated? |

| A 1: | Yes. It is regulated by Financial Conduct Authority (FCA, License No. 182110). |

| Q 2: | What type of broker LCG is? |

| A 2: | LCG is both an STP and ECN broker. |

| Q 3: | At LCG, are there any regional restrictions for traders? |

| A 3: | Yes. The information on their website is not directed at residents of the following countries: Australia, Belgium, Canada, New Zealand, Singapore and United States, and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to the local law or regulation. |

| Q 4: | Does LCG offer demo accounts? |

| A 4: | Yes. |

| Q 5: | Does LCG offer the industry leading MT4 & MT5? |

| A 5: | Yes. It supports LCG Trader & MT4. |

| Q 6: | How much do I need to deposit? |

| A 6: | The minimum deposit is $100 to start trading. |

| Q 7: | Is LCG a good broker for beginners? |

| A 7: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

This article of London Capital Group Review presents a covering key aspects such as its regulatory standing and feedback from real users, including reported complaints and concerns. The goal of this review is to provide traders with a clearer understanding of how London Capital Group operates, helping them make an informed decision about whether the broker aligns with their individual trading goals, preferences, and overall requirements.

WikiFX

WikiFX

LCG Capital Markets Limited, known as FlowBroker, ceases operations due to FlowBank SA's bankruptcy following FINMA's regulatory actions and the appointment of a liquidator.

WikiFX

WikiFX

The FCA restricts London Capital Group's activities, barring them from onboarding new clients following FlowBank's bankruptcy.

WikiFX

WikiFX

The decision was taken after a meeting of the CySEC's board held on April 5, 2021.

WikiFX

WikiFX

More

User comment

7

CommentsWrite a review

2023-02-24 12:13

2023-02-24 12:13