User Reviews

More

User comment

8

CommentsWrite a review

2024-07-19 17:17

2024-07-19 17:17

2024-06-28 14:52

2024-06-28 14:52

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index0.00

Business Index7.15

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

| R24 CAPITAL Review Summary | |

| Founded | 2020 |

| Registered Country/Region | Hong Kong |

| Regulation | Unregulated |

| Market Instruments | Forex, Metals, Energy, Indices, Cryptocurrencies |

| Demo Account | / |

| Leverage | Up to 1:1000 |

| EUR/USD Spread | From 1.8 pips (STP account) |

| Trading Platform | MT4 |

| Min Deposit | $100 |

| Customer Support | Tel: +852 59320907, +1-646 479 0462 |

| Email: info@r24capital.com | |

| Address: Flat A222, 3/F, Phase 2, Hang Fung Industrial Building, 2G Hok Yuen Street, Hung Hom, Kowloon, Hong Kong | |

| O307A-DEIRA TOWER, AL REGA P.O.Box 1451, Dubai, United Arab Emirates | |

Founded in 2020, R24 Capital is an unregulated broker registered in Hong Kong, offering trading in Forex, Metals, Energy, Indices, and Cryptocurrencies with leverage up to up to 1:1000 and spread from 1.8 pips on the STP account via the MT4 account. The minimum deposit requirement to open a live account is $100.

| Pros | Cons |

| Wide range of market instruments | Inaccessible website |

| Multiple account types | Lack of regulation |

| Commission-free for most account types | Limited payment options |

| MT4 supported | Withdrawal fee charged |

No, R24 Capital currently has no valid regulations. Please be aware of the risk!

Tradable financial instruments offered by R24 Capital include forex currency pairs, metals, energies, indices, and cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Energy | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Account Type | Min Deposit |

| STP | $100 |

| VIP | $3 000 |

| ECN | $8 000 |

| Affiliate | $100 |

R24 Capital offers a maximum trading leverage of up to 1:1000 for all account types. While high leverage can amplify potential profits, it also significantly increases the level of risk. Traders should use leverage cautiously and be aware that it can lead to substantial losses if not managed properly.

| Account Type | EUR/USD Spread | Commission |

| STP | From 1.8 pips | ❌ |

| VIP | From 1.0 pips | ❌ |

| ECN | From 0 pips | 7 USD |

| Affiliate | From 2.3 pips | ❌ |

The minimum single trade volume of R24 forex is 0.01 lots. Traders can choose the most suitable trade size according to your current situation. It supports a maximum trade volume of 100 standard lots and can hold up to 1000 orders at the same time.

R24 Capital supports MetaTrader4 (MT4) – a mainstay in the forex industry. MT4 trading platform is recognized as the best trading platform in the forex trading industry, featuring 21 timeframes, a large number of built-into technical indicators, supporting EA as well as automated trading.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | PC, iOS, Android | Beginners |

| MT5 | ❌ | / | Experienced traders |

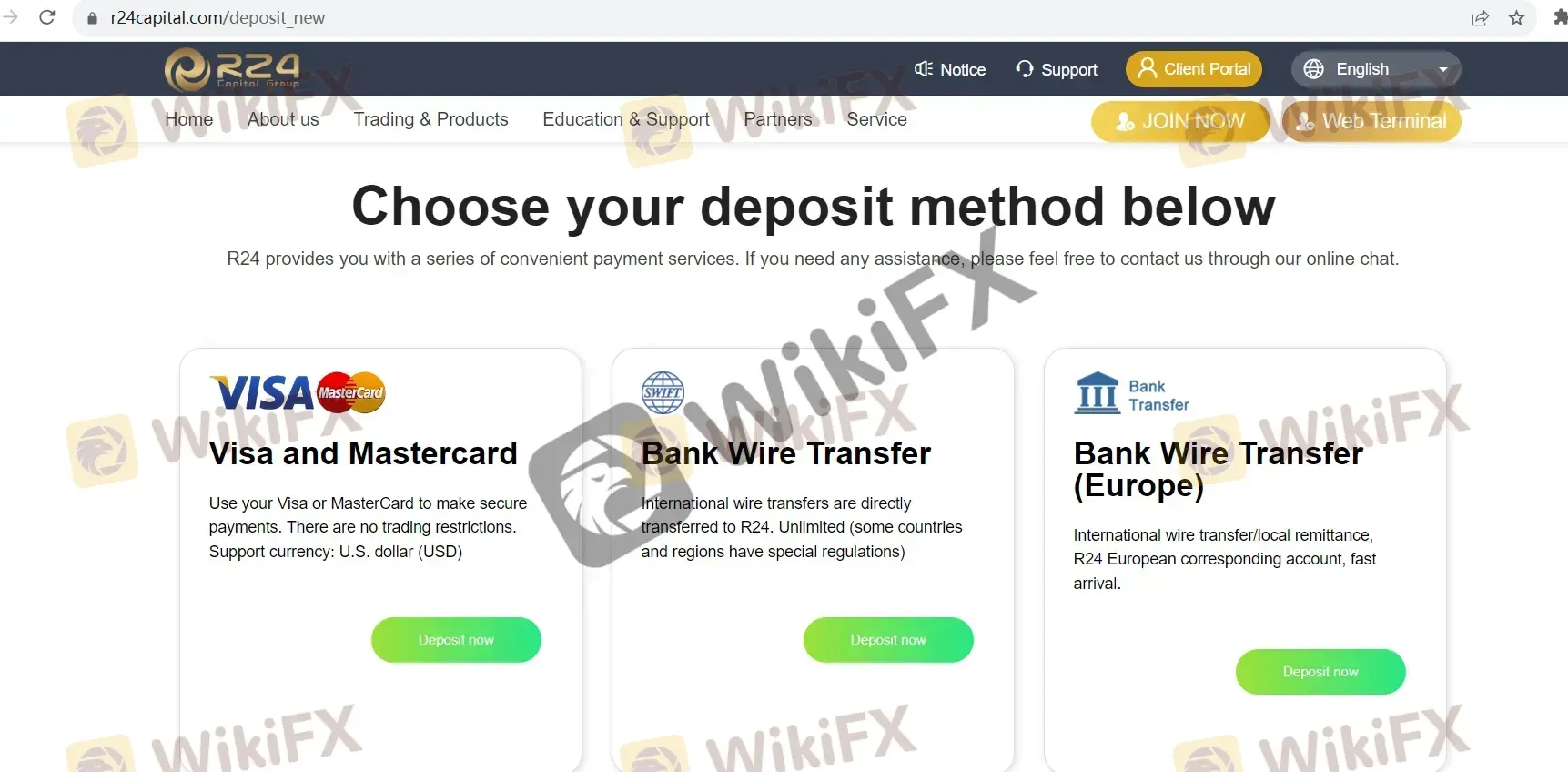

R24 accepts deposits via Visa and Mastercard, Bank Wire Transfer, and Bank Wire Transfer (Europe).

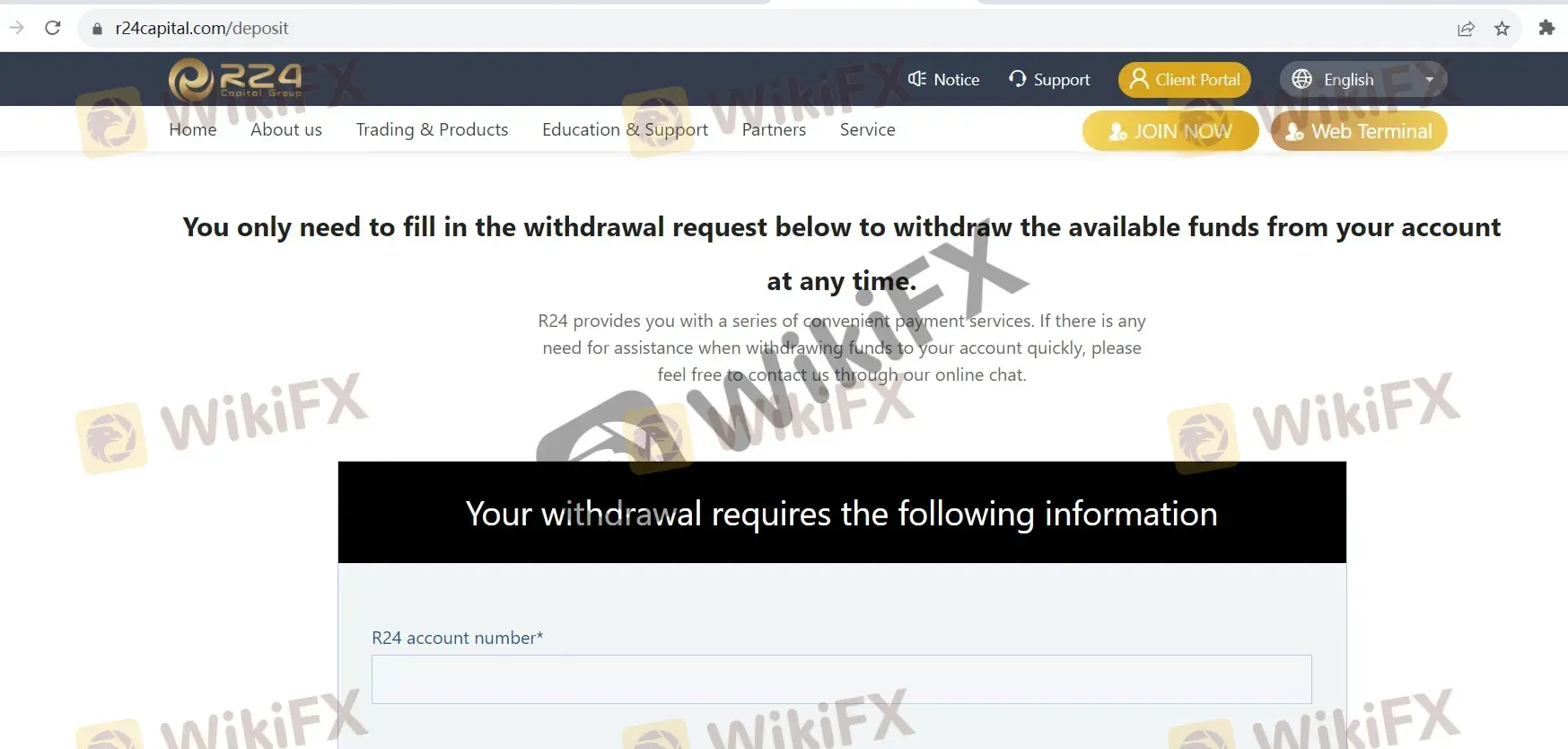

For withdrawals, clients provide necessary information, including account number, name, email, withdrawal amount, and bank details. Withdrawal fees apply, with US$5 for ACH wire transfers within the U.S. and US$75 for international transfers.

Maintaining sufficient funds in the account, matching bank account names, and providing accurate bank details are essential. R24 verifies all withdrawal requests for security and compliance. Clients can seek assistance through online chat for any questions or uncertainties in the process.

More

User comment

8

CommentsWrite a review

2024-07-19 17:17

2024-07-19 17:17

2024-06-28 14:52

2024-06-28 14:52