User Reviews

More

User comment

18

CommentsWrite a review

2025-11-14 20:16

2025-11-14 20:16

2025-10-22 21:14

2025-10-22 21:14

Score

2-5 years

2-5 yearsSuspicious Regulatory License

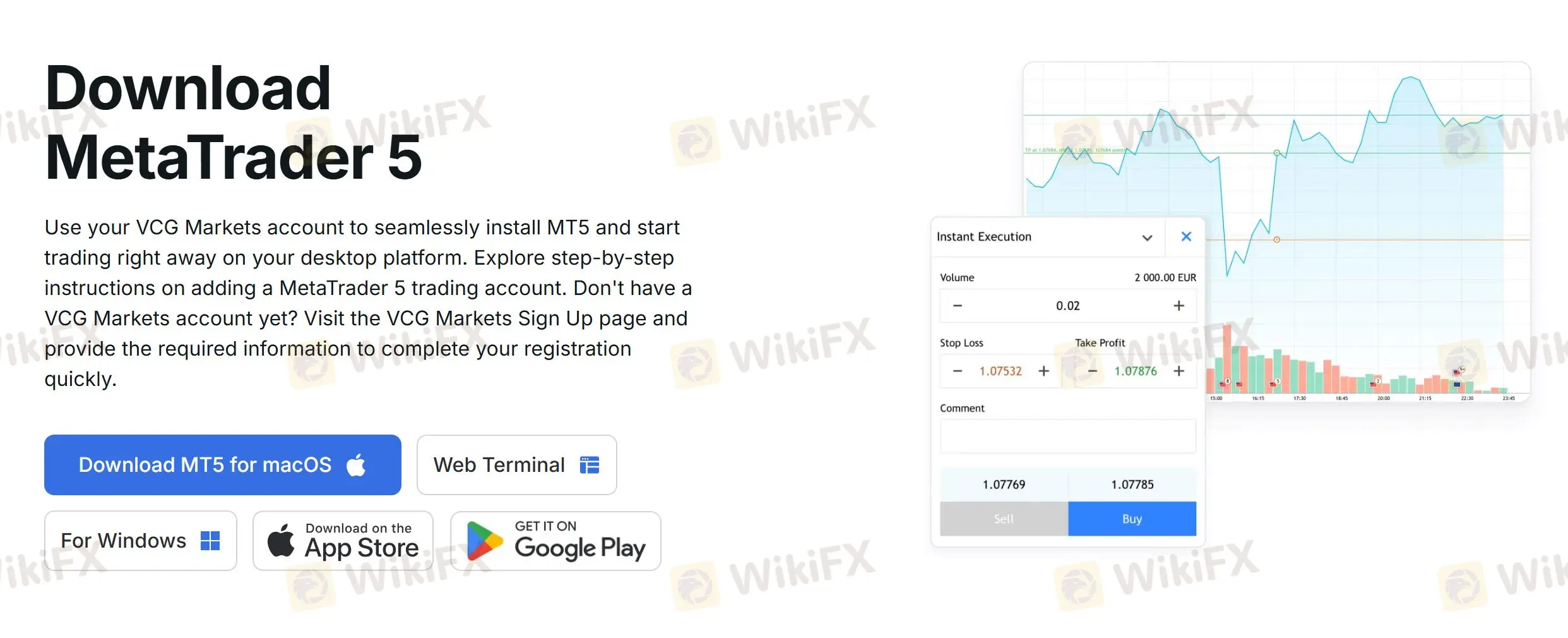

MT5 Full License

Global Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.62

Risk Management Index0.00

Software Index9.21

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

VCG Markets Ltd

Company Abbreviation

VCG Markets

Platform registered country and region

Mauritius

Company website

YouTube

Company summary

Pyramid scheme complaint

Expose

| VCG Markets Review Summary | |

| Founded | 2021 |

| Registered Country/Region | Mauritius |

| Regulation | No regulation |

| Market Instruments | 500+ tradable instruments, CFDs on forex, shares, commodities, indices, cryptos, ETFs |

| Demo Account | ✅ |

| Leverage | / |

| EUR/USD Spread | Floating around 0.6 pips |

| Commission | ❌ |

| Trading Platform | MT5, Mobile App |

| Copy Trading | ✅ |

| Min Deposit | / |

| Customer Support | Live chat, contact form |

| WhatsApp: +23052970988 | |

| Email: support@vcgmarkets.com | |

| Facebook, LinkedIn, YouTube, Instagram, Telegram | |

| Regional Restrictions | The United States of America, Belgium, Canada, Singapore |

Founded in 2021, VCG Markets is an unregulated broker registered in Mauritius, offering 500+ tradable instruments, including CFDs on forex, shares, commodities, indices, cryptos, and ETFs on the MT5 and Mobile App platforms. Demo accounts are available but the minimum deposit requirement to open a live account is unclear.

| Pros | Cons |

| Diverse tradable assets | No regulation |

| Demo accounts | Limited info on trading conditions |

| Tight EUR/USD spread | Regional restrictions |

| No commissions | |

| MT5 platform | |

| Copy trading | |

| Live chat support |

VCG Markets claims to offer negative balance protection, data secured, and segregated funds.

However, there is no evidence showing that this broker holds any regulatory license to prove it operates legally. Please be aware of the risk!

| Tradable Instruments | Supported |

| CFDs | ✔ |

| Forex | ✔ |

| Shares | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptos | ✔ |

| ETFs | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| Trading Platform | Supported | Available Devices | Suitable for |

| Mobile App | ✔ | iOS, Android | / |

| MT5 | ✔ | Mac OS, Web, Windows, iOS, Android | Experienced traders |

| MT4 | ❌ | / | Beginners |

VCG Markets accepts payments via Visa/MasterCard, bank transfers, Neteller, and Apple Pay.

More

User comment

18

CommentsWrite a review

2025-11-14 20:16

2025-11-14 20:16

2025-10-22 21:14

2025-10-22 21:14