User Reviews

More

User comment

5

CommentsWrite a review

2025-05-25 02:18

2025-05-25 02:18

2025-05-25 00:22

2025-05-25 00:22

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index0.00

Business Index6.94

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

SKY LADDER LLC

Company Abbreviation

iq option

Platform registered country and region

Antigua and Barbuda

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| IQ Option Review Summary | |

| Founded | 2013 |

| Registered Country/Region | Antigua and Barbuda |

| Regulation | No regulation |

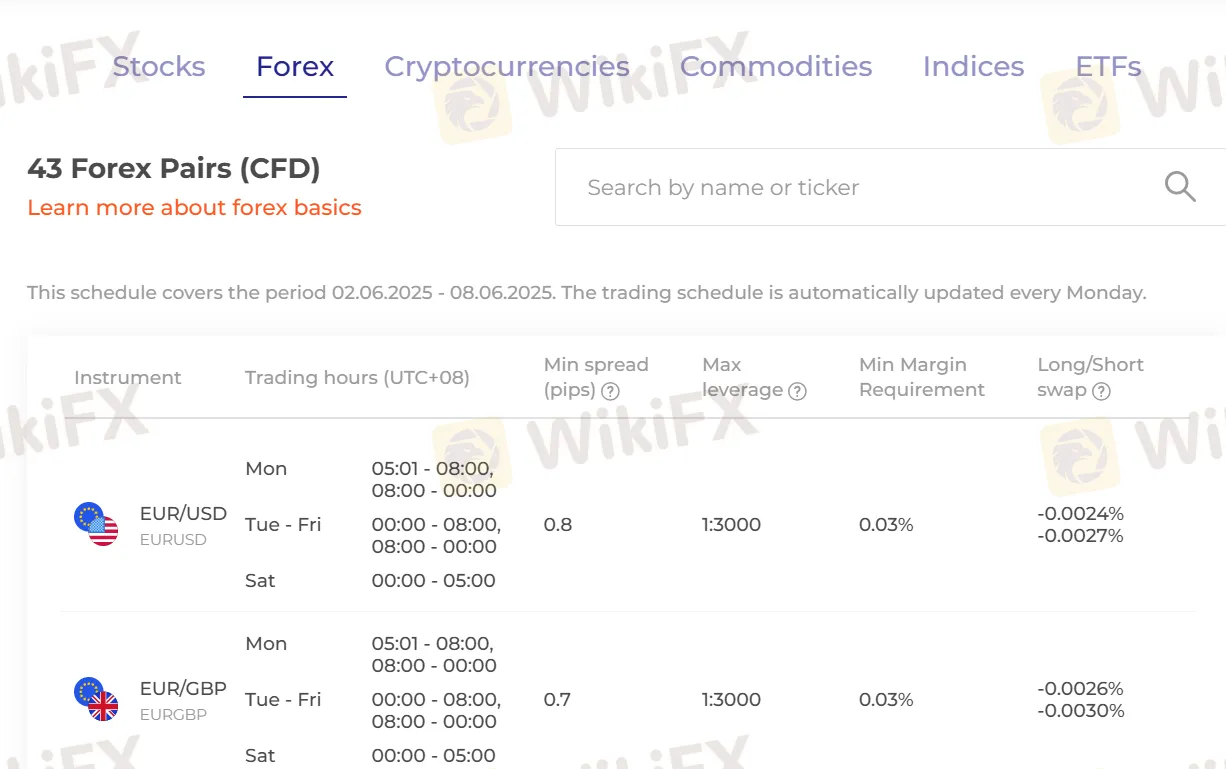

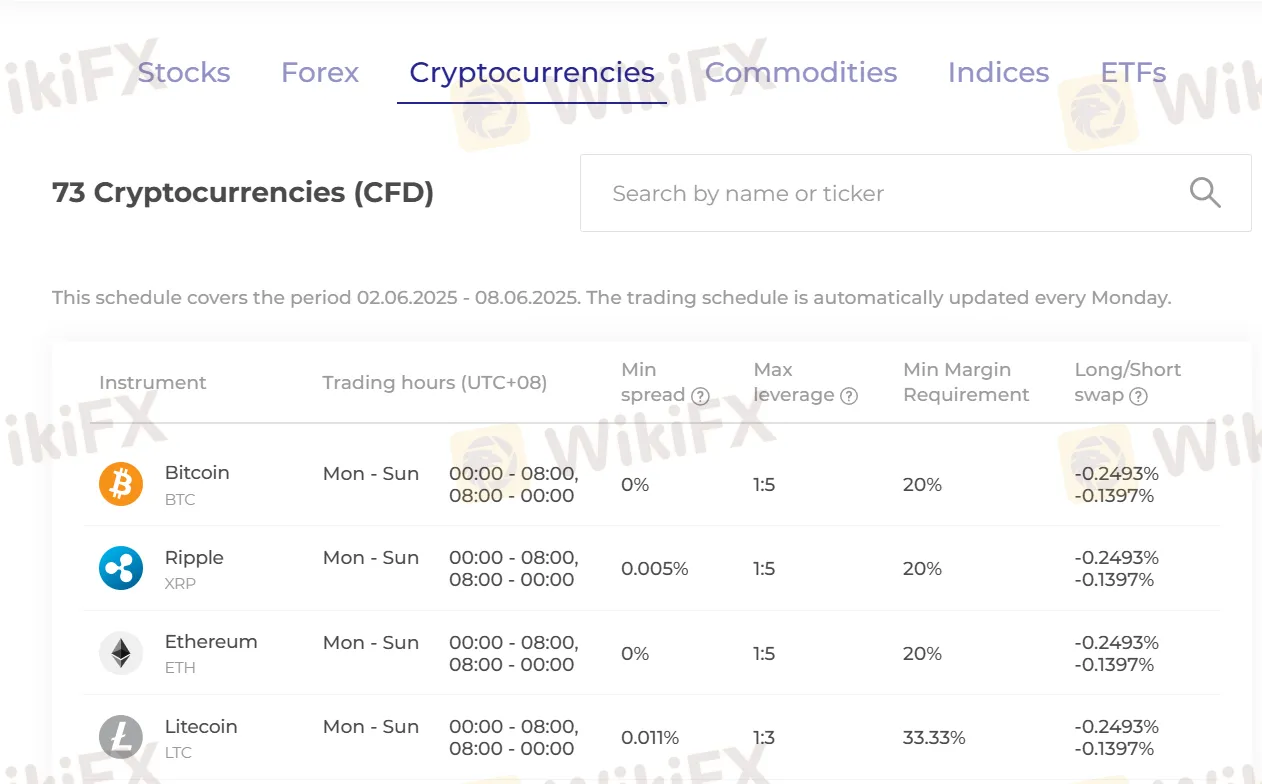

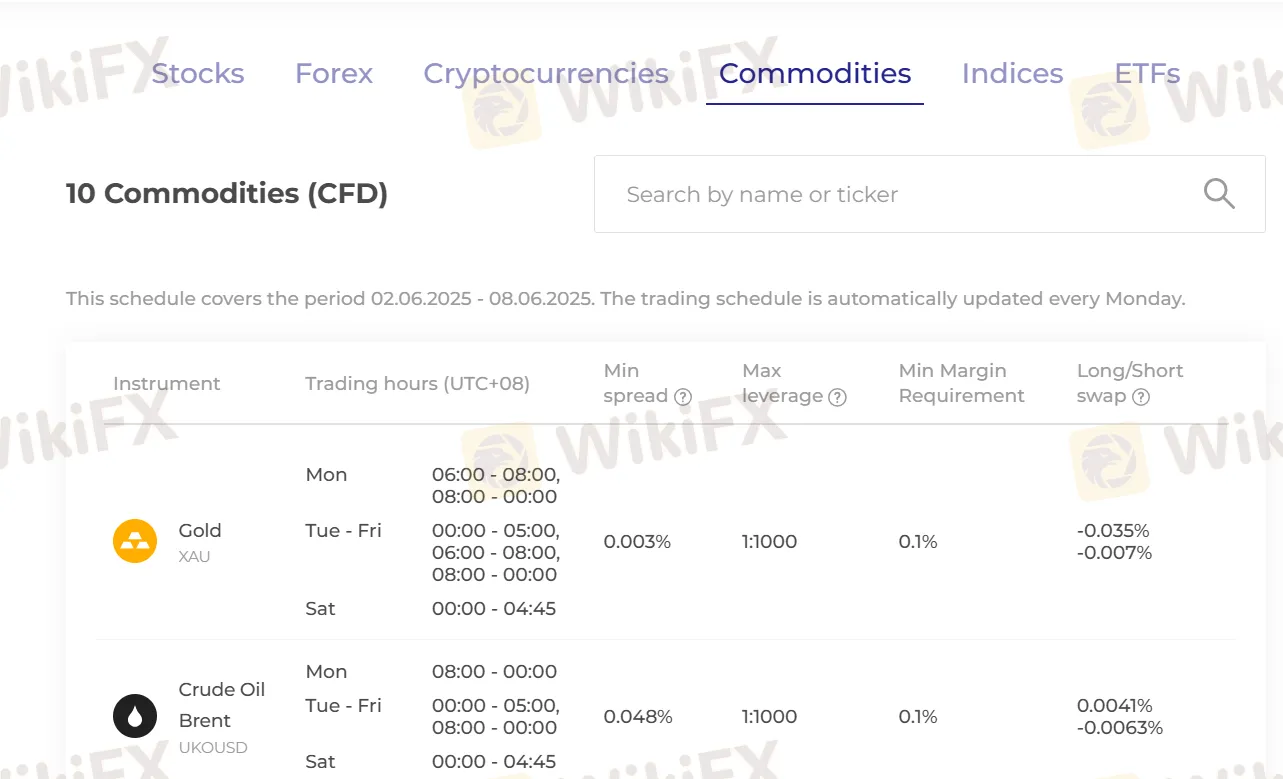

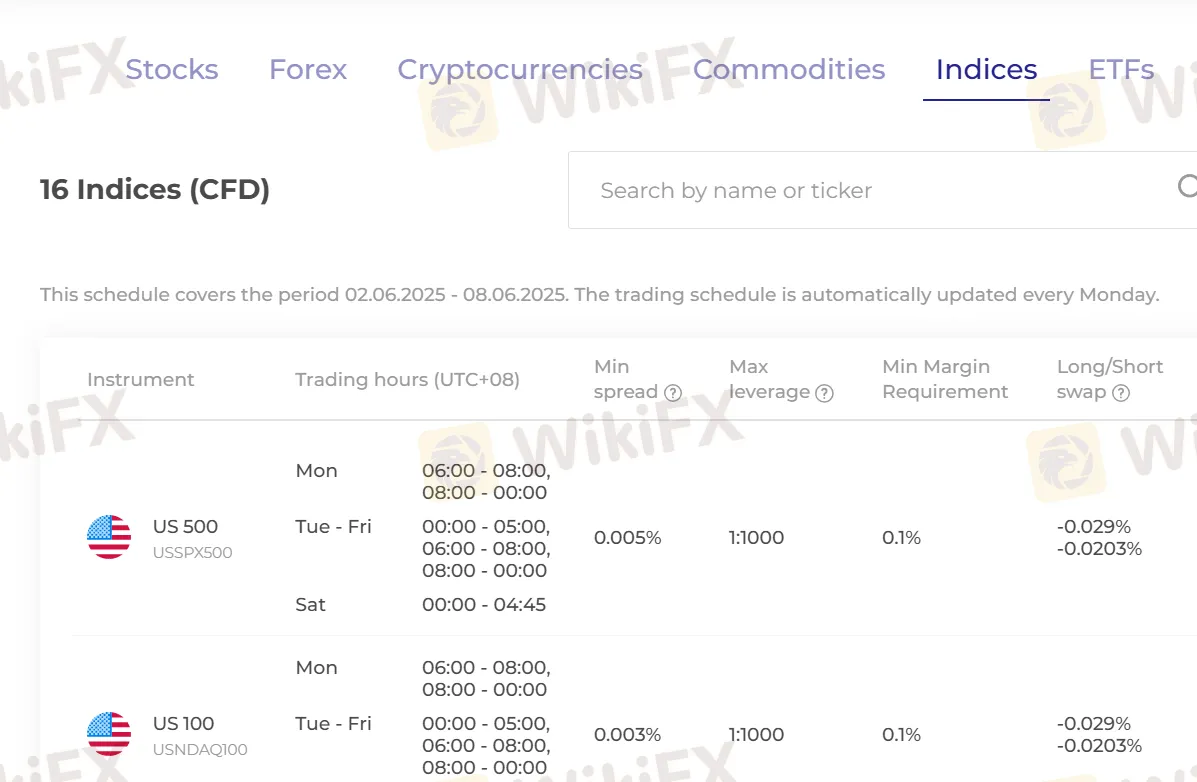

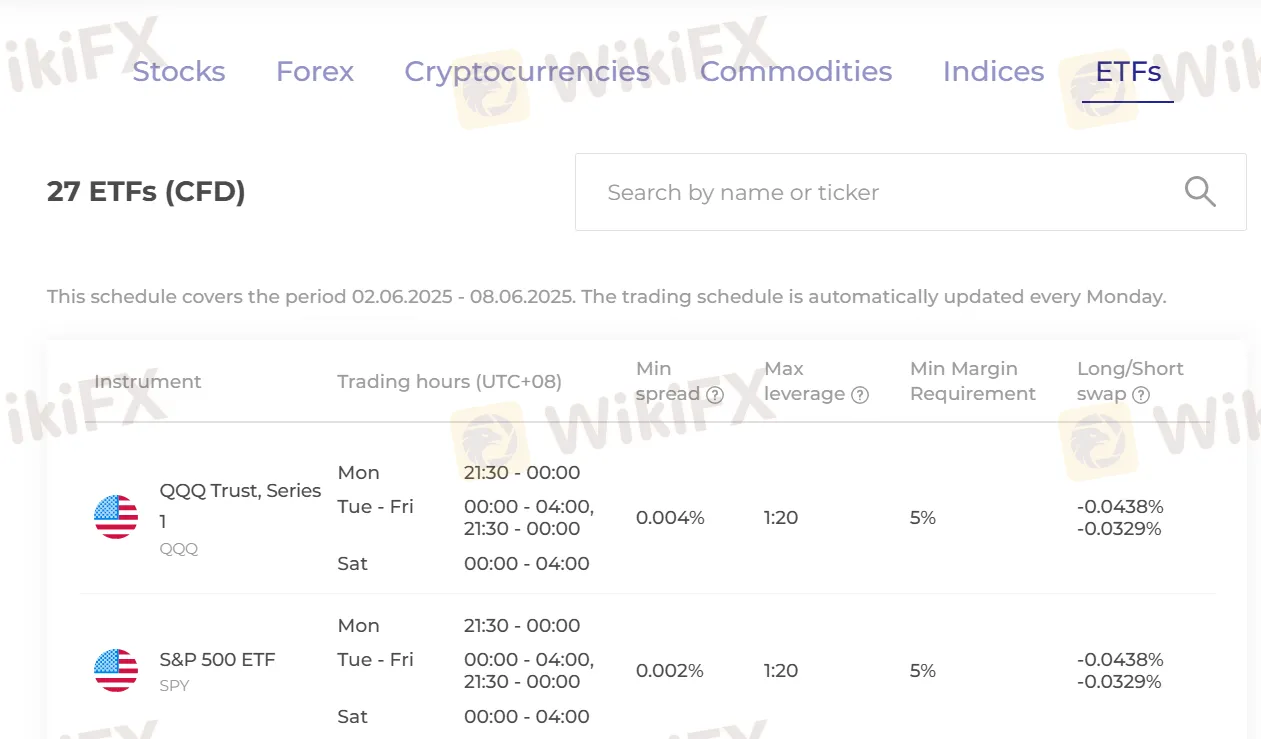

| Market Instruments | Forex, stocks, cryptos, commodities, indices, ETFs |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Leverage | Up to 1:20 (forex) |

| Up to 1:3000 (stocks) | |

| Spread | From 0 pips |

| Trading Platform | IQ Option |

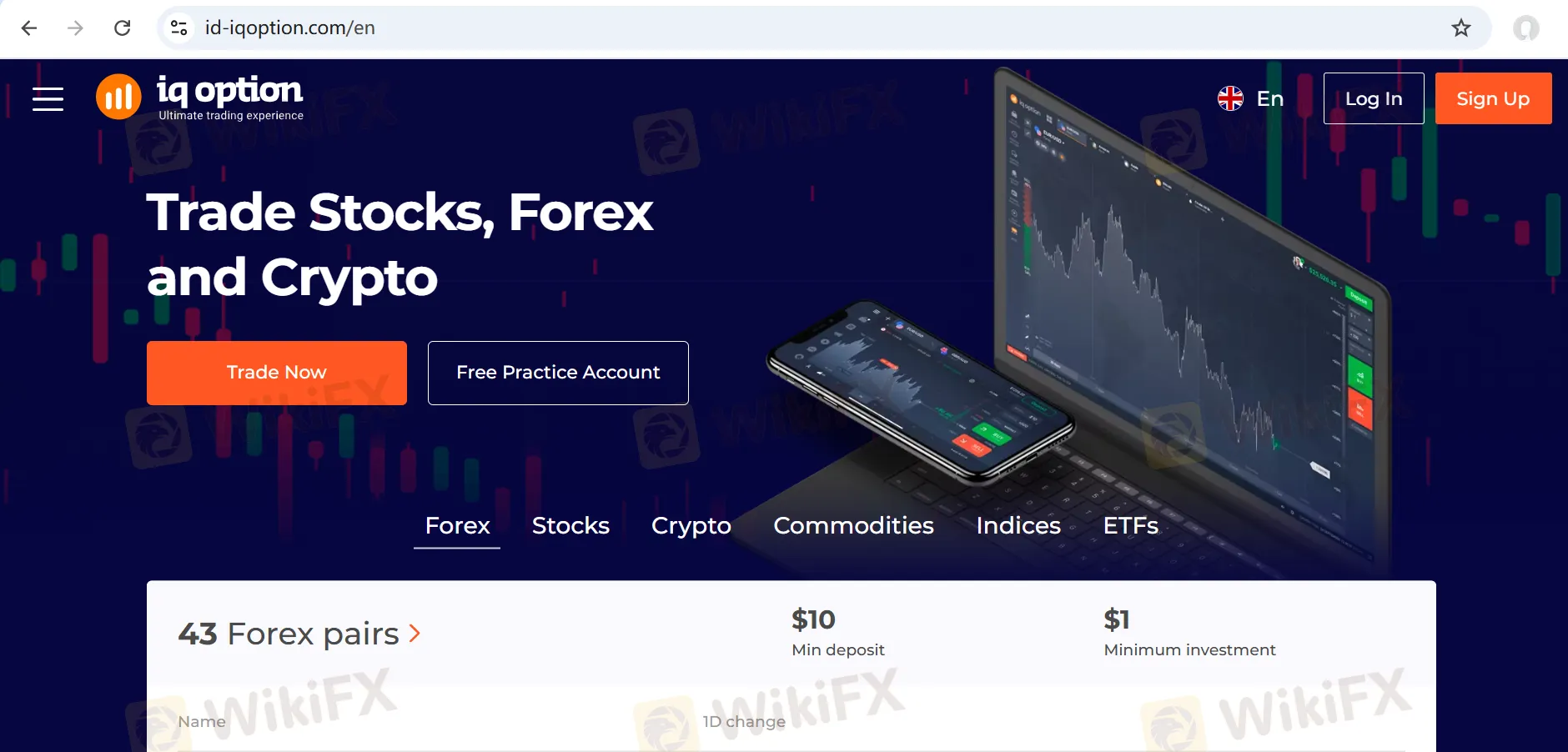

| Minimum Deposit | $10 |

| Customer Support | Email: support@iqoption.com |

| Address: The Colony House, 41 Nevis Street, Saint Johns, Antigua and Barbuda | |

| X, Instagram, YouTube, Twitter | |

IQ Option is an unregulated broker, offering trading on forex, stocks, cryptos, commodities, indices, and ETFs with leverage up to 1:3000 and spread from 0 pips on IQ Option trading platform. The minimum deposit requirement is $10.

| Pros | Cons |

| Demo accounts | No regulation |

| Various trading products | Inactivity account fee charged |

| Flexible leverage ratios | Withdrawal fees charged |

| Low minimum deposit | No MT4/MT5 platform |

| No deposit fees | No direct contact channel |

No. IQ Option currently has no valid regulations. Please be aware of the risk!

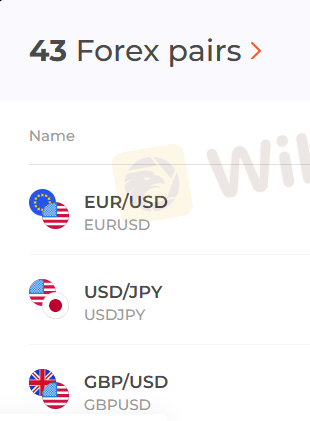

IQ Option offers trading on forex, stocks, cryptos, commodities, indices, and ETFs.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Stocks | ✔ |

| Cryptos | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| ETFs | ✔ |

| Options | ❌ |

| Bonds | ❌ |

IQ Option offers demo accounts and Islamic Account. But it does not mention anything about live accounts.

IQ Option offers flexible leverage options, varying by product. However, high leverage can amplify both profits and losses.

| Asset Class | Maximum Leverage |

| Forex | 1:20 |

| Stocks | 1:3000 |

| Cryptos | 1:5 |

| Commodities | 1:1000 |

| Indices | |

| ETFs | 1:20 |

If an account remains inactive for ninety (90) consecutive calendar days, IQ Option may charge an Inactivity Fee of€10. The annual fee will not exceed the total balance of the Client's account.

In cases where the remaining balance in the client's account is equal to or less than €5, the broker reserves the right to charge up to €5 (five euros or its equivalent amount in another currency on the day of the deduction of the fee) for closing the account due to lack of verification.

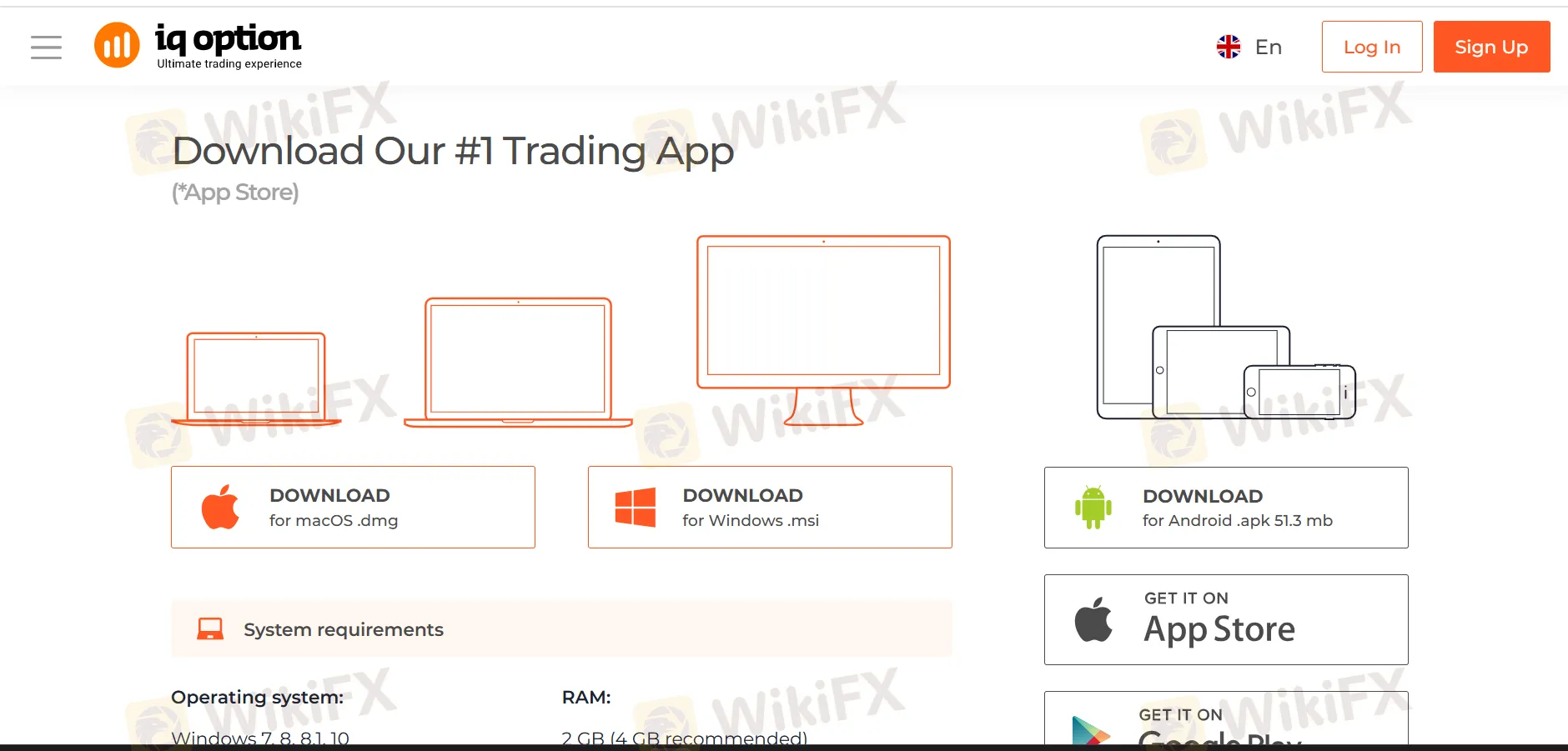

| Trading Platform | Supported | Available Devices | Suitable for |

| IQ Option | ✔ | Desktop, mobile | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

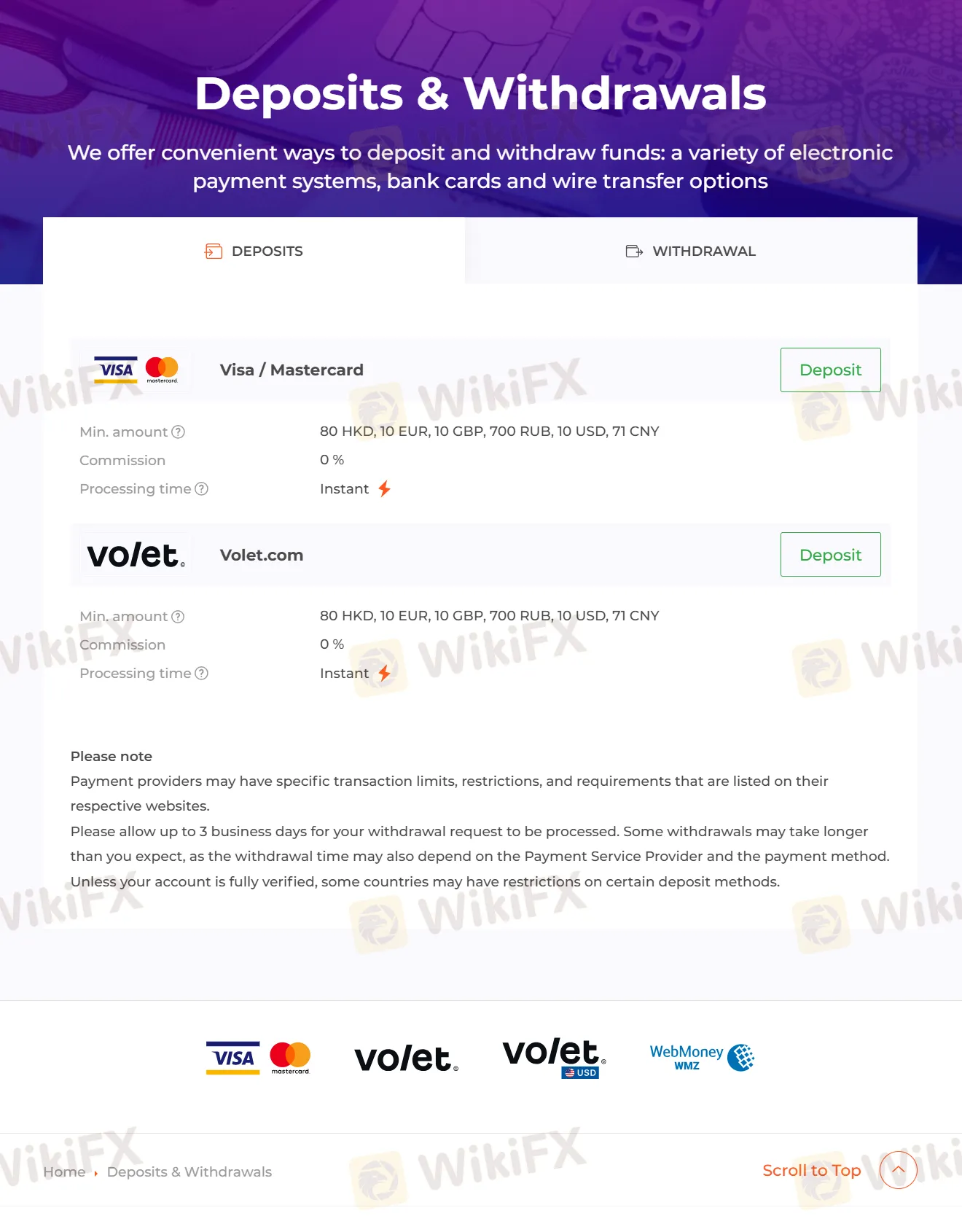

| Deposit Options | Minimum Deposit | Deposit Fees | Deposit Time |

| Visa / Mastercard | 80 HKD, 10 EUR/USD/GBP, 700 RUB, 71 CNY | 0 | Instant |

| Volet.com |

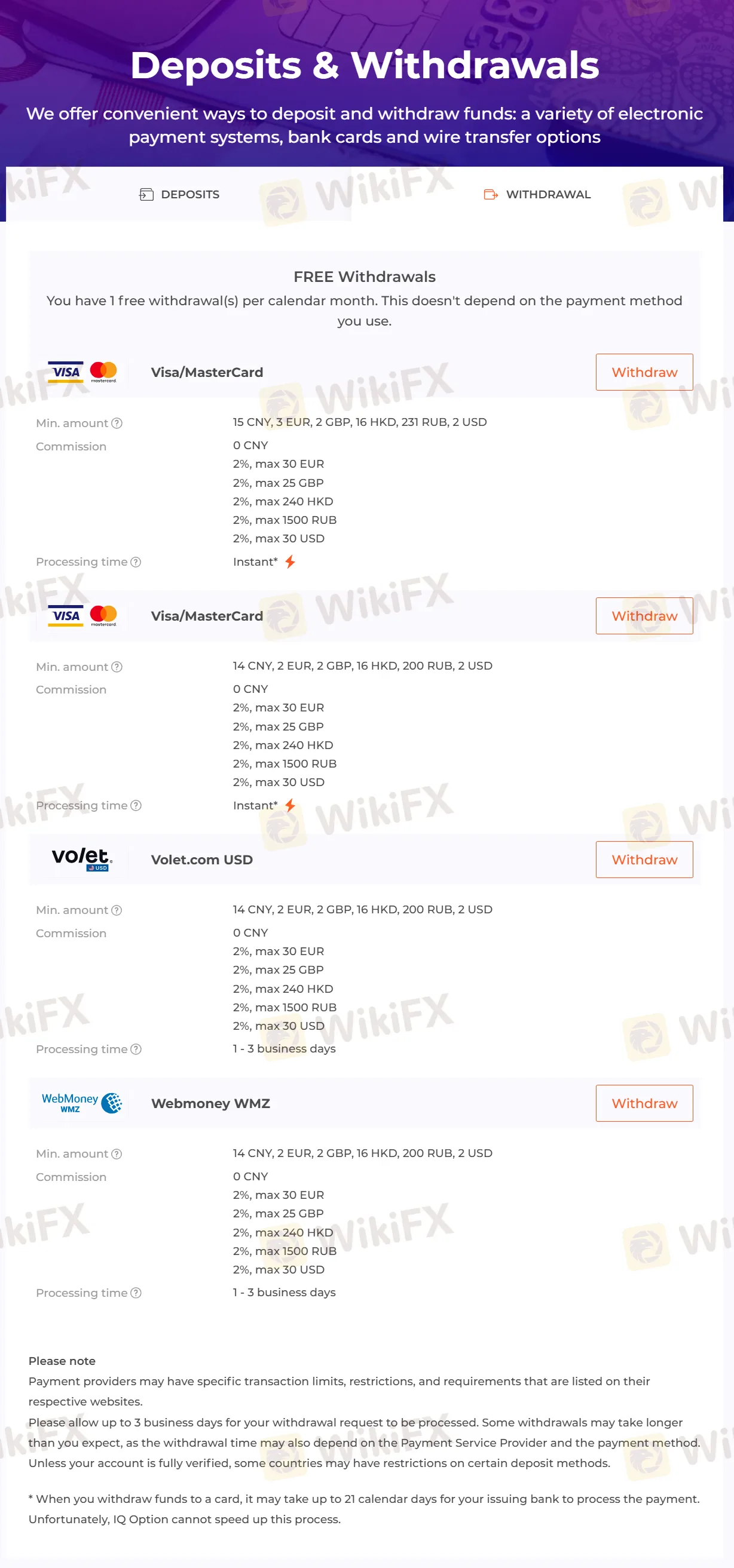

Withdrawal Options

You have 1 free withdrawalper calendar month. The minimum withdrawal amount is $2.

| Withdrawal Options | Minimum Withdrawal | Fees | Processing Time |

| Visa | 15 CNY, 3 EUR, 2 USD/GBP, 16 HKD, 231 RUB | 0 CNY | Instant |

| 2%, max 30 EUR/USD | |||

| 2%, max 25 GBP | |||

| 2%, max 240 HKD | |||

| 2%, max 1500 RUB | |||

| MasterCard | 14 CNY, 2 EUR/USD/GBP, 16 HKD, 200 RUB | 0 CNY | |

| 2%, max 30 EUR/USD | |||

| 2%, max 25 GBP | |||

| 2%, max 240 HKD | |||

| 2%, max 1500 RUB | |||

| Volet.com USD/Webmoney WMZ | 0 CNY | 1 - 3 business days | |

| 2%, max 30 EUR/USD | |||

| 2%, max 25 GBP | |||

| 2%, max 240 HKD | |||

| 2%, max 1500 RUB |

More

User comment

5

CommentsWrite a review

2025-05-25 02:18

2025-05-25 02:18

2025-05-25 00:22

2025-05-25 00:22