User Reviews

More

User comment

1

CommentsWrite a review

2024-01-14 04:05

2024-01-14 04:05

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.37

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Aspire Investments

Company Abbreviation

Aspire Investments

Platform registered country and region

New Zealand

Company website

Company summary

Pyramid scheme complaint

Expose

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Regulation | No Regulation |

| Market Instrument | 490 tradable instruments: forex, cryptocurrencies, commodities, stocks, indices and bonds |

| Account Type | Price Action Analysis, Divergence Investment and Moving Average Investment |

| Demo Account | N/A |

| Maximum Leverage | 1:500 |

| Spread | Raw spreads from 0.0 pips |

| Commission | N/A |

| Trading Platform | MT4, MT5, cTrader (no download links) |

| Minimum Deposit | $110 |

| Deposit & Withdrawal Method | cryptocurrencies of Bitcoin and Ethereum, etc. |

Aspire Investments is allegedly a forex and CFD broker registered in New Zealand that claims to provide its clients with 490 tradable financial instruments with leverage up to 1:500 and raw spreads from 0.0 pips, as well as 24/7 customer support service. Here is the home page of this brokers official site:

As for regulation, it has been verified that Aspire Investments currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.20/10. Please be aware of the risk.

Market Instruments

Aspire Investments advertises that it offers access to 490 tradable instruments, which include forex, cryptocurrencies, commodities, stocks, indices and bonds.

Trading Plans

Aspire Investments claims to offer 3 types of trading plans - Price Action Analysis, Divergence Investment and Moving Average Investment, with minimum initial deposit requirements of $110, $5,001 and $13,001 respectively.

Leverage

The maximum leverage provided by Aspire Investments is capped at 1:500. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads

Aspire Investments boasts to offer raw spreads from 0.0 pips. However, we cannot confirm if it is available because the broker refuses to offer trading platforms directly.

Trading Platform Available

Aspire Investments‘ website displays the logos of MT5, MT4 and cTrader, as well as multiple devices including Windows, Mac, Android, Web Browser and iOS, yet we didn’t find any download links to these trading platforms. Anyway, you had better choose brokers who offer the leading MT4 and MT5, which are highly praised by traders and brokers alike due to their ease of use and great functionality, offering top-notch charting and flexible customization options. They are especially popular for their automated trading bots, a.k.a. Expert Advisors.

Deposit & Withdrawal

Aspire Investments only works with cryptocurrencies such as Bitcoin and Ethereum. The minimum deposit is $110 worth of Bitcoin or other accepted cryptocurrencies. Withdrawal requests are said to be processed within 2 trading hours.

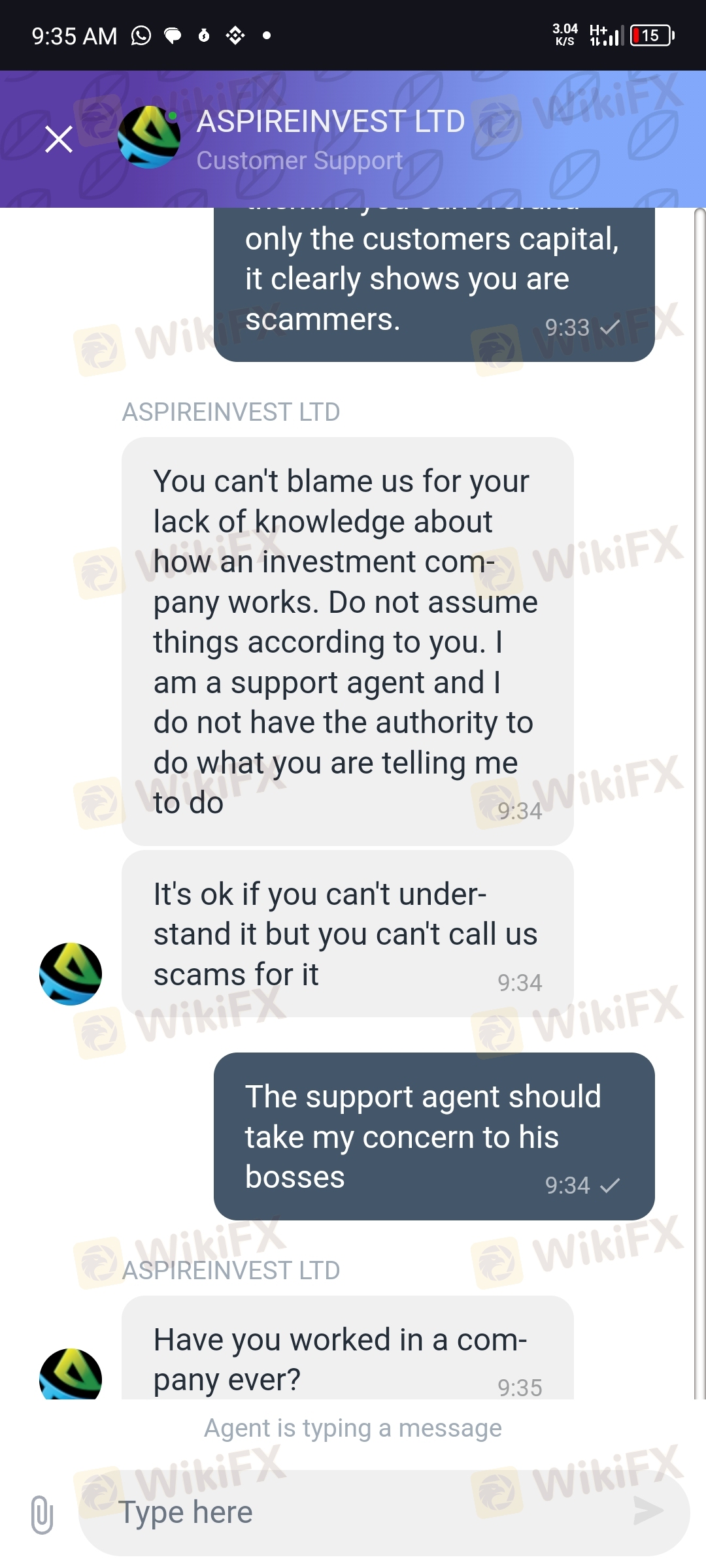

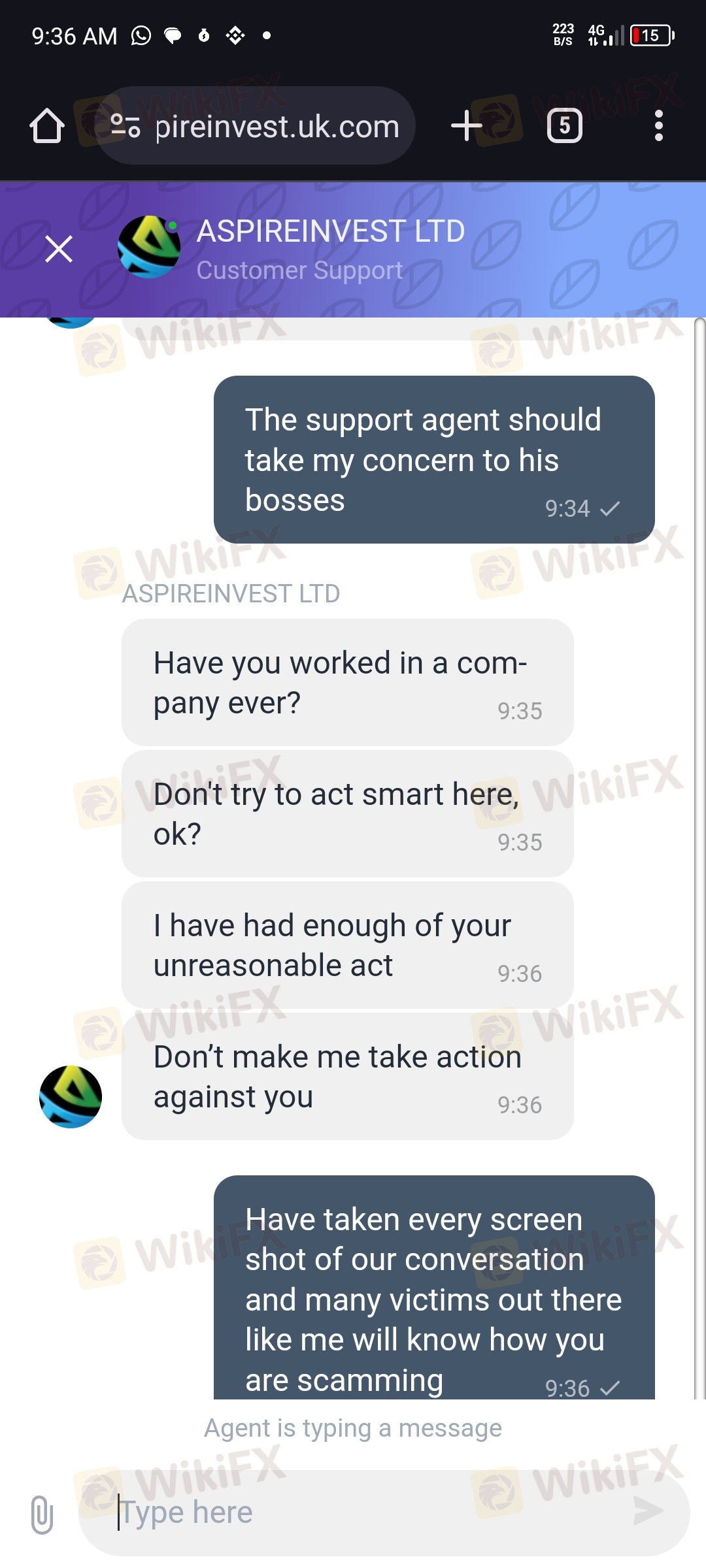

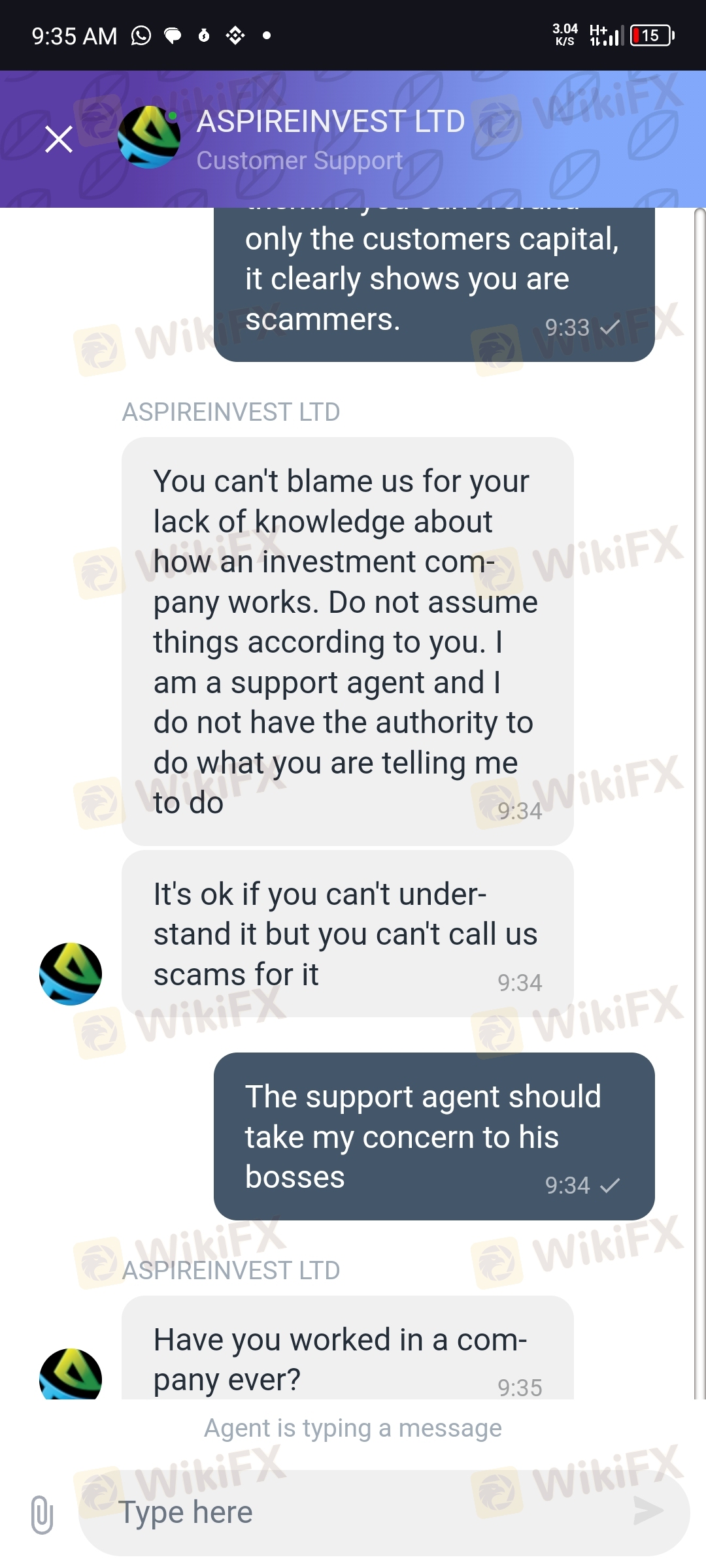

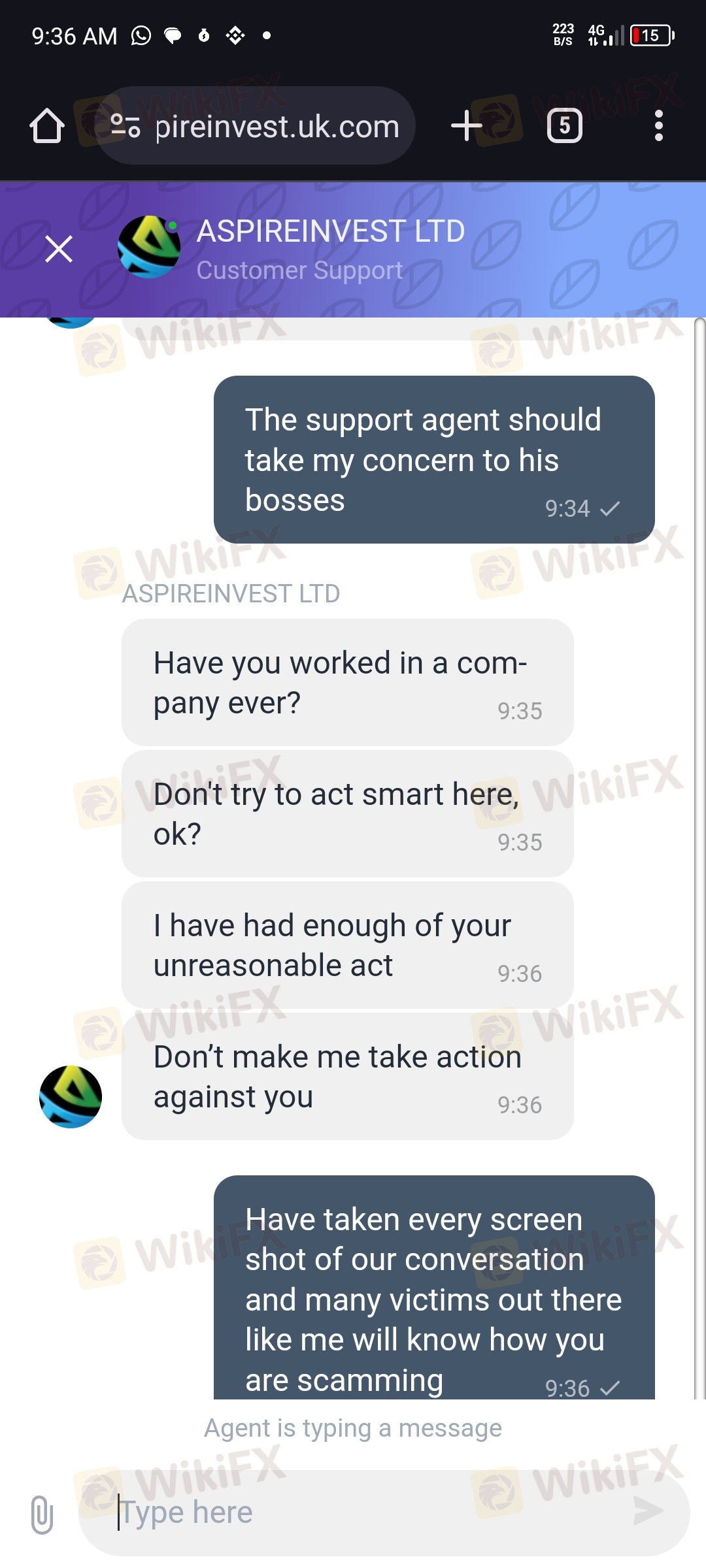

Customer Support

Aspire Investments customer support can be reached by telephone: +64 (0)7 981 1505, email: support@aspireinvestments.ltd or live chat. You can also follow this broker on social networks such as WhatsApp and Telegram. Company address: 58 Shakespeare Road, Milford, Auckland, 0620, New Zealand.

Pros & Cons

| Pros | Cons |

| • Multiple tradable instruments and plans to choose from | • No regulation |

| • Only cryptocurrency payments supported |

Frequently Asked Questions (FAQs)

| Q 1: | Is Aspire Investments regulated? |

| A 1: | No. It has been verified that Aspire Investments currently has no valid regulation. |

| Q 2: | Does Aspire Investments offer the industry-standard MT4 & MT5? |

| A 2: | Aspire Investments website gives the logos of MT4, MT5 and cTrader, but no download links are offered. |

| Q 3: | What is the minimum deposit for Aspire Investments? |

| A 3: | The minimum deposit is $110 worth of Bitcoin or other accepted cryptocurrencies. |

| Q 4: | Is Aspire Investmentsa good broker for beginners? |

| A 4: | No. Aspire Investments is not a good choice for beginners. Not only because of its unregulated condition, but also due to its lack of transparency. |

More

User comment

1

CommentsWrite a review

2024-01-14 04:05

2024-01-14 04:05