User Reviews

More

User comment

3

CommentsWrite a review

2024-02-06 17:29

2024-02-06 17:29 2023-02-23 18:37

2023-02-23 18:37

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

Suspicious Overrun

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.33

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

Atossa Financial Services (Pty) Ltd

Company Abbreviation

AtossaCapital

Platform registered country and region

South Africa

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

Note: AtossaCapitals official site (https://atossacapital.com/) is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

| AtossaCapital Review Summary | |

| Registered Country/Region | South Africa |

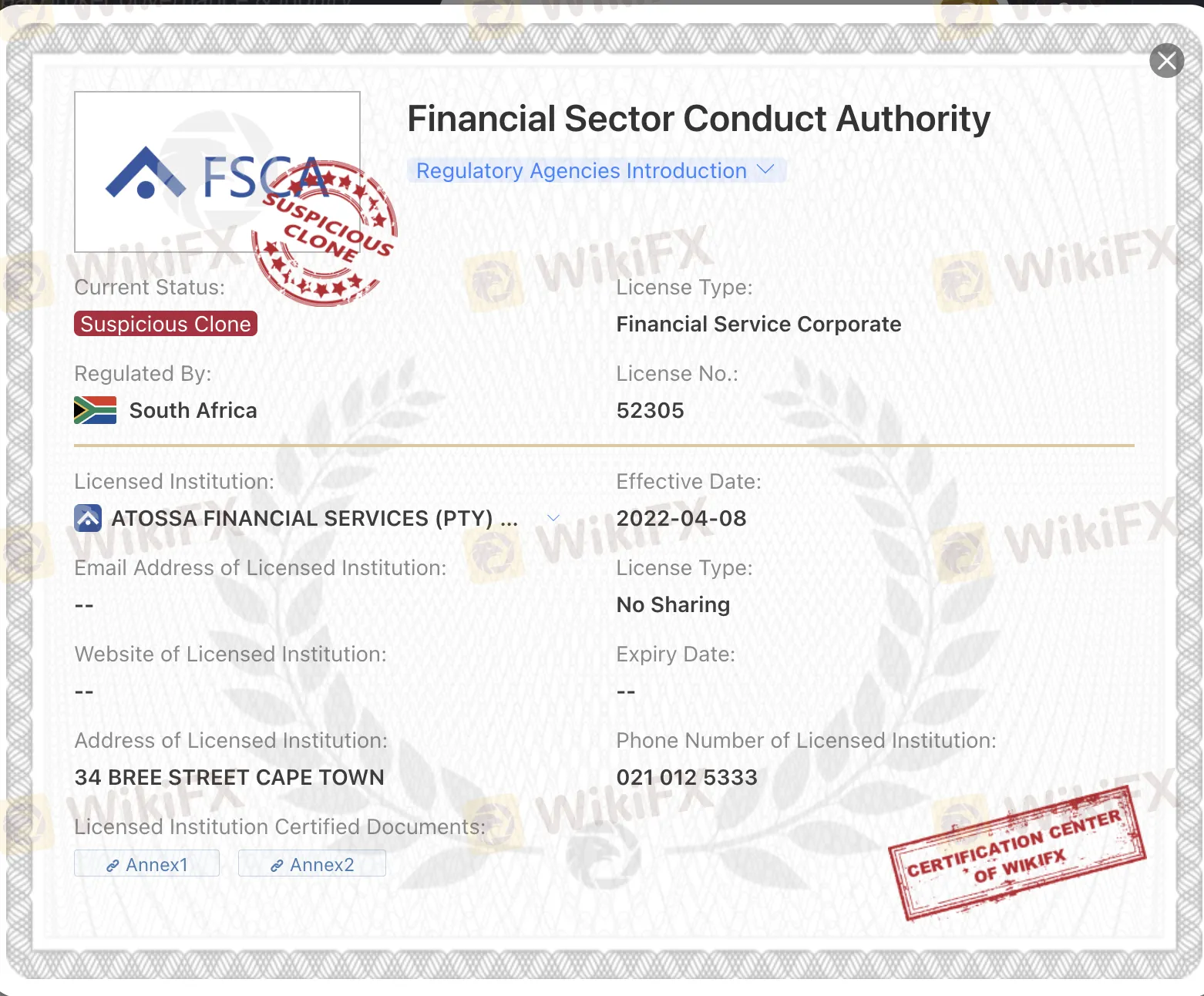

| Regulation | FSCA (Suspicious clone) |

| Leverage | 1:500 |

| EUR/USD Spread | 1.6 pips (Std) |

| Minimum Deposit | $250 |

| Customer Support | email, telephone, social media |

The main website of AtossaCapital raises concerns due to its lack of accessibility and transparency. Additionally, it is crucial to keep in mind that this broker lacks a recognized regulation. It appears to be locked off or inaccessible, which may be an indication of a less-than-professional attitude or even portend fraud. In the lack of freely accessible information, it is challenging for prospective consumers or investors to verify the legitimacy of the company or its products.

| Pros | Cons |

| • Offers different account types | • The website is unavailable |

| • Various communication channels | • Lack of transparency |

| • Lack of valid regulation | |

| • High minimum deposit |

There are many alternative brokers to AtossaCapital depending on the specific needs and preferences of the trader. Some popular options include:

Plus500 - A CFD service provider that offers a simple, user-friendly platform and a wide range of tradable instruments, making it suitable for those interested in CFD trading.

Forex.com - As a leading forex broker, it provides a wide range of currency pairs, a robust trading platform, and high-quality research tools, making it an excellent option for forex traders.

XTB - Known for its combination of educational materials, comprehensive market analysis, and a custom trading platform, it's an excellent choice for new and experienced traders alike.

AtossaCapital's regulations are invalid right now, and the website is unavailable. Given these details, there is reason to be skeptical and believe that this brokerage company is a scam. Any financial dealings with such a corporation should be conducted with the utmost caution, and it is strongly encouraged to conduct in-depth research and speak with reputable financial experts before making any investment decisions. Being aware and informed can help people protect their financial stability and prevent falling for risky con games.

The broker claims to be regulated by Financial Sector Conduct Authority (FSCA, License No. 52305) by South Africa. But the current status is suspicious clone.

AtossaCapital offers different types of accounts, like Standard accounts, and ECN accounts.

The Standard Account is designed to cater to a broad spectrum of traders, including beginners and those with limited capital.

In addition, the ECN Account caters to more experienced and active traders seeking direct market access and the potential for enhanced trading conditions.

Both types of accounts typically require a minimum deposit of $250, making it an accessible option for traders looking to get started in the financial markets without a significant initial investment.

AtossaCapital provides traders with a generous maximum leverage of 1:500 across all types of accounts, making it an appealing option for those seeking to amplify their trading positions and potentially increase their profit potential.

Before trading with high leverage, potential clients of AtossaCapital should familiarize themselves with the company's specific leverage policies, terms, and conditions. They should also ensure they understand the concept of leverage, its associated risks, and how to use it responsibly to optimize their trading strategies. Seeking professional advice or educational resources on leveraging and risk management can be beneficial for traders looking to make the most of this powerful trading tool.

AtossaCapital offers trading conditions for both its Standard and ECN account holders. For the Standard accounts, traders can benefit from spreads starting as low as 1.6 pips on major currency pairs and other financial instruments. On the other hand, AtossaCapital's ECN accounts offer even tighter spreads, starting from 0.0 pips on select major currency pairs.

Moreover, AtossaCapital's Standard accounts come with a zero-commission structure. This means that traders using Standard accounts won't be charged a separate commission fee for each trade they execute.

Conversely, for ECN account holders, AtossaCapital implements a commission of $7 per lot traded on forex and metals. This commission-based structure is common among ECN accounts and ensures a more transparent pricing model. By charging a fixed commission, the broker eliminates any potential conflict of interest between itself and the trader, as the broker's profit is not directly tied to the trader's losses.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| AtossaCapital | 1.6 (Std) | None |

| Plus500 | Average of 0.6 | No commissions |

| Forex.com | Average of 0.6 | Varies (depending on account type) |

| XTB | Average of 0.2 | Not provided |

AtossaCapital values open communication with its clients, and there are multiple ways to get in touch with the company's support team. For general inquiries or assistance, you can reach out to AtossaCapital via telephone by dialing +27 (0) 87 012 6065.

If you prefer written communication, you can contact AtossaCapital through their official email address: help@atossacapital.com.

In addition to traditional contact methods, AtossaCapital is also active on various social media platforms, enhancing accessibility for its clients. Look for them on popular platforms such as Twitter, Facebook, Instagram, and YouTube.

The link to YouTube is https://www.youtube.com/channel/UCGE8yeDu6kkKHBdzkJjb7qQ

In conclusion, AtossaCapital is a brokerage firm that serves as a reliable gateway to the financial markets. Traders can choose from various account types, including Standard accounts with competitive spreads and zero commission, or ECN accounts with tighter spreads and low commissions on FX and metals. The company's maximum leverage of 1:500 offers traders the potential to magnify their trading positions, but it's essential to approach leveraged trading with caution and appropriate risk management.

However, considering that the regulations of AtossaCapital are currently invalid and the website is unavailable, it is crucial to approach any financial dealings with the utmost caution. It is strongly encouraged to conduct thorough research, verify the regulatory status, and seek advice from reputable financial experts before making any investment decisions.

Q1: What is the maximum leverage offered by AtossaCapital?

A1: AtossaCapital provides a maximum leverage of 1:500 for all types of accounts. This allows traders to control larger positions with a fraction of their own capital. However, it's important to be aware that higher leverage also increases the risk of significant losses.

Q2: How can I contact AtossaCapital's customer support?

A2: You can contact them via telephone at +27 (0) 87 012 6065 or send an email to help@atossacapital.com. Additionally, the company is active on social media platforms like Twitter, Facebook, Instagram, and YouTube, providing another means of communication and access to educational resources.

Q3: Is AtossaCapital a regulated brokerage firm?

A3: No, AtossaCaptial currently has no valid regulations.

More

User comment

3

CommentsWrite a review

2024-02-06 17:29

2024-02-06 17:29 2023-02-23 18:37

2023-02-23 18:37