User Reviews

More

User comment

6

CommentsWrite a review

2023-10-21 21:02

2023-10-21 21:02

2023-02-24 14:43

2023-02-24 14:43

Score

5-10 years

5-10 yearsRegulated in Seychelles

Retail Forex License

MT5 Full License

Medium potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index3.92

Business Index7.28

Risk Management Index8.90

Software Index9.31

License Index3.92

Single Core

1G

40G

Danger

More

Company Name

XBTFX LLC

Company Abbreviation

XBTFX

Platform registered country and region

Antigua and Barbuda

Company website

X

Company summary

Pyramid scheme complaint

Expose

| XBTFXReview Summary | |

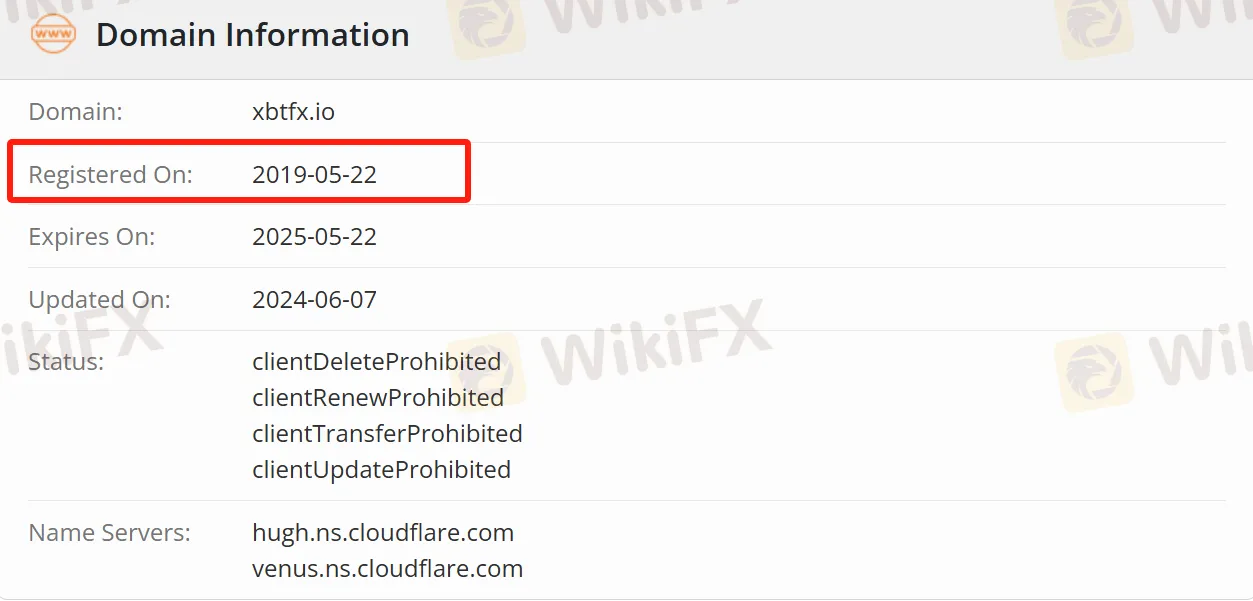

| Registered On | 2019-05-22 |

| Registered Country/Region | Antigua and Barbuda |

| Regulation | Regulated |

| Market Instruments | Forex, Energies, Stocks, Cryptocurrencies, Precious Metals, and Indices |

| Demo Account | / |

| Leverage | Up to 1:500 |

| Spread | From 0.01 pips |

| Trading Platform | MT5, cTrader (Desktop, Mobile, and Web) |

| Min Deposit | $10 |

| Customer Support | Tel: +44 2038079081 |

| 24/7 Chat Support | |

| Facebook, Twitter | |

| Ekzarh Yosif 9, Burgas, 8000, Bulgaria | |

Founded in 2019, XBTFX is an international platform specializing in Contract for Difference (CFD) trading. It covers multiple asset classes such as forex, cryptocurrencies, precious metals, energies, and stock indices, and supports two major trading platforms, MetaTrader 5 (MT5) and cTrader. XBTFX is suitable for traders seeking low entry barriers, high leverage, and diversified assets, including novice traders and professional investors.

| Pros | Cons |

| Regulated | Differences in regulatory qualifications (XBTFX LLC) |

| Over 200 trading assets | Complex fee structure |

| Flexible account types | No information on demo accounts |

| Islamic accounts available (no overnight interest) | |

| Leverage up to 1:500 | |

| MT5/cTrader available |

The Seychelles entity XBTFX (SC) Ltd holds an FSA securities dealer license (SD169), falling under the category of formal regulation. The Antigua entity XBTFX LLC does not require a local financial license, resulting in lower regulatory transparency.

XBTFX offers over 400 trading instruments, including forex, cryptocurrencies, precious metals, energies, stocks, and indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Energies | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Precious Metals | ✔ |

| Indices | ✔ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

XBTFX LLC offers ECN and Standard accounts, while XBTFX (SC) Ltd provides ECN and ECN GOLD accounts.

| Account Type | ECN | Standard | ECN GOLD | Islamic |

| Commissions | from $2.75/lot/side | Zero | from $2.5 lot/side | from $2.5 lot/side |

| Spread from | 0.01 pips | 1 pip | 0.01 pips | 1 pip |

| Minimum Deposit | $10 | $10 | $25,000 | $25,000 |

| Deposit Fee | Zero | Zero | Zero | Zero |

| Withdrawals | Same Day | Same Day | Same Day | Same Day |

| FX, Commodities & CFDs fees | $2.75/lot/side | Zero Commission | 0.05% per deal | 0.05% per deal |

| CryptoCurrency fees | 0.05% per deal | Zero Commission | Zero Commission | Zero Commission |

| Share CFD, per share | USA: $0.10, EU, ASIA: 0.45% | USA: $0.10, EU, ASIA: 0.45% | USA: $0.10, EU, ASIA: 0.45% | USA: $0.10, EU, ASIA: 0.45% |

| Spreads | From 0.01 pips | From 1pip | From 0.01 pips | From 0.01 pips |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Islamic Account Option | ✔ | ❌ | - | ✔ |

| Micro Lot Trading (0.01) | ✔ | 76 | 76 | 76 |

| Automated Expert Advisor trading | Yes, Encouraged! | Yes, Encouraged! | Yes, Encouraged! | Yes, Encouraged! |

| Trading Styles Allowed | All | All | All | All |

The ECN account offers spreads as low as 0.01 pips, while the Standard and Islamic accounts charge zero commission.

| Account Type | Minimum Deposit | Commission | Spread |

| Standard | $10 | 0 | From 1 pip |

| ECN | $10 | $2.75 per lot/side | From 0.01 pips |

| ECN GOLD | $25,000 | $2.5 per lot/side | From 0.01 pips |

| Islamic Account | $10 | 0 | From 1 pip |

More

User comment

6

CommentsWrite a review

2023-10-21 21:02

2023-10-21 21:02

2023-02-24 14:43

2023-02-24 14:43