User Reviews

More

User comment

13

CommentsWrite a review

2025-12-24 01:55

2025-12-24 01:55

2025-08-27 00:33

2025-08-27 00:33

Score

5-10 years

5-10 yearsRegulated in Mauritius

Securities Trading License (EP)

MT5 Full License

High potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 6

Exposure

Score

Regulatory Index4.62

Business Index6.94

Risk Management Index0.00

Software Index9.46

License Index4.62

Single Core

1G

40G

More

Company Name

Dominion Markets LLC

Company Abbreviation

DOMINION MARKETS

Platform registered country and region

Mauritius

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

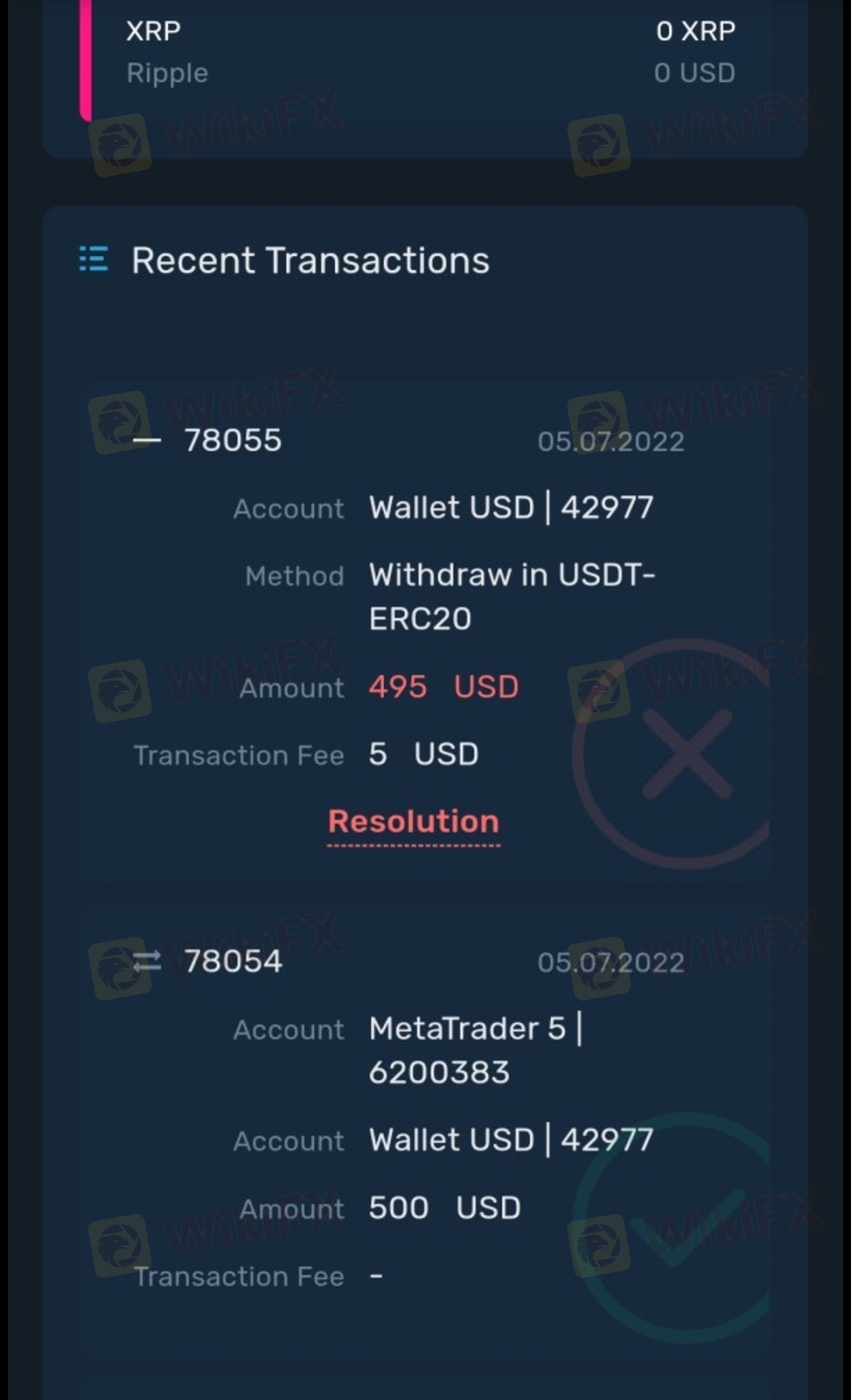

The platform does not allow to withdraw. Please help. I was placing orders and trading normally.

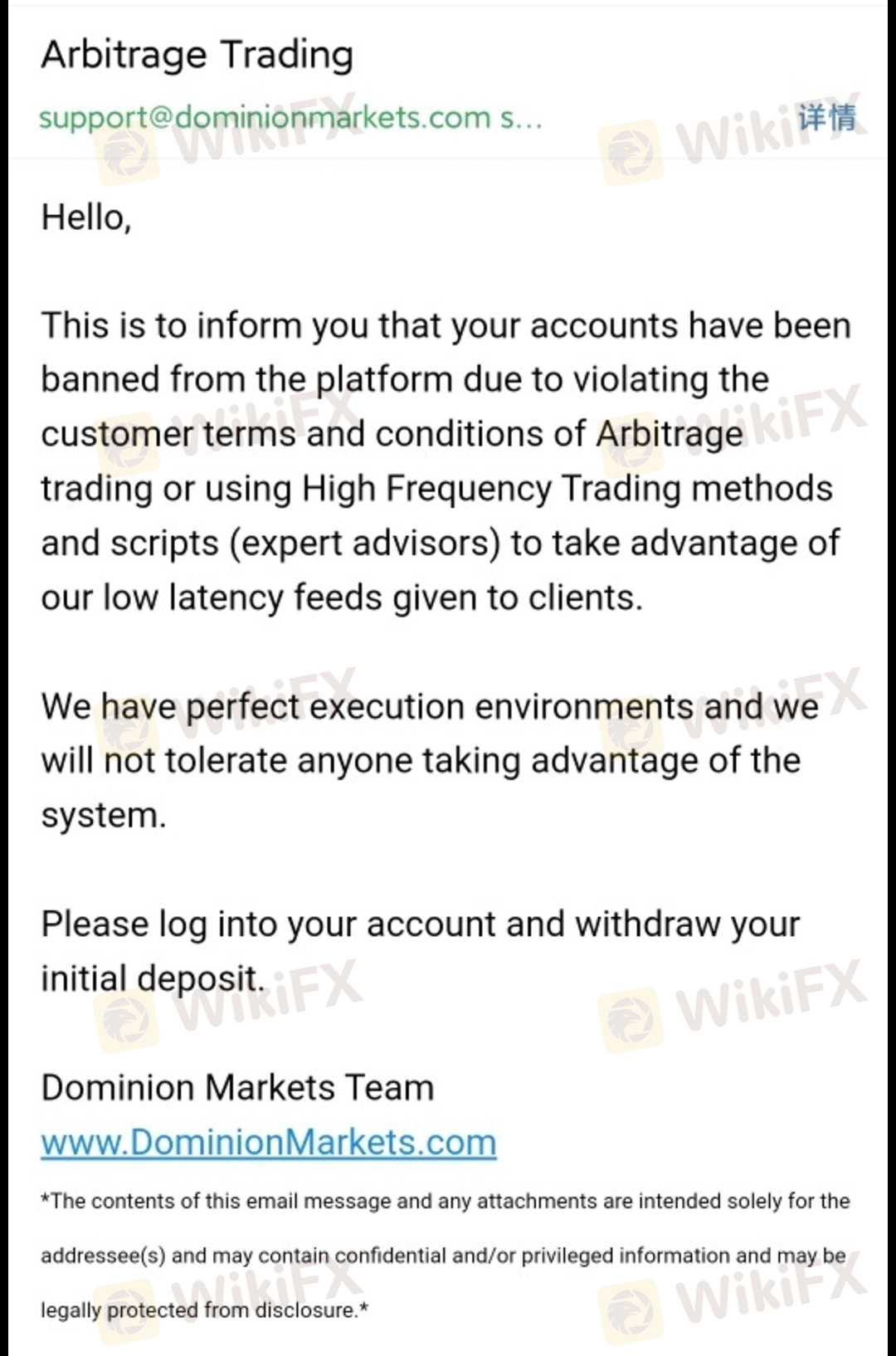

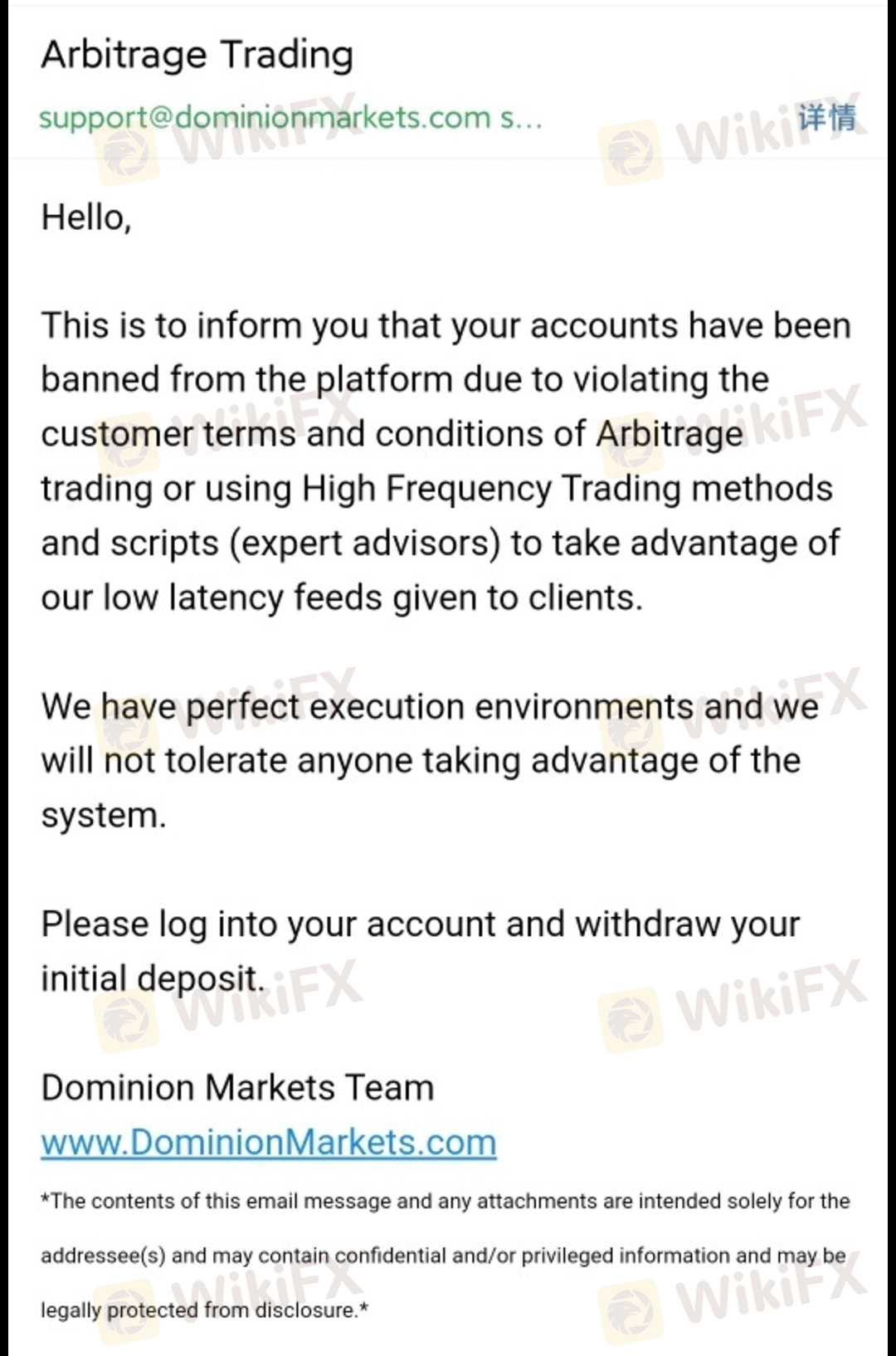

Typical broker where till you are loosing, no problem. Issues started when you earn and try to withdraw. Then they deactivated in toto the account. When I asked, they reply that I apply a sort of Arbitrage trading. When I asked more info availability to show all the transactions and even I have shared the name of EA used (scalper), they simply ignore me. Trading is all about money and when there are money there must be fully transparency and you need to be sure the broker is paying when (few times unfortunately) there are profit.

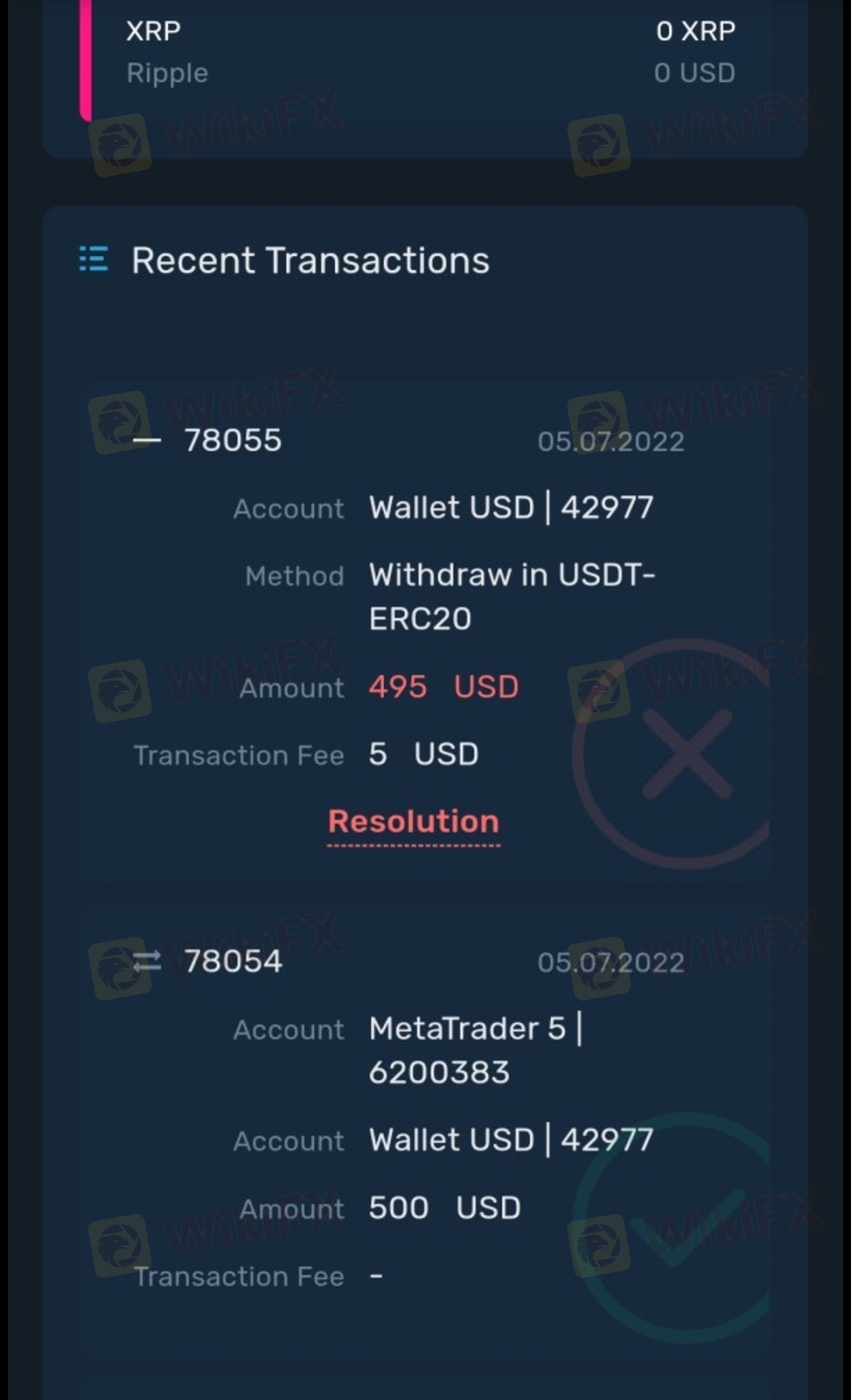

Deposit 480dollars and withdraw 300 dollars after making profit. The account still has 456 dollars, but it cannot be withdrawn. The profit was not given nor the principle. The email was not replied. It is not understandable. They should at least provide an explaination for the problem. Such a big company, should not do it to my principle. My trading account is 6194684. I hope to resolve it ASAP.

dominion market 100% DD broker and scam beware if the withdrawal of funds is close to 100% capital. without notification your money can not be withdrawn WD for various reasons dominion market broker will blame your open position. This broker will initially withdraw you for a deposit, it seems easy to trade for profit. then the funds are frozen unilaterally. Beware.....

3000 usd in profit and account has been suspended by stating that I use expert advisors which I didn't and provided them all evidences on email.. No response at all.. Where to complain

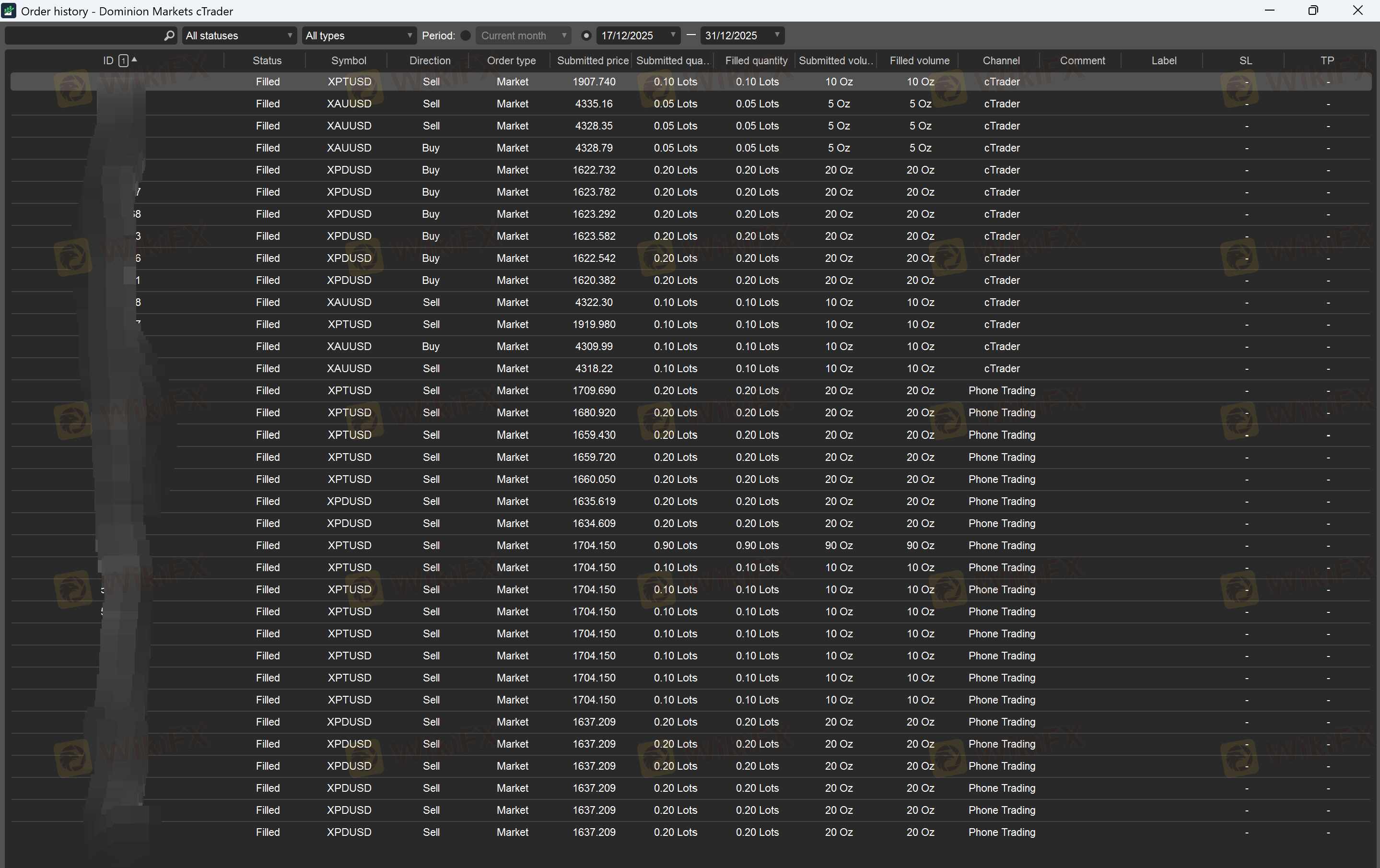

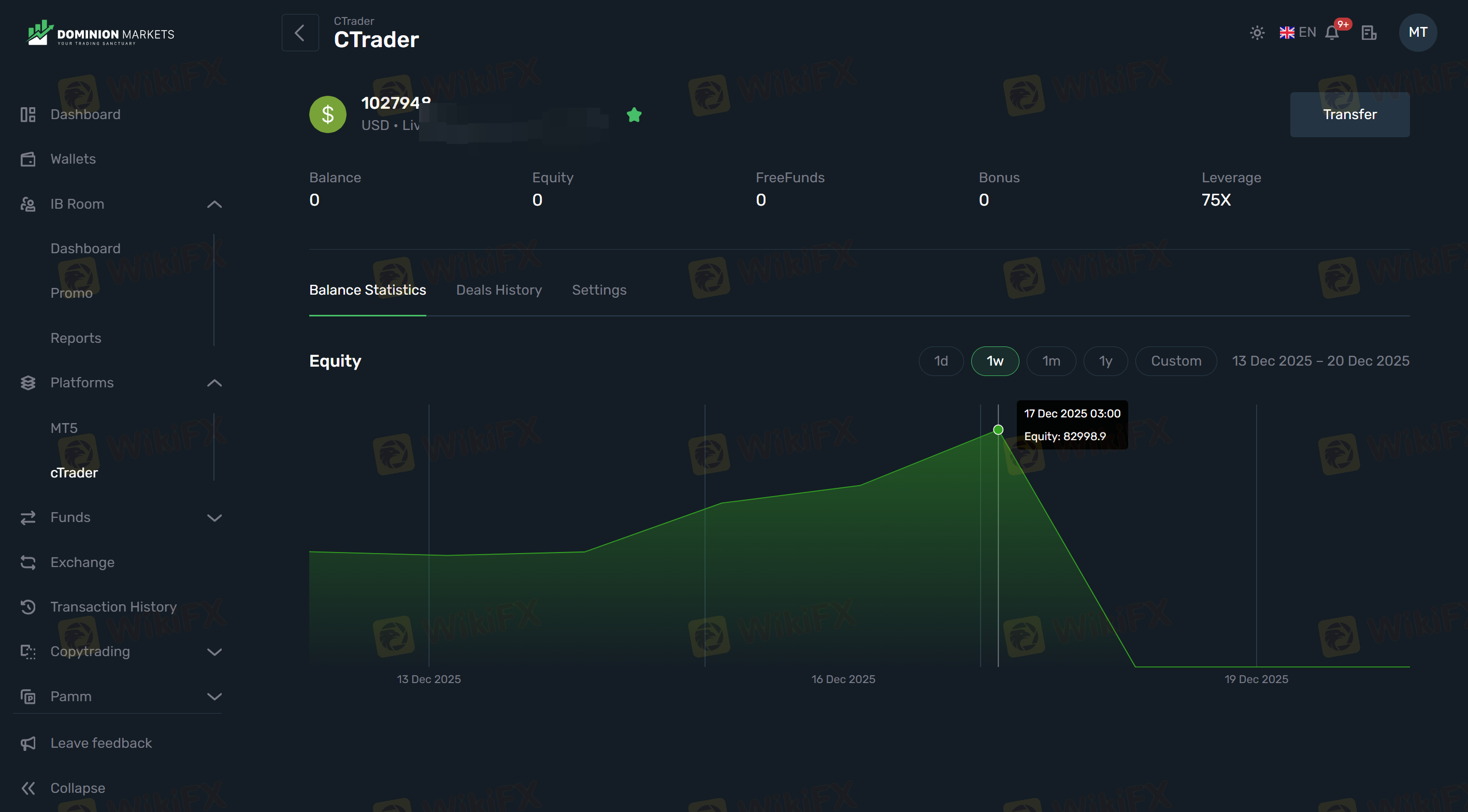

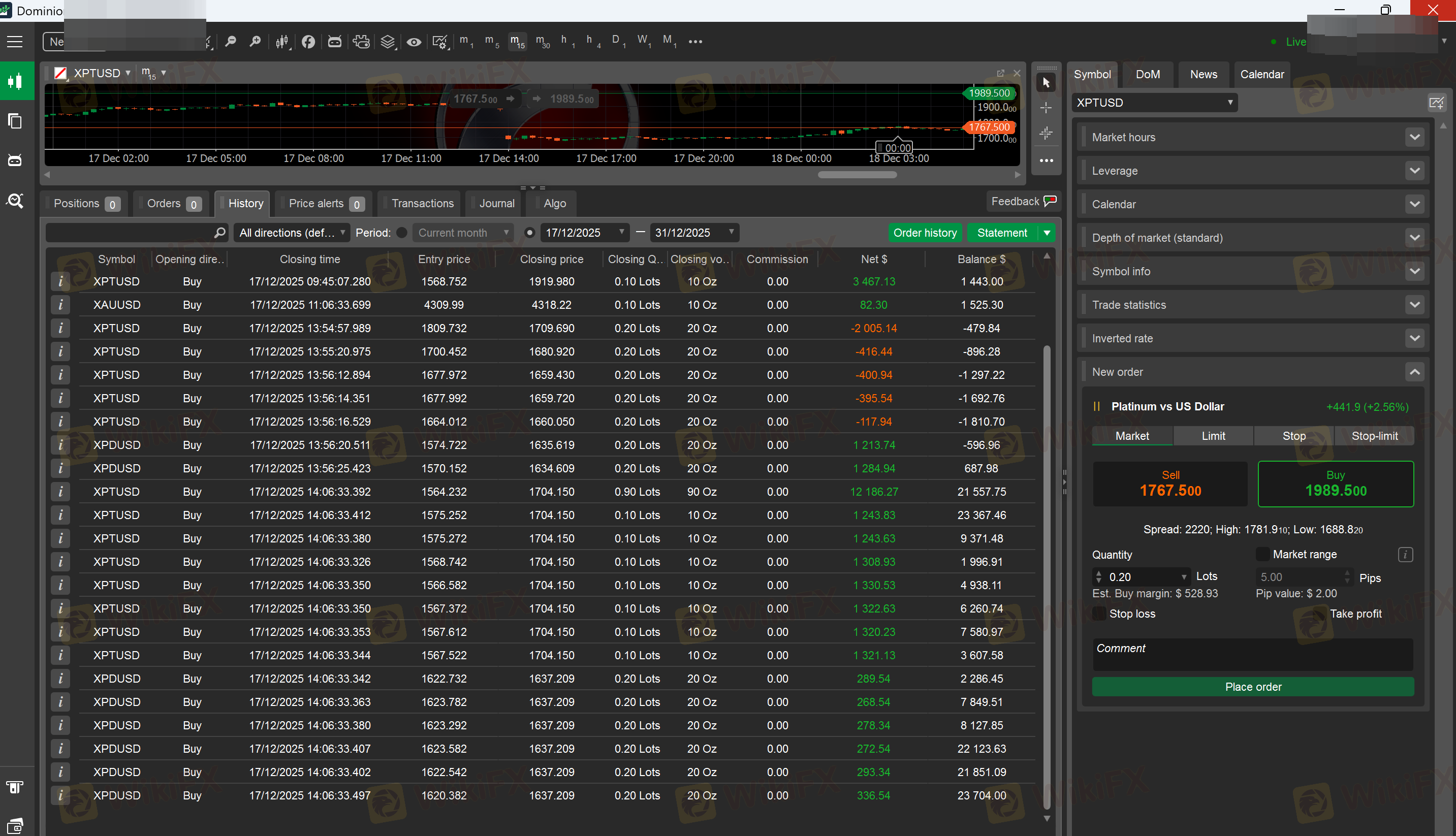

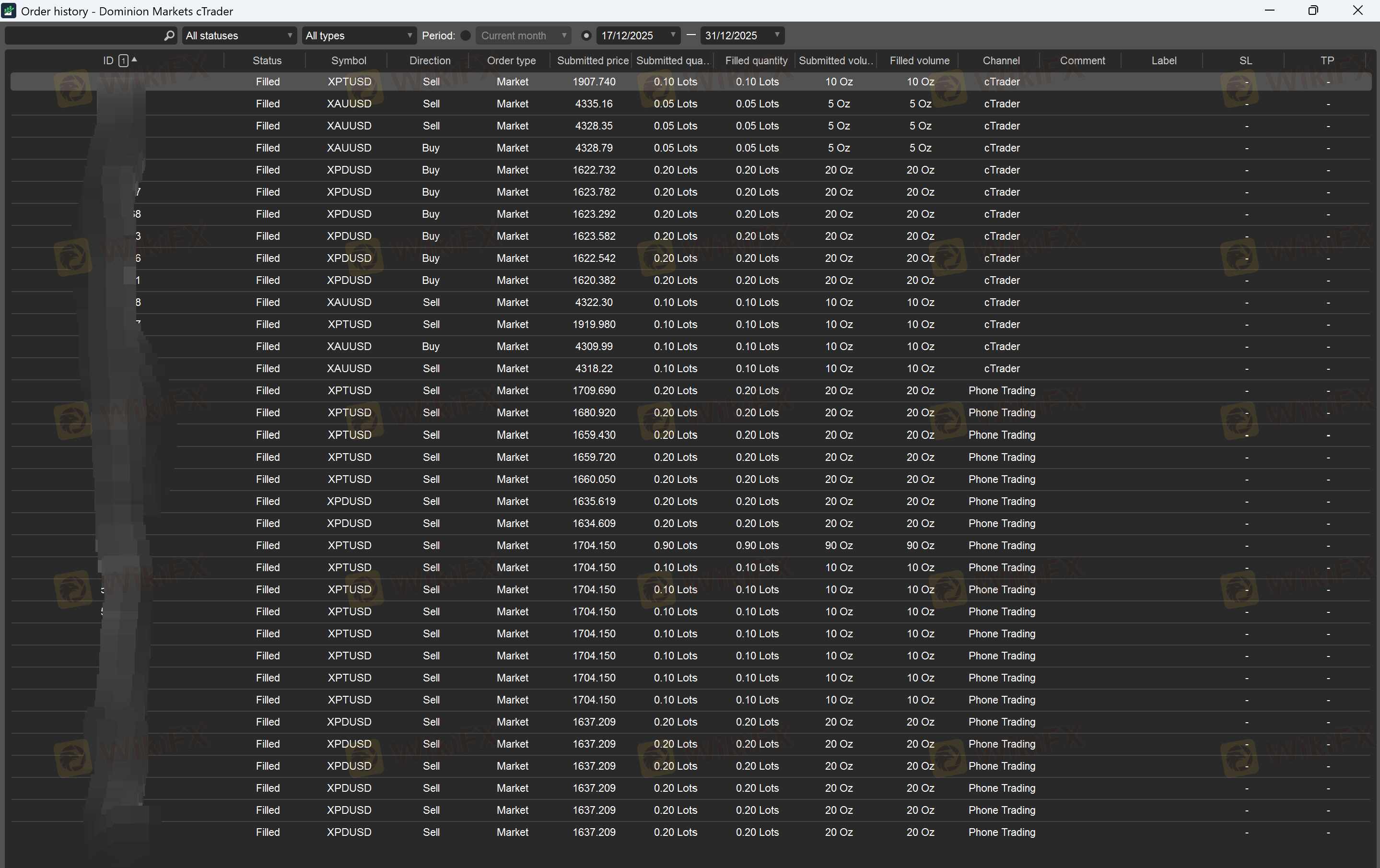

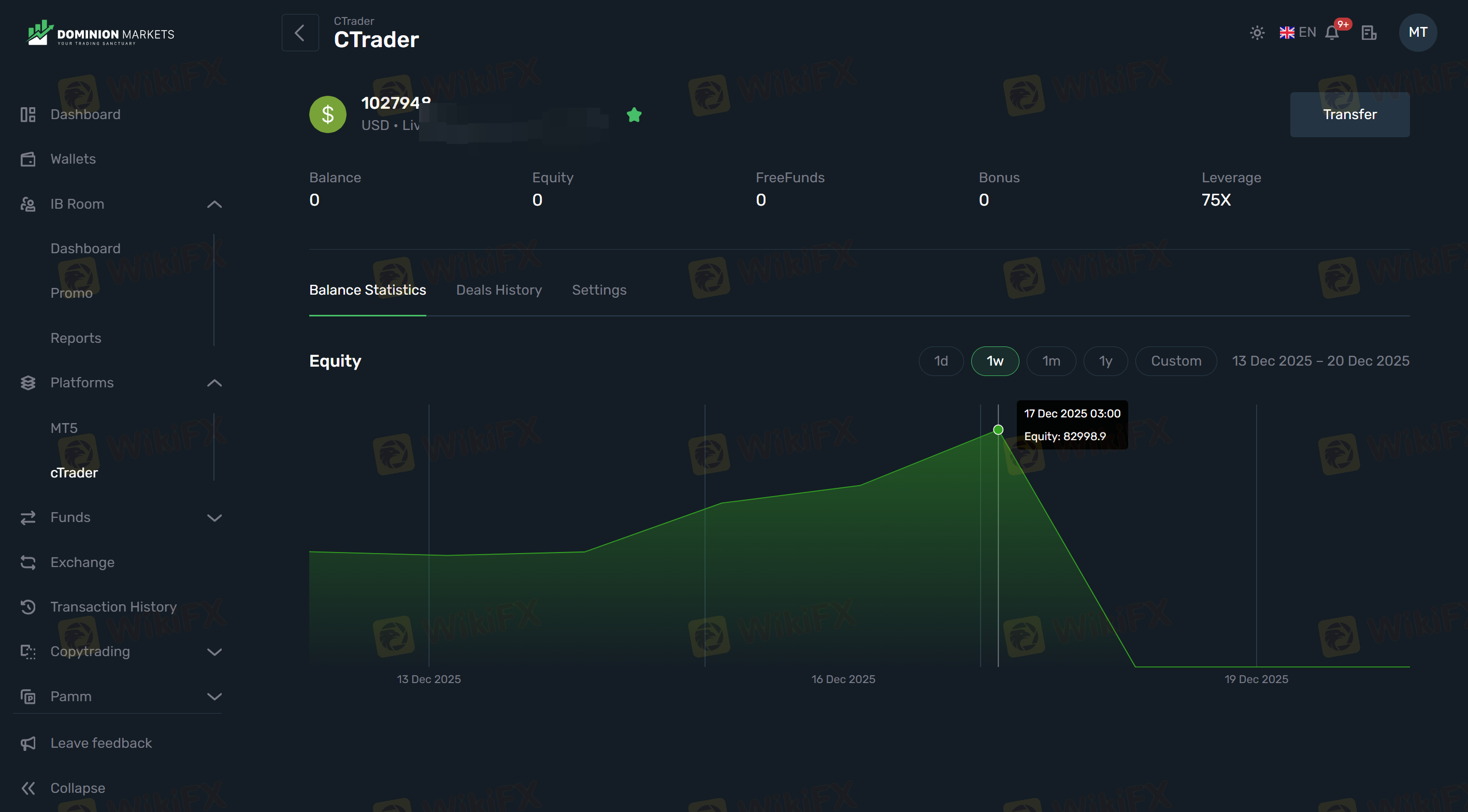

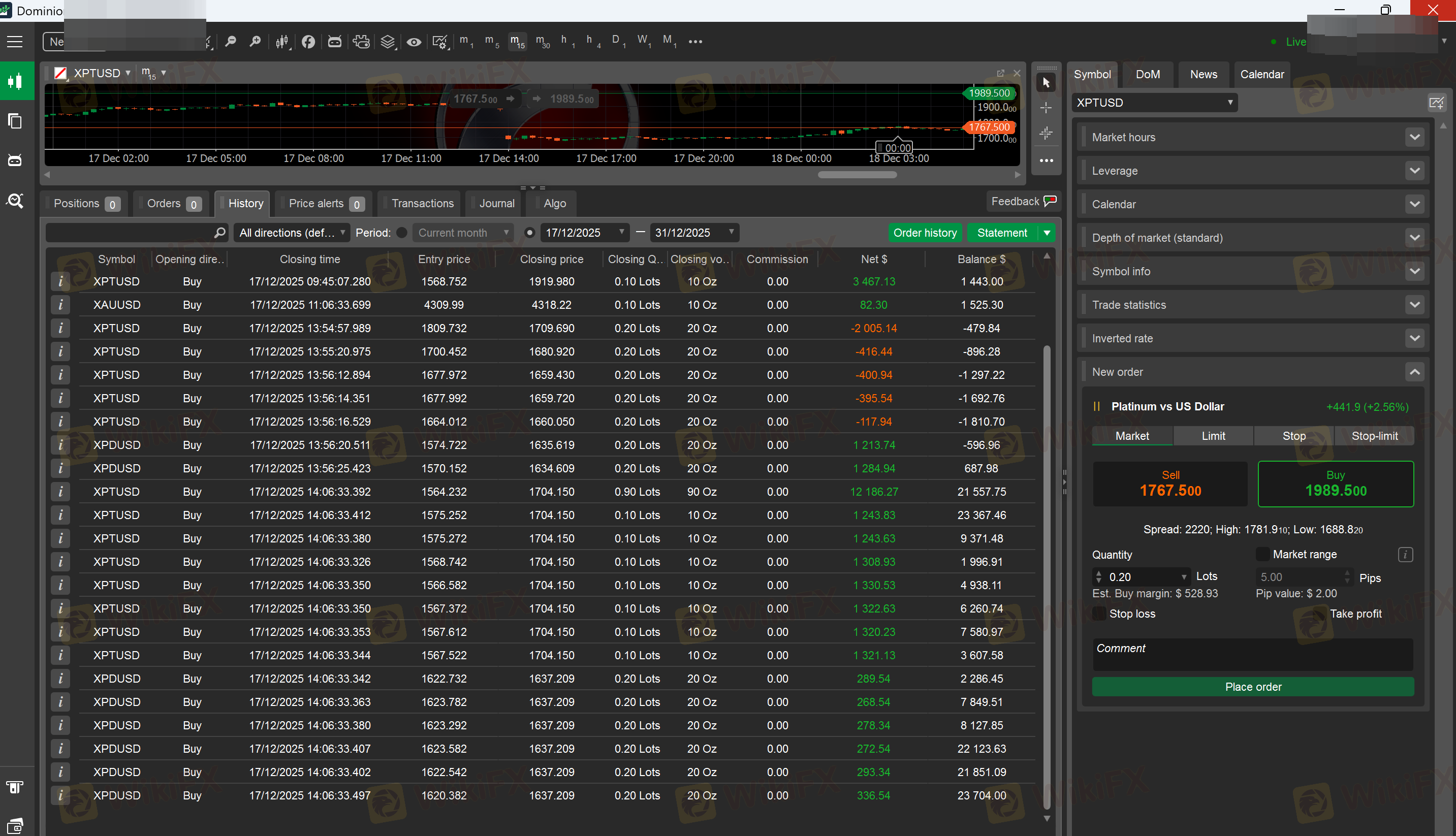

I was a verified client of Dominion Markets since November 25, 2025. My trading was going well; I went long XPTUSD and XPDUSD and watched my account grow. But on December 17, 2025, they logged into my trading account and closed my winning trades themselves, increasing the spread by $200 on XPTUSD. The actual closing price should have been around $1,911, but they closed my positions at $1,660-$1,704. They also closed my account. Because of this, I lost $67,310. They didn't notify me of this; instead, I messaged them all day, but they ignored me. I believe they did this intentionally to steal my profits. I have screenshots to prove this. There are also many negative reviews about their activities, including how they block accounts and prevent people from withdrawing their funds. I recommend everyone stay away from this company to avoid giving a penny to these scammers. How can they be held accountable?

| Dominion Markets Review Summary | |

| Founded | 2020-12-07 |

| Registered Country/Region | Mauritius |

| Regulation | Regulated by FSC in Mauritius |

| Market Instruments | Forex, Indices, Cryptos, Shares |

| Demo Account | / |

| Leverage | Up to 500:1 |

| Spread | Start from 0.0 pips |

| Trading Platform | cTrader, MT5 |

| Min Deposit | $50 |

| Customer Support | Tel: +(971) 4570 4324(Hours: 10 am - 6 pm GMT +4) |

| Email: info@dominionmarkets.com | |

| Social media:Twitter: https://twitter.com/DominionMktsLLCInstagram: https://www.instagram.com/dominionmarkets/YouTube: https://www.youtube.com/@DominionMarkets/featured | |

| Company address:Management Office: Office-4f-B-04 345-Sh. Zayed Road Dubai, UAERegistered Office: Misa Building, B.P. 724, Fomboni, Island of Mohéli, Comoros Union | |

Dominion Markets was registered in Mauritius in 2020. It uses cTrader and MT5 as its trading platforms, and it claims to offer trading services on Forex, Indices, Cryptos, and Shares. This company is regulated by FSC. The leverage is 500:1, and the minimum deposit is $50.

| Pros | Cons |

| Multiple account types | Wide spreads |

| Various trading products | |

| MT5 support | |

| Multiple Contacts | |

| Popular payment options | |

| Regulated by FSC |

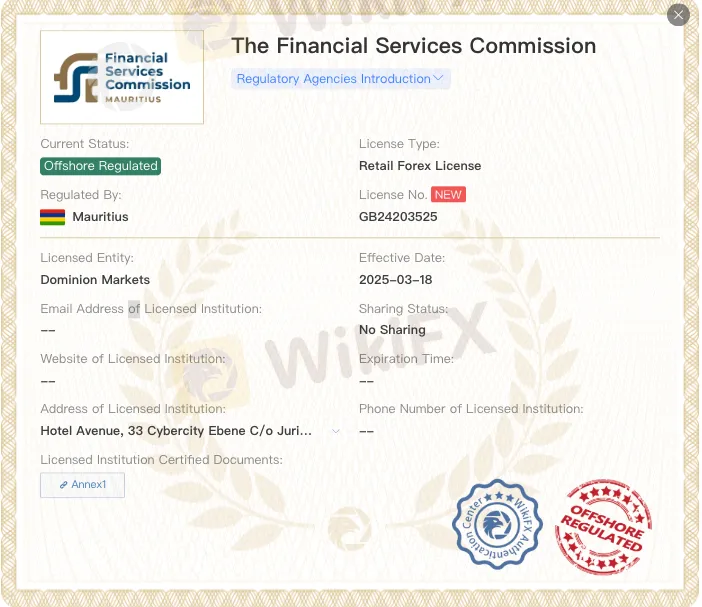

Dominion Markets is regulated by the Financial Services Commission of Mauritius. It holds a Retail Forex License under offshore regulation, with the license number GB24203525.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ✔ |

| Bonds | ❌ |

| ETFs | ❌ |

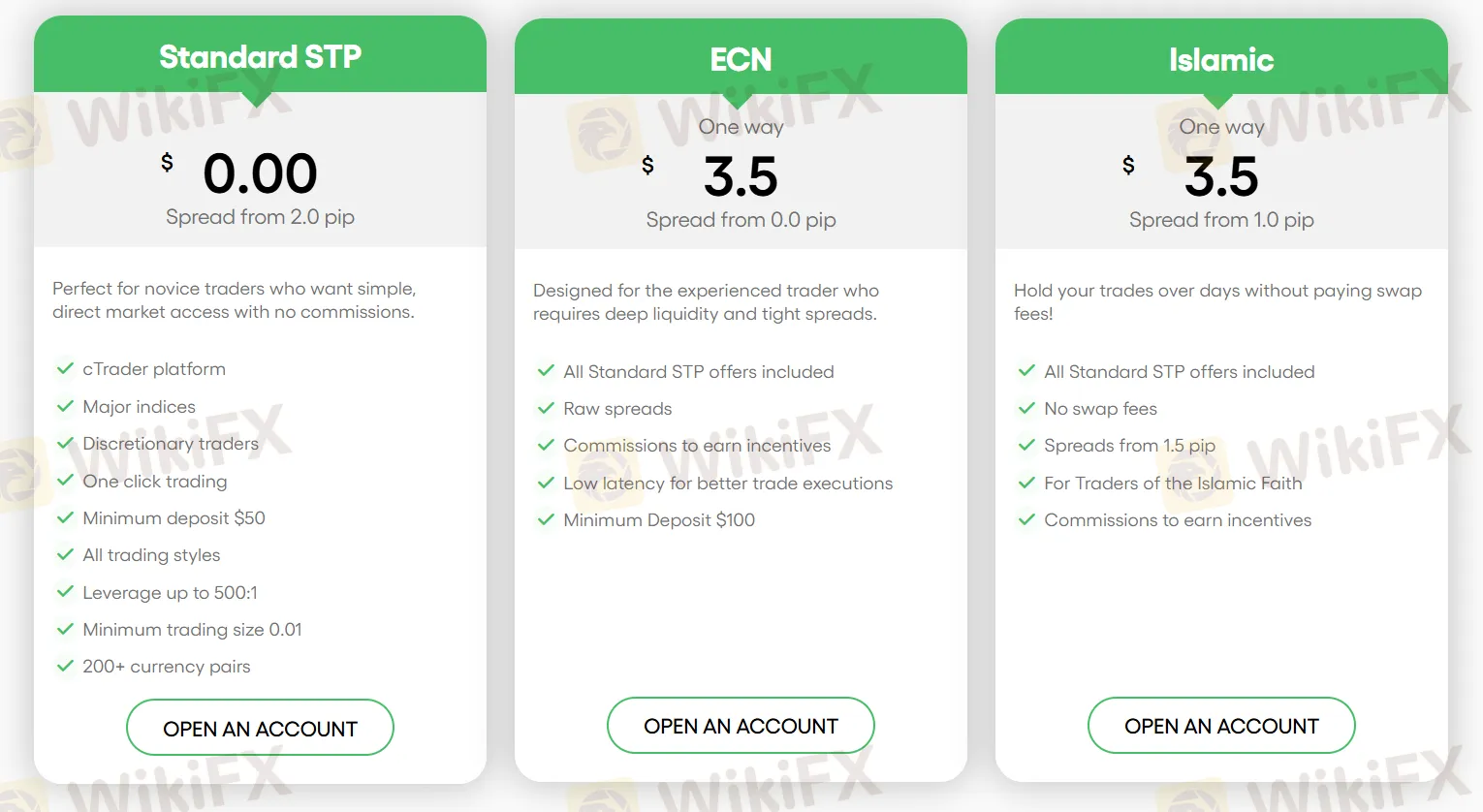

| Account | Mini Deposit |

| Standard STP | $50 |

| ECN | $100 |

| Islamic | / |

| Account | Spread | Commission |

| Standard STP | Spread from 2.0 pip | $0.00 |

| ECN | Spread from 0.0 pip | $3.5(one way) |

| Islamic | Spread from 1.0 pip | $3.5(one way) |

While leverage can make your potential gains look bigger, it can also make your potential losses look bigger. Leverage magnifies the returns from favorable movements in a currency's exchange rate. Forex traders must learn how to manage leverage and employ risk management strategies to mitigate forex losses.

| Account | Leverage |

|---|---|

| Standard STP | 500:1 |

| ECN | / |

| Islamic | / |

| Trading Platform | Supported | Available Devices | Suitable for |

| cTrader | ✔ | IOS, Android, MacOS, Windows, Web, Amazon | / |

| MT4 | ❌ | Beginners | |

| MT5 | ✔ | Experienced trader |

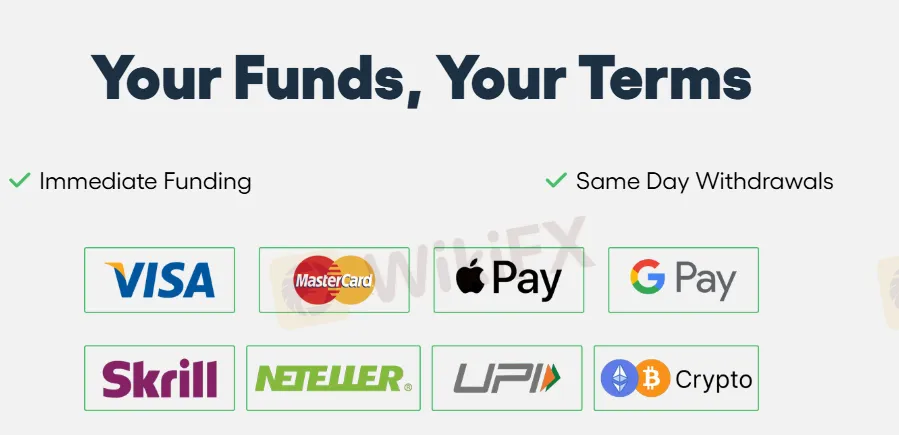

| Payment Methods | Supported |

| VISA | ✔ |

| MasterCard | ✔ |

| Apple Pay | ✔ |

| Google Pay | ✔ |

| Skrill | ✔ |

| NETELLER | ✔ |

| UPI | ✔ |

| Crypto | ✔ |

Have you thought about what would happen if you invested your money in Dominion Markets? Will it be safe? Are you confident enough about the broker? Do you know all the relevant details about Dominion Markets? Always gather information before trading. In this article, you will find all the details about Dominion Markets in one place.

WikiFX

WikiFX

Dominion Market has faced allegations of freezing funds and preventing withdrawals without proper notice. Traders report that the broker, claiming to be a 100% Dealing Desk, blocks withdrawals when capital is near full withdrawal. The broker cites open positions as the reason for locked funds, raising concerns about its legitimacy and transparency.

WikiFX

WikiFX

Dominion Markets, a forex broker founded in 2020 currently caught our eye. Is this broker reliable? This article may give you some clues.

WikiFX

WikiFX

More

User comment

13

CommentsWrite a review

2025-12-24 01:55

2025-12-24 01:55

2025-08-27 00:33

2025-08-27 00:33