User Reviews

More

User comment

11

CommentsWrite a review

2025-09-08 14:48

2025-09-08 14:48

2025-09-08 13:01

2025-09-08 13:01

Score

5-10 years

5-10 yearsRegulated in United States

Currency Exchange License (MSB)

MT5 Full License

High potential risk

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index4.94

Business Index7.07

Risk Management Index0.00

Software Index9.99

License Index5.23

Single Core

1G

40G

More

Company Name

QRS GLOBAL LLC

Company Abbreviation

QRS GLOBAL

Platform registered country and region

Australia

Company website

YouTube

Company summary

Pyramid scheme complaint

Expose

| QRSFX Review Summary | |

| Founded | 2020 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Market Instruments | Forex pairs, Commodities, CFDs |

| Account Type | QRS Cent Account, QRS Freedom Account, QRS Standard Swap Free Account, PRO MT5 Account. |

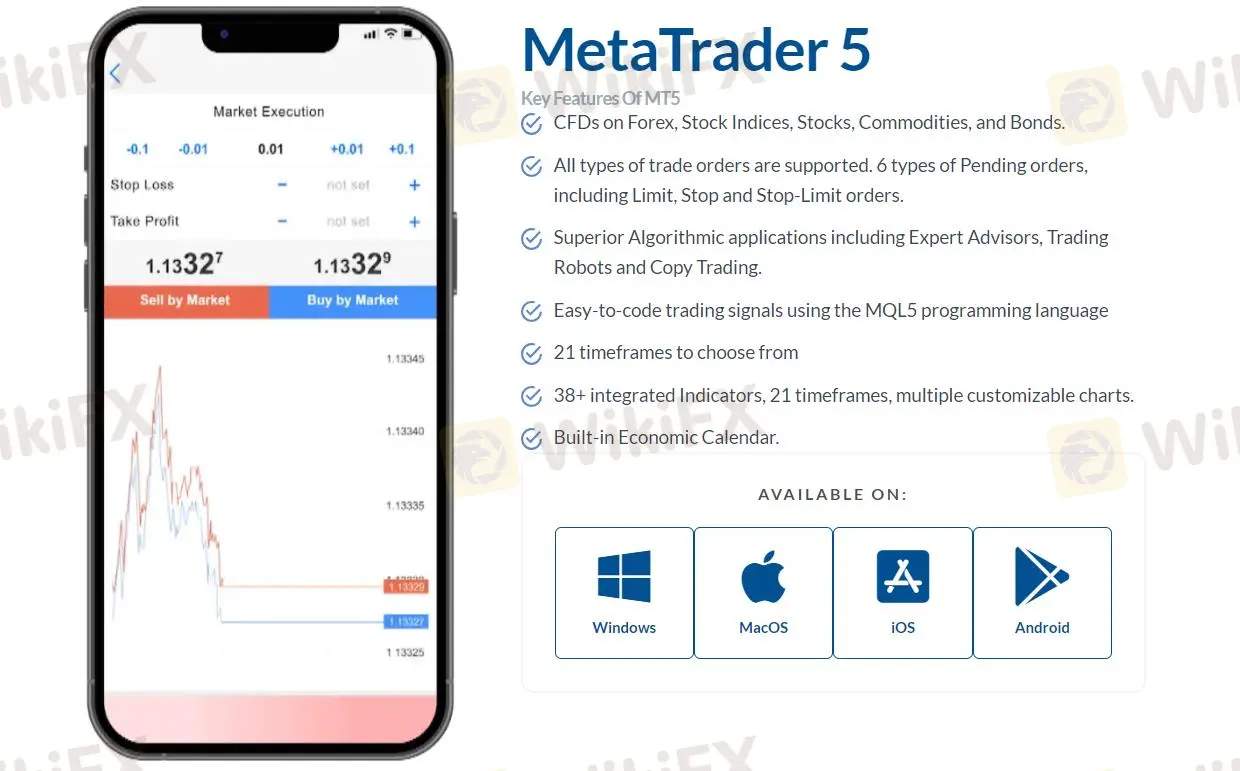

| Trading Platform | MT5 |

| Maximum Leverage | 1:1000 |

| Min Deposit | $10 |

| Spreads | 0.8-1.6 pips |

| Commissions | No |

| Customer Support | Phone: 677 264 514 |

| Email: support@qrsfx.com | |

| Physical Address: 2 132 Epsom Rd Zetland NSW 2017.49 Sukonthasawat Road, Lad Prao, Bangkok | |

QRSFX, founded in 2020, is a brokerage registered in Australia. It provides forex pairs, commodities, CFDs for traders to trade. It is regulated by Australia.

| Pros | Cons |

| Regulated | No information on deposit and withdrawal methods |

| MT5 supported | No MT4 supported |

| No commissions | Limited information on market instrument |

| Low spreads | |

| High leverage | |

| No demo accounts provided |

QRSFX is regulated by Australia. It has 1 type of license - ASIC. Its license type is Appointed Representative(AR).

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| Australia | ASIC | QRS GLOBAL (AUSTRALIA) PTY LTD | Appointed Representative(AR) | 001309317 | Regulated |

QRSFX offers traders Forex pairs, Commodities, CFDs.

| Tradable Instruments | Supported |

| Forex pairs | ✔ |

| Commodities | ✔ |

| CFDs | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Cryptocurrencies | ❌ |

| Currencies | ❌ |

| Metals | ❌ |

| Indices | ❌ |

| Futures | ❌ |

| Options | ❌ |

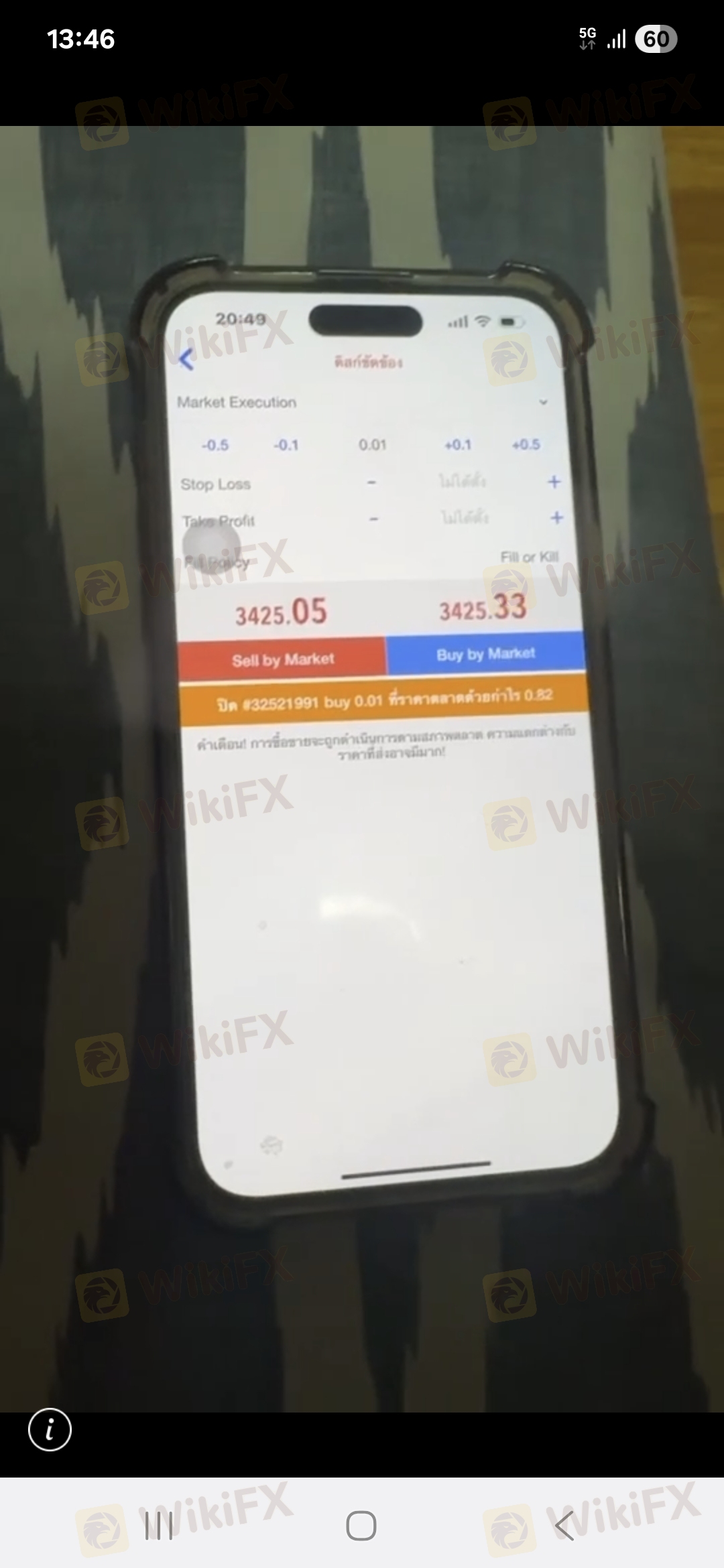

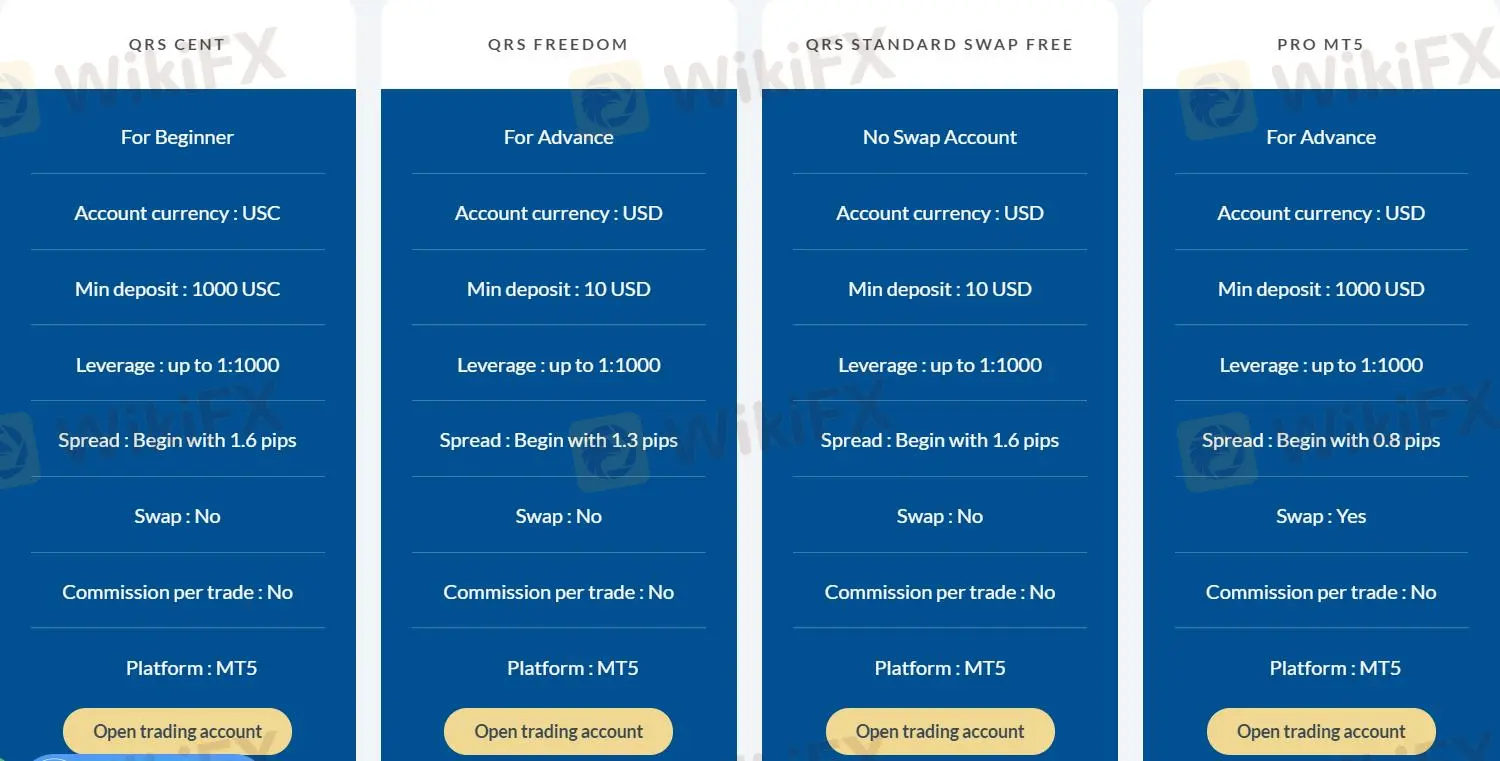

QRSFX provides 4 types of accounts - QRS Cent Account, QRS Freedom Account, QRS Standard Swap Free Account, PRO MT5 Account.

| Account Type | QRS Cent Account | QRS Freedom Account | QRS Standard Swap Free Account | PRO MT5 Account |

| Account Currency | USC | USD | USD | USD |

| Min Deposit | $1000 USC | $10 USD | $10 USD | $1000 USD |

| Leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 |

| Spreads | Begin with 1.6 pips | Begin with 1.3 pips | Begin with 1.6 pips | Begin with 0.8 pips |

| Swap | No | No | No | Yes |

| Commission | No | No | No | No |

QRSFX charges no commissions for per trade. Its spread is 1.6 pips for QRS Cent Account, 1.3 pips for QRS Freedom Account, 1.6 pips QRS Standard Swap Free Account, 0.8 pips for PRO MT5 Account.

QRSFX's trading platform is MT5 platform, which support traders on PC,Mac,iPhone and Android.

| Trading Platform | Supported | Available Devices |

| MT5 Margin WebTrader | ✔ | Web, Mobile |

| MT4 | ❌ |

More

User comment

11

CommentsWrite a review

2025-09-08 14:48

2025-09-08 14:48

2025-09-08 13:01

2025-09-08 13:01