User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.51

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Topwealth Bullion | Basic Information |

| Registered Countries | Australia |

| Regulation | Unregulated |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 |

| Minimum Spread | From 0.0 pips (PRO account) |

| Trading Platform | MetaTrader 4 (MT4) |

| Trading Assets | Forex, CFDs, Commodities, Crypto |

| Payment Methods | Not specified |

| Customer Support | 24/7 via email and online chat |

| Bonus Available | Not specified |

| Demo Account | No |

Over 60 forex, CFD, commodity, and cryptocurrency instruments are available from Topwealth Bullion. It supports MetaTrader 4 and offers 1:500 leverage, appealing to experienced traders. Lack of regulation raises risks.

| Pros | Cons |

| High leverage (up to 1:500) | No valid regulation |

| Low spreads on PRO account | No demo or Islamic accounts |

| 24/7 customer support | Limited payment details |

Topwealth Bullion has no valid regulation. This means the broker is not licensed by key regulatory authorities like the FCA or ASIC. Broker safety and credibility are compromised by this absence of regulation, therefore traders should be wary.

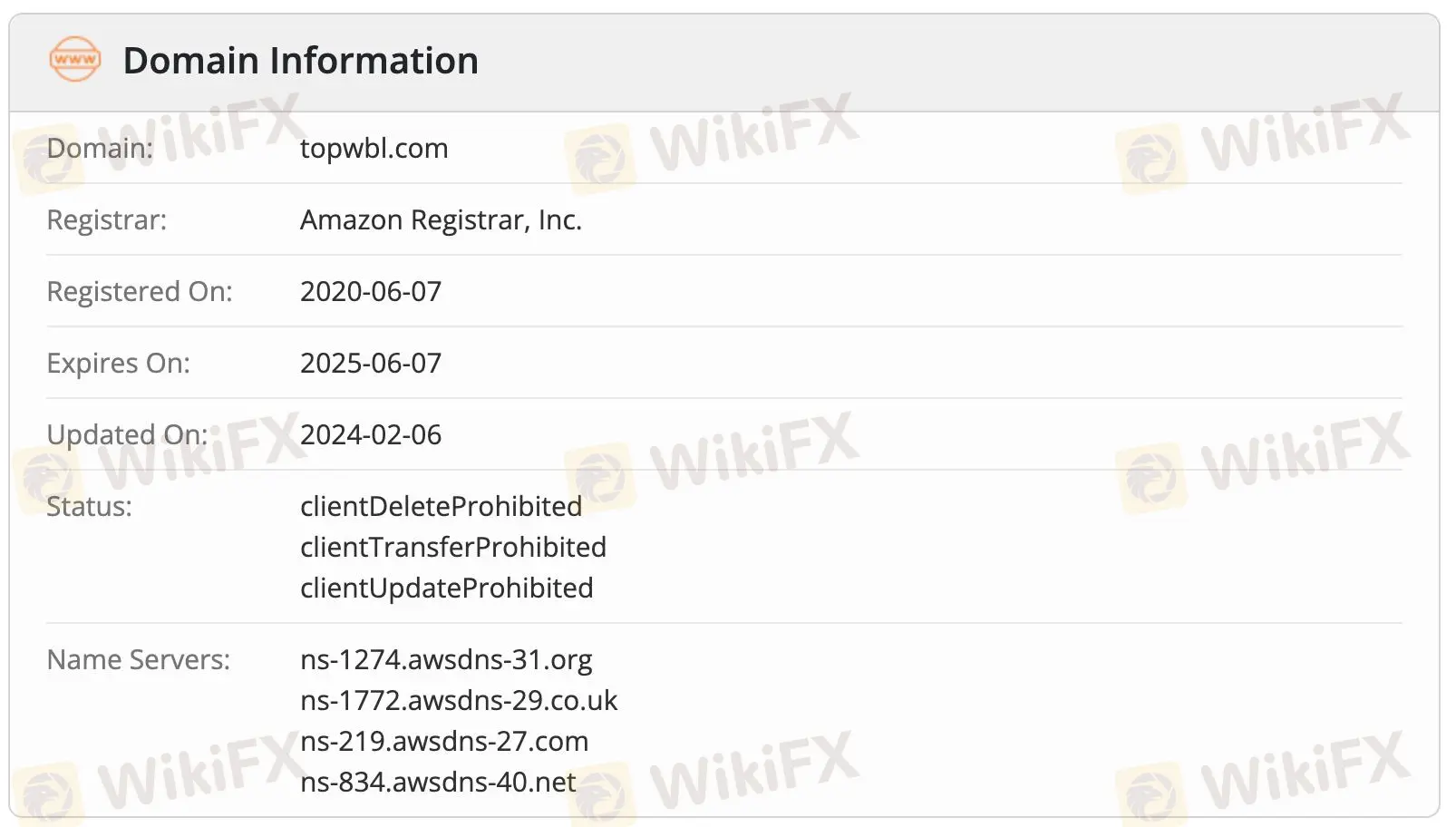

Topwbl.com was registered on June 7, 2020, and will expire on June 7, 2025. It was last modified on February 6, 2024, and is in a protected status (clientDeleteProhibited, clientTransferProhibited, clientUpdateProhibited).

Topwealth Bullion provides access to over 60 instruments, such as forex, CFDs, indices, and futures.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities (Precious Metals, Oil) | ✔ |

| Crypto | ✔ |

| CFD | ✔ |

| Indexes | ❌ |

| Stock | ❌ |

| ETF | ❌ |

Two live accounts are available from Topwealth Bullion: Standard for beginners and intermediate traders and PRO for experienced traders with tighter spreads. There are not any Islamic or Demo accounts.

Topwealth Bullion provides traders with the ability to manage larger positions with a smaller initial investment by offering leverage of up to 1:500. Although higher leverage can increase potential profits, it also significantly increases risks.

Standard industry fees apply at Topwealth Bullion. PRO spreads start at 0.0 pips, and Standard accounts have no commissions. Overnight swap rates vary per asset. The cost structure caters to traders seeking commission-free or tighter spreads.

The Topwealth Bullion minimum deposit is $100. Deposit and withdrawal fees are unknown.

| Trading Platform | Supported | Available Devices | Suitable for 适合何种类型交易者 |

| MetaTrader 4 (MT4) | ✔ | Windows, Mac, Android, iOS | All traders |

Topwealth Bullion offers 24/7 support. Email and online support are available.

| Contact Options | Details |

| Phone | Not specified |

| service@topwbl.com | |

| Support Ticket System | Not specified |

| Online Chat | Available |

| Social Media | Not specified |

| Supported Language | English |

| Website Language | English |

| Physical Address | P.O. Box 1498, Port Vila, Efate, Republic of Vanuatu |

High leverage and low spreads make Topwealth Bullion appropriate for experienced traders. Traders may worry about its lack of regulation and demo or Islamic accounts.

Is Topwealth Bullion safe?

No major authority regulate it.

Is Topwealth Bullion good for beginners?

Due to the lack of demo accounts and regulation, newbies may not like it.

Is Topwealth Bullion good for day trading?

Low spreads and high leverage make day trading possible.

Is it safe to trade with Topwealth Bullion?

Be careful when trading with an unregulated broker.

Online trading involves considerable risk, so it may not be suitable for every client.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment