User Reviews

More

User comment

3

CommentsWrite a review

2024-07-01 14:27

2024-07-01 14:27

2023-12-19 18:46

2023-12-19 18:46

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.44

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

Mega Trader FX Ltd.

Company Abbreviation

MTFX

Platform registered country and region

United Kingdom

Company website

Company summary

Pyramid scheme complaint

Expose

| MTFXReview Summary | |

| Founded | 2011 |

| Registered Country/Region | UK |

| Regulation | CYSEC (Suspicious Clone) |

| Market Instruments | Currencies, CFDs, metals, stocks, indices |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 1 pips |

| Trading Platform | MT4, MTFX APP |

| Minimum Deposit | $0 |

| Bonus | ✅ |

| Customer Support | 24/5 support, live chat |

| Email: support@megatraderfx.com | |

| Social media: Twitter, Facebook | |

| Regional Restrictions | US |

MTFX was registered in 2011 in the UK, specializing in currencies, CFDs, metals, stocks, and indices markets. It offers three types of accounts, among which the Micro Account does not require minimum deposit and the maximum leverage can be 1:500. Bonuses and demo accounts are also offered. However, it holds a suspicious clone license, and it does not provide services to US residents.

| Pros | Cons |

| Low minimum deposit | Suspicious clone license |

| Tight spreads | Regional restrictions |

| MT4 supported | |

| Demo account and Islamic account | |

| No commission fees | |

| Promotion and bonus offered | |

| Long operation time |

No, MTFX holds a suspicious clone license. Traders should be cautious and be aware of the potential risks!

| Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| Cyprus Securities and Exchange Commission (CYSEC) | Suspicious Clone | Cyprus | Market Maker (MM) | 120/10 |

MTFX provides several types of products, including currencies, CFDs, metals, stocks, and indices.

| Tradable Instruments | Supported |

| Currencies | ✔ |

| CFDs | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

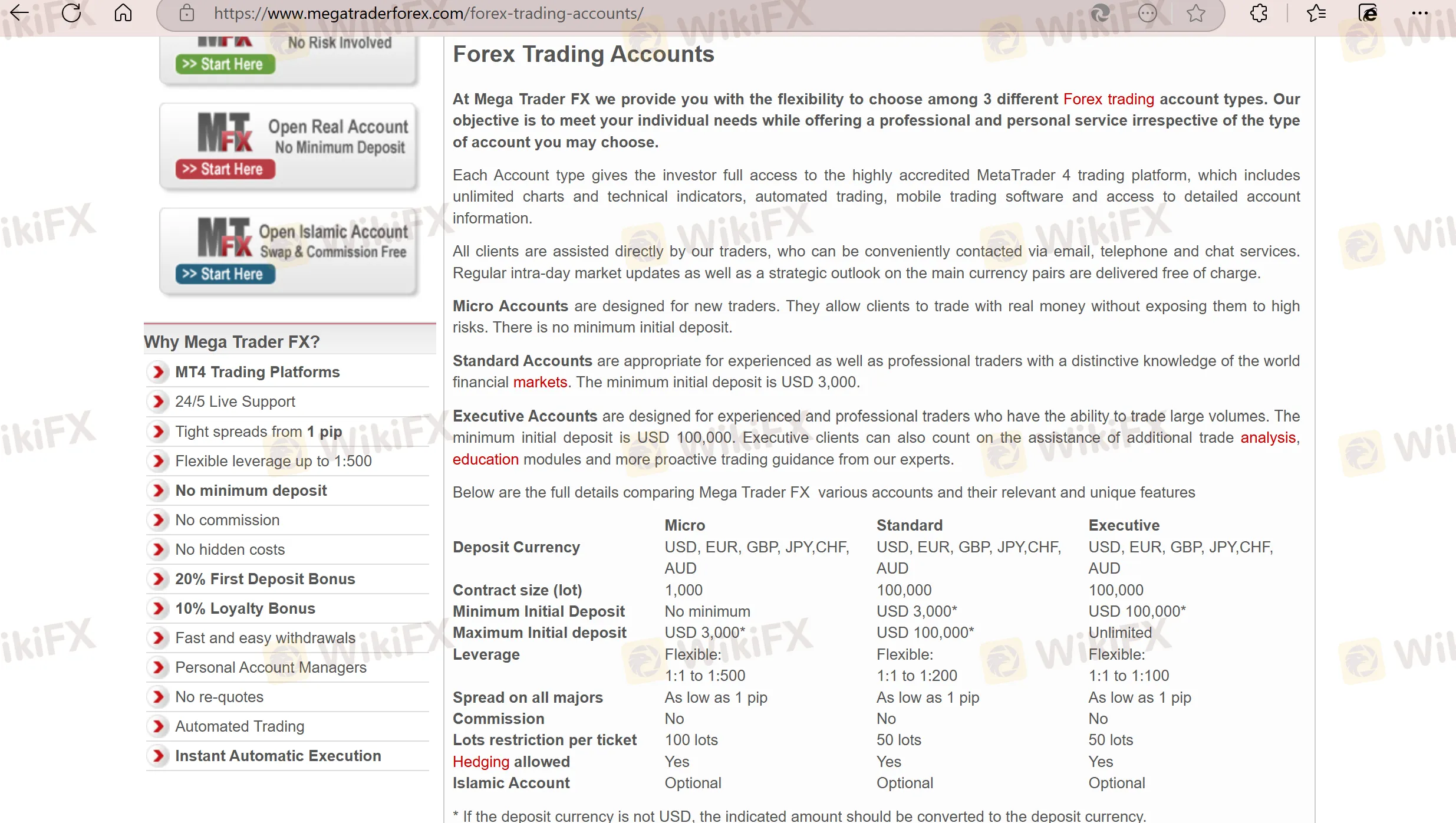

MTFX provides three types of accounts: Micro, Standard, Executive Account. Besides, demo accounts and Islamic accounts are also available. More importantly, it does not charge any commission fees.

| Account Type | Minimum Deposit | Maximum Leverage | Spread | Commission | Deposit Currencies |

| Micro | ❌ | 1:500 | From 1 pips | ❌ | USD, EUR, GBP, JPY, CHF, AUD |

| Standard | $3,000 | 1:200 | ❌ | ||

| Executive | $100,000 | 1:100 | ❌ |

The leverage ranges from 1:1 to 1:500. Traders need to consider carefully before investing, since high leverage is likely to bring high potential risks.

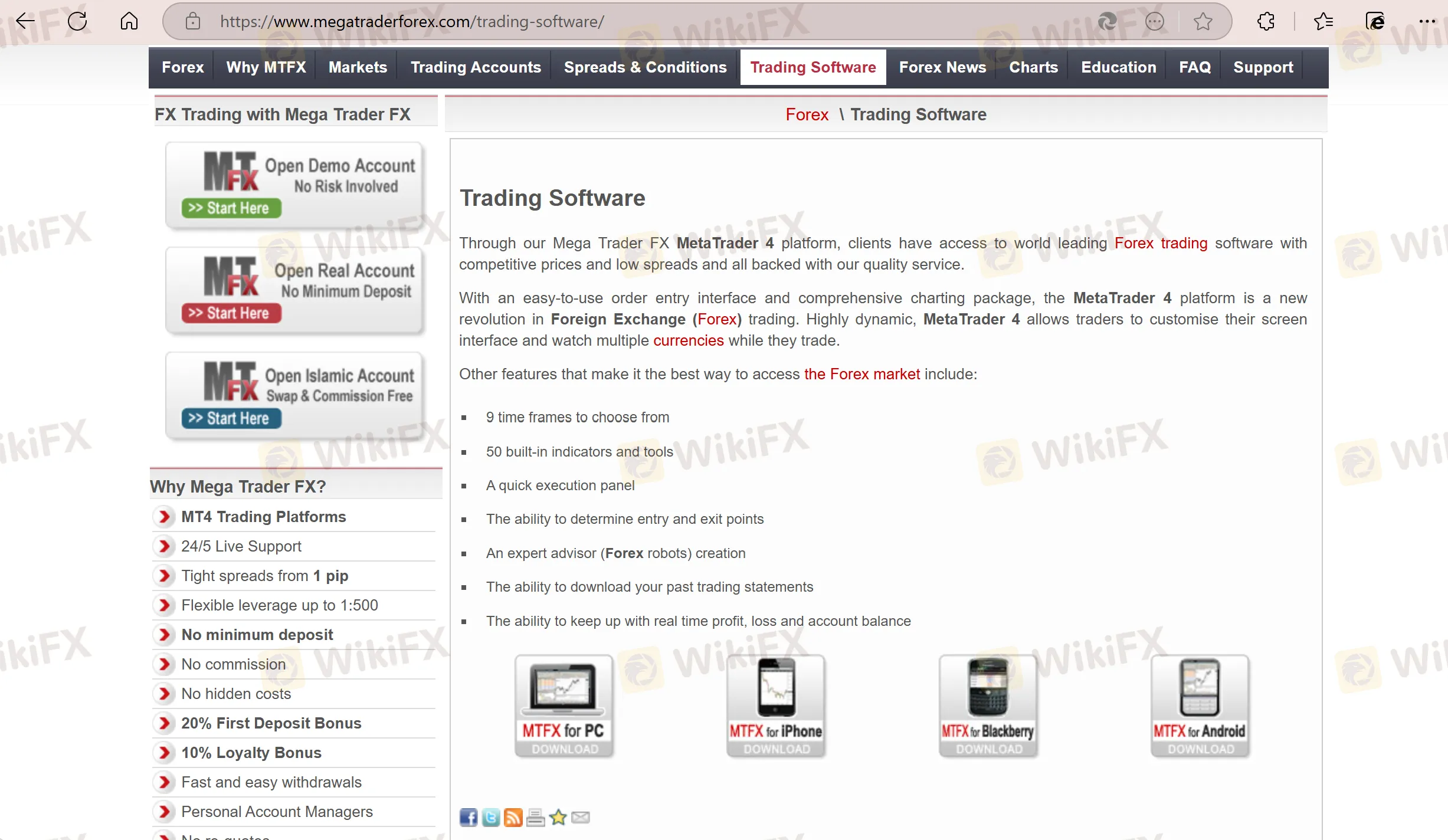

MTFX uses MT4 and mobile APP as its trading platforms. MT4 is a commonly used platform, which is suitable for beginners. Its mobile trading APP can be used on iPhone, Blackberry, and Android devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | PC, web, mobile, mac | Beginners |

| MTFX APP | ✔ | Mobile (iPhone, Blackberry, Android) | / |

| MT5 | ❌ | / | Experienced traders |

MTFX supports several types of payment options, such as VISA, Neteller, Mastercard and so on. However, other details such as the processing time and minimum withdrawal are not clear.

MTFX offers two types of bonuses: 20% welcome bonus and 10% loyalty bonus. As long as traders open a new account, they can receive the welcome bonus. As to the loyalty bonus, it can be applied to all redeposits.

More

User comment

3

CommentsWrite a review

2024-07-01 14:27

2024-07-01 14:27

2023-12-19 18:46

2023-12-19 18:46