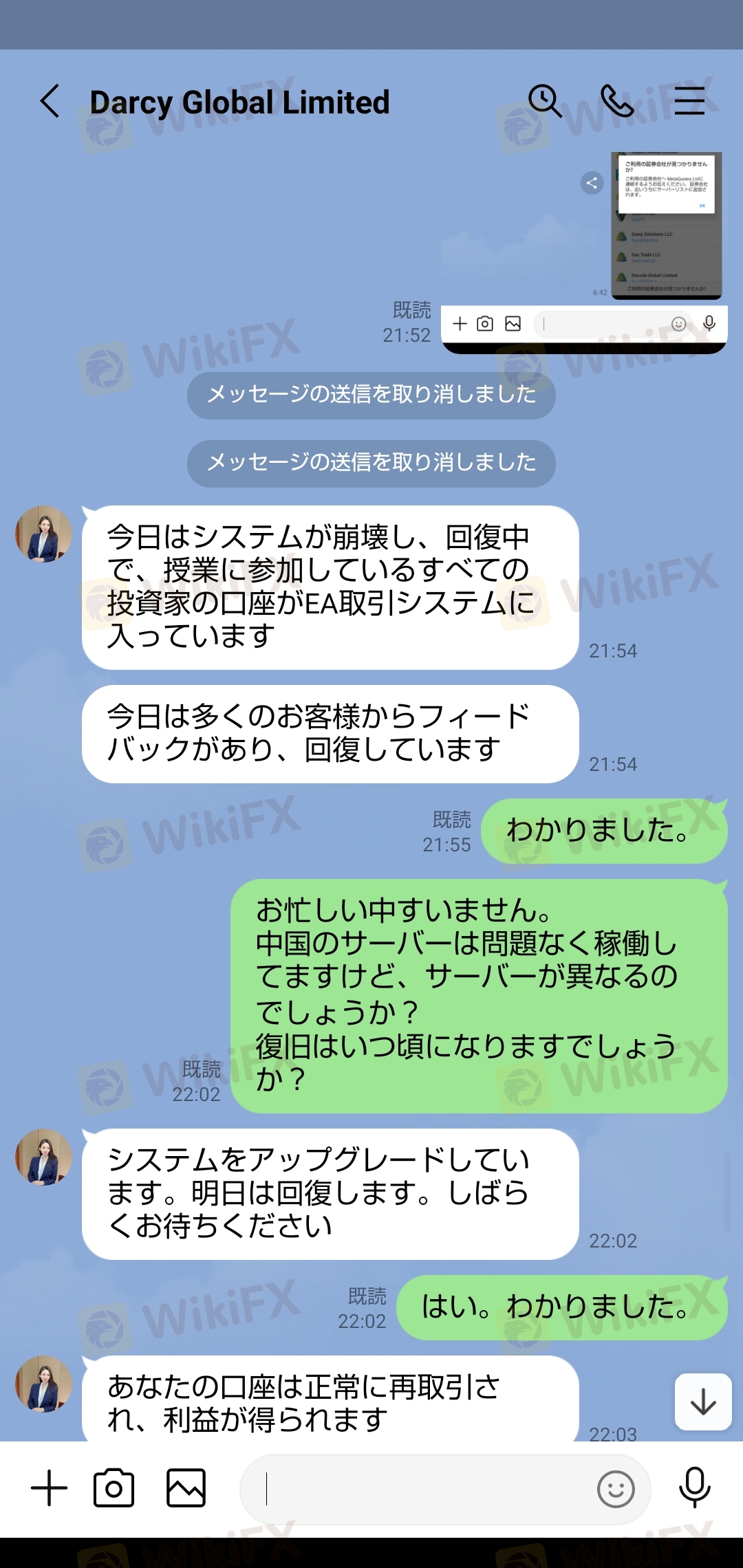

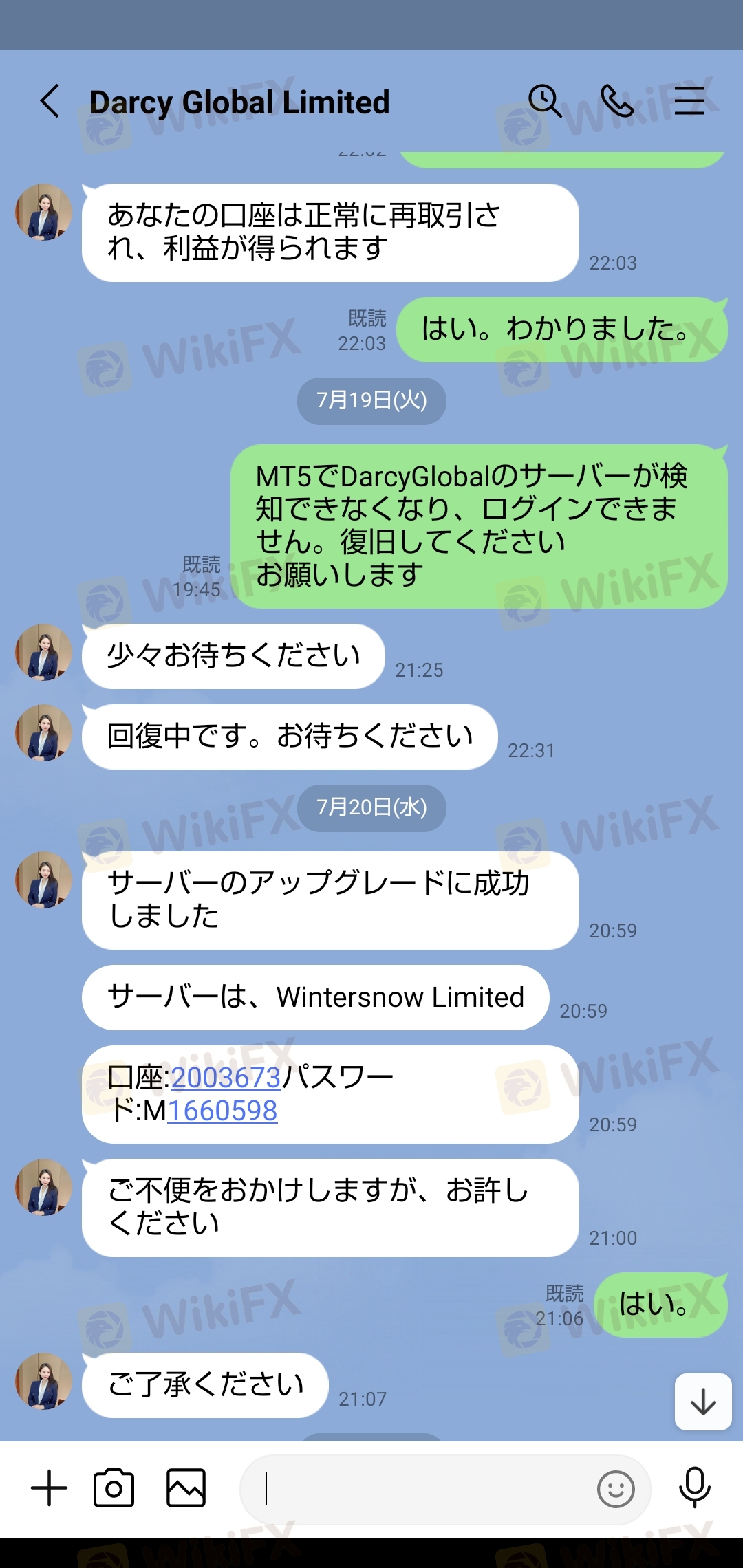

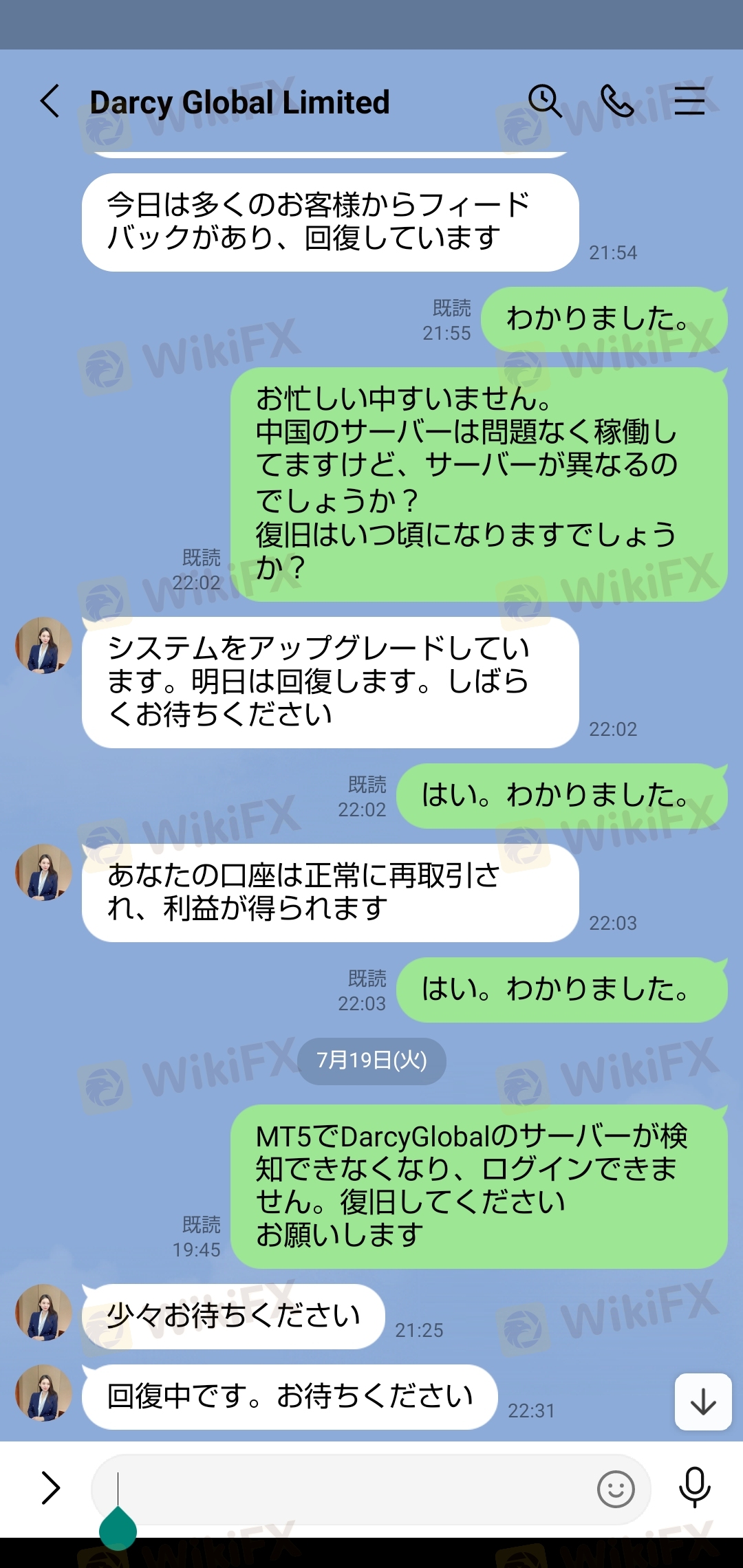

User Reviews

More

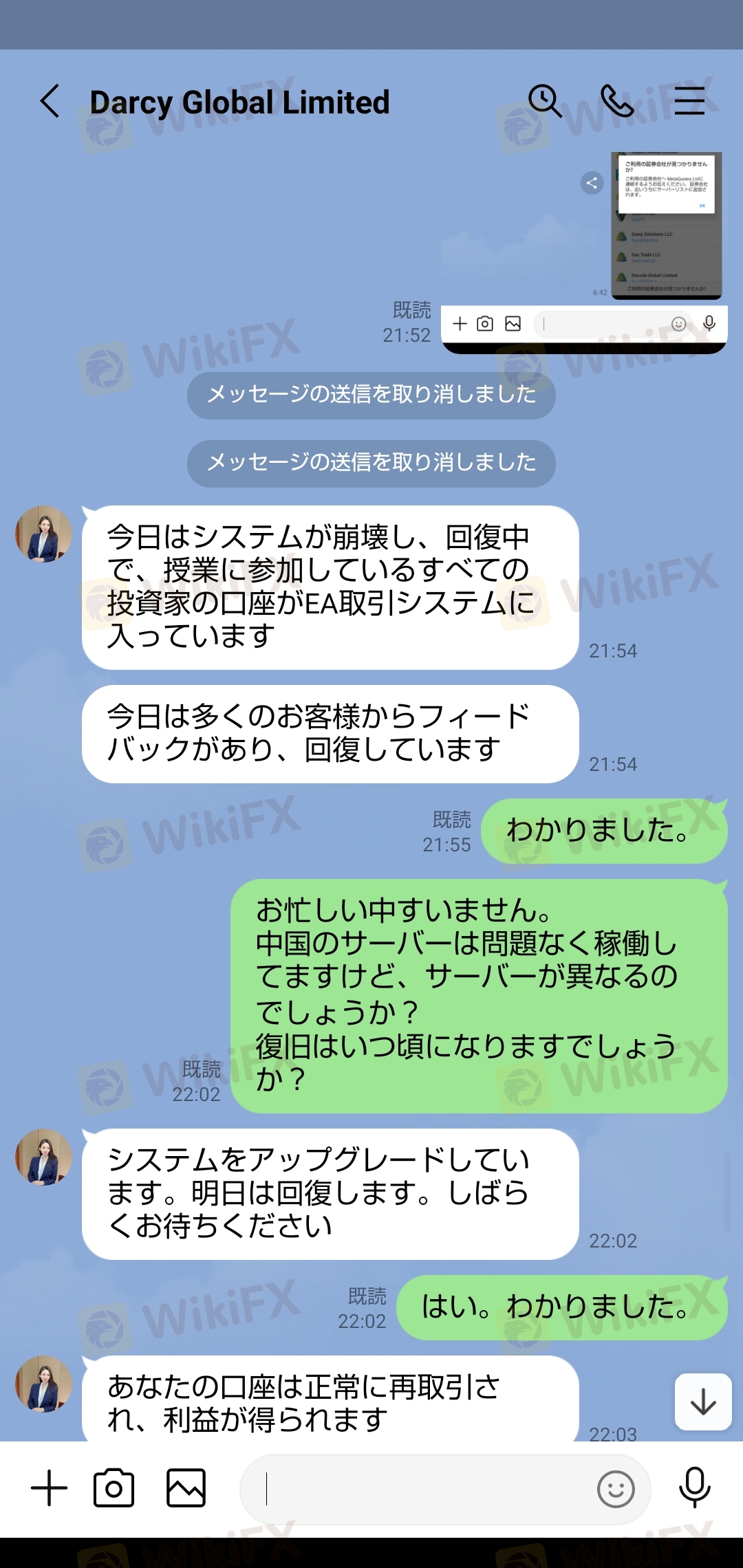

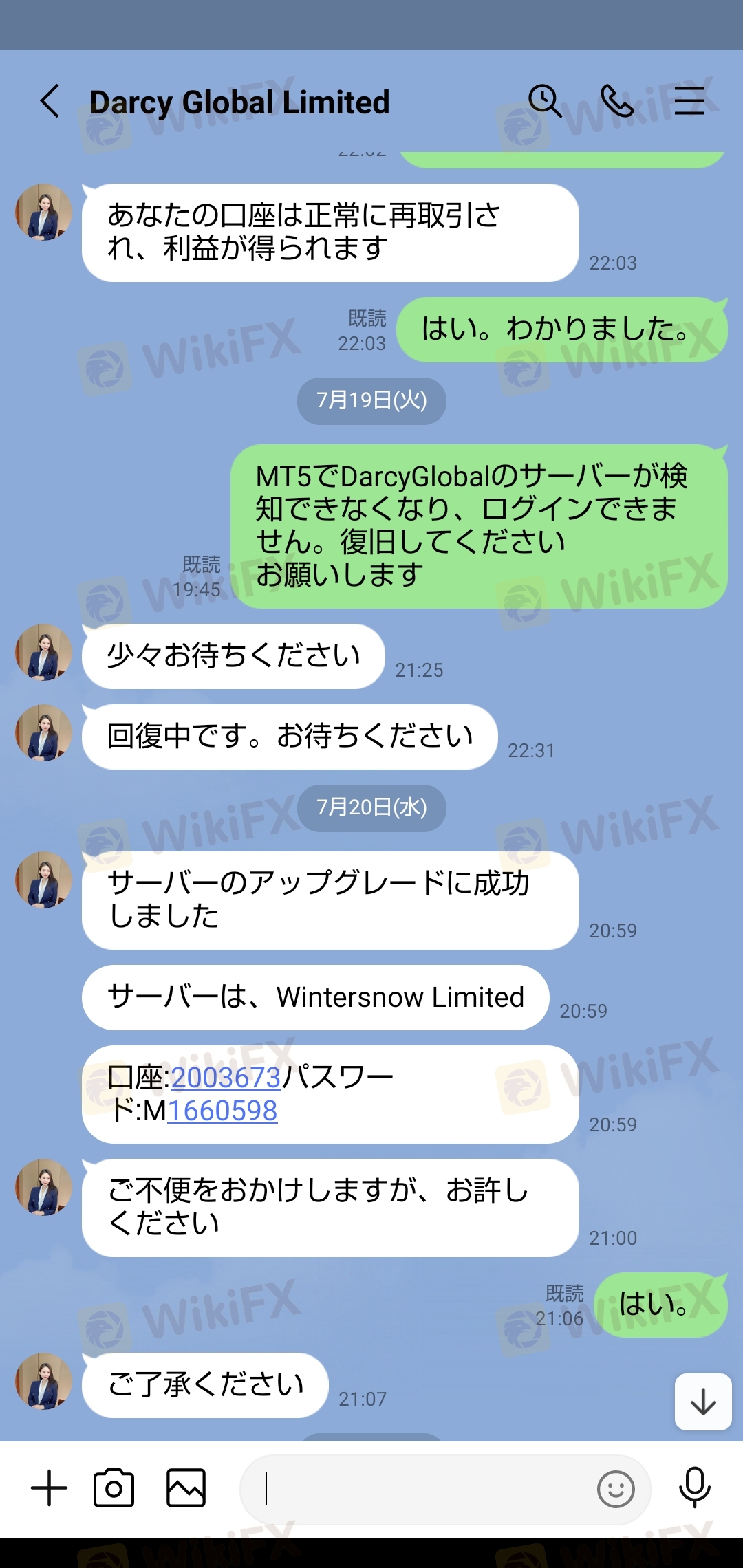

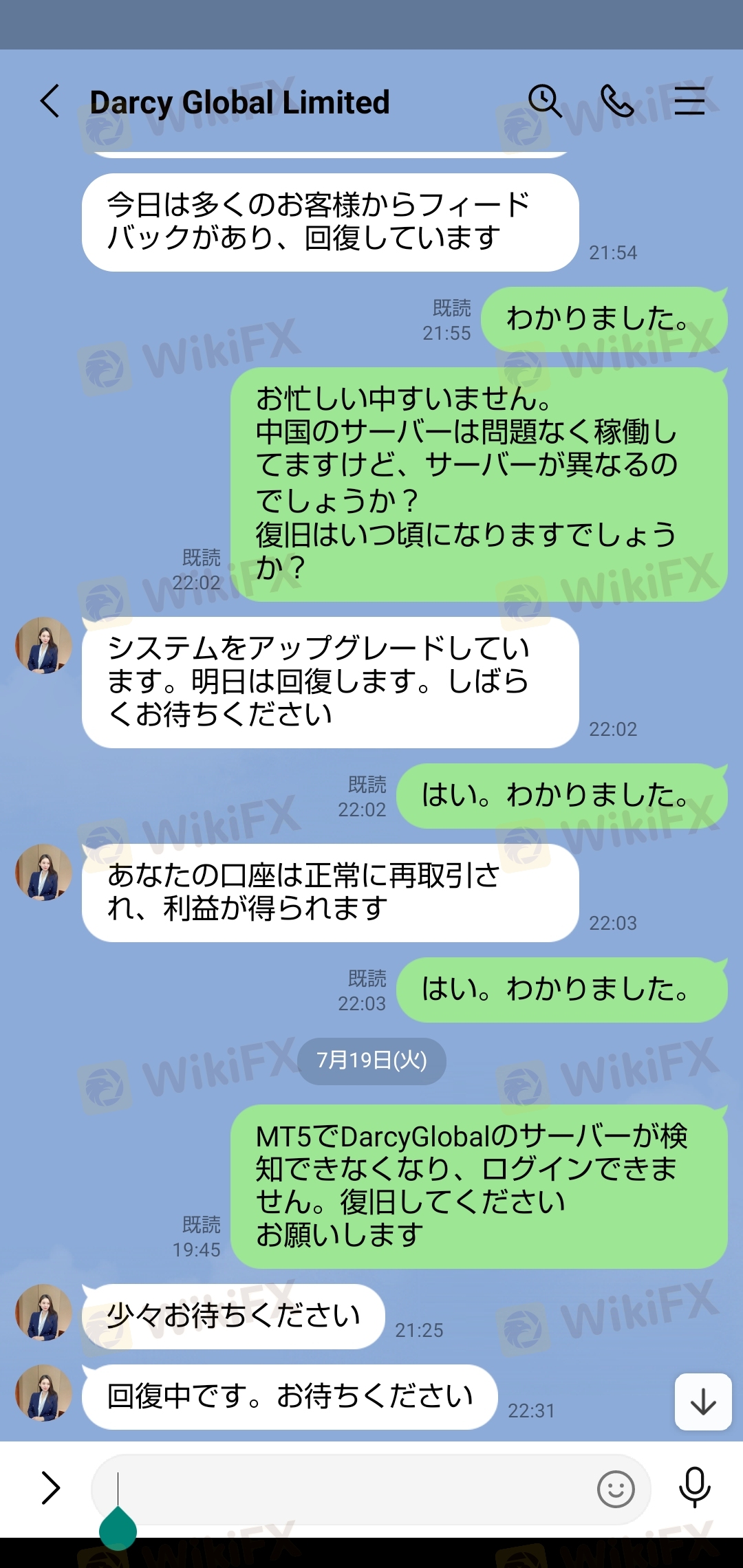

User comment

1

CommentsWrite a review

2022-10-02 07:25

2022-10-02 07:25

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.14

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Key Information | Details |

| Company Name | Darcy Global Limited |

| Years of Establishment | 1-2 years |

| Headquarters | China |

| Office Locations | N/A |

| Regulation | Unregulated |

| Tradable Assets | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Account Types | Demo Account, Standard Account, VIP Account |

| Minimum Deposit | $250 |

| Leverage | Up to 1:1000 |

| Spread | As low as 1.0 pips |

| Deposit/Withdrawal | Bank wire transfer, Credit card, Debit card, E-wallet |

| Trading Platforms | MetaTrader 4 |

| Customer Support |

Darcy Global Limited is an unregulated forex and CFD broker headquartered in China. With around 1-2 years of establishment, the company offers online trading services for a range of tradable assets, including forex, stocks, indices, commodities, and cryptocurrencies. The company's customer support is available, and inquiries can be made through email.

Traders can access various account types, including a demo account, standard account, and VIP account, with minimum deposits starting from $250. The trading platform provided by Darcy Global Limited is MetaTrader 4, offering leverages of up to 1:1000 and spreads starting from 1.0 pips. Customers can make deposits and withdrawals via bank wire transfer, credit card, debit card, as well as through e-wallet options like Skrill, Neteller, and Perfect Money.

Darcy Global Limited operates as an unregulated broker, which means it does not fall under the oversight or supervision of any regulatory authority. The absence of regulation implies that the company's activities in the forex and CFD market are not subject to specific rules or compliance standards imposed by financial authorities. Without regulatory supervision, there is no external body ensuring the company's adherence to industry practices, customer protection measures, or financial transparency. As an unregulated entity, Darcy Global Limited is not obligated to follow guidelines that are typically put in place to safeguard traders' interests, prevent potential conflicts of interest, or enforce strict financial reporting. This lack of regulatory oversight may raise concerns among potential traders, as they have limited recourse or protection in case of disputes or malpractices by the broker.

Darcy Global Limited offers a wide range of tradable assets, including forex, stocks, indices, commodities, and cryptocurrencies, providing traders with various investment opportunities. The availability of different account types, such as the demo, standard, and VIP accounts, caters to traders with diverse trading preferences and risk appetites. Additionally, the option to use popular e-wallet services like Skrill, Neteller, and Perfect Money for deposits and withdrawals can offer convenience and efficiency to clients. The leverage ratios provided, up to 1:1000, may attract traders looking for higher leverage to amplify their trading positions. Moreover, the MetaTrader 4 trading platform offers a robust and widely used interface, known for its advanced charting tools and analytical capabilities.

One significant drawback of Darcy Global Limited is its lack of regulation. As an unregulated broker, the company operates without the oversight and safeguards imposed by financial authorities, potentially raising concerns about the security and transparency of its operations. The inaccessible website further hampers the company's credibility, making it challenging for traders to access essential information or create trading accounts. This limitation can deter potential clients, as it may signal a lack of professionalism and reliability. Additionally, the absence of physical office locations may be a cause for apprehension, as traders may prefer brokers with visible brick-and-mortar establishments for added reassurance.

| Pros | Cons |

| Range of tradable assets | Unregulated |

| Different account types | Inaccessible website |

| Convenient Withdrawal/Deposit | No physical office locations |

| High Leverage | |

| MetaTrader 4 platform |

The website of Darcy Global Limited is currently inaccessible, rendering potential traders unable to access the platform and its services. This lack of online presence can significantly impact the company's credibility in the financial market. An inaccessible website raises concerns about the company's reliability and professionalism, as it fails to provide a seamless and transparent platform for traders to gather information or create trading accounts. Without access to the website, prospective traders are unable to explore the company's offerings, including the available tradable assets, account types, and trading conditions. This limitation can deter traders from engaging with Darcy Global Limited, as the lack of a functional website may raise doubts about the company's legitimacy and commitment to providing a reliable trading environment. As a result, potential clients may seek alternative brokers with accessible and transparent websites to ensure a more secure and reliable trading experience.

Darcy Global Limited offers forex, stocks, indices, commodities, and cryptocurrencies for trading. The specifics are as follows:

Forex: Darcy Global Limited offers forex trading, enabling traders to participate in the foreign exchange market and speculate on the price movements of various currency pairs.

Stocks: Darcy Global Limited provides access to stock trading, allowing traders to invest in shares of publicly listed companies.

Indices: With Darcy Global Limited, traders can trade on various stock market indices, reflecting the overall performance of specific groups of stocks.

Commodities: Darcy Global Limited offers trading in commodities, allowing traders to speculate on the price movements of natural resources like gold, silver, oil, and more.

Cryptocurrencies: Darcy Global Limited provides the opportunity to trade cryptocurrencies, allowing traders to speculate on the price movements of digital assets like Bitcoin, Ethereum, and others.

The following is a table that compares Darcy Global Limited to competing brokerages:

| Broker | Market Instruments |

| Darcy Global Limited | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| OctaFX | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| FXCC | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Tickmill | Forex, Stocks, Indices, Commodities |

| FxPro | Forex, Stocks, Indices, Commodities |

Darcy Global Limited offers Demo, Standard, and VIP accounts for traders with varying needs. Specifics are as follows:

Demo Account: Darcy Global Limited offers a Demo Account that allows traders to practice and familiarize themselves with the trading platform and market conditions without risking real money. This account type is suitable for beginners and those who want to test their trading strategies before committing to live trading.

Standard Account: The Standard Account at Darcy Global Limited requires a minimum deposit of $250 and offers leverage of up to 1:500. Spreads start from 1.5 pips for this account type, providing traders with access to the full range of tradable assets.

VIP Account: Darcy Global Limited's VIP Account requires a higher minimum deposit of $5000, but in return, traders can enjoy higher leverage of up to 1:1000 and tighter spreads starting from 1.0 pips. This account is designed for experienced traders who seek more favorable trading conditions.

The specifics of the account types are as follows:

| Account Type | Minimum Deposit | Leverage | Spread |

| Demo Account | None | Up to 1:500 | Starting from 1.0 pips |

| Standard Account | $250 | Up to 1:500 | Starting from 1.5 pips |

| VIP Account | $5,000 | Up to 1:1000 | Starting from 1.0 pips |

Darcy Global Limited requires a minimum deposit of $250 for its Standard Account and a higher minimum deposit of $5000 for its VIP Account. Traders can also access a Demo Account with no minimum deposit requirement, allowing them to practice and explore the platform without financial commitment. The company's minimum deposit rates cater to different levels of traders, providing options for both beginners and experienced traders with varying investment capacities.

Darcy Global Limited offers varying levels of leverage to its traders, depending on the account type chosen. Traders using the Standard Account can access leverage of up to 1:500, while those opting for the VIP Account can enjoy even higher leverage of up to 1:1000. The leverage ratios provided by the company aim to cater to the different risk appetites and trading strategies of its clientele.

Darcy Global Limited offers different spreads depending on the chosen account type. For the Standard Account, spreads start from 1.5 pips, while the VIP Account enjoys tighter spreads starting from 1.0 pips. Spreads represent the difference between the buying and selling prices of a financial instrument and can affect trading costs and potential profits. Traders should consider the spread along with other factors when making their trading decisions.

Darcy Global Limited offers a range of deposit and withdrawal methods for its clients' convenience. Traders can make deposits using bank wire transfers, credit cards, and debit cards. Additionally, the company provides e-wallet options like Skrill, Neteller, and Perfect Money for both deposits and withdrawals. These various payment methods allow traders to choose the option that best suits their preferences and enables efficient and timely transactions. However, it is essential for traders to be aware of any associated fees or processing times that may apply to each payment method.

Darcy Global Limited offers the popular and widely used MetaTrader 4 and 5 trading platforms for its clients. MetaTrader 4 and 5 are known for its user-friendly interface, advanced charting tools, technical indicators, and analytical capabilities. MetaTrader 5 being the newer mode of the software, allowing for faster and more efficient trading.

Comparison of Darcy Global Limited's available Trading Platforms compared to competing brokers:

| Broker | Trading Platforms |

| Darcy Global Limited | MetaTrader 4, MetaTrade 5 |

| OctaFX | MetaTrader 4, MetaTrader 5, cTrader |

| FXCC | MetaTrader 4, xStation 5 |

| Tickmill | MetaTrader 4, MetaTrader 5 |

| FxPro | MetaTrader 4, MetaTrader 5, cTrader, FxPro Edge |

Darcy Global Limited offers customer support solely through email. Traders can reach the support team by sending their inquiries to support@darcygloup.com. However, there is no information provided about other customer support channels like live chat or phone support. Having only one customer support option, which is email in this case, can be a disadvantage for traders as it limits their avenues of communication. Without alternative channels like live chat or phone support, clients may experience delays in receiving timely responses to urgent queries or technical issues, potentially affecting their overall trading experience.

In conclusion, Darcy Global Limited is an unregulated forex and CFD broker that offers a range of tradable assets, including forex, stocks, indices, commodities, and cryptocurrencies, catering to traders with varying investment preferences. Traders can choose from different account types, such as the Demo Account, Standard Account, and VIP Account, each with its own set of features and trading conditions.

While the MetaTrader 4 trading platform provides a reliable interface for clients, the lack of regulatory oversight raises concerns about the company's transparency and accountability. Moreover, the inaccessible website and absence of physical office locations may impact the broker's credibility and professional image.

Q: What types of trading instruments does Darcy Global Limited offer?

A: Darcy Global Limited provides forex, stocks, indices, commodities, and cryptocurrencies for trading.

Q: What is the minimum deposit required for a Standard Account with Darcy Global Limited?

A: The minimum deposit for a Standard Account is $250.

Q: How can traders deposit and withdraw funds with Darcy Global Limited?

A: Traders can use bank wire transfers, credit cards, debit cards, and e-wallet options like Skrill, Neteller, and Perfect Money.

Q: Which trading platform does Darcy Global Limited offer?

A: Darcy Global Limited provides the MetaTrader 4 trading platform.

Q: Does Darcy Global Limited have any physical office locations?

A: No, Darcy Global Limited does not have any physical office locations.

Q: Is Darcy Global Limited a regulated broker?

A: No, Darcy Global Limited operates as an unregulated broker.

More

User comment

1

CommentsWrite a review

2022-10-02 07:25

2022-10-02 07:25